Dow Jones Steady Rise: Positive PMI Data Provides Support

Table of Contents

Positive PMI Data: A Key Driver of the Dow Jones Steady Rise

The recent surge in PMI data, both in the manufacturing and services sectors, points towards a healthy expansion of the US economy. This positive indicator reflects increased business activity, strong demand, and improved supply chain conditions, all key components contributing to the Dow Jones steady rise. Understanding PMI's impact is crucial for investors seeking to understand market movements.

- Strong PMI numbers signal increased consumer spending and business investment. Higher PMI readings indicate businesses are optimistic about the future, leading to increased capital expenditures and hiring. This positive feedback loop fuels economic growth and supports the upward trajectory of the Dow Jones.

- Improved manufacturing output contributes significantly to overall economic growth. A robust manufacturing sector is a cornerstone of a strong economy. Positive PMI data in this sector signals increased production, job creation, and overall economic strength, all positively impacting the Dow Jones index.

- The services sector PMI reflects a healthy job market and strong consumer confidence. The services sector, a significant portion of the US economy, shows strong performance when the PMI is high. This translates to a healthy job market, increased consumer spending, and ultimately, a positive impact on the stock market and the Dow Jones steady rise. This confidence is directly reflected in the market's upward trend.

Investor Sentiment and Market Confidence

Positive PMI data significantly influences investor sentiment, leading to increased market confidence. This encourages investors to maintain or increase their risk appetite, resulting in higher stock prices and a steady rise in the Dow Jones. Understanding investor psychology is key to interpreting market trends.

- Positive economic outlook encourages investment in equities. When economic indicators like PMI are strong, investors feel more confident about the future, leading to increased investment in stocks. This increased demand pushes stock prices higher, contributing to the Dow Jones steady rise.

- Reduced uncertainty leads to increased investor participation. Positive PMI data reduces economic uncertainty, encouraging more investors to participate in the market. This increased participation further fuels demand and pushes stock prices upward.

- Stronger earnings expectations drive stock valuations higher. Positive PMI data often translates to stronger earnings expectations for companies. This leads to higher stock valuations and contributes to the overall upward trend in the Dow Jones.

Impact on Different Sectors

The positive PMI data has had a ripple effect across various sectors. While some sectors might experience more significant gains than others, the overall impact on the Dow Jones is positive. Analyzing sector-specific performance provides a deeper understanding of the market's dynamics.

- Technology stocks often benefit from increased consumer spending. As consumer confidence rises (reflected in a strong services PMI), spending on technology products and services increases, boosting the performance of tech companies.

- Industrial stocks reflect the strength of the manufacturing sector. A strong manufacturing PMI directly impacts industrial stocks, as increased production and demand translate into higher profits for these companies.

- Consumer discretionary stocks are sensitive to changes in consumer confidence. Positive PMI data, particularly in the services sector, boosts consumer confidence, leading to increased spending on discretionary items and positively influencing this sector's performance.

Potential Risks and Future Outlook

Despite the positive PMI data, potential risks remain. Inflation, interest rate hikes, and geopolitical uncertainties could impact the Dow Jones’ steady rise. It's crucial to maintain a balanced perspective and consider these factors when assessing the market's future.

- Persistent inflation could lead to increased interest rates, impacting market performance. High inflation can prompt central banks to raise interest rates to cool down the economy, potentially impacting market performance and the Dow Jones steady rise.

- Geopolitical events can create market volatility and uncertainty. Unforeseen geopolitical events can introduce uncertainty into the market, potentially leading to volatility and impacting investor sentiment.

- Supply chain disruptions could still impact economic growth. While supply chains have improved, the risk of future disruptions remains, which could negatively impact economic growth and the Dow Jones.

Conclusion

The Dow Jones' steady rise is largely attributed to the positive PMI data, reflecting a healthy and expanding US economy. This positive economic indicator boosts investor confidence, leading to increased market participation and higher stock prices. However, it's essential to acknowledge potential risks and maintain a balanced view of the market's future trajectory. A thorough understanding of PMI data and its implications is vital for informed investment strategies.

Call to Action: Stay informed about the Dow Jones' performance and the latest PMI data to make informed investment decisions. Understanding the factors driving the Dow Jones steady rise is crucial for navigating the complexities of the stock market and achieving your financial goals. Continue monitoring the Dow Jones and related economic indicators, including the PMI, for a comprehensive view of the market and to make sound investment choices.

Featured Posts

-

Mest Myagkovu Kak Brezhnev Spas Garazh Ryazanova Ot Tsenzury

May 24, 2025

Mest Myagkovu Kak Brezhnev Spas Garazh Ryazanova Ot Tsenzury

May 24, 2025 -

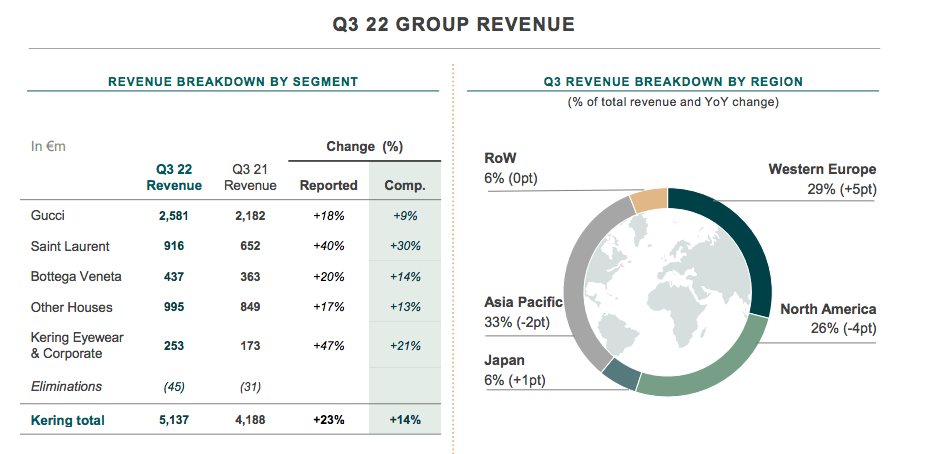

Kering Shares Plunge 6 Following Disappointing Q1 Earnings

May 24, 2025

Kering Shares Plunge 6 Following Disappointing Q1 Earnings

May 24, 2025 -

Glastonbury 2025 Olivia Rodrigo And The 1975 Join The Lineup

May 24, 2025

Glastonbury 2025 Olivia Rodrigo And The 1975 Join The Lineup

May 24, 2025 -

Nyt Connections Game Answers And Clues For Puzzle 646 March 18 2025

May 24, 2025

Nyt Connections Game Answers And Clues For Puzzle 646 March 18 2025

May 24, 2025 -

Ferrari Bengaluru Official Service Centre Opens Its Doors

May 24, 2025

Ferrari Bengaluru Official Service Centre Opens Its Doors

May 24, 2025

Latest Posts

-

Actress Mia Farrow Demands Trumps Imprisonment Regarding Venezuelan Deportations

May 24, 2025

Actress Mia Farrow Demands Trumps Imprisonment Regarding Venezuelan Deportations

May 24, 2025 -

Mia Farrows Plea Jail Trump For Deporting Venezuelan Gang Members

May 24, 2025

Mia Farrows Plea Jail Trump For Deporting Venezuelan Gang Members

May 24, 2025 -

Mia Farrow Calls For Trumps Arrest Over Venezuelan Deportations

May 24, 2025

Mia Farrow Calls For Trumps Arrest Over Venezuelan Deportations

May 24, 2025 -

Farrows Plea Jail Trump For Handling Of Venezuelan Deportations

May 24, 2025

Farrows Plea Jail Trump For Handling Of Venezuelan Deportations

May 24, 2025 -

Actress Mia Farrow Trump Should Be Jailed For Venezuelan Deportation Policy

May 24, 2025

Actress Mia Farrow Trump Should Be Jailed For Venezuelan Deportation Policy

May 24, 2025