DSP Raises Cash, Issues Stock Market Caution For India Fund

Table of Contents

DSP Mutual Fund's Capital Raise: A Strategic Response

DSP Mutual Fund's capital raise is not simply a financial maneuver; it's a strategic response to the evolving dynamics of the Indian stock market. This proactive measure underscores the fund's commitment to navigating market uncertainties and capitalizing on emerging opportunities.

Reasons behind the capital infusion:

- Increased Investment Opportunities: The influx of capital provides DSP with the financial firepower to seize promising investment opportunities as they arise, particularly in sectors poised for growth despite overall market caution.

- Strengthening the Fund's Financial Position: This capital injection strengthens the fund's financial resilience, enabling it to withstand potential market downturns and maintain stability for its investors. A stronger financial base allows for better risk management.

- Preparing for Potential Market Volatility: The current global economic climate presents various uncertainties, including geopolitical tensions and interest rate fluctuations. Securing additional capital acts as a buffer against potential market volatility, allowing the fund to weather any storms.

Sources of funding:

While specific details regarding the sources of funding may not be publicly available, it's likely that DSP leveraged a combination of strategies, potentially including private equity investments or debt financing. Further information may be released in official company statements or financial reports.

Impact on existing investors:

The impact on existing unit holders is largely positive, albeit indirectly. The increased financial strength of the fund, resulting from the capital raise, improves its ability to manage risk and potentially generate better returns in the long term. It does not, however, directly impact the number of units held.

Cautionary Signals and Market Outlook for India:

DSP's cautious outlook on the Indian market reflects a thorough assessment of prevailing conditions and potential risks. Their strategic adjustments to the India Fund's portfolio highlight their commitment to responsible investment management.

DSP's assessment of the current market conditions:

- Overvaluation Concerns: DSP likely identified overvaluation in specific sectors, prompting a more cautious approach to investments in those areas. This prudent strategy aims to mitigate potential losses stemming from inflated valuations.

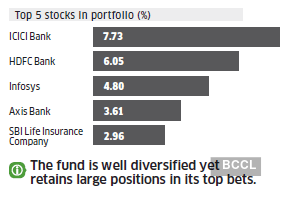

- Geopolitical Risks: Global geopolitical instability, including the ongoing war in Ukraine and escalating tensions in other regions, can significantly impact the Indian economy and market sentiment, necessitating a cautious approach.

- Interest Rate Hikes: The anticipated interest rate hikes by central banks globally, including the Reserve Bank of India, could dampen economic growth and negatively affect market sentiment, making risk management crucial.

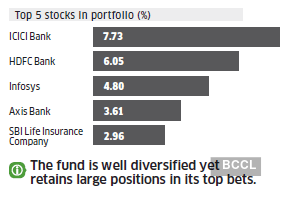

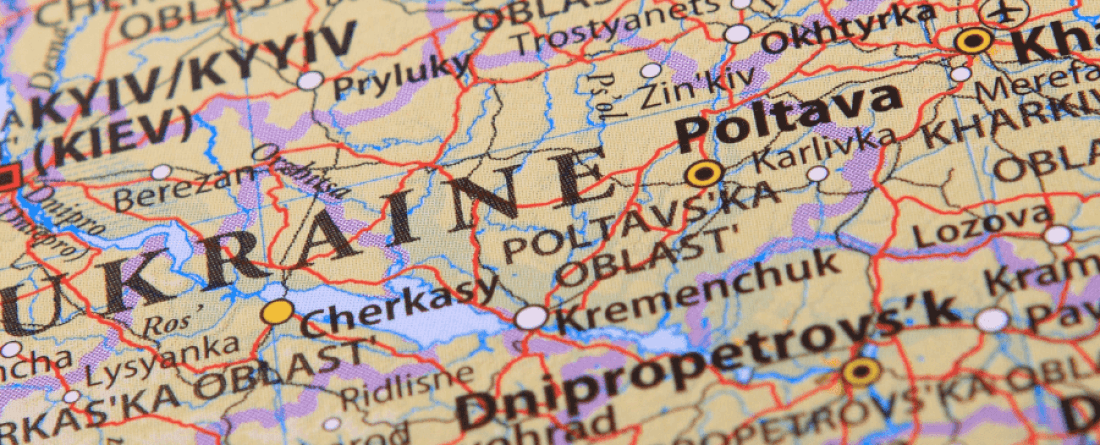

Strategic adjustments to the India Fund's portfolio:

In response to these concerns, DSP likely adjusted its portfolio strategy, focusing on diversification and potentially reducing exposure to riskier sectors. This could involve shifting investments towards more stable sectors or increasing holdings in defensive assets. Specific sector adjustments will depend on the fund’s investment mandate.

Comparison to other fund managers' views:

While DSP's cautious stance is notable, it's important to compare it with the perspectives of other major fund managers operating in the Indian market. Analyzing the collective viewpoint offers a more comprehensive understanding of the prevailing sentiment and risk assessment.

Implications for Investors in the DSP India Fund:

The DSP India Fund's strategic adjustments present both opportunities and challenges for investors. Understanding these implications is crucial for making informed decisions.

Should investors stay invested?:

Whether investors should remain invested depends heavily on their individual risk tolerance and investment goals. Investors with a long-term horizon and higher risk tolerance might view the current market correction as an opportunity for long-term growth. However, risk-averse investors may consider adjusting their portfolio.

Alternative investment strategies:

For risk-averse investors, alternative strategies include diversifying into other asset classes, such as fixed income instruments or international equities, to mitigate exposure to the Indian market's volatility.

Long-term outlook for the Indian market:

Despite the current challenges, India's long-term growth prospects remain promising, driven by its young population, expanding middle class, and ongoing economic reforms. A balanced perspective considers both the short-term risks and the long-term potential.

Conclusion: Navigating the Indian Market with DSP's Insights

DSP Mutual Fund's decision to raise capital while expressing caution regarding the Indian stock market provides valuable insights for investors. The fund's strategic actions highlight the importance of understanding market risks, diversifying portfolios based on risk tolerance, and maintaining a long-term perspective. Stay informed about the latest developments in the Indian market by researching DSP's insights and carefully considering your investment strategy in the DSP India Fund. Consult with a financial advisor to assess your individual circumstances and create a suitable investment plan tailored to your risk tolerance and financial goals concerning DSP India Fund investment and DSP's market caution regarding the India fund market outlook.

Featured Posts

-

Pace Of Rent Increases Slows In Metro Vancouver Housing Costs Remain High

Apr 29, 2025

Pace Of Rent Increases Slows In Metro Vancouver Housing Costs Remain High

Apr 29, 2025 -

Europe On Edge Analyzing Recent Russian Military Actions

Apr 29, 2025

Europe On Edge Analyzing Recent Russian Military Actions

Apr 29, 2025 -

China Market Slowdown Case Studies Of Bmw And Porsche And Implications For The Industry

Apr 29, 2025

China Market Slowdown Case Studies Of Bmw And Porsche And Implications For The Industry

Apr 29, 2025 -

April 8th Treasury Market What Happened And What It Means

Apr 29, 2025

April 8th Treasury Market What Happened And What It Means

Apr 29, 2025 -

The Fight Within The Gop Trumps Tax Bill Under Threat

Apr 29, 2025

The Fight Within The Gop Trumps Tax Bill Under Threat

Apr 29, 2025

Latest Posts

-

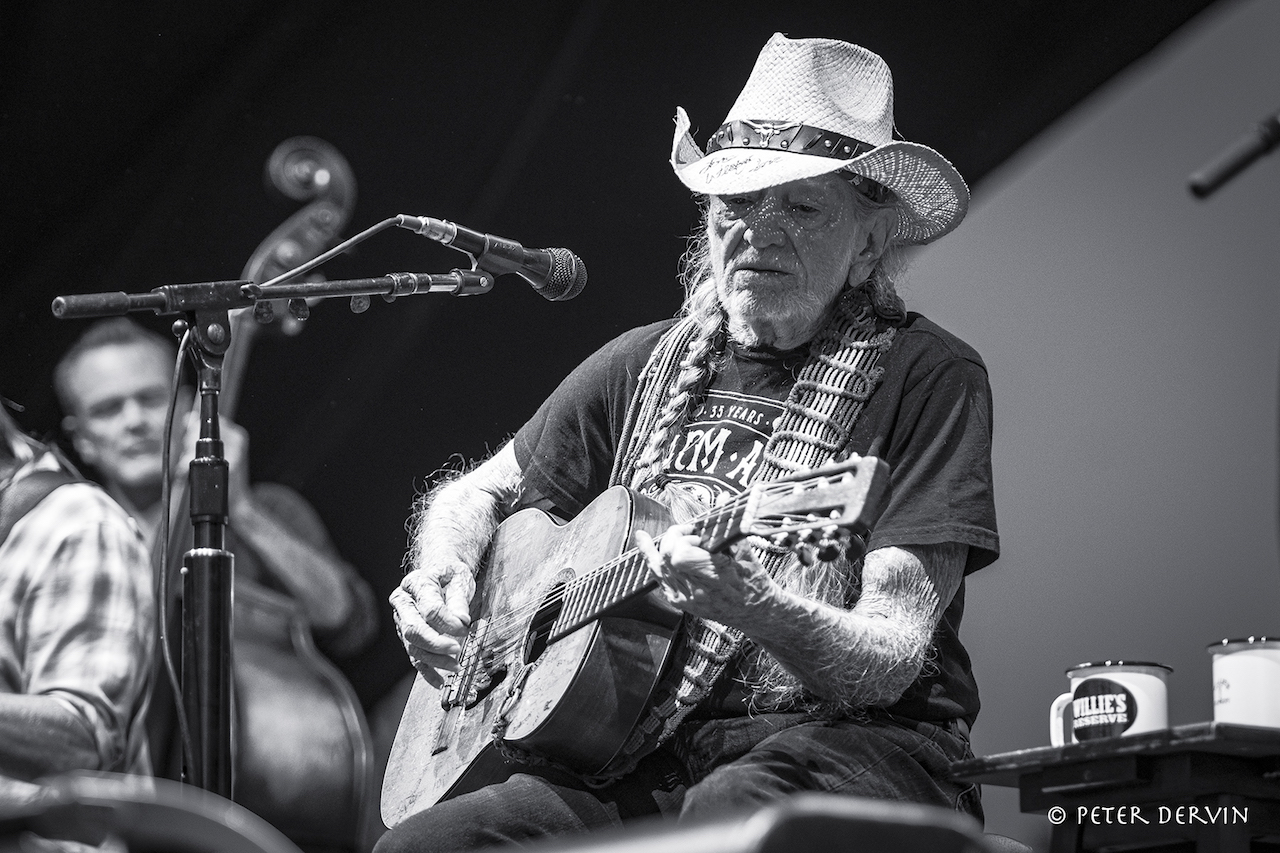

Willie Nelsons 4th Of July Picnic A Texas Tradition Returns

Apr 29, 2025

Willie Nelsons 4th Of July Picnic A Texas Tradition Returns

Apr 29, 2025 -

Understanding Willie Nelson Key Facts And Figures

Apr 29, 2025

Understanding Willie Nelson Key Facts And Figures

Apr 29, 2025 -

Willie Nelsons New Album Oh What A Beautiful World

Apr 29, 2025

Willie Nelsons New Album Oh What A Beautiful World

Apr 29, 2025 -

Willie Nelsons 4th Of July Picnic Returns To Texas

Apr 29, 2025

Willie Nelsons 4th Of July Picnic Returns To Texas

Apr 29, 2025 -

Willie Nelsons Life A Collection Of Fast Facts

Apr 29, 2025

Willie Nelsons Life A Collection Of Fast Facts

Apr 29, 2025