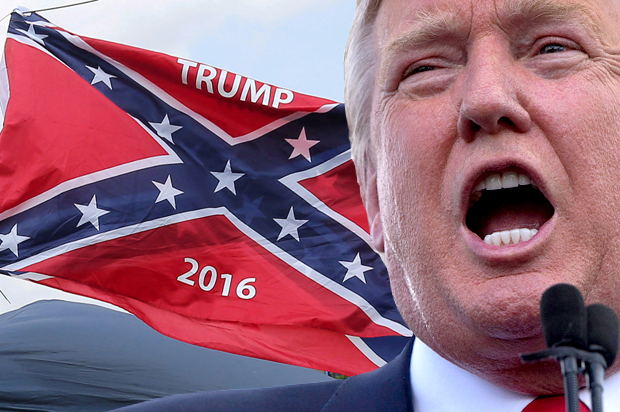

The Fight Within The GOP: Trump's Tax Bill Under Threat

Table of Contents

Internal GOP Divisions Over Trump's Tax Bill

The Republican party, far from being a monolithic entity, is fractured into various factions with differing opinions on Trump's Tax Bill. These divisions are creating significant hurdles to the bill's continued success and even its survival in its current form.

-

Fiscal Conservatives vs. Pro-Growth Republicans: A significant rift exists between fiscal conservatives concerned about the long-term impact on the national debt and those prioritizing economic growth through significant tax cuts, regardless of the deficit implications. This disagreement is central to the debate around corporate tax rates versus individual tax cuts.

-

Social Conservatives and Targeted Tax Provisions: Certain social conservative groups have expressed concerns over specific provisions within Trump's Tax Bill, potentially leading to opposition or demands for amendments. These groups may prioritize certain social programs over broad-based tax reductions.

-

Trump Loyalists and Party Unity: A powerful faction within the GOP remains fiercely loyal to President Trump and his legislative agenda. Their support for the bill, regardless of its specifics, is a crucial factor in its fate, however, even this loyalty is being tested by the internal dissent.

Key Republican figures like Senator [Insert Senator's Name] and Representative [Insert Representative's Name] have publicly voiced their concerns, highlighting the deep divisions within the party. While some compromises are being floated, the path forward remains uncertain, with potential concessions on certain tax provisions being actively negotiated.

Economic Consequences of Modifying Trump's Tax Bill

Altering or repealing significant portions of Trump's Tax Bill would have profound economic ramifications, impacting various sectors and income groups.

-

National Debt: Significant tax cuts, especially for corporations, could lead to a further ballooning of the national debt, potentially impacting future fiscal policy and government spending. Discussions about fiscal responsibility are becoming increasingly urgent.

-

Impact on Income Groups: Changes to the tax bill could disproportionately affect different income groups. Reducing tax cuts for higher earners could free up government funds for social programs, while increasing taxes on lower earners could further exacerbate income inequality. This is a major point of contention in the ongoing debate.

-

Business and Investment: Uncertainty surrounding the bill's future could negatively impact business investment and economic growth. Businesses rely on stable tax policies for long-term planning and investment decisions; a volatile tax landscape could lead to hesitancy and reduced economic activity. Related keywords: tax reform, economic growth, fiscal policy.

Political Ramifications of the Tax Bill Battle

The internal struggle over Trump's Tax Bill has significant political ramifications, extending far beyond the immediate legislative implications.

-

Midterm Elections: The ongoing debate will undoubtedly impact the upcoming midterm elections. The outcome of the struggle will shape the narrative of the Republican party and its ability to rally its base. Related keywords: midterm elections, political polarization, Republican party.

-

President Trump's Legacy: The success or failure of the tax bill will have a lasting impact on President Trump's legacy and approval ratings. Failure to deliver on a key campaign promise could significantly erode his support base.

-

Future Legislative Agendas: The current battle sets a precedent for future legislative efforts. The level of internal division demonstrated could foreshadow difficulties in passing future Republican legislation, further impacting the party’s agenda.

Potential Alternatives and Future of Trump's Tax Bill

Given the internal divisions, alternative tax policies are being considered, ranging from minor adjustments to complete overhauls.

-

Modifications and Amendments: Negotiations may lead to compromises involving amendments to specific provisions. These may include targeted tax increases in certain areas to offset cuts elsewhere or adjustments to tax brackets.

-

Likelihood of Success or Failure: The future of Trump's Tax Bill remains uncertain. The level of internal dissent within the GOP makes its continued success in its current form highly questionable.

-

Alternative Legislative Strategies: If the bill fails, the GOP might pursue alternative legislative strategies, such as focusing on smaller, less divisive tax reforms or delaying action until after the midterm elections. Related keywords: tax legislation, tax policy, fiscal responsibility.

Conclusion: The Future of Trump's Tax Bill and the GOP's Internal Struggle

The internal conflict within the GOP regarding Trump's Tax Bill is a defining moment for the party. The potential economic consequences, from impacting the national debt to affecting different income groups, are significant. The political ramifications, including the influence on the midterm elections and President Trump’s legacy, are equally substantial. The path forward remains uncertain, with various potential alternatives and compromises under consideration. To understand the full implications of this ongoing struggle, stay informed about the latest developments surrounding Trump's tax legislation. Further research into the specifics of the bill and the positions of key Republican figures will provide a deeper understanding of this critical issue and the future of the Republican tax bill.

Featured Posts

-

Chinas Nuclear Energy Sector Expands With Approval Of 10 New Reactors

Apr 29, 2025

Chinas Nuclear Energy Sector Expands With Approval Of 10 New Reactors

Apr 29, 2025 -

2 5 Trillion Evaporated The Market Value Decline Of The Magnificent Seven

Apr 29, 2025

2 5 Trillion Evaporated The Market Value Decline Of The Magnificent Seven

Apr 29, 2025 -

Exploring The Data Center Landscape Of Negeri Sembilan Malaysia

Apr 29, 2025

Exploring The Data Center Landscape Of Negeri Sembilan Malaysia

Apr 29, 2025 -

The Rise Of Data Centers In Malaysias Negeri Sembilan

Apr 29, 2025

The Rise Of Data Centers In Malaysias Negeri Sembilan

Apr 29, 2025 -

Beyond Quinoa Exploring The Latest Superfood Sensation

Apr 29, 2025

Beyond Quinoa Exploring The Latest Superfood Sensation

Apr 29, 2025

Latest Posts

-

Ohio Train Derailment Aftermath Prolonged Toxic Chemical Contamination Of Buildings

Apr 29, 2025

Ohio Train Derailment Aftermath Prolonged Toxic Chemical Contamination Of Buildings

Apr 29, 2025 -

Office365 Security Failure Costs Millions Federal Investigation Reveals Extent Of Damage

Apr 29, 2025

Office365 Security Failure Costs Millions Federal Investigation Reveals Extent Of Damage

Apr 29, 2025 -

Data Breach Exposes Millions In Losses From Compromised Office365 Accounts

Apr 29, 2025

Data Breach Exposes Millions In Losses From Compromised Office365 Accounts

Apr 29, 2025 -

T Mobile Data Breaches Result In 16 Million Fine A Comprehensive Overview

Apr 29, 2025

T Mobile Data Breaches Result In 16 Million Fine A Comprehensive Overview

Apr 29, 2025 -

Federal Charges Filed After Millions Stolen Via Office365 Executive Accounts

Apr 29, 2025

Federal Charges Filed After Millions Stolen Via Office365 Executive Accounts

Apr 29, 2025