Dubai Holding REIT IPO Size Jumps To $584 Million

Table of Contents

Increased IPO Size: A Sign of Market Confidence

The dramatic increase in the Dubai Holding REIT IPO size underscores the considerable optimism surrounding Dubai's real estate sector. This heightened investor interest stems from several key factors.

Investor Sentiment and Demand

Several factors have fueled the impressive surge in demand for the Dubai Holding REIT IPO:

- Strong Performance of Dubai's Real Estate Sector: Dubai's real estate market has demonstrated consistent growth and resilience, attracting both domestic and international investors. This positive trajectory has built confidence in the long-term prospects of the sector.

- Attractive Dividend Yields Projected by Dubai Holding REIT: The REIT's projected dividend yields are highly competitive, making it an attractive proposition for income-seeking investors. This promise of steady returns is a major draw for participation in the IPO.

- Growing Tourism and Economic Diversification in Dubai: Dubai's continuous growth in tourism and its commitment to economic diversification create a stable and robust environment for real estate investment. This sustained economic vitality provides a solid foundation for the REIT's success.

- Global Investor Appetite for Stable Real Estate Investments: Real estate is generally considered a relatively stable asset class, particularly appealing during times of market uncertainty. Global investors are actively seeking such opportunities, further driving demand for the Dubai Holding REIT IPO.

This amplified demand for the IPO is a strong indicator of positive sentiment towards Dubai's real estate market, solidifying its position as a prime investment destination.

Implications for Dubai's Real Estate Sector

The successful expansion of the Dubai Holding REIT IPO carries significant implications for Dubai's broader real estate landscape:

- Increased Liquidity in the Market: The infusion of capital from the IPO will inject much-needed liquidity into the market, facilitating further development and transactions.

- Potential for Further Development Projects: The success of this IPO may encourage additional development projects, contributing to Dubai's continued growth and expansion.

- Attraction of Foreign Investment: The increased profile of Dubai's real estate market, enhanced by this large IPO, will attract further foreign investment, boosting the economy.

- Boost to the Overall Economy: The positive ripple effects extend beyond the real estate sector, positively impacting related industries and contributing to overall economic growth.

Details of the Dubai Holding REIT IPO

Understanding the specifics of the Dubai Holding REIT IPO is crucial for potential investors.

Asset Portfolio and Investment Strategy

The REIT boasts a diversified portfolio of high-quality properties:

- Types of Properties: The portfolio includes a mix of residential, commercial, and retail properties, strategically located throughout Dubai. This diversification mitigates risk and provides exposure to various market segments.

- Geographic Location of Assets: Assets are strategically located across prime areas of Dubai, ensuring exposure to high-growth zones and maximizing rental income potential.

- Diversification of the Portfolio: The portfolio's diversification across property types and locations reduces reliance on any single asset or market segment.

- Long-Term Growth Strategy: The REIT’s long-term growth strategy focuses on acquiring and developing high-yield properties, enhancing shareholder value.

The underlying assets offer strong potential for capital appreciation and stable income streams.

Pricing and Allocation of Shares

The IPO's pricing strategy and share allocation are key details for investors:

- Share Price: [Insert Share Price Here – this information will need to be sourced from official announcements].

- Number of Shares Offered: [Insert Number of Shares Here – this information will need to be sourced from official announcements].

- Allocation Process: The allocation process for both retail and institutional investors will be transparent and fair, ensuring equitable distribution of shares. [Insert details of allocation process here if available].

- Timeline: [Insert IPO timeline here – this information will need to be sourced from official announcements].

This information is crucial for investors to make informed decisions about participation.

Opportunities and Risks for Investors

As with any investment, the Dubai Holding REIT IPO presents both opportunities and risks.

Potential Returns and Growth Prospects

Investing in the Dubai Holding REIT offers several potential benefits:

- Projected Dividend Yields: [Insert projected dividend yield – this information will need to be sourced from official announcements]. These attractive yields are a key incentive for income-focused investors.

- Potential Capital Appreciation: The long-term growth potential of Dubai's real estate market suggests substantial opportunities for capital appreciation.

- Long-Term Growth Potential of Dubai’s Real Estate Market: Dubai's sustained economic growth and attractiveness to both residents and tourists provide a strong backdrop for real estate market growth.

These factors present a compelling case for significant potential returns.

Risk Factors to Consider

Potential investors must also be aware of potential risks:

- Market Volatility: The real estate market, like any investment market, is subject to fluctuations and volatility.

- Geopolitical Risks: Global geopolitical events can influence investment markets, impacting returns.

- Interest Rate Fluctuations: Changes in interest rates can affect borrowing costs and property values.

- Specific Risks Related to the Dubai Real Estate Market: Investors should be aware of any specific risks related to the Dubai real estate market, such as potential regulatory changes.

A thorough understanding of these risks is crucial for making an informed investment decision.

Conclusion

The Dubai Holding REIT IPO's expansion to $584 million reflects substantial investor confidence in Dubai's robust real estate market. This increased size signifies a positive outlook for the sector, injecting liquidity, attracting foreign investment, and stimulating broader economic growth. While the IPO presents attractive potential returns, investors must carefully consider the associated risks. Learn more about this exciting investment opportunity and assess if it aligns with your risk profile and investment goals. Don't miss out on the Dubai Holding REIT IPO – explore the investment prospectus and seek professional financial advice before making any investment decisions. Remember to consult your financial advisor before investing in the Dubai Holding REIT IPO.

Featured Posts

-

Scorpion Sting Surprise Ramon Rodriguezs Will Trent Sleep Story

May 21, 2025

Scorpion Sting Surprise Ramon Rodriguezs Will Trent Sleep Story

May 21, 2025 -

Henriksen At Mainz The Next Klopp Or Tuchel

May 21, 2025

Henriksen At Mainz The Next Klopp Or Tuchel

May 21, 2025 -

5 Podcasts Imperdibles Para Amantes Del Misterio Suspenso Y Terror

May 21, 2025

5 Podcasts Imperdibles Para Amantes Del Misterio Suspenso Y Terror

May 21, 2025 -

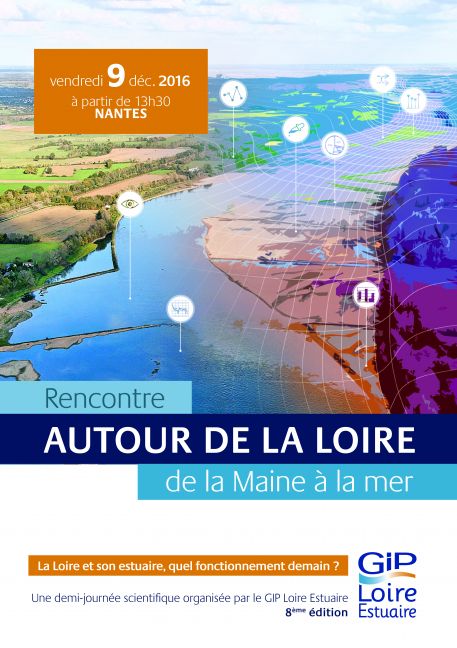

Explorer La Loire Nantes Et Son Estuaire A Velo 5 Itineraires

May 21, 2025

Explorer La Loire Nantes Et Son Estuaire A Velo 5 Itineraires

May 21, 2025 -

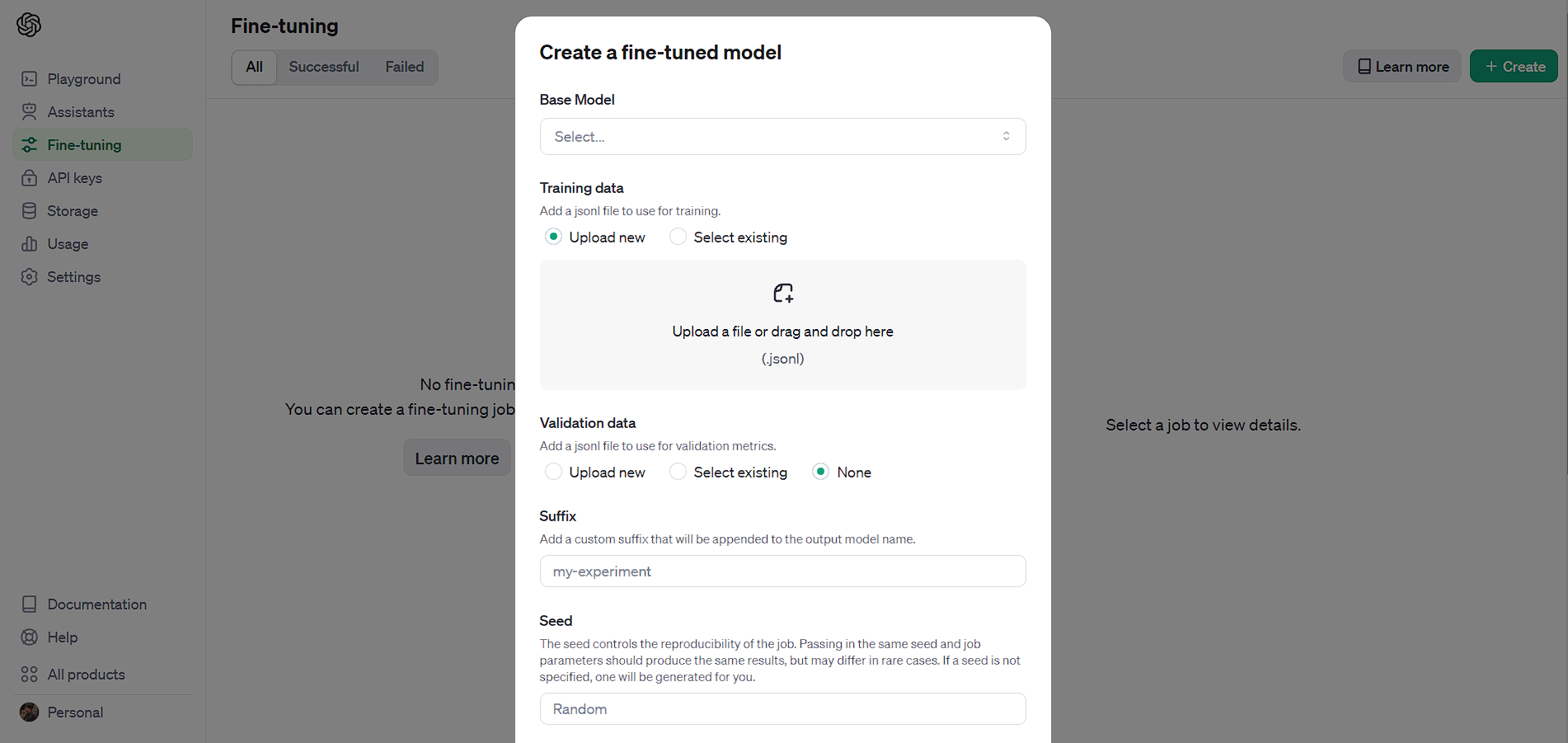

Open Ai Simplifies Voice Assistant Creation Key Highlights From The 2024 Developer Event

May 21, 2025

Open Ai Simplifies Voice Assistant Creation Key Highlights From The 2024 Developer Event

May 21, 2025

Latest Posts

-

Lady And The Tramp Hot Dog A Classic Cubs Game Moment

May 22, 2025

Lady And The Tramp Hot Dog A Classic Cubs Game Moment

May 22, 2025 -

Liverpool Menargetkan Juara Liga Inggris 2024 2025 Siapa Pelatih Idealnya

May 22, 2025

Liverpool Menargetkan Juara Liga Inggris 2024 2025 Siapa Pelatih Idealnya

May 22, 2025 -

Viral Video Cubs Fans Recreate Lady And The Tramp Scene With Hot Dog

May 22, 2025

Viral Video Cubs Fans Recreate Lady And The Tramp Scene With Hot Dog

May 22, 2025 -

Analisis Peluang Liverpool Juara Liga Inggris 2024 2025 Faktor Pelatih

May 22, 2025

Analisis Peluang Liverpool Juara Liga Inggris 2024 2025 Faktor Pelatih

May 22, 2025 -

Chicago Cubs Fans Lady And The Tramp Hot Dog Moment Goes Viral

May 22, 2025

Chicago Cubs Fans Lady And The Tramp Hot Dog Moment Goes Viral

May 22, 2025