Dubai REIT IPO: Size Boosted To $584 Million By Dubai Holding

Table of Contents

The Upsized Dubai REIT IPO: From Initial Plans to $584 Million

The Dubai REIT IPO's journey to its current $584 million valuation is a testament to strong investor interest and favorable market conditions. While the initial plans called for a significantly smaller IPO, the decision to increase the size reflects a surge in demand and strategic goals. This substantial increase represents a remarkable vote of confidence in Dubai's ongoing economic strength and the attractiveness of its real estate market.

- Original IPO size: [Insert Original Size Here]

- Revised IPO size: $584 Million

- Percentage increase: [Calculate and Insert Percentage Here]

- Date of announcement: [Insert Date Here]

- Key individuals involved in the decision: [Insert Names and Titles Here]

The decision to upsize wasn't arbitrary. Several factors contributed to this strategic move, including exceptionally high demand from both local and international investors, a positive outlook for Dubai's real estate sector fueled by robust economic growth and significant infrastructure development projects, and the overall strategic objectives of Dubai Holding, the entity driving the IPO.

Dubai Holding's Strategic Objectives Behind the Increased IPO Size

Dubai Holding, a prominent investment company in Dubai, is clearly aiming for significant gains with this enlarged REIT IPO. This move aligns perfectly with its broader investment strategy, focusing on diversification and maximizing returns from its extensive real estate portfolio.

- Dubai Holding's portfolio diversification strategy: The IPO allows Dubai Holding to further diversify its investment portfolio, reducing its reliance on specific assets and mitigating overall risk.

- Expected returns from the REIT investment: The increased size suggests a strong expectation of high returns, potentially leading to significant profits for Dubai Holding and its shareholders.

- Long-term goals for the real estate sector in Dubai: The successful IPO will contribute significantly to Dubai's long-term strategy to strengthen its position as a global real estate hub.

By increasing the IPO size, Dubai Holding aims to raise considerably more capital, potentially reducing its debt levels, enabling further expansion in the real estate sector, and solidifying its leadership position in Dubai's dynamic market.

Investor Sentiment and Market Reaction to the Enlarged Dubai REIT IPO

The market reacted positively to the news of the increased Dubai REIT IPO size. This positive response is attributed to a number of factors, including Dubai's strong economic fundamentals, ongoing infrastructure development, and the overall positive global outlook for real estate investment.

- Stock market reaction (if applicable): [Insert details about stock market performance following the announcement]

- Analyst ratings and predictions: [Include analyst quotes and ratings, citing sources]

- Investor interest and subscription levels: [Include data or estimates on investor interest and subscription rates]

Positive analyst forecasts, coupled with strong investor interest, suggest a highly successful IPO. The increased size indicates significant confidence in both Dubai's real estate market and the potential for long-term growth and substantial returns.

Potential Risks and Challenges Associated with the Dubai REIT IPO

While the Dubai REIT IPO presents exciting opportunities, potential risks and challenges must be acknowledged. Investors need to carefully consider the following:

- Market risk factors: Global economic downturns or regional instability could negatively impact the value of the REIT's assets.

- Interest rate sensitivity: Fluctuations in interest rates could affect the REIT's profitability and borrowing costs.

- Geopolitical risks: Regional or international conflicts could create uncertainty and potentially affect investor confidence.

- Management risks: Effective management of the REIT's assets and meeting investor expectations will be crucial for long-term success.

Dubai Holding will need to effectively manage these risks to ensure the REIT's long-term success and meet the high expectations set by the significant investment it has attracted.

Conclusion: Investing in the Future with the Dubai REIT IPO

The upsized Dubai REIT IPO, now valued at $584 million, represents a significant milestone for Dubai's real estate market and offers a compelling investment opportunity. The increase in size reflects the strong investor confidence in Dubai's continued economic growth and the potential for high returns. While some risks exist, the potential rewards are substantial. Don't miss out on this significant investment opportunity; research the Dubai REIT IPO further to make an informed decision. Learn more about the exciting investment opportunities offered by the expanded Dubai REIT IPO and explore how you can participate in the growth of Dubai's vibrant real estate market. Remember to consult with a financial advisor before making any investment decisions.

Featured Posts

-

Investing In Quantum Computing Stocks In 2025 A Guide To Rigetti Rgti And Ion Q

May 20, 2025

Investing In Quantum Computing Stocks In 2025 A Guide To Rigetti Rgti And Ion Q

May 20, 2025 -

Madrid Open Sabalenka Secures Opening Victory

May 20, 2025

Madrid Open Sabalenka Secures Opening Victory

May 20, 2025 -

Vodacom Vod Q Quarter Earnings Payout Surpasses Forecasts

May 20, 2025

Vodacom Vod Q Quarter Earnings Payout Surpasses Forecasts

May 20, 2025 -

Atkinsrealis Droit Expertise Juridique Et Conseils D Affaires

May 20, 2025

Atkinsrealis Droit Expertise Juridique Et Conseils D Affaires

May 20, 2025 -

Prima Poza Familia Schumacher Saluta Un Nou Membru

May 20, 2025

Prima Poza Familia Schumacher Saluta Un Nou Membru

May 20, 2025

Latest Posts

-

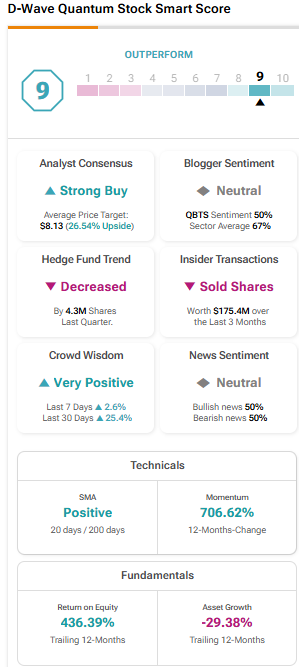

Analyzing The D Wave Quantum Qbts Stock Decrease On Thursday

May 20, 2025

Analyzing The D Wave Quantum Qbts Stock Decrease On Thursday

May 20, 2025 -

Market Reaction To D Wave Quantum Qbts Fridays Stock Price Rise Explained

May 20, 2025

Market Reaction To D Wave Quantum Qbts Fridays Stock Price Rise Explained

May 20, 2025 -

Investing In Quantum Computing A D Wave Qbts Stock Perspective

May 20, 2025

Investing In Quantum Computing A D Wave Qbts Stock Perspective

May 20, 2025 -

Analyzing The Friday Increase In D Wave Quantum Qbts Stock Price

May 20, 2025

Analyzing The Friday Increase In D Wave Quantum Qbts Stock Price

May 20, 2025 -

D Wave Quantum Qbts Stock Performance Analyzing The Impact Of Kerrisdale Capitals Report

May 20, 2025

D Wave Quantum Qbts Stock Performance Analyzing The Impact Of Kerrisdale Capitals Report

May 20, 2025