Earnings Preview: Gibraltar Industries' Q[Quarter] 2024 Performance Forecast

![Earnings Preview: Gibraltar Industries' Q[Quarter] 2024 Performance Forecast Earnings Preview: Gibraltar Industries' Q[Quarter] 2024 Performance Forecast](https://hirschfeld-kongress.de/image/earnings-preview-gibraltar-industries-q-quarter-2024-performance-forecast.jpeg)

Table of Contents

Analyst Expectations for Gibraltar Industries Q3 2024 Earnings

Leading financial analysts offer a range of estimates for Gibraltar Industries' Q3 2024 earnings per share (EPS). The consensus EPS estimate currently sits between $1.20 and $1.40, reflecting some uncertainty in the market. Recent downward revisions to these estimates, primarily attributed to concerns about softening demand in the residential construction market and increased raw material costs, have created some volatility in investor sentiment.

- Consensus EPS estimate: $1.25 - $1.40

- High EPS estimate: $1.50

- Low EPS estimate: $1.10

- Key factors influencing estimates: Raw material price fluctuations, overall construction sector activity, interest rate hikes impacting housing starts, and potential supply chain disruptions.

Key Performance Indicators (KPIs) to Watch in Gibraltar Industries' Q3 2024 Report

Beyond the EPS figure, several key performance indicators (KPIs) will offer a more comprehensive view of Gibraltar Industries' Q3 2024 performance. Investors should pay close attention to the following:

- Revenue Growth: Year-over-year and quarter-over-quarter revenue comparisons will reveal the company's ability to maintain sales momentum amidst economic headwinds. A slowdown in revenue growth could signal weakening demand.

- Gross Margin: Analyzing gross margin trends will provide insight into Gibraltar Industries' pricing power and efficiency in managing raw material costs. Compression of the gross margin could point to increasing pressure on profitability.

- Operating Income: Operating income assesses operational efficiency and profitability, excluding interest and taxes. A strong operating income indicates healthy operational management.

- Net Income: This is the ultimate measure of overall profitability, reflecting all revenues and expenses. Significant changes in net income compared to previous quarters require careful scrutiny.

- Debt Levels: Monitoring debt levels helps determine the company's financial health and stability. Rising debt levels may signal increased financial risk.

Potential Impact of Macroeconomic Factors on Gibraltar Industries' Q3 2024 Results

Macroeconomic factors significantly influence Gibraltar Industries' performance. The current economic climate presents both challenges and opportunities:

- Impact of inflation on raw material costs: Elevated inflation continues to pressure input costs, impacting profitability. Gibraltar Industries' ability to manage these costs effectively is crucial.

- Effect of interest rate changes on capital expenditures and borrowing costs: Higher interest rates increase borrowing costs and potentially dampen capital expenditures, slowing down growth.

- Influence of the housing market on demand for Gibraltar Industries' products: The housing market's health directly affects demand for Gibraltar Industries' building products. A slowdown in housing starts could negatively impact sales.

- Geopolitical risks and their potential impact: Global events and supply chain disruptions can affect material availability and production costs.

Gibraltar Industries' Q3 2024 Earnings: Opportunities and Risks

Gibraltar Industries' Q3 2024 earnings present both opportunities and risks:

- Potential for exceeding analyst expectations: Stronger-than-anticipated demand or effective cost management could lead to better-than-expected results.

- Risks related to supply chain disruptions: Continued supply chain bottlenecks could impact production and profitability.

- Opportunities for growth in specific market segments: Potential growth exists in specific market segments, such as renewable energy infrastructure, which could offset weakness in other areas.

- Potential for unforeseen events affecting the results: Unexpected economic shifts or geopolitical events could significantly impact the financial results.

Conclusion

The outlook for Gibraltar Industries' Q3 2024 earnings presents a mixed picture. While analysts anticipate moderate growth, macroeconomic headwinds and potential supply chain issues pose significant risks. Investors should carefully monitor key performance indicators like revenue growth, gross margin, and debt levels to assess the company's overall performance. Stay tuned for the official Gibraltar Industries Q3 2024 earnings announcement and keep an eye on our future analyses of Gibraltar Industries’ financial performance for further insights into this important development. For further insights into Gibraltar Industries’ earnings, check back regularly.

![Earnings Preview: Gibraltar Industries' Q[Quarter] 2024 Performance Forecast Earnings Preview: Gibraltar Industries' Q[Quarter] 2024 Performance Forecast](https://hirschfeld-kongress.de/image/earnings-preview-gibraltar-industries-q-quarter-2024-performance-forecast.jpeg)

Featured Posts

-

Pochemu Lishili Roditelskikh Prav Syna Tatyany Kadyshevoy Semeyniy Skandal

May 13, 2025

Pochemu Lishili Roditelskikh Prav Syna Tatyany Kadyshevoy Semeyniy Skandal

May 13, 2025 -

Sneak Peek Elsbeth And The Family Business In S02 E14

May 13, 2025

Sneak Peek Elsbeth And The Family Business In S02 E14

May 13, 2025 -

Sicherheitsvorfall An Braunschweiger Schule Update Zur Evakuierung

May 13, 2025

Sicherheitsvorfall An Braunschweiger Schule Update Zur Evakuierung

May 13, 2025 -

Nba Draft Lottery 2025 Odds Live Stream And Top Contenders

May 13, 2025

Nba Draft Lottery 2025 Odds Live Stream And Top Contenders

May 13, 2025 -

Di Caprios Untold Story How He Saved Romeo Juliet From A Rollerblade Disaster

May 13, 2025

Di Caprios Untold Story How He Saved Romeo Juliet From A Rollerblade Disaster

May 13, 2025

Latest Posts

-

L Allemagne Renforce Sa Protection Civile Un Besoin Urgent Apres Des Annees De Negligence

May 13, 2025

L Allemagne Renforce Sa Protection Civile Un Besoin Urgent Apres Des Annees De Negligence

May 13, 2025 -

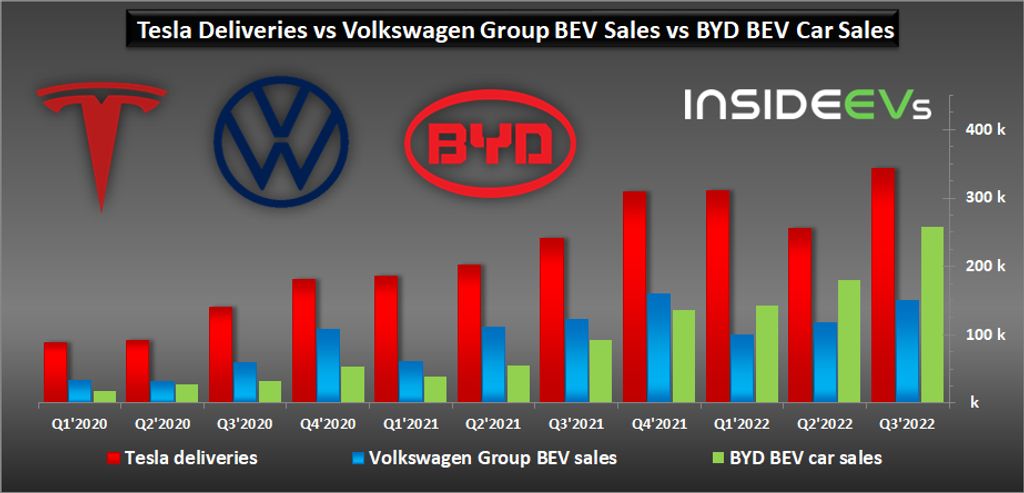

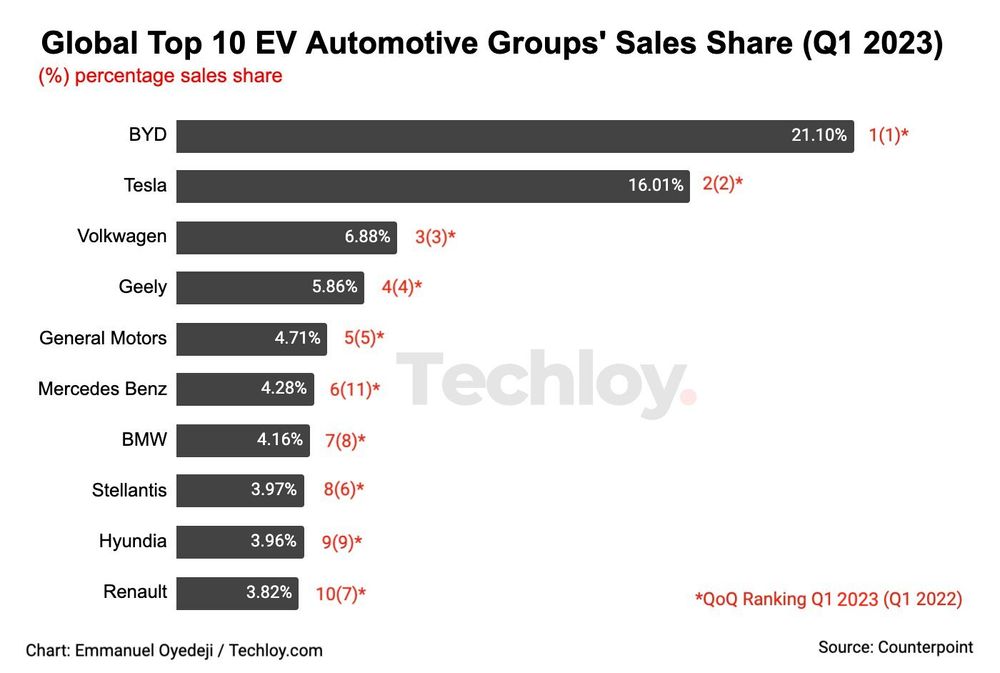

Electric Vehicle Market Byds Global Expansion And Fords Brazilian Challenges

May 13, 2025

Electric Vehicle Market Byds Global Expansion And Fords Brazilian Challenges

May 13, 2025 -

Four Walls Appoints New Chief Executive Officer

May 13, 2025

Four Walls Appoints New Chief Executive Officer

May 13, 2025 -

The Impact Of Restored Trump Tariffs On The European Economy

May 13, 2025

The Impact Of Restored Trump Tariffs On The European Economy

May 13, 2025 -

The Maluf Factor Analyzing Fords Departure And Byds Entry Into The Brazilian Ev Market

May 13, 2025

The Maluf Factor Analyzing Fords Departure And Byds Entry Into The Brazilian Ev Market

May 13, 2025