Easing Regulations For Bond Forwards: A Boon For Indian Insurers?

Table of Contents

Increased Investment Opportunities for Indian Insurers

Currently, Indian insurers face limitations in their investment strategies due to stringent regulations on bond forwards. Relaxing these restrictions would dramatically broaden investment opportunities within the fixed-income market. This diversification is crucial for optimizing portfolio management and maximizing returns.

-

Access to a Wider Range of Bond Instruments and Maturities: Easing regulations would unlock access to a wider array of government and corporate bonds with varying maturities, allowing for a more granular approach to portfolio construction. This means insurers can tailor their investments to specific risk appetites and return targets.

-

Potential for Higher Returns Compared to Traditional Investment Options: Bond forwards offer the potential for higher yields compared to traditional fixed-income investments. This improved return on investment (ROI) can significantly enhance the profitability of insurance companies.

-

Improved Risk-Adjusted Returns through Strategic Hedging Using Bond Forwards: Sophisticated hedging strategies using bond forwards can mitigate the impact of interest rate fluctuations and inflation, ultimately leading to better risk-adjusted returns.

-

Opportunities for Better Yield Curve Management: Access to the full spectrum of the bond market allows for optimized yield curve management strategies, allowing insurers to maximize returns while controlling their exposure to various interest rate risks.

Enhanced Risk Management Capabilities

Bond forwards are powerful tools for managing various financial risks. For Indian insurers, easing regulations on these instruments would significantly enhance their risk mitigation capabilities.

-

Effective Hedging Against Interest Rate Fluctuations: Bond forwards provide an effective mechanism for hedging against adverse movements in interest rates. This protection is crucial, considering the sensitivity of bond portfolios to interest rate risk.

-

Protection Against Adverse Movements in Bond Prices: These instruments can safeguard against losses from unexpected changes in bond prices, reducing portfolio volatility and enhancing overall financial stability.

-

Improved Management of Credit Risk Through Selective Exposure: Bond forwards allow insurers to selectively manage their exposure to credit risk, tailoring their investments to specific credit ratings and counterparty risks.

-

Potential for Reducing Portfolio Volatility: By employing sophisticated hedging strategies, insurers can reduce the overall volatility of their investment portfolios, leading to improved stability and predictability.

Boosting Competitiveness in the Insurance Sector

Easing regulations for bond forwards would not only benefit individual insurers but also contribute to the growth and global competitiveness of the entire Indian insurance sector.

-

Enhanced Ability to Offer Competitive Products and Services: Improved risk management and investment returns allow insurers to offer more competitive insurance products and services, attracting a larger customer base.

-

Increased Profitability Due to Efficient Risk Management and Investment Strategies: Strategic use of bond forwards can lead to significant improvements in profitability, strengthening the financial health of insurers.

-

Attraction of Foreign Investment into the Indian Insurance Sector: A more sophisticated and globally competitive insurance sector is more likely to attract foreign direct investment, fueling further growth and development.

-

Increased Market Share for Domestic Insurers: By leveraging the opportunities presented by bond forwards, domestic insurers can significantly improve their market share, both domestically and internationally.

Potential Challenges and Considerations

While easing regulations offers significant benefits, it's crucial to acknowledge potential risks and challenges.

-

Need for Robust Regulatory Oversight to Prevent Market Manipulation: A robust regulatory framework is essential to prevent market manipulation and ensure fair play within the bond forward market.

-

Potential for Increased Liquidity Risk if Not Managed Properly: Increased trading in bond forwards could heighten liquidity risks if not managed effectively. Insurers need to establish appropriate risk management strategies to mitigate this.

-

Importance of Investor Education and Awareness Regarding Bond Forwards: Effective investor education and awareness campaigns are crucial to ensure that all market participants understand the risks and rewards associated with bond forwards.

-

Strengthening of Internal Risk Management Systems Within Insurance Companies: Insurers need to strengthen their internal risk management systems to effectively manage the additional complexities introduced by trading bond forwards.

Conclusion

Easing regulations on bond forwards presents a significant opportunity for the Indian insurance sector. Increased investment opportunities, enhanced risk management capabilities, and improved global competitiveness are all potential outcomes. However, a balanced approach is essential, emphasizing robust regulatory oversight, investor education, and the strengthening of internal risk management systems within insurance companies. The potential of easing regulations for bond forwards in propelling the Indian insurance sector forward deserves further in-depth analysis. Let's engage in a productive dialogue on this transformative opportunity.

Featured Posts

-

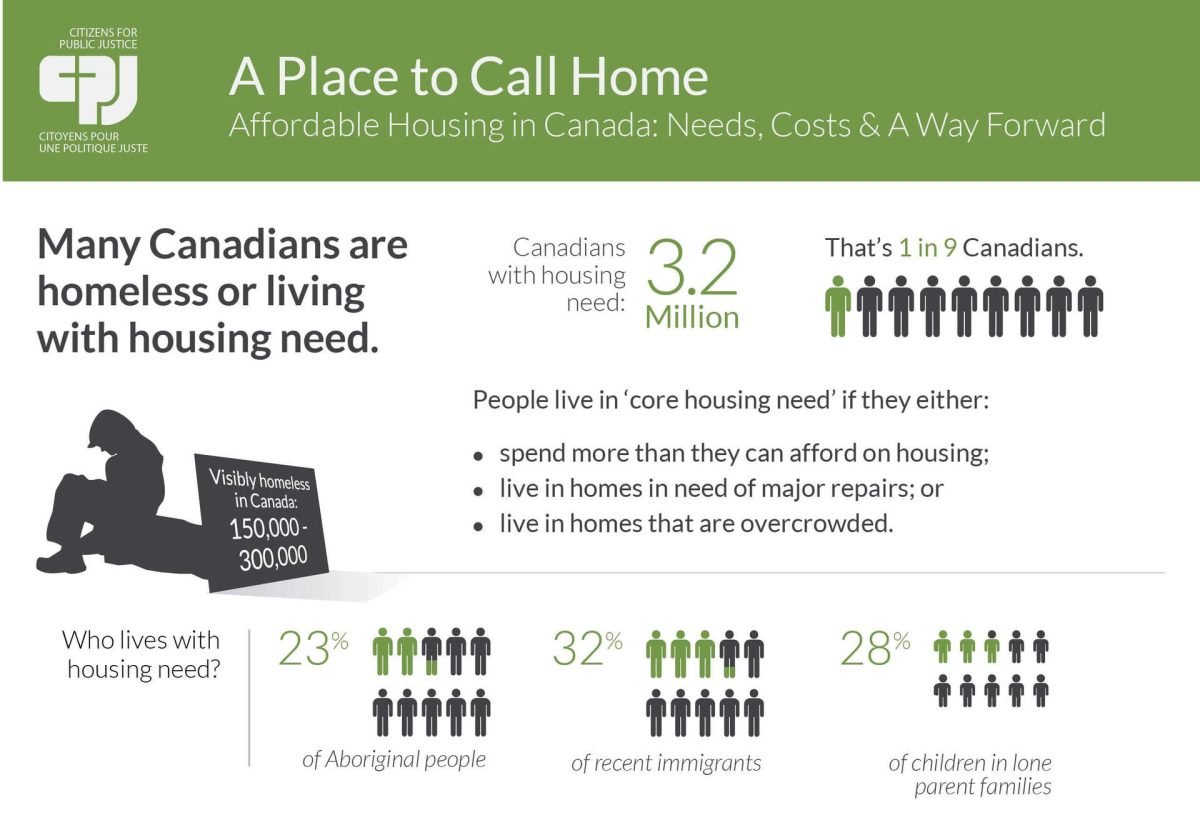

Is Homeownership In Canada Out Of Reach The Role Of High Down Payments

May 10, 2025

Is Homeownership In Canada Out Of Reach The Role Of High Down Payments

May 10, 2025 -

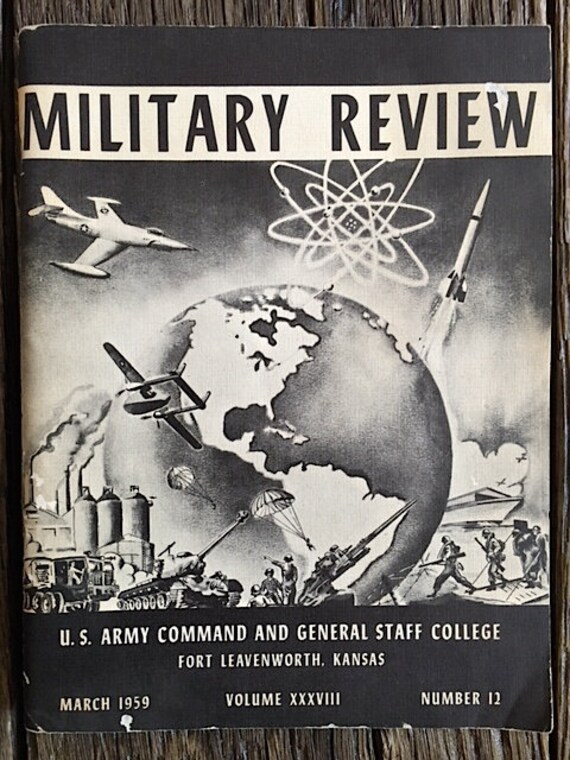

Pentagons Book Review Directive Impacts Military Academies

May 10, 2025

Pentagons Book Review Directive Impacts Military Academies

May 10, 2025 -

The Chief Justice And The Congressman A Story Of Mistaken Identity

May 10, 2025

The Chief Justice And The Congressman A Story Of Mistaken Identity

May 10, 2025 -

1078 2025 R5

May 10, 2025

1078 2025 R5

May 10, 2025 -

Leon Draisaitl Injury Update Out Against Winnipeg

May 10, 2025

Leon Draisaitl Injury Update Out Against Winnipeg

May 10, 2025