ECB Creates Task Force To Streamline Banking Regulations

Table of Contents

The Rationale Behind the ECB's Initiative

The ECB's decision to create a task force focused on streamlining banking regulations stems from growing concerns about the excessive regulatory burden placed on European banks. This burden has several detrimental effects:

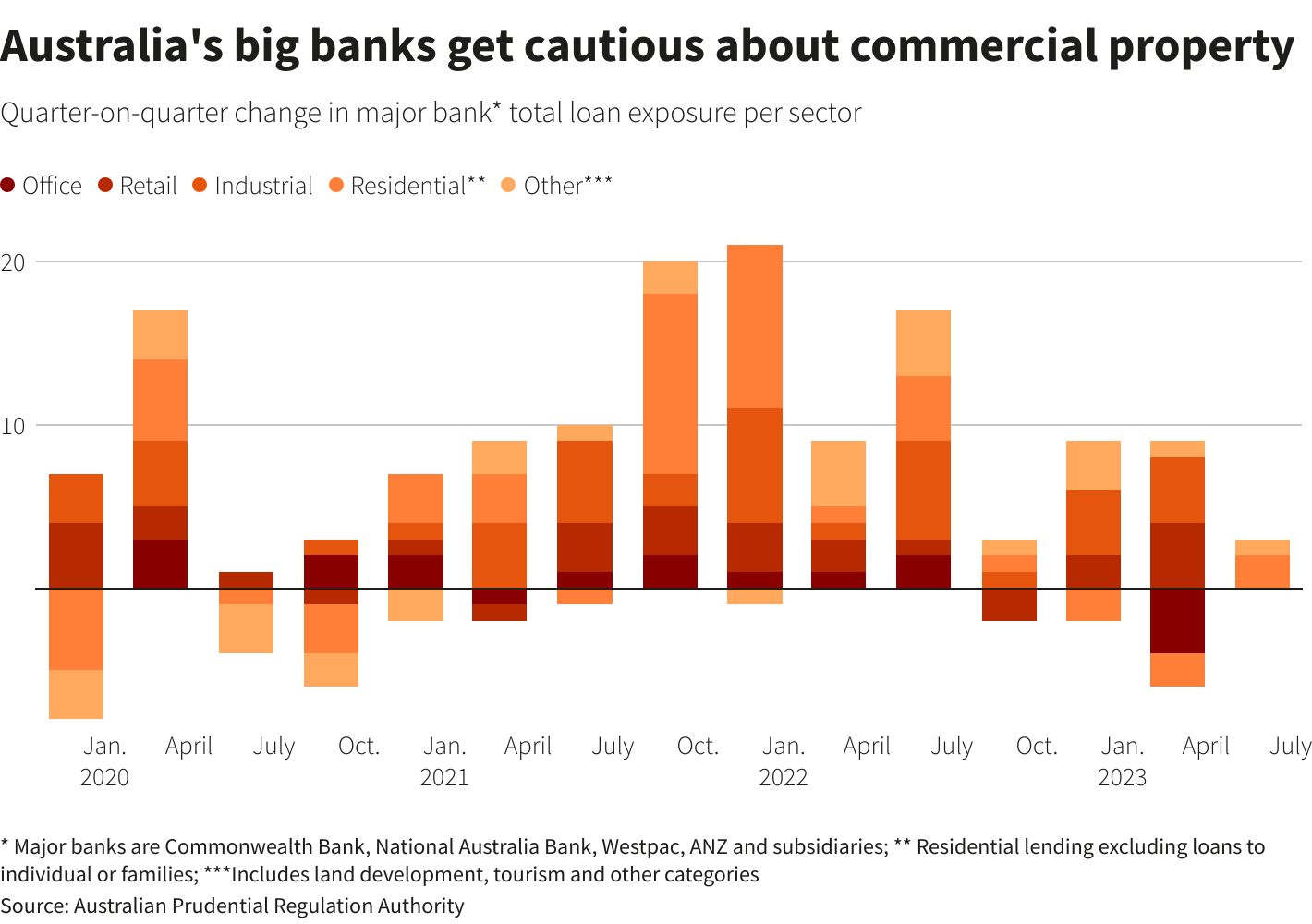

- High compliance costs: Meeting the numerous and often complex regulatory requirements consumes significant resources, diverting funds away from core banking activities like lending and investment. This reduces profitability and hinders innovation.

- Reduced bank lending: The increased cost of compliance and the uncertainty surrounding future regulations have led to a decrease in bank lending. This restricts credit availability for businesses and consumers, thereby stifling economic growth and investment.

- Increased complexity: The sheer volume and intricacy of existing regulations make it challenging for banks to ensure full compliance, potentially increasing the risk of errors and compromising financial stability. The current system is often criticized for being overly bureaucratic and inefficient.

The task force aims to tackle these challenges by meticulously analyzing the effectiveness of existing regulations and identifying areas where simplification is possible without compromising essential safeguards for financial stability. This includes identifying overlaps, inconsistencies, and unnecessary complexities within the existing framework of European banking regulation reform.

Key Objectives of the Task Force

The ECB's task force on streamlining banking regulations has several key objectives:

- Regulatory simplification: The primary goal is to reduce the complexity of existing regulations, making them clearer, more concise, and easier to understand and implement. This includes identifying and eliminating unnecessary requirements.

- Efficiency gains: The task force aims to improve the efficiency of the regulatory process, reducing administrative burden on banks and freeing up resources for core business activities. This could involve simplifying reporting requirements and streamlining supervisory practices.

- Improved risk assessment: The task force will focus on ensuring that regulations are proportionate to the risks involved, avoiding overly stringent requirements for low-risk activities. This should lead to a more risk-sensitive and efficient approach to financial regulation.

- Streamlined supervisory practices: The task force aims to make the supervisory process more efficient and less burdensome for banks, promoting better cooperation and communication between banks and supervisors.

- Proportionality: A key aspect is ensuring that regulations are proportionate to the size and risk profile of individual banks. Smaller banks shouldn't face the same regulatory burden as larger, more complex institutions.

Specific examples of regulatory areas under scrutiny may include capital requirements (Basel III and its implications), reporting requirements under CRR/CRD, and the methodologies used in stress testing.

Potential Impact on the European Banking Sector

Successfully streamlining banking regulations could have a profoundly positive impact on the European banking sector and the wider economy:

- Increased competitiveness: Reduced regulatory burden will allow European banks to operate more efficiently, improving their competitiveness on the global stage. This will enable them to compete more effectively with banks from other jurisdictions.

- Improved lending: Easing the regulatory pressure should increase bank lending, providing businesses and consumers with improved access to credit. This increased access to finance will stimulate investment and economic growth.

- Reduced costs: Streamlined regulations will lead to significant cost savings for banks, freeing up resources for investment in new technologies, products, and services, driving innovation.

- Economic stimulus: Increased lending and investment, driven by reduced regulatory burden, will act as a powerful economic stimulus, creating jobs and fostering economic growth across the Eurozone.

- A more resilient financial system: A simplified and more efficient regulatory framework will contribute to a more resilient and stable financial system, better equipped to withstand economic shocks.

The potential benefits extend far beyond the banking sector, impacting the broader European economy and fostering a more favorable environment for investment and job creation.

Challenges and Potential Obstacles

Despite the potential benefits, the task force faces several challenges in achieving its goals:

- Political will: Significant regulatory reform requires strong political will and support from all relevant stakeholders across different European countries. Reaching a consensus on substantial changes can be a lengthy and complex process.

- Regulatory divergence: Differences in national regulatory approaches across the Eurozone could hinder the implementation of uniform standards. Harmonizing regulations across diverse jurisdictions will require careful negotiation and compromise.

- Implementation challenges: Implementing large-scale regulatory changes is a complex undertaking, requiring meticulous planning, coordination, and effective communication with all affected parties.

- International coordination: Effective banking regulation often requires international coordination. The task force will need to work closely with other international regulatory bodies to ensure consistency and avoid conflicting regulations.

Conclusion

The ECB's establishment of a task force to streamline banking regulations represents a crucial step towards creating a more efficient and competitive European banking sector. By tackling the excessive regulatory burden, the task force aims to unlock significant economic benefits and enhance financial stability within European finance. The potential for increased bank lending, economic growth, and enhanced competitiveness is significant. However, the success of this initiative hinges on overcoming the challenges of securing political will, addressing regulatory divergence, and managing the complexities of implementation.

Call to Action: Stay informed about the progress of the ECB's initiative to streamline banking regulations. Follow the latest developments to understand the potential impact on European finance and how it might reshape the future of banking in the Eurozone. Learn more about the ongoing efforts to improve European banking regulation and its implications for businesses and consumers.

Featured Posts

-

Sources Reveal Hhss Controversial Choice For Autism Vaccine Study

Apr 27, 2025

Sources Reveal Hhss Controversial Choice For Autism Vaccine Study

Apr 27, 2025 -

Planning A Happy Day For February 20 2025

Apr 27, 2025

Planning A Happy Day For February 20 2025

Apr 27, 2025 -

Crack The Code 5 Dos And Don Ts To Land A Job In The Private Credit Industry

Apr 27, 2025

Crack The Code 5 Dos And Don Ts To Land A Job In The Private Credit Industry

Apr 27, 2025 -

Offenlegung Gemaess Artikel 40 Absatz 1 Wp Hg Pne Ag

Apr 27, 2025

Offenlegung Gemaess Artikel 40 Absatz 1 Wp Hg Pne Ag

Apr 27, 2025 -

The Ramiro Helmeyer Story Forging Blaugrana Glory

Apr 27, 2025

The Ramiro Helmeyer Story Forging Blaugrana Glory

Apr 27, 2025

Latest Posts

-

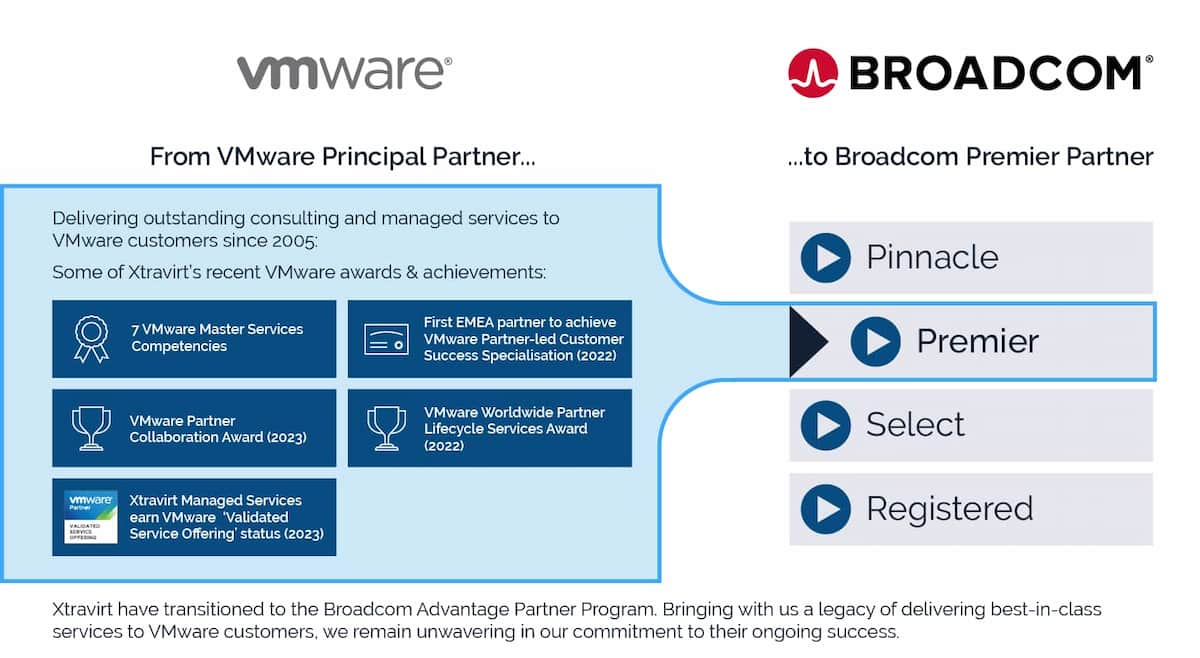

The Broadcom V Mware Deal An Extreme Price Hike Of 1 050 For At And T

Apr 28, 2025

The Broadcom V Mware Deal An Extreme Price Hike Of 1 050 For At And T

Apr 28, 2025 -

At And T Raises Alarm Over Extreme V Mware Price Hike After Broadcom Deal

Apr 28, 2025

At And T Raises Alarm Over Extreme V Mware Price Hike After Broadcom Deal

Apr 28, 2025 -

Broadcoms V Mware Acquisition At And T Highlights Extreme Price Increase Concerns

Apr 28, 2025

Broadcoms V Mware Acquisition At And T Highlights Extreme Price Increase Concerns

Apr 28, 2025 -

1 050 Price Hike At And T Challenges Broadcoms V Mware Acquisition Proposal

Apr 28, 2025

1 050 Price Hike At And T Challenges Broadcoms V Mware Acquisition Proposal

Apr 28, 2025 -

Assessing The Us Economy The Immediate Effects Of A Canadian Travel Boycott

Apr 28, 2025

Assessing The Us Economy The Immediate Effects Of A Canadian Travel Boycott

Apr 28, 2025