Election Outcome To Impact Australian Asset Prices: Expert Views

Table of Contents

H2: Potential Impact on the Australian Stock Market

The Australian stock market (ASX), a key indicator of the Australian economy's health, is highly sensitive to political shifts. Election uncertainty often leads to increased market volatility, as investors react to the promises and policies of different political parties. The impact on specific sectors will vary depending on the winning party's platform. Keywords: Australian stock market, ASX, share prices, election uncertainty, market reaction, sector performance.

-

Analysis of how different political parties' policies might affect specific sectors: For example, a focus on renewable energy might boost the technology sector while impacting traditional mining companies. Conversely, a policy favoring fossil fuels could have the opposite effect. Healthcare policies could significantly affect pharmaceutical and healthcare provider share prices.

-

Expert predictions on market volatility in the lead-up to and following the election: Many experts anticipate increased volatility in the weeks leading up to the election, with potential sharp movements in share prices immediately following the announcement of the result. The level of volatility will depend largely on the unexpectedness of the result and the clarity of the government's mandate.

-

Discussion on investor sentiment and its influence on share prices: Investor confidence plays a significant role. A decisive win for a party with a clear economic plan might boost investor sentiment, leading to higher share prices. Conversely, a hung parliament or a surprise victory could trigger a sell-off.

-

Potential Scenarios:

- Scenario 1: A Coalition win: This could lead to continued focus on fiscal conservatism, potentially benefiting established companies and resource sectors.

- Scenario 2: A Labor win: Policies focused on social programs and infrastructure spending might favor sectors like construction and renewable energy, while potentially impacting sectors reliant on government subsidies.

- Scenario 3: A minority government: This scenario usually leads to increased uncertainty and volatility as the government navigates complex negotiations and potentially compromises on key policies.

H2: The Australian Property Market and the Election

The Australian property market, a significant component of the nation's wealth, is also vulnerable to election outcomes. Government policies directly influence housing affordability, interest rates, and infrastructure spending, all of which impact property prices. Keywords: Australian property market, house prices, interest rates, property investment, housing affordability, property market outlook.

-

Examination of how policies relating to housing affordability, taxation, and infrastructure could influence property prices: Changes to negative gearing, capital gains tax, and first-home buyer schemes can significantly affect investment property values and demand. Increased infrastructure spending in certain regions can boost property values in those areas.

-

Expert opinions on potential changes in interest rates and their effect on the property market: Interest rate hikes, potentially influenced by government fiscal policy, will impact borrowing costs and affordability, directly affecting property prices. Lower interest rates generally stimulate the market, while higher rates tend to cool it down.

-

Analysis of the regional variations in the property market and their susceptibility to election outcomes: The impact of election outcomes varies across regions. For example, increased infrastructure spending in regional areas could disproportionately impact property values there.

-

Potential Policy Impacts:

- Impact of negative gearing changes on investment property values: Restricting negative gearing could reduce demand for investment properties, potentially lowering their value.

- Effects of first-home buyer schemes on demand and prices: Generous schemes can increase demand, potentially driving up prices, especially in entry-level markets.

- Influence of infrastructure spending on property values in specific regions: Increased government investment in infrastructure projects will boost local property markets.

H2: Impact on the Australian Dollar and Other Asset Classes

The Australian dollar (AUD) is sensitive to global economic conditions and domestic policy decisions. Election outcomes directly influence investor confidence and economic outlook, thereby impacting the currency's value. Keywords: Australian dollar (AUD), currency exchange rates, bond yields, commodities, gold, election impact on currency.

-

Discussion on how different economic policies could affect the AUD’s value against other major currencies: Policies perceived as fiscally responsible might strengthen the AUD, while those seen as inflationary could weaken it.

-

Analysis of the impact of election results on Australian bond yields: Changes in government borrowing and investor sentiment can affect bond yields, influencing the cost of borrowing for businesses and the government.

-

Exploration of the potential influence on commodities like iron ore and gold: Commodity prices can react to changes in government policy related to mining, resource management, and environmental regulations.

-

Potential Scenarios:

- Strong AUD scenario: A strong AUD typically benefits importers but can negatively affect exporters.

- Weak AUD scenario: A weak AUD makes exports more competitive but increases import costs.

- Impact on other asset classes like bonds and commodities: Bond yields and commodity prices often react to shifts in investor sentiment and economic forecasts related to the election outcome.

3. Conclusion:

The upcoming Australian federal election is poised to significantly influence Australian asset prices across various sectors. Experts anticipate substantial market volatility depending on the winning party and its subsequent policies. Understanding the potential impacts of different election outcomes is crucial for making informed investment decisions. The election outcome to impact Australian asset prices will be significant and requires careful monitoring.

Call to Action: Stay informed about the unfolding Australian political landscape and its implications for your investments. Monitor the election outcome to impact Australian asset prices closely to adapt your portfolio strategically. Seek professional financial advice to navigate the complexities of this pivotal period for the Australian economy.

Featured Posts

-

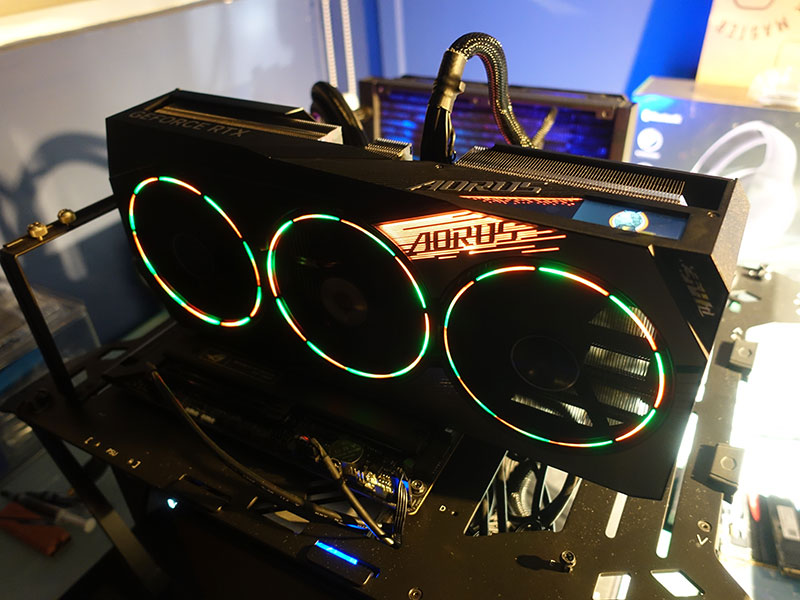

Aorus Master 16 Gigabyte Review High Performance Gaming Laptop With Fan Noise Considerations

May 06, 2025

Aorus Master 16 Gigabyte Review High Performance Gaming Laptop With Fan Noise Considerations

May 06, 2025 -

Economic Concerns Sidelined As Trump Seeks New Trade Deals

May 06, 2025

Economic Concerns Sidelined As Trump Seeks New Trade Deals

May 06, 2025 -

Romania Election Update Runoff Between Far Right And Centrist Candidate

May 06, 2025

Romania Election Update Runoff Between Far Right And Centrist Candidate

May 06, 2025 -

Where To Watch Celtics Vs Knicks Live Stream Guide And Tv Listings

May 06, 2025

Where To Watch Celtics Vs Knicks Live Stream Guide And Tv Listings

May 06, 2025 -

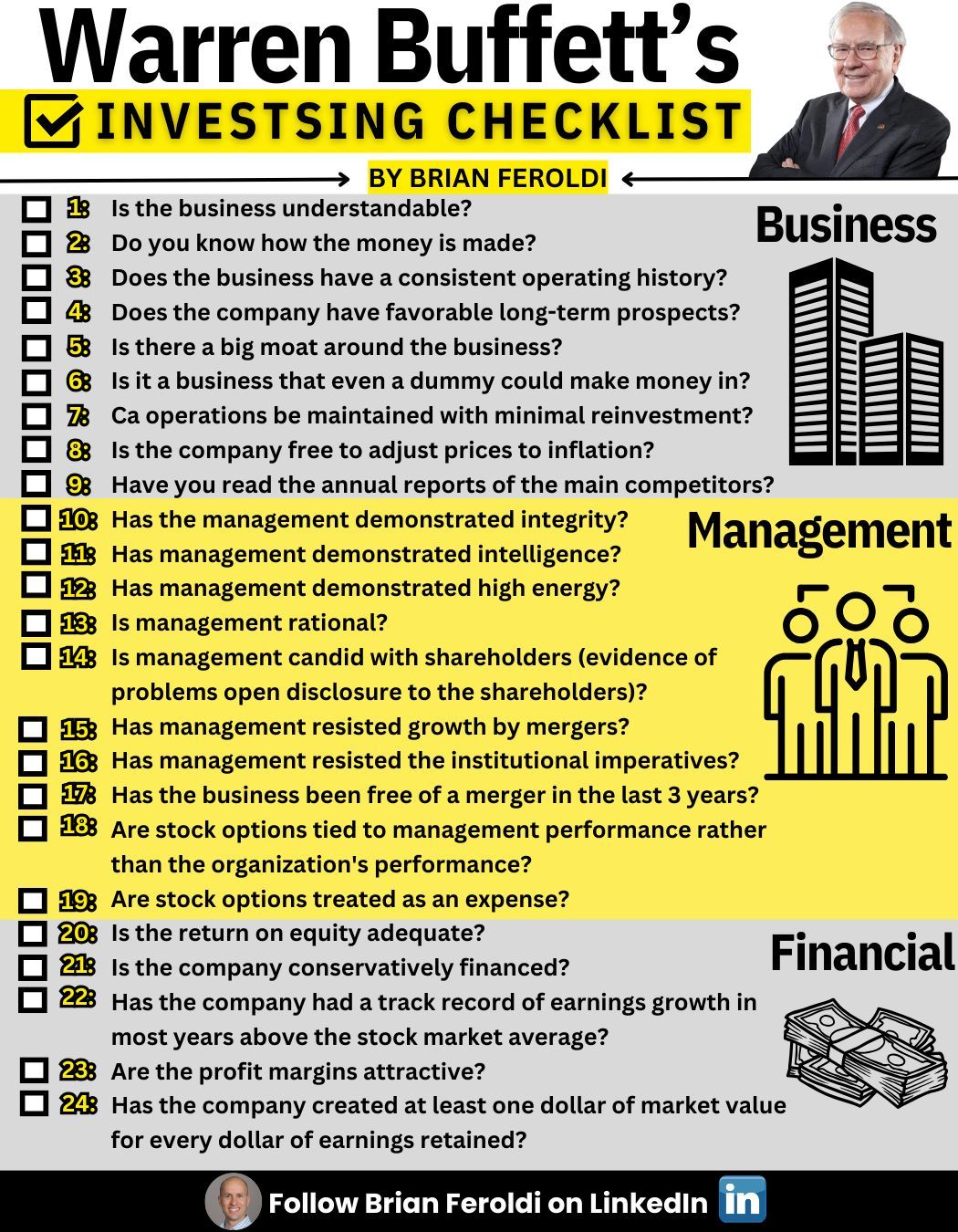

Analyzing Warren Buffetts Investing History Insights From His Best And Worst Decisions

May 06, 2025

Analyzing Warren Buffetts Investing History Insights From His Best And Worst Decisions

May 06, 2025

Latest Posts

-

Mindy Kaling And B J Novaks Friendship From The Office To Today

May 06, 2025

Mindy Kaling And B J Novaks Friendship From The Office To Today

May 06, 2025 -

Mindy Kalings Hollywood Walk Of Fame Star A Celebration

May 06, 2025

Mindy Kalings Hollywood Walk Of Fame Star A Celebration

May 06, 2025 -

B J Novak Comments On His Friendship With Mindy Kaling Amidst Dating Rumors

May 06, 2025

B J Novak Comments On His Friendship With Mindy Kaling Amidst Dating Rumors

May 06, 2025 -

Eastern Conference Semifinals Celtics Game Schedule And Preview

May 06, 2025

Eastern Conference Semifinals Celtics Game Schedule And Preview

May 06, 2025 -

Celtics Playoffs 2024 Eastern Conference Semifinal Start Time

May 06, 2025

Celtics Playoffs 2024 Eastern Conference Semifinal Start Time

May 06, 2025