Elon Musk Net Worth Drops Below $300 Billion: Tesla, Tariffs, And Market Volatility

Table of Contents

Tesla Stock Performance and its Impact on Elon Musk's Net Worth

Elon Musk's net worth is intrinsically linked to Tesla's market capitalization. As the company's largest shareholder, fluctuations in Tesla's stock price directly translate to changes in his personal wealth. Understanding the mechanisms behind this relationship is crucial to grasping the recent drop.

Tesla's Recent Stock Volatility

Tesla's stock price has experienced significant volatility in recent months. This volatility directly impacts Elon Musk's net worth calculation, as his wealth is largely tied to his ownership stake in the company.

- Example 1: A 10% drop in Tesla's stock price in [Date] resulted in an estimated [Dollar Amount] decrease in Musk's net worth.

- Example 2: News of [Specific News Event, e.g., production delays at Gigafactory Berlin] led to a [Percentage]% decline in Tesla's stock price on [Date], further reducing Musk's net worth by an estimated [Dollar Amount].

- Example 3: Negative Tesla investor sentiment surrounding [Specific Issue, e.g., concerns about competition or the company's expansion plans] contributed to a sustained period of lower stock prices.

These fluctuations highlight the inherent risk associated with a net worth so heavily concentrated in a single, highly volatile stock. The relationship between "Tesla stock price" and "Elon Musk net worth calculation" is direct and undeniable. Tracking Tesla's market capitalization is essential for understanding the dynamics of Musk's wealth.

Competition and Market Saturation

The electric vehicle (EV) market is rapidly expanding, attracting significant investment and leading to increased competition. This growing competition, coupled with concerns about market saturation, puts pressure on Tesla's market share and consequently its stock valuation.

- Key Competitors: Companies like BYD, Volkswagen, and Rivian are aggressively expanding their EV offerings, posing a significant challenge to Tesla's dominance.

- Market Saturation Concerns: As more automakers enter the EV space, concerns are growing about the potential for market saturation, affecting future growth projections and impacting Tesla's stock price.

The "electric vehicle market" is becoming increasingly crowded, and "Tesla market share" is no longer guaranteed. These "automotive industry trends" underscore the challenges facing Tesla and, consequently, Elon Musk's net worth.

The Role of Tariffs and Global Trade Disputes

Global trade disputes and tariffs significantly impact Tesla's operations and profitability, indirectly affecting Elon Musk's net worth.

Impact of Trade Wars on Tesla's Global Operations

Tariffs and trade wars, particularly those between China and the US, significantly affect Tesla's manufacturing, supply chain, and profitability.

- Example 1: Tariffs on imported components increased Tesla's production costs, impacting margins and potentially reducing profitability.

- Example 2: Trade disputes disrupted Tesla's supply chain, causing production delays and negatively affecting its financial performance.

These factors contribute to a less favorable "global supply chain" environment for Tesla, impacting its performance and ultimately "Elon Musk net worth". The implications of "China-US trade relations" on Tesla’s global business strategy are undeniable.

Geopolitical Uncertainty and its Influence on Investor Confidence

Broader geopolitical instability negatively influences investor confidence in Tesla and subsequently its stock price.

- Example 1: Geopolitical tensions in [Region] increased market uncertainty, causing investors to move towards safer assets, leading to a sell-off in Tesla stock.

- Example 2: Global economic slowdown fueled by [Specific Event] negatively affected investor sentiment towards riskier assets such as Tesla.

This "geopolitical risk" plays a crucial role in shaping "investor sentiment" and affecting the valuation of the company. "Market uncertainty" directly impacts the price of Tesla's stock and, consequently, Elon Musk's net worth.

Broader Market Volatility and its Effect on High-Growth Tech Stocks

The recent downturn in the broader market has significantly impacted high-growth tech stocks, including Tesla, causing a ripple effect on Elon Musk's net worth.

The Overall Market Downturn and its Impact on High-Value Assets

Market corrections disproportionately affect high-growth tech stocks like Tesla, known for their higher valuations and faster growth potential. These stocks tend to be more susceptible to changes in investor sentiment.

- Example 1: [Other tech stock] experienced a similar price drop, demonstrating the broader trend impacting high-value assets.

- Example 2: Investors' shift towards safer assets during periods of market uncertainty contributes to this volatility.

Understanding "market correction" and "tech stock volatility" is crucial for assessing the risks associated with investments in high-growth companies. "Portfolio diversification" is a key strategy for managing risk in such environments.

Interest Rate Hikes and Their Influence on Stock Prices

Rising interest rates increase borrowing costs for companies and reduce the appeal of riskier, high-growth stocks, like Tesla, impacting their valuations.

- Increased interest rates reduce investor appetite for riskier assets, leading to sell-offs in growth stocks.

- Higher interest rates make debt financing more expensive, affecting company profitability and impacting stock prices.

The interplay between "interest rate hikes," "inflation," and "monetary policy" heavily influences "investor behavior" and ultimately, the valuation of "stock market valuation".

Conclusion

The dramatic drop in Elon Musk's net worth below $300 billion underscores the intricate relationship between company performance, global economic factors, and market sentiment. Tesla's stock performance, amplified by trade tensions and broader market volatility, has significantly contributed to this decline. Understanding these interconnected factors is crucial for investors. Staying informed about Elon Musk's net worth and the factors influencing it, particularly Tesla's stock performance and global economic trends, is vital for anyone interested in the future of electric vehicles and the tech sector. Continue to monitor news and analyses related to Elon Musk's net worth and Tesla's performance for a comprehensive understanding.

Featured Posts

-

700 Point Sensex Rally Live Stock Market Updates And Insights

May 10, 2025

700 Point Sensex Rally Live Stock Market Updates And Insights

May 10, 2025 -

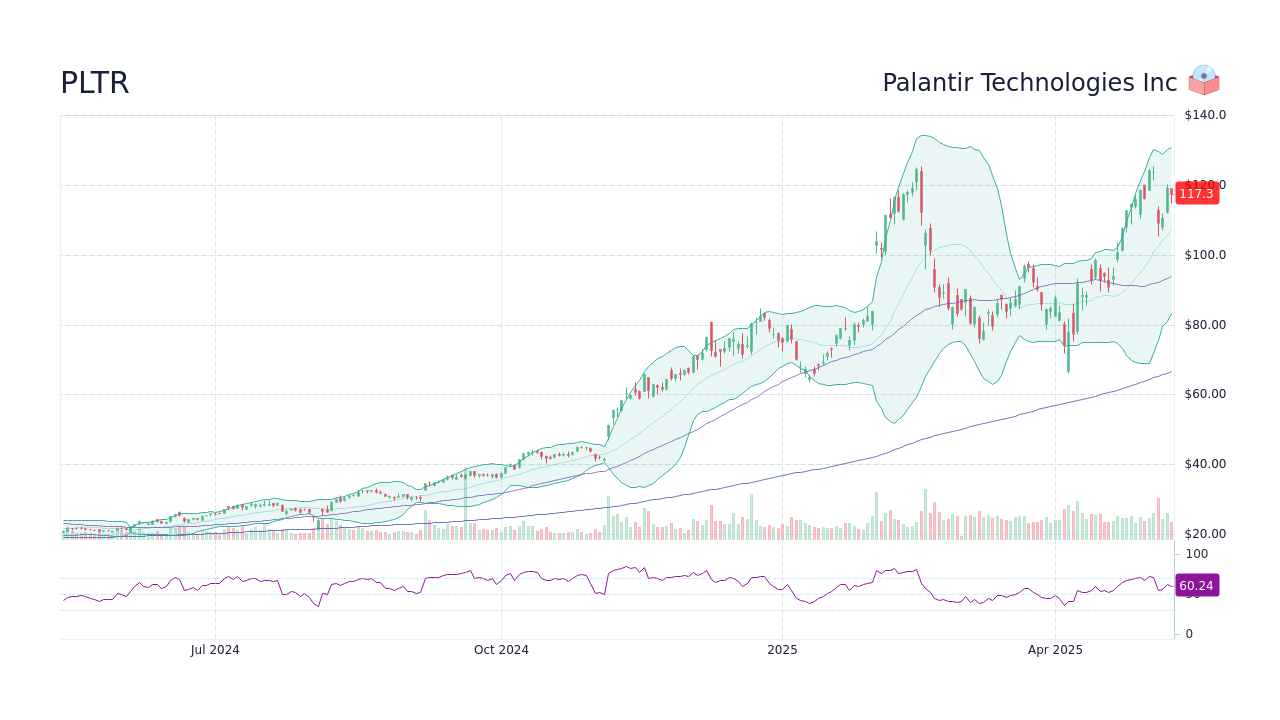

Palantir Stock Forecast 2025 Is A 40 Rise Realistic

May 10, 2025

Palantir Stock Forecast 2025 Is A 40 Rise Realistic

May 10, 2025 -

S Sh A I Noviy Migratsionniy Krizis Vzglyad Iz Germanii Na Ugrozu Pritoka Ukrainskikh Bezhentsev

May 10, 2025

S Sh A I Noviy Migratsionniy Krizis Vzglyad Iz Germanii Na Ugrozu Pritoka Ukrainskikh Bezhentsev

May 10, 2025 -

Us Debt Limit Could Expire In August Raising Concerns

May 10, 2025

Us Debt Limit Could Expire In August Raising Concerns

May 10, 2025 -

9 Maya Makron Starmer Merts I Tusk Ostanutsya V Svoikh Stolitsakh

May 10, 2025

9 Maya Makron Starmer Merts I Tusk Ostanutsya V Svoikh Stolitsakh

May 10, 2025