Canadian Dollar: A Complex Currency Picture

Table of Contents

The Impact of Commodity Prices on the Canadian Dollar

The Canadian economy is significantly tied to its natural resources. Therefore, commodity prices, particularly oil and lumber, have a strong correlation with the Canadian dollar's exchange rate. Canada is a major exporter of these commodities, and global demand directly impacts the value of the CAD. When global demand for Canadian resources like oil increases, the inflow of foreign currency strengthens the Canadian dollar. Conversely, a decrease in global demand weakens the CAD as export revenues decline.

For example, periods of high oil prices have historically led to a stronger CAD, while periods of low oil prices, such as the 2014-2016 oil slump, have significantly weakened the currency. This volatility underscores the importance of understanding commodity markets for anyone seeking to predict or manage CAD exposure.

- Increased demand for Canadian resources leads to a stronger CAD. Higher export earnings increase the demand for the Canadian dollar.

- Decreased demand weakens the CAD. Reduced export revenues lead to a lower demand for the Canadian dollar, causing its value to fall.

- Diversification of the Canadian economy reduces reliance on commodities. While challenging, moving away from sole reliance on commodities can lessen the impact of commodity price fluctuations on the CAD.

Interest Rate Influence on the Canadian Dollar Exchange Rate

The Bank of Canada's monetary policy, specifically its interest rate decisions, plays a pivotal role in influencing the Canadian dollar exchange rate. Higher interest rates generally attract foreign investment, as investors seek higher returns. This increased demand for Canadian dollar assets strengthens the currency. Conversely, lower interest rates can lead to capital outflow as investors seek higher returns elsewhere, weakening the CAD. Interest rate changes also influence inflation; high inflation typically weakens a currency, while controlled inflation can contribute to a stronger exchange rate.

- Higher interest rates attract foreign investment, increasing demand for CAD. Investors are drawn to higher yields, increasing demand for the Canadian dollar.

- Lower interest rates can lead to capital outflow and a weaker CAD. Reduced returns incentivize investors to move their capital elsewhere.

- Central bank policies play a crucial role in managing the CAD's value. The Bank of Canada's actions directly influence interest rates and, consequently, the Canadian dollar.

Geopolitical Factors and the Canadian Dollar

Global political events and international trade relations significantly impact the Canadian dollar. The relationship between the US and Canada is particularly crucial, as the US is Canada's largest trading partner. A strong US dollar generally puts downward pressure on the CAD, while uncertainty in US economic policy or global markets can also negatively affect the Canadian dollar due to risk aversion by investors. Trade agreements, sanctions, and global political instability all contribute to the volatility of the CAD.

- Trade agreements and disputes significantly impact the CAD. Changes in trade relationships directly affect the flow of goods and capital, impacting the Canadian dollar.

- Global political instability can weaken the CAD due to risk aversion. Investors often move their money to safer havens during times of uncertainty.

- A stronger US dollar generally weakens the CAD. The USD/CAD exchange rate is heavily influenced by the relative strength of the two currencies.

Investing in the Canadian Dollar: Strategies and Risks

Investing in the Canadian dollar presents both opportunities and risks. Strategies include direct currency trading, where investors speculate on the CAD's value against other currencies, or indirect investment through Canadian stocks, which are denominated in CAD. However, the volatility of the Canadian dollar introduces considerable risk. Currency trading, in particular, can be highly speculative and requires expertise. Diversifying your investment portfolio across various asset classes and currencies helps to mitigate this risk.

- Currency trading involves significant risk and requires expertise. It's not suitable for all investors.

- Investing in Canadian companies provides exposure to the CAD indirectly. This offers a less direct, potentially less volatile approach.

- Diversification reduces the impact of CAD volatility on your portfolio. Spreading your investments minimizes the risk associated with any single currency's fluctuations.

Conclusion: Navigating the Complexities of the Canadian Dollar

The value of the Canadian dollar is influenced by a complex interplay of factors, including commodity prices, interest rates set by the Bank of Canada, and geopolitical events. Predicting future movements is challenging due to this multifaceted nature. Understanding these key influences is paramount before making any investment decisions related to the Canadian dollar exchange rate, Canadian currency, or CAD trading. Stay informed about these factors to make educated decisions regarding your financial planning and investments. Keep abreast of the latest news and analysis on the Canadian dollar to navigate this dynamic market effectively.

Featured Posts

-

Herros Hot Shooting 3 Point Contest Victory And Cavs Skills Challenge Win

Apr 24, 2025

Herros Hot Shooting 3 Point Contest Victory And Cavs Skills Challenge Win

Apr 24, 2025 -

Ohio Train Derailment Lingering Toxic Chemicals In Buildings

Apr 24, 2025

Ohio Train Derailment Lingering Toxic Chemicals In Buildings

Apr 24, 2025 -

Tyler Herro And The Cavaliers Shine At Nba All Star Weekend

Apr 24, 2025

Tyler Herro And The Cavaliers Shine At Nba All Star Weekend

Apr 24, 2025 -

Improved Trade Relations Boost Chinese Stocks Listed In Hong Kong

Apr 24, 2025

Improved Trade Relations Boost Chinese Stocks Listed In Hong Kong

Apr 24, 2025 -

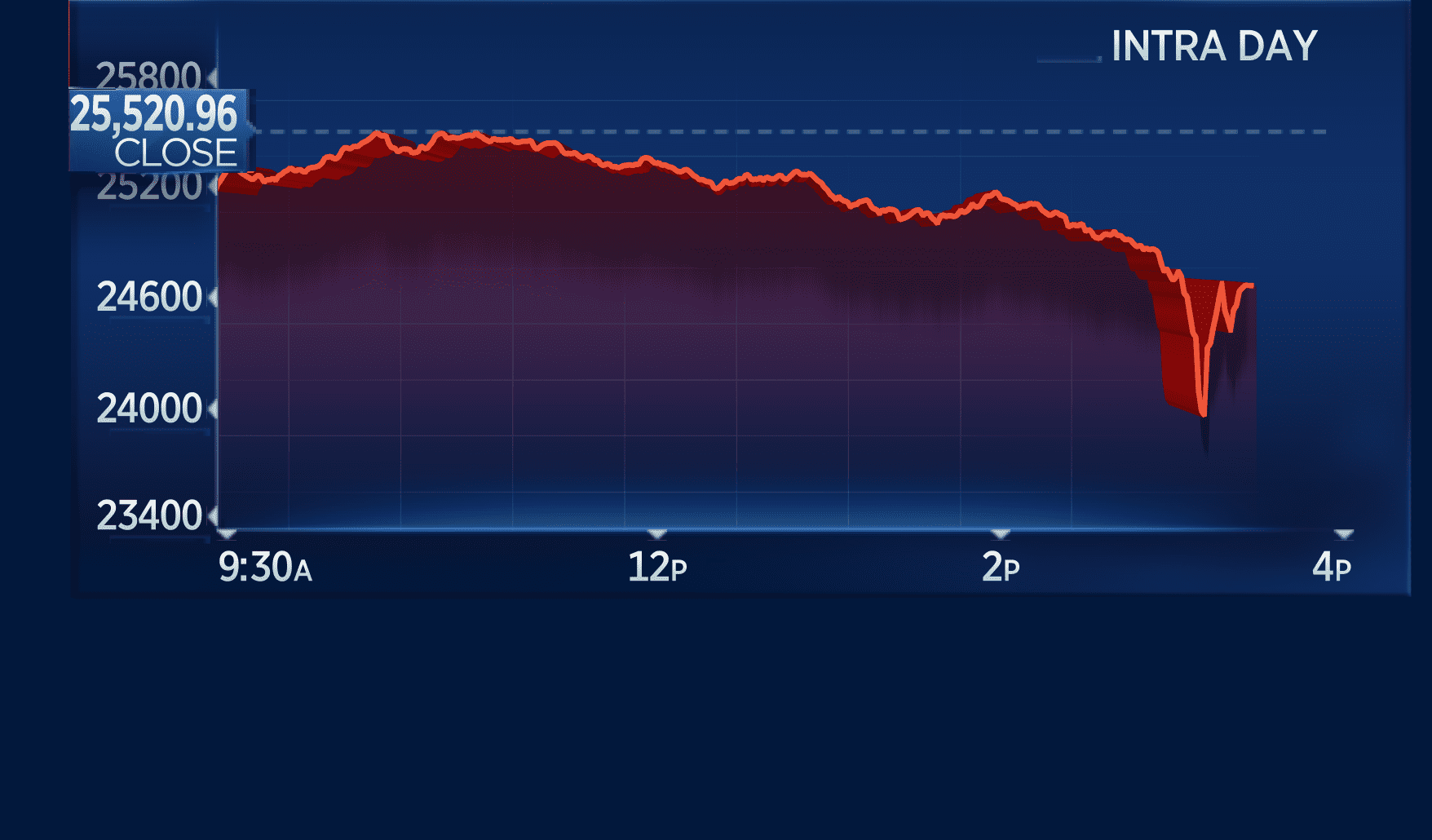

Stock Market Today Dow S And P 500 Live Updates April 23rd

Apr 24, 2025

Stock Market Today Dow S And P 500 Live Updates April 23rd

Apr 24, 2025

Latest Posts

-

Hajis Hat Trick Highlights Usmnt Weekend Action

May 12, 2025

Hajis Hat Trick Highlights Usmnt Weekend Action

May 12, 2025 -

The Rare Condition Of Bilateral Anophthalmia Medical Advances And Future Outlook

May 12, 2025

The Rare Condition Of Bilateral Anophthalmia Medical Advances And Future Outlook

May 12, 2025 -

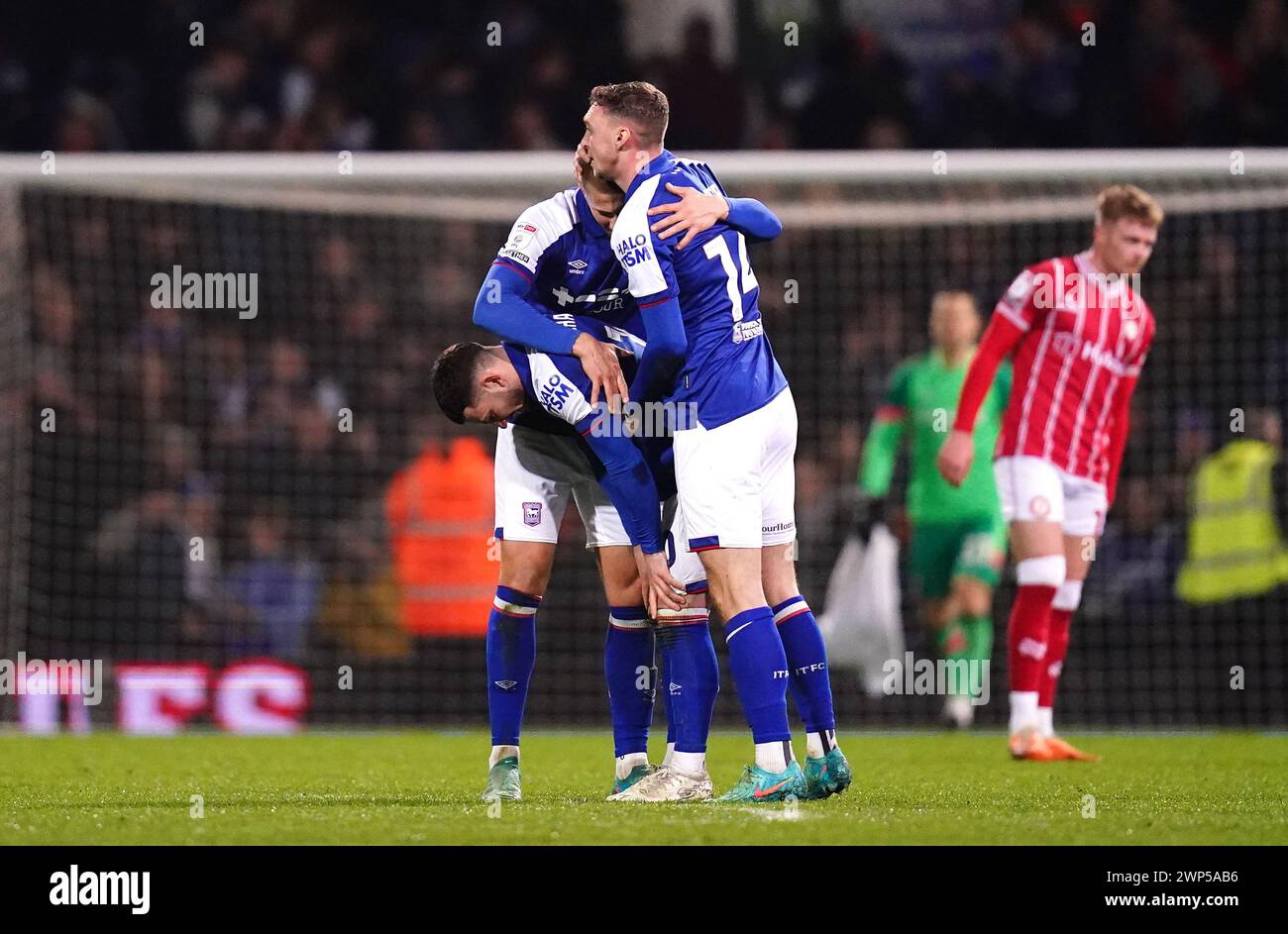

Ipswich Towns Chaplin The Path To Victory

May 12, 2025

Ipswich Towns Chaplin The Path To Victory

May 12, 2025 -

Kieran Stevenson And The Future Of Ipswich Town Football Club

May 12, 2025

Kieran Stevenson And The Future Of Ipswich Town Football Club

May 12, 2025 -

Bilateral Anophthalmia A Comprehensive Guide For Parents And Caregivers

May 12, 2025

Bilateral Anophthalmia A Comprehensive Guide For Parents And Caregivers

May 12, 2025