Escape To The Country: How Nicki Chapman Made £700,000 On A Property Investment

Table of Contents

Nicki Chapman's Property Investment Strategy

Nicki Chapman's success wasn't accidental; it was the result of a well-defined investment strategy encompassing several key elements. Her approach highlights the potential for significant returns in the property market, particularly when focusing on specific strategies.

Identifying Undervalued Properties

The foundation of any successful property investment lies in identifying undervalued properties with significant growth potential. This requires meticulous research and a deep understanding of local market trends. Escape to the Country often showcases areas with hidden potential, providing valuable insights for aspiring investors.

- Thorough market research: Analyzing comparable properties, studying local council plans (for infrastructure projects or zoning changes), and researching future development prospects are crucial. Tools like online property portals and local council websites offer invaluable data.

- Effective negotiation: Securing a lower purchase price is vital. This involves skillful negotiation, understanding the seller's motivations, and presenting a compelling offer.

- Patience and persistence: Finding the right property takes time. Don't rush the process; persevere until you find a property that meets your investment criteria and offers a solid return potential. Remember, the "Escape to the Country" ideal often involves patience and finding the perfect fit.

Renovation and Improvement

Adding value through strategic renovations and improvements is a cornerstone of maximizing profits. Focusing on key areas yields the greatest return on investment (ROI).

- Prioritizing cost-effective upgrades: Concentrate on renovations that offer the highest return. Updating kitchens and bathrooms typically provides the most significant impact on property value.

- High-impact improvements: Kitchens and bathrooms are always popular, but consider energy efficiency upgrades (like insulation) and landscaping for additional appeal. These add value without huge costs.

- Skilled contractors: Employing reliable and skilled contractors is essential to ensure quality workmanship and avoid costly delays or rework. References and reviews are crucial in this area.

Strategic Timing of Sale

Selling at the optimal time in the market cycle is crucial for maximizing profits. Understanding market cycles and utilizing effective marketing strategies are key.

- Monitoring market trends: Keep a close eye on local property market trends, including price fluctuations, buyer demand, and interest rates.

- Understanding local cycles: Some areas experience seasonal peaks in demand. Understanding these cycles allows for strategic timing of the sale for optimal pricing.

- Effective marketing: Employing professional marketing strategies – including high-quality photography, engaging property descriptions, and leveraging online portals – ensures a wider reach and faster sale.

Lessons Learned from Nicki Chapman's Success

Nicki Chapman's success highlights several essential lessons for aspiring property investors.

The Importance of Due Diligence

Thorough research and investigation are paramount before committing to any property purchase. Due diligence minimizes risks and maximizes chances of success.

- Professional surveys and inspections: Don't skip this vital step. A professional survey identifies potential structural issues, while inspections ensure everything is functioning correctly.

- Legal and financial understanding: Understand the legal implications of buying and selling property, including conveyancing and taxation. Seek professional advice as needed.

- Expert advice: Consult with experienced property professionals, such as solicitors, surveyors, and financial advisors. Their expertise can prevent costly mistakes.

Managing Risk and Budget

Proper budgeting and risk management are crucial in property investment. Account for all potential costs, including unexpected expenses.

- Realistic budgeting: Create a detailed budget that encompasses purchase price, renovation costs, legal fees, taxes, and potential financing costs.

- Contingency planning: Always include a contingency fund to cover unforeseen expenses, such as repairs or delays.

- Risk mitigation: Identify potential risks (e.g., market fluctuations, planning permission issues) and develop strategies to mitigate them.

Long-Term Vision

Successful property investment often requires patience and a long-term perspective. Focus on the potential for long-term capital growth.

- Long-term capital growth: View the property as a long-term investment, not just a quick flip. This approach offers greater potential for profit over time.

- Holding period: Be prepared to hold onto the property for an extended period if market conditions aren't ideal for selling.

- Potential rental income: Consider the possibility of generating rental income during the holding period, further boosting returns.

Conclusion

Nicki Chapman's £700,000 profit from her Escape to the Country property investment demonstrates the significant financial rewards achievable through careful planning, diligent research, and strategic execution. By learning from her example and applying these lessons, you can significantly increase your chances of success in the property market. Don't just watch "Escape to the Country"; start your own Escape to the Country property investment journey today! Research the market, find your undervalued gem, and begin your path to financial freedom through smart Escape to the Country property investment.

Featured Posts

-

Net Asset Value Nav Changes In Amundi Msci World Catholic Principles Ucits Etf Acc

May 24, 2025

Net Asset Value Nav Changes In Amundi Msci World Catholic Principles Ucits Etf Acc

May 24, 2025 -

Escape To The Country Your Guide To A Peaceful Rural Retreat

May 24, 2025

Escape To The Country Your Guide To A Peaceful Rural Retreat

May 24, 2025 -

Crystal Palace Eyeing Kyle Walker Peters On A Free

May 24, 2025

Crystal Palace Eyeing Kyle Walker Peters On A Free

May 24, 2025 -

The Ultimate Escape To The Country Homes Land And Lifestyle

May 24, 2025

The Ultimate Escape To The Country Homes Land And Lifestyle

May 24, 2025 -

Your Escape To The Country Making The Move A Success

May 24, 2025

Your Escape To The Country Making The Move A Success

May 24, 2025

Latest Posts

-

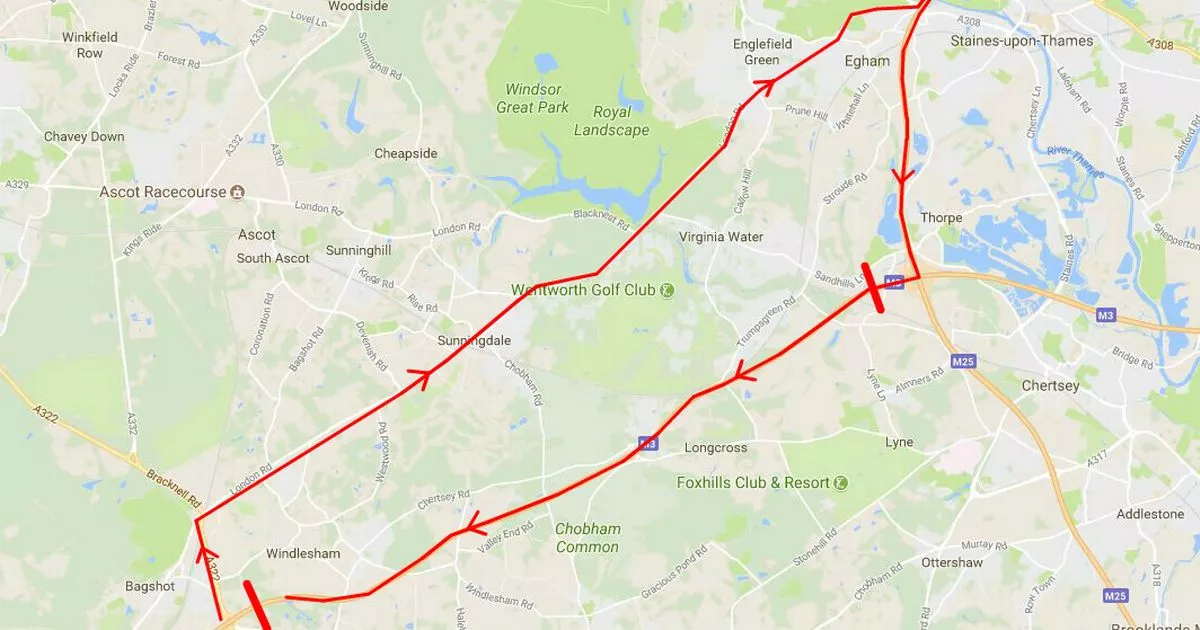

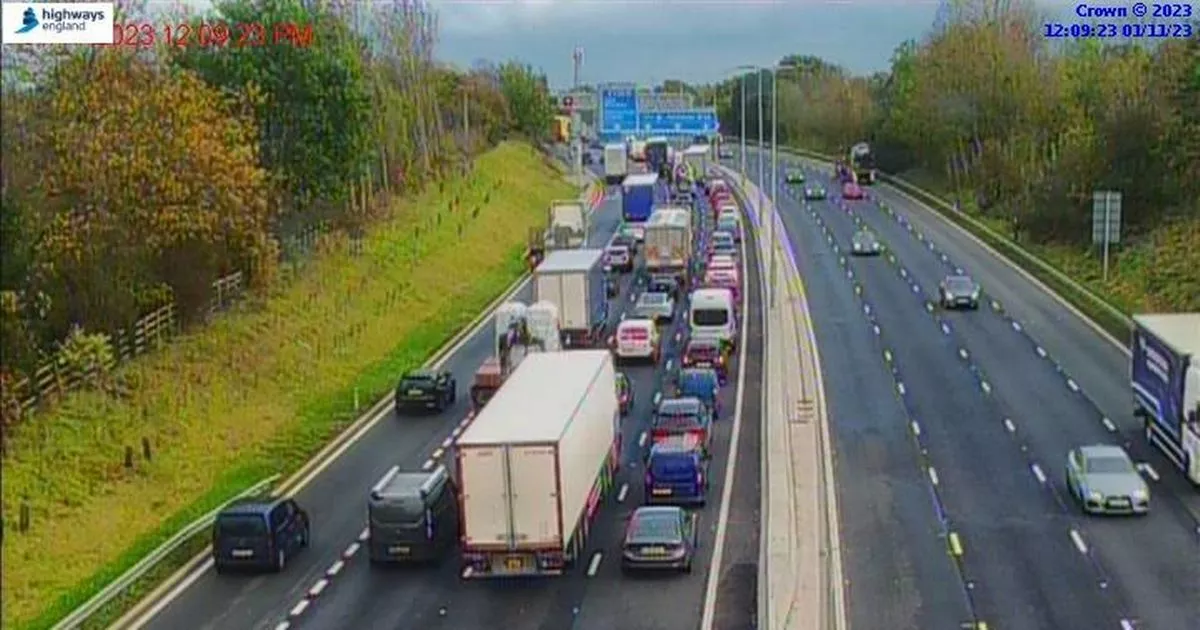

M56 Motorway Closure Live Updates On Serious Crash And Traffic Delays

May 24, 2025

M56 Motorway Closure Live Updates On Serious Crash And Traffic Delays

May 24, 2025 -

M56 Closed Serious Crash Causes Major Traffic Disruption Live M56 Traffic Updates

May 24, 2025

M56 Closed Serious Crash Causes Major Traffic Disruption Live M56 Traffic Updates

May 24, 2025 -

M56 Traffic Motorway Closure Due To Serious Crash Live Updates

May 24, 2025

M56 Traffic Motorway Closure Due To Serious Crash Live Updates

May 24, 2025 -

M56 Road Closure Live Traffic Updates And Diversion Routes

May 24, 2025

M56 Road Closure Live Traffic Updates And Diversion Routes

May 24, 2025 -

Long Queues On M56 Due To Crash Current Traffic Conditions

May 24, 2025

Long Queues On M56 Due To Crash Current Traffic Conditions

May 24, 2025