Ethereum CrossX Indicators Flash Buy Signal: Institutions Accumulating, $4,000 Target?

Table of Contents

Deciphering the Ethereum CrossX Indicators Flash Buy Signal

Ethereum CrossX indicators are a suite of technical analysis tools used to interpret the price action and momentum of Ethereum (ETH). They combine various indicators like Relative Strength Index (RSI), Moving Average Convergence Divergence (MACD), and volume analysis to generate buy/sell signals. These indicators are not solely reliant on price; they also consider market sentiment and trading volume, providing a more holistic view of the market.

The recent flash buy signal was characterized by:

- RSI Breakout: The RSI, a momentum indicator, surged above the overbought level of 70, indicating strong bullish momentum.

- MACD Bullish Crossover: The MACD lines crossed, with the fast line moving above the slow line, signaling a potential upward trend.

- Significant Volume Spike: A considerable increase in trading volume accompanied the price surge, confirming the strength of the buy signal.

This specific signal is significant because it follows a period of relative market consolidation. This suggests that the buying pressure wasn't just short-term speculation, but potentially indicative of a larger trend shift.

[Insert chart/graph illustrating the RSI, MACD, and volume data around the flash buy signal]

Evidence of Institutional Accumulation in Ethereum

Several factors suggest significant institutional investment in Ethereum. On-chain data reveals:

- Large Wallet Movements: A notable increase in ETH transfers to large wallets, often associated with institutional investors, has been observed.

- Exchange Outflows: The net outflow of ETH from major cryptocurrency exchanges suggests that institutional investors are accumulating ETH off exchanges, reducing the available supply in the open market.

Beyond on-chain data, several news reports and analyses point towards growing institutional interest:

- Increased Grayscale ETH Trust Holdings: Grayscale Investments, a significant player in the crypto investment space, has steadily increased its holdings of ETH, signaling confidence in the asset's long-term prospects.

- Other Major Institutional Investors in Ethereum: Other notable firms, including pension funds and endowments, have quietly entered the Ethereum market, further supporting the theory of institutional accumulation.

The impact of this institutional buying pressure cannot be overstated. Large-scale purchases can significantly influence price movements, driving the price higher and establishing a firmer price floor.

Grayscale Investments and Ethereum

Grayscale's Ethereum Trust (ETHE) is a prominent example of institutional participation in the Ethereum market. The growth of ETHE's assets under management (AUM) serves as a strong indication of the increasing institutional appetite for Ethereum.

Other Major Institutional Investors in Ethereum

While precise details on the holdings of all institutional investors remain opaque, analysts have detected activity pointing towards the involvement of various significant players, contributing to the accumulating buying pressure.

The $4,000 Ethereum Price Target: Realistic or Overly Optimistic?

A $4,000 Ethereum price target is certainly ambitious, but not entirely unrealistic considering several factors:

- Positive Market Sentiment: The overall positive sentiment surrounding Ethereum, fueled by growing adoption in DeFi and NFTs, contributes to bullish price predictions.

- Technological Advancements: Ongoing upgrades to the Ethereum network, such as the transition to Ethereum 2.0, are expected to enhance scalability and efficiency, potentially attracting further investment.

- DeFi Growth: The thriving decentralized finance (DeFi) ecosystem built on Ethereum continues to expand, driving demand for ETH.

However, several headwinds could impede this price target:

- Regulatory Uncertainty: The evolving regulatory landscape for cryptocurrencies could introduce unforeseen challenges, affecting market sentiment and price.

- Macroeconomic Factors: Global economic conditions, such as inflation and interest rate changes, can significantly impact the cryptocurrency market.

Bullish Factors:

- Increased Institutional Adoption

- Ethereum 2.0 Improvements

- DeFi Ecosystem Growth

Bearish Factors:

- Regulatory Uncertainty

- Macroeconomic Instability

- Potential Market Corrections

Based on these factors, several price trajectories are possible. A conservative estimate might see ETH reaching $3,000-$3,500 in the near term, while a more optimistic scenario could lead to the $4,000 target, though likely over a longer timeframe.

Risk Management for Ethereum Investors

Investing in cryptocurrencies, especially during periods of heightened volatility, requires a robust risk management strategy.

- Diversification: Never put all your eggs in one basket. Diversify your portfolio across various assets to mitigate potential losses.

- Stop-Loss Orders: Implement stop-loss orders to automatically sell your ETH if the price falls below a predetermined level, limiting potential losses.

- Dollar-Cost Averaging (DCA): DCA involves investing a fixed amount of money at regular intervals, regardless of price fluctuations, reducing the impact of market volatility.

Remember, responsible investing is crucial. Thoroughly research before making any investment decisions, and only invest what you can afford to lose.

Conclusion

The Ethereum CrossX flash buy signal, coupled with evidence of institutional accumulation, suggests a potentially bullish outlook for ETH. The possibility of reaching a $4,000 price target is certainly plausible, but not guaranteed. Several factors, both bullish and bearish, will influence the price trajectory. Ultimately, thorough research and a sound risk management strategy are paramount for any investor considering exposure to Ethereum.

Call to Action: Learn more about Ethereum CrossX indicators and stay informed about the latest Ethereum price predictions to make well-informed investment decisions. Understand the risks involved in investing in Ethereum before committing your capital. [Link to relevant resources/further reading]

Featured Posts

-

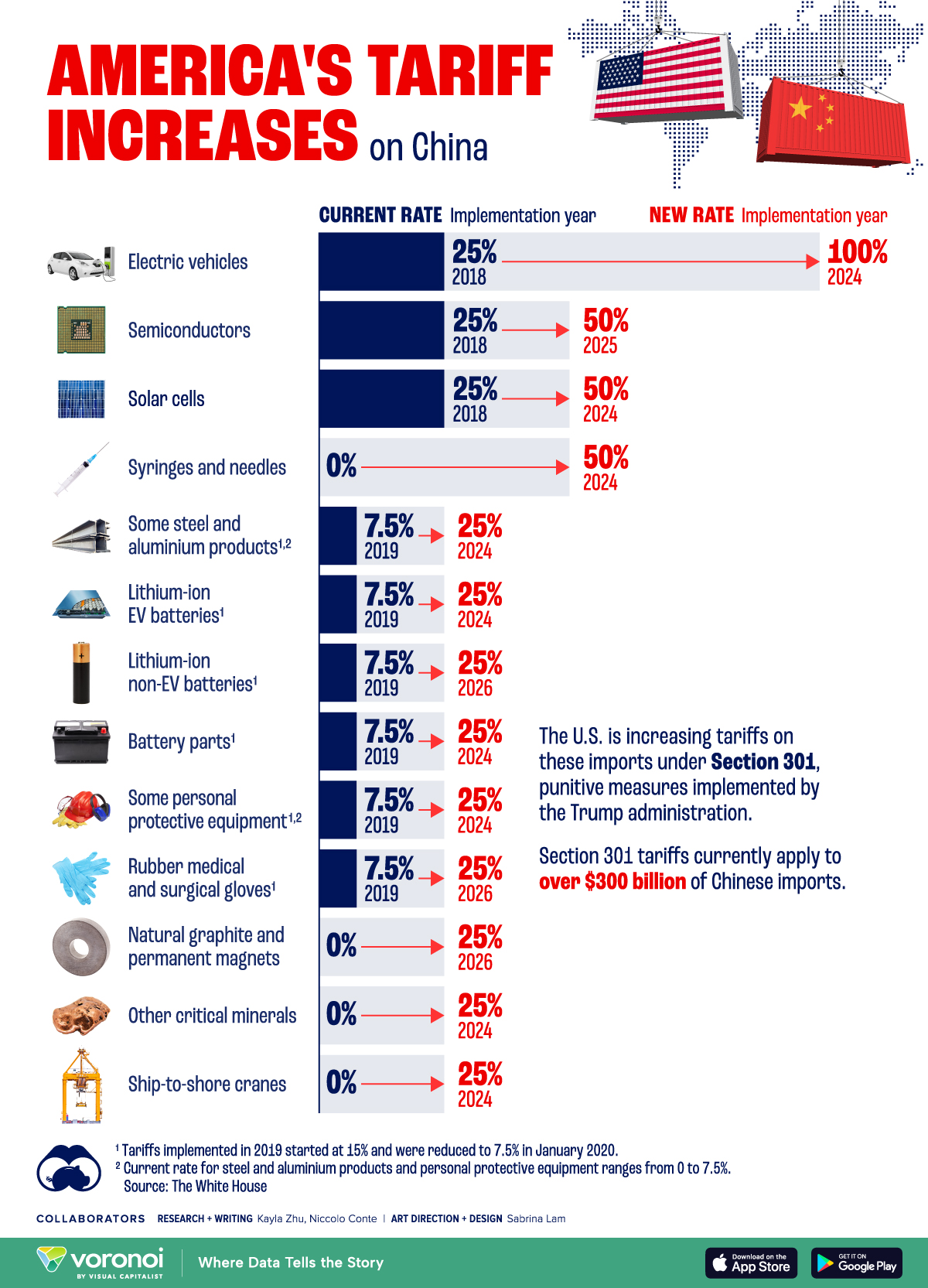

Understanding The Liberation Day Tariffs Their Current And Future Impact On Stock Prices

May 08, 2025

Understanding The Liberation Day Tariffs Their Current And Future Impact On Stock Prices

May 08, 2025 -

Ranking The Best Krypto Stories A Definitive List

May 08, 2025

Ranking The Best Krypto Stories A Definitive List

May 08, 2025 -

5 Uber Shuttle Service Now Available From United Center

May 08, 2025

5 Uber Shuttle Service Now Available From United Center

May 08, 2025 -

Is A Princess Leia Cameo Coming To The New Star Wars Series 3 Reasons To Think So

May 08, 2025

Is A Princess Leia Cameo Coming To The New Star Wars Series 3 Reasons To Think So

May 08, 2025 -

Barcelona Vs Inter Milan Six Goal Thriller In Champions League Semi Final

May 08, 2025

Barcelona Vs Inter Milan Six Goal Thriller In Champions League Semi Final

May 08, 2025