Ethereum Network Sees Significant Increase In Address Activity

Table of Contents

Increased DeFi Activity Fuels Ethereum Address Growth

Decentralized Finance (DeFi) applications are intrinsically linked to the rise in active Ethereum addresses. The explosive growth of DeFi has directly fueled the increased network activity. Many DeFi protocols operate exclusively on the Ethereum blockchain, leading to a surge in transactions and, consequently, an increase in the number of unique addresses interacting with the network.

- Growth in lending and borrowing platforms: Platforms like Aave and Compound have experienced phenomenal growth, facilitating billions of dollars in lending and borrowing activities. Each transaction on these platforms represents a unique address interacting with the Ethereum network.

- Increased usage of decentralized exchanges (DEXs): Decentralized exchanges such as Uniswap and SushiSwap have become increasingly popular, offering users a permissionless and decentralized way to trade cryptocurrencies. The high volume of trades on these platforms contributes significantly to the overall Ethereum address activity.

- Rise in popularity of yield farming and staking activities: The pursuit of high yields has driven users to engage in yield farming and staking, further increasing the number of active addresses on the Ethereum network. These activities require users to interact with various smart contracts, boosting transaction volumes.

- Impact of new DeFi protocols and innovations: The constant emergence of new DeFi protocols and innovative applications continues to attract new users and drive further growth in Ethereum address activity. The space is dynamic and constantly evolving, leading to continuous network engagement.

NFT Market Boom Contributes to Ethereum Network Congestion

The explosive growth of the Non-Fungible Token (NFT) market is another significant contributor to the increased Ethereum network activity and congestion. The popularity of NFTs has resulted in a massive increase in transactions on the Ethereum blockchain.

- Increased transaction volume due to NFT minting, trading, and sales: Minting, buying, selling, and transferring NFTs all require Ethereum transactions, contributing heavily to the network's activity. This activity directly translates to a larger number of active addresses.

- High gas fees associated with NFT transactions: While high gas fees can be a deterrent for some, they don't negate the overall increase in activity. The willingness of many users to pay high fees to participate in NFT sales and auctions demonstrates strong demand and contributes to the high address count.

- The role of NFT marketplaces: Marketplaces like OpenSea, Rarible, and others play a crucial role in facilitating NFT trading and, consequently, increasing the number of active Ethereum addresses. The ease of use of these platforms makes NFT participation accessible to a broader audience.

- The impact of popular NFT collections and projects: High-profile NFT collections and projects often trigger surges in activity, as users flock to participate in the associated sales and trading. These events are significant drivers of increased address activity on the Ethereum network.

Ethereum Improvement Proposals (EIPs) and Network Upgrades

Recent Ethereum upgrades and improvements have played a crucial role in enhancing the network's efficiency and fostering broader adoption, indirectly contributing to the increase in address activity.

- Impact of EIP-1559 on transaction fees and network scalability: EIP-1559 introduced a significant change to how transaction fees are handled, leading to more predictable and potentially lower fees in the long run. This improvement can attract more users and contribute to higher address activity.

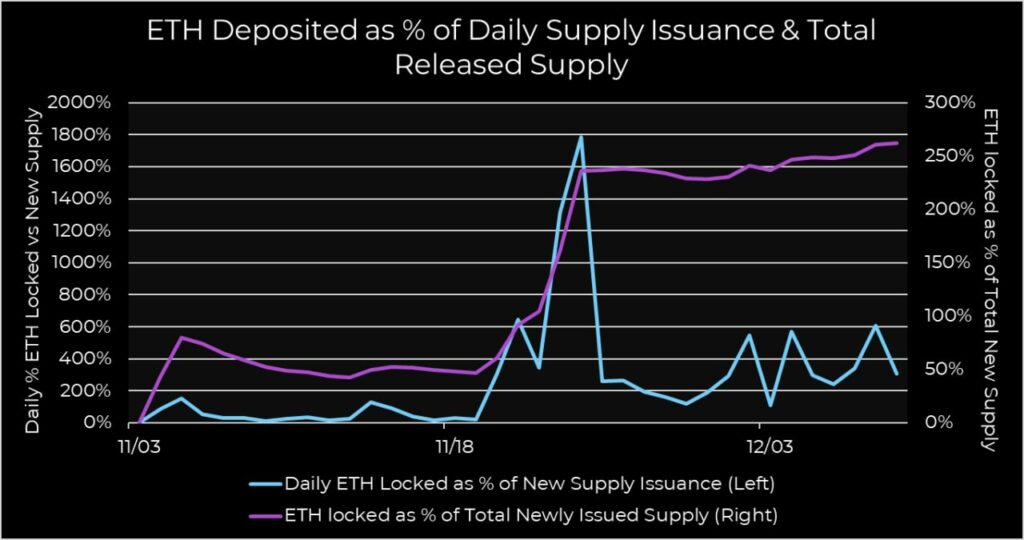

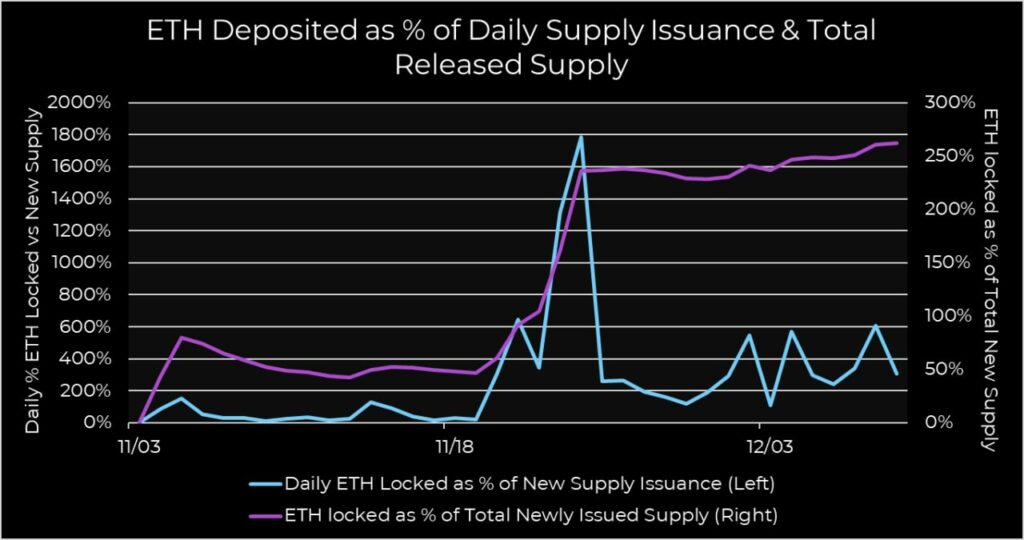

- Anticipation of the Ethereum 2.0 transition to proof-of-stake: The upcoming transition to a proof-of-stake consensus mechanism is anticipated to significantly improve the scalability and efficiency of the Ethereum network, making it more attractive to users and further boosting address activity.

- Positive effects of network upgrades on user experience and transaction speeds: Ongoing network upgrades aim to enhance the user experience by improving transaction speeds and reducing latency. A better user experience encourages greater participation and contributes to increased address activity.

- The role of Layer-2 scaling solutions: Layer-2 scaling solutions, such as Optimism and Arbitrum, are designed to alleviate network congestion and reduce transaction fees. Their increasing adoption contributes to the overall growth in Ethereum address activity by enabling more efficient transactions.

The Role of Institutional Investors

The growing involvement of institutional investors in the Ethereum ecosystem is a noteworthy factor contributing to the rise in network activity.

- Increased investment in Ethereum-based projects and protocols: Institutional investors are increasingly allocating capital to Ethereum-based projects and protocols, demonstrating their confidence in the platform's long-term potential.

- Growing adoption of Ethereum by institutional investors and corporations: More institutional investors and corporations are exploring and adopting Ethereum for various use cases, further contributing to the rise in network activity.

- The effect of institutional interest on price and overall network activity: Institutional interest often leads to price appreciation, which, in turn, attracts more individual investors and further increases the overall network activity and number of active addresses.

Conclusion

The significant increase in Ethereum address activity is a positive indicator, driven by a confluence of factors including the booming DeFi and NFT markets, ongoing network upgrades, and growing institutional interest. This surge in activity highlights the increasing relevance and adoption of the Ethereum network. The sustained growth in address activity suggests a healthy and vibrant ecosystem, indicating strong potential for future growth and innovation.

Call to Action: Stay informed about the latest developments in the Ethereum ecosystem and its growing address activity. Understanding these trends is crucial for navigating the evolving landscape of the cryptocurrency market. Continue to research Ethereum network updates, DeFi/NFT trends, and the impact of institutional investment to capitalize on future opportunities within the Ethereum ecosystem. Monitor the increase in Ethereum address activity to stay ahead of the curve in this dynamic market.

Featured Posts

-

Thousands Affected Dwp Expands Home Visit Program

May 08, 2025

Thousands Affected Dwp Expands Home Visit Program

May 08, 2025 -

The Ultimate Guide To The Best Krypto Stories

May 08, 2025

The Ultimate Guide To The Best Krypto Stories

May 08, 2025 -

Angels Kyren Pari Hits Game Winning Homer In Rain Affected Match Against White Sox

May 08, 2025

Angels Kyren Pari Hits Game Winning Homer In Rain Affected Match Against White Sox

May 08, 2025 -

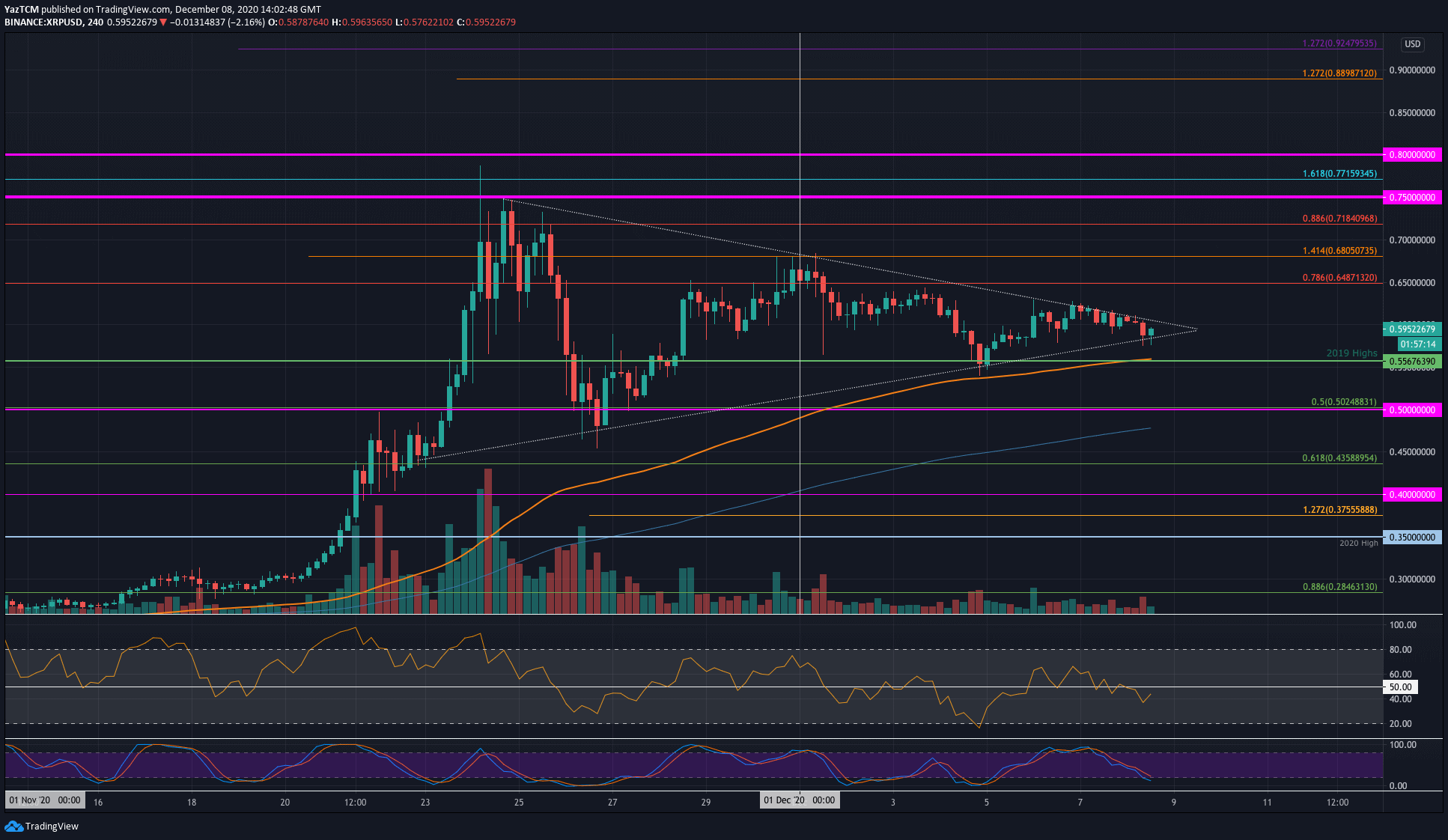

Xrp Breakout Analysis Of Ripples Potential To Reach 3 40

May 08, 2025

Xrp Breakout Analysis Of Ripples Potential To Reach 3 40

May 08, 2025 -

Grayscales Xrp Etf Application Impact On Xrp Price And Potential Record High

May 08, 2025

Grayscales Xrp Etf Application Impact On Xrp Price And Potential Record High

May 08, 2025