XRP Breakout: Analysis Of Ripple's Potential To Reach $3.40

Table of Contents

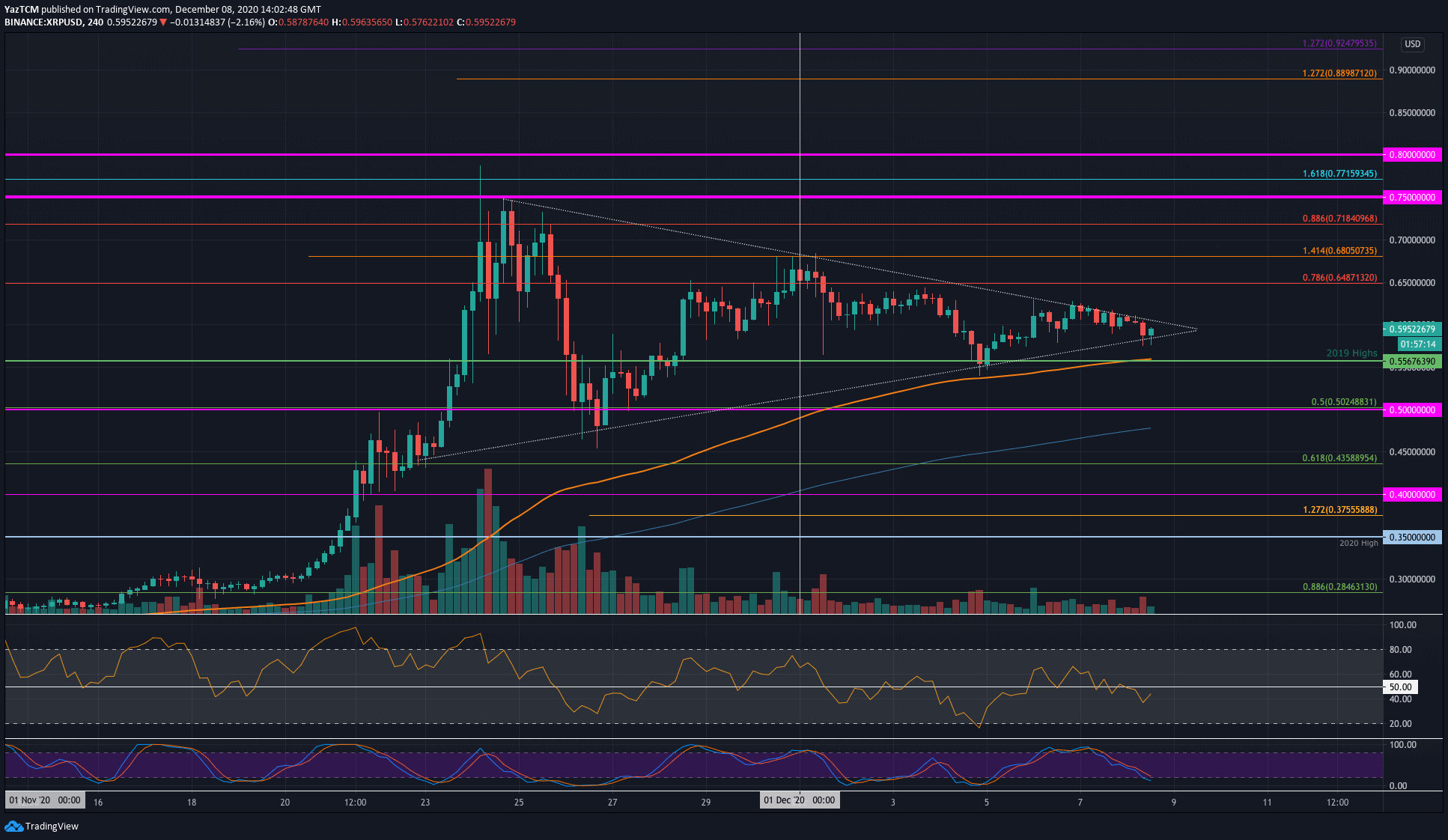

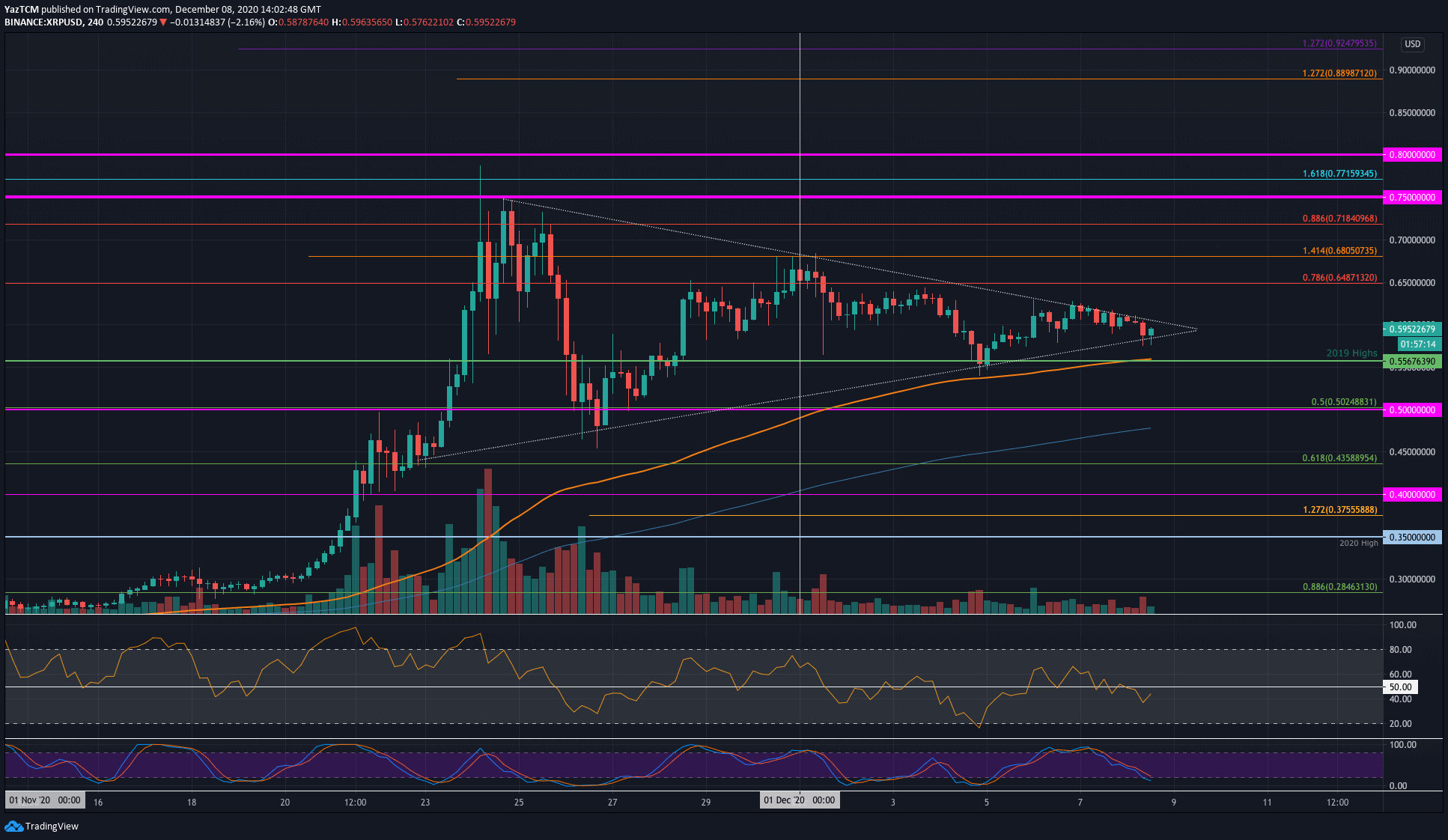

Technical Analysis: Chart Patterns and Indicators Suggesting an XRP Breakout

Technical analysis provides valuable insights into XRP's potential price movements. By examining chart patterns and key indicators, we can assess the likelihood of a significant breakout. Several factors suggest a bullish trend for XRP.

-

Identifying Key Chart Patterns: The XRP/USD chart has shown promising patterns in recent months. A breakout from a descending triangle, for instance, often signifies a significant price surge. Other patterns, like bullish flags or pennants, also suggest upward momentum. Analyzing these patterns alongside key indicators provides a more comprehensive picture. (Include relevant chart image here with alt text: "XRP/USD chart showing descending triangle breakout and bullish indicators").

-

Utilizing Technical Indicators: Indicators such as the Relative Strength Index (RSI), Moving Average Convergence Divergence (MACD), and various moving averages offer further confirmation.

- RSI: An RSI nearing oversold territory (below 30) can signal a potential bullish reversal, indicating that the selling pressure is waning and a price increase is likely.

- MACD: A bullish crossover of the MACD lines (the fast-moving line crossing above the slow-moving line) suggests increasing buying pressure and potential upward momentum.

- Moving Averages: A sustained price above key moving averages (e.g., 50-day and 200-day moving averages) further supports a bullish trend.

Ripple's Fundamentals and Partnerships Driving XRP Adoption

Ripple's underlying technology and partnerships play a crucial role in XRP's price appreciation. The growing adoption of XRP by financial institutions strengthens its position in the cryptocurrency market and increases its utility.

-

RippleNet and Cross-Border Payments: RippleNet, Ripple's payment network, facilitates faster and more cost-effective cross-border transactions. This technology is driving the adoption of XRP by banks and payment providers worldwide. Increased transaction volume on RippleNet directly impacts the demand for XRP.

-

Strategic Partnerships: Ripple has forged strategic partnerships with numerous major banks and financial institutions globally. These collaborations demonstrate growing institutional adoption and trust in Ripple's technology and XRP. (Include a list of key partnerships and their significance here).

- Increased Institutional Adoption: Recent partnerships with significant financial players showcase a growing belief in XRP's utility within the financial ecosystem.

- Growth in RippleNet Transaction Volume: A consistent increase in the volume of transactions processed through RippleNet signifies a rising demand for XRP.

- Positive Legal Developments: Positive developments in Ripple's ongoing legal battle with the SEC could dramatically improve market sentiment and unlock further price appreciation.

Market Sentiment and Investor Confidence in XRP

Market sentiment and investor confidence are significant drivers of XRP's price. Positive news coverage, social media sentiment, and overall market conditions influence investor behavior.

-

Social Media Sentiment Analysis: A positive trend in social media discussions and news coverage surrounding XRP indicates growing investor interest and confidence. Increased mentions and positive sentiment can lead to higher trading volume and price appreciation.

-

Investor Confidence and Speculation: Growing investor interest, evidenced by increased trading volume and market capitalization, fuels speculation about XRP's future price, potentially pushing it higher.

-

Correlation with Bitcoin: XRP’s price often shows a positive correlation with Bitcoin's price. A bullish Bitcoin market usually benefits altcoins like XRP. Monitoring Bitcoin's price movements is crucial for understanding XRP's potential price trajectory.

Addressing the Regulatory Uncertainty Surrounding XRP

The ongoing legal battle between Ripple and the SEC introduces a significant element of uncertainty. The outcome of this case will have a considerable impact on XRP's price.

-

Potential Outcomes of the SEC Lawsuit: A favorable ruling for Ripple could trigger a significant price increase, as it would remove a major obstacle to XRP's wider adoption. Conversely, an unfavorable outcome could negatively impact XRP's price.

-

Regulatory Clarity and Investor Sentiment: Regulatory clarity is crucial for long-term growth and investor confidence. Addressing regulatory concerns is vital for unlocking XRP's full potential and driving further price appreciation.

- Positive Outcomes: A positive resolution to the SEC lawsuit could lead to a substantial price surge.

- Regulatory Uncertainty: Regulatory uncertainty remains a key risk factor for XRP investors and may limit price appreciation until clarity emerges.

- Long-Term Growth: Addressing regulatory concerns is crucial for XRP’s long-term growth and mainstream adoption.

Conclusion

This analysis suggests that XRP has the potential to reach $3.40, driven by a confluence of factors, including strong technical indicators, growing adoption fueled by Ripple's partnerships, and improving market sentiment. While regulatory uncertainty remains a challenge, potential positive resolutions could significantly boost XRP’s price. Remember to conduct your own thorough research before making any investment decisions.

Call to Action: Stay informed about the latest developments in the XRP market and continue researching XRP's potential. Keep an eye on the technical indicators and news regarding the Ripple lawsuit for further insights into the potential for an XRP breakout and its journey towards $3.40. Conduct your own thorough due diligence before making any investment decisions related to XRP or any other cryptocurrency.

Featured Posts

-

Vatican Finances A Persistent Problem Despite Pope Franciss Efforts

May 08, 2025

Vatican Finances A Persistent Problem Despite Pope Franciss Efforts

May 08, 2025 -

Impact Of Psl On Lahore School Timings

May 08, 2025

Impact Of Psl On Lahore School Timings

May 08, 2025 -

Ethereum Cross X Indicators Flash Buy Signal Institutions Accumulating 4 000 Target

May 08, 2025

Ethereum Cross X Indicators Flash Buy Signal Institutions Accumulating 4 000 Target

May 08, 2025 -

Ueberpruefung Der Lottozahlen 6aus49 Vom 12 April 2025

May 08, 2025

Ueberpruefung Der Lottozahlen 6aus49 Vom 12 April 2025

May 08, 2025 -

Nuggets React To Russell Westbrook Trade Rumors

May 08, 2025

Nuggets React To Russell Westbrook Trade Rumors

May 08, 2025