Ethereum Price: $2,700 Within Reach As Wyckoff Accumulation Nears Completion

Table of Contents

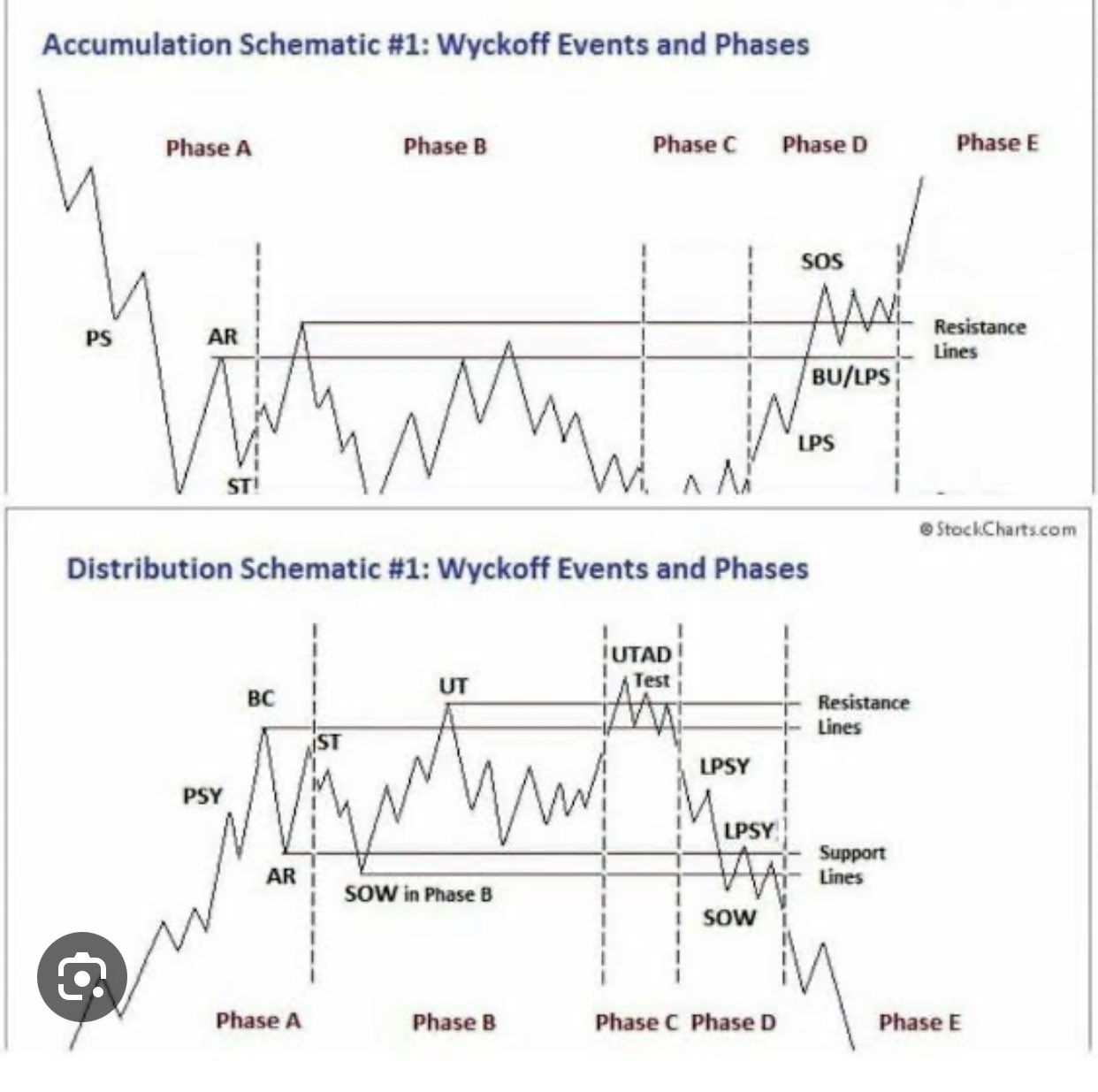

Understanding Wyckoff Accumulation in Ethereum's Chart

Analyzing Ethereum's price chart using the Wyckoff method reveals compelling evidence suggesting a nearing completion of an accumulation phase. The Wyckoff method is a technical analysis technique that identifies periods of market manipulation and accumulation before significant price movements. Understanding its phases is crucial to interpreting the current ETH price action.

The Wyckoff Accumulation process typically involves several phases:

- Testing: The price fluctuates within a defined range, testing support and resistance levels. This phase reveals the market maker's willingness to absorb selling pressure.

- Secondary Test: A subsequent test of the support level confirms the accumulation phase is ongoing and the buyers are still in control.

- Sign of Strength (SOS): A break above the resistance level, indicating increased buying pressure.

- Climax Upthrust: A sudden, dramatic price increase followed by a sharp correction, often designed to shake out weak holders. This is typically followed by a period of consolidation.

Examining the Ethereum price chart (insert chart here), we observe several key indicators consistent with a Wyckoff Accumulation pattern:

- Identification of the "Spring": A noticeable price drop (insert specific price point and date) can be interpreted as a "spring," a manipulative price drop designed to attract more buyers at a lower price point.

- Increased Buying Pressure: Despite bearish sentiment, the volume during the subsequent price increase suggests strong buying pressure (insert specific volume data).

- On-Chain Metrics Correlation: Analysis of on-chain metrics such as exchange balances and active addresses supports this interpretation, indicating a gradual accumulation of ETH by large holders (insert data source and relevant metrics).

Factors Contributing to the Potential Ethereum Price Surge

Beyond the technical analysis suggesting a Wyckoff Accumulation, several fundamental factors contribute to the potential for an Ethereum price surge towards $2700:

- Ethereum Upgrades: Upcoming upgrades like the Shanghai upgrade and future scaling solutions (e.g., sharding) promise enhanced network efficiency and scalability, increasing the value proposition of Ethereum.

- DeFi Growth: The burgeoning DeFi ecosystem built on Ethereum continues to attract significant investment and user participation. New projects constantly emerge, fueling demand for ETH. Examples include (mention specific examples of popular DeFi protocols).

- Institutional Interest: Institutional investors are increasingly recognizing Ethereum's potential, leading to substantial investments in ETH. (Mention specific instances of institutional investment, if available).

- Market Sentiment: While overall market sentiment can fluctuate, positive developments surrounding Ethereum tend to boost confidence and drive price appreciation. Regulatory clarity (or lack thereof) will also play a significant role.

Addressing Potential Risks and Challenges

While the outlook for Ethereum's price is positive, it's crucial to acknowledge potential risks:

- Market Volatility: The cryptocurrency market is inherently volatile. Unforeseen events, such as broader market downturns or regulatory changes, can significantly impact the price of ETH.

- Regulatory Uncertainty: Regulatory landscapes worldwide remain uncertain for cryptocurrencies. Negative regulatory developments could trigger significant price corrections.

To mitigate these risks, investors should consider:

- Diversification: Spreading investments across different asset classes can reduce overall portfolio risk.

- Stop-Loss Orders: Setting stop-loss orders helps limit potential losses if the price unexpectedly drops.

- Position Sizing: Carefully manage the amount invested to avoid substantial losses.

- Fundamental Analysis: Constantly evaluating the underlying value proposition of Ethereum is crucial.

Conclusion

This analysis suggests that Ethereum's price could reach $2700, driven by a nearing completion of a Wyckoff Accumulation phase and several positive fundamental factors. The observed technical patterns, combined with the growing adoption of Ethereum, paint a bullish picture. However, remember that cryptocurrency investment carries inherent risks. Market volatility and regulatory uncertainty remain significant challenges.

While understanding the potential for Ethereum to reach $2700 is important, stay informed on market developments and implement robust risk management strategies to navigate the volatile cryptocurrency landscape. Continue researching the Ethereum price and Wyckoff Accumulation to make informed investment decisions. Stay updated on the latest Ethereum price movements and analysis. Remember to conduct thorough research and consult with a financial advisor before making any investment decisions.

Featured Posts

-

Penny Pritzker A Deep Dive Into The Life And Legacy Of The Billionaire

May 08, 2025

Penny Pritzker A Deep Dive Into The Life And Legacy Of The Billionaire

May 08, 2025 -

Bitcoins Future A Look At Important Price Levels

May 08, 2025

Bitcoins Future A Look At Important Price Levels

May 08, 2025 -

A Closer Look At Nathan Fillions Impactful Saving Private Ryan Scene

May 08, 2025

A Closer Look At Nathan Fillions Impactful Saving Private Ryan Scene

May 08, 2025 -

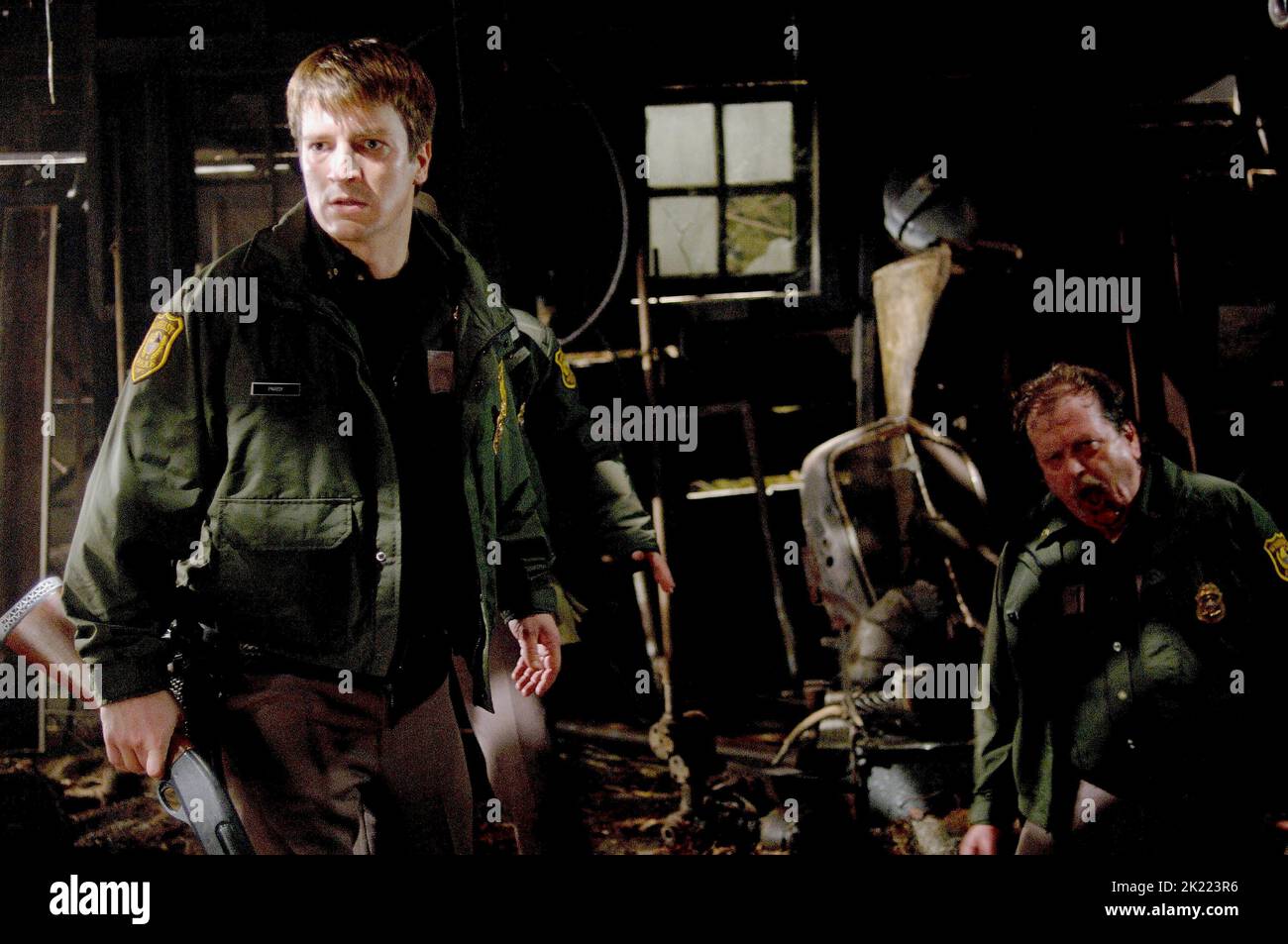

Ethereum Price Forecast 1 11 Million Eth Accumulated Bullish Momentum Builds

May 08, 2025

Ethereum Price Forecast 1 11 Million Eth Accumulated Bullish Momentum Builds

May 08, 2025 -

Trump On Cusma Positive Assessment But Termination Remains Possible

May 08, 2025

Trump On Cusma Positive Assessment But Termination Remains Possible

May 08, 2025

Latest Posts

-

Could Xrp Etf Approval Unleash 800 Million In First Week Investments

May 08, 2025

Could Xrp Etf Approval Unleash 800 Million In First Week Investments

May 08, 2025 -

Grayscale Xrp Etf Filing Why Xrp Outperforms Bitcoin And Other Cryptocurrencies

May 08, 2025

Grayscale Xrp Etf Filing Why Xrp Outperforms Bitcoin And Other Cryptocurrencies

May 08, 2025 -

Checken Sie Jetzt Lotto 6aus49 Gewinnzahlen Mittwoch 9 4 2025

May 08, 2025

Checken Sie Jetzt Lotto 6aus49 Gewinnzahlen Mittwoch 9 4 2025

May 08, 2025 -

Xrp Etfs Potential For 800 Million In Week 1 Inflows Upon Approval

May 08, 2025

Xrp Etfs Potential For 800 Million In Week 1 Inflows Upon Approval

May 08, 2025 -

Lotto 6aus49 Ergebnisse Ziehung Vom 19 April 2025

May 08, 2025

Lotto 6aus49 Ergebnisse Ziehung Vom 19 April 2025

May 08, 2025