Ethereum Price Analysis: Resilience And Potential For Growth

Table of Contents

Current Market Conditions and Ethereum's Performance

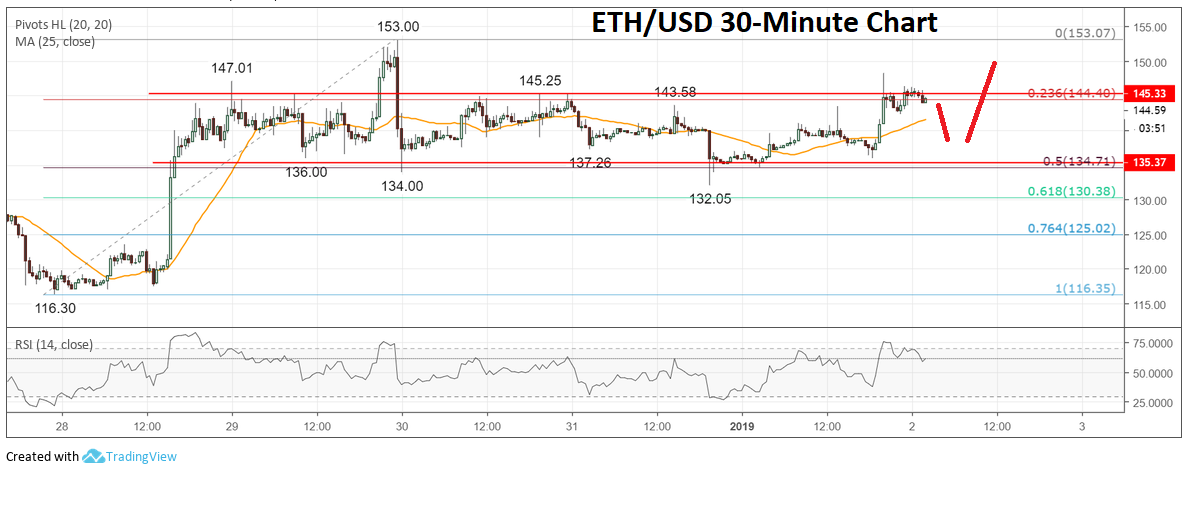

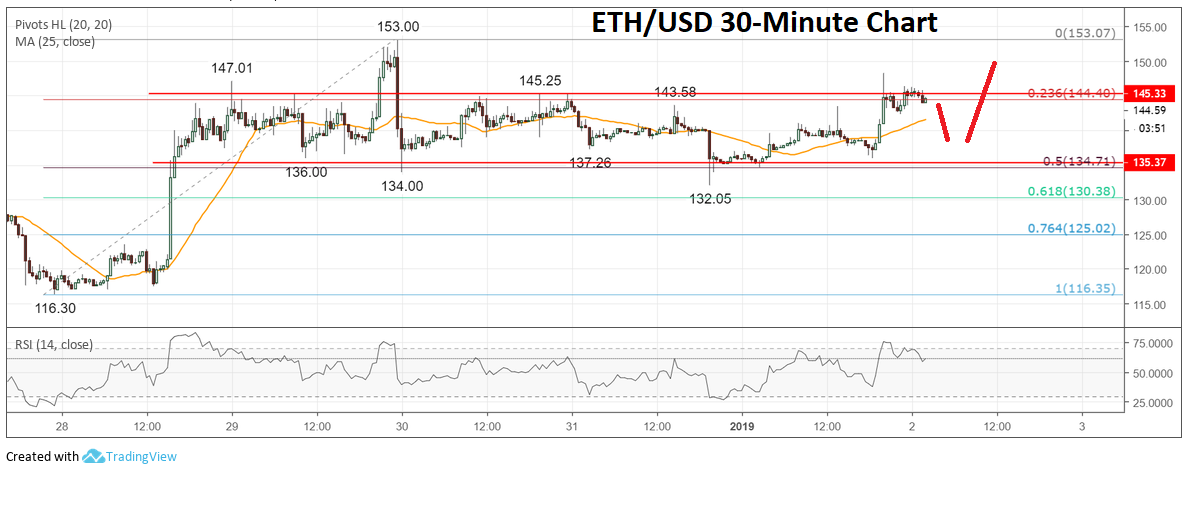

The overall cryptocurrency market sentiment remains cautiously optimistic. While Bitcoin experienced a recent correction, Ethereum has demonstrated relative strength. Analyzing Ethereum's recent price movements reveals a pattern of consolidation, with price action fluctuating within a defined range. Compared to Bitcoin, Ethereum's price has shown a degree of decoupling, indicating its own unique market dynamics. The following chart illustrates Ethereum's price performance over the last three months:

[Insert Chart Here: A clear, well-labeled chart showing Ethereum's price over the last 3 months. Ideally, this would include moving averages and key support/resistance levels.]

- Price action: Ethereum's price has recently tested key support levels around [insert price], indicating potential buying pressure. Resistance sits around [insert price], representing a potential hurdle for further price increases.

- Trading volume: Trading volume has [increased/decreased] recently, suggesting [increased/decreased] market interest. High volume during price increases confirms strong bullish momentum, whereas high volume during price decreases suggests a bearish trend.

- Market capitalization: Ethereum maintains its position as a leading cryptocurrency by market capitalization, second only to Bitcoin, highlighting its significance in the overall crypto market.

Factors Influencing Ethereum's Price

Several key factors interplay to influence Ethereum's price. Let's analyze some of the most significant ones:

Network Development and Upgrades

The ongoing development and implementation of Ethereum 2.0 is a major catalyst for price appreciation. These upgrades are designed to address scalability issues, enhance security, and reduce transaction fees.

- Improved scalability (sharding): Sharding promises to significantly increase transaction throughput, making Ethereum more efficient and capable of handling a larger volume of transactions.

- Enhanced security: Upgrades strengthen the network's resistance to attacks and improve overall security.

- Reduced transaction fees: Lower gas fees make Ethereum more attractive to developers and users.

- Increased efficiency: Overall improvements in efficiency lead to a more robust and user-friendly network.

DeFi Ecosystem Growth

The explosive growth of the Decentralized Finance (DeFi) ecosystem built on Ethereum is a significant factor driving its price. The Total Value Locked (TVL) in DeFi protocols serves as a key indicator of this growth.

- Total Value Locked (TVL): A high TVL indicates strong investor confidence and substantial capital flowing into DeFi applications on Ethereum.

- Growth of popular DeFi applications: The emergence and success of popular DeFi platforms built on Ethereum reinforce its position as a leading platform for decentralized finance.

- Impact of new DeFi innovations: Continuous innovation within the DeFi space fuels further growth and attracts new users to the Ethereum network.

Regulatory Landscape and Institutional Adoption

The regulatory environment and institutional adoption of Ethereum significantly influence its price. Growing acceptance by financial institutions and clearer regulatory frameworks can boost investor confidence.

- Government regulations: Clear regulatory frameworks in various jurisdictions can foster greater legitimacy and attract institutional investors.

- Impact of large institutional investments: Increased participation from institutional investors adds stability and legitimacy to the Ethereum market.

- Growing acceptance by financial institutions: As more financial institutions integrate Ethereum into their services, its adoption and price will likely increase.

Macroeconomic Factors

Global economic conditions also impact Ethereum's price. Factors such as inflation, interest rates, and overall economic uncertainty affect investor risk appetite.

- Impact of inflation and interest rates: High inflation and rising interest rates can negatively affect risk assets like cryptocurrencies, potentially leading to price corrections.

- Correlation with the stock market: Ethereum's price often shows some correlation with traditional financial markets. A downturn in the stock market could also negatively affect Ethereum's price.

- Global economic uncertainty: Periods of economic instability typically lead to increased volatility in the cryptocurrency market.

Predicting Future Ethereum Price Trends

Predicting future Ethereum price trends with certainty is challenging. However, by analyzing various indicators and factors, we can explore potential scenarios. Technical analysis, considering indicators like moving averages and RSI, can offer insights into short-term price movements. Fundamental analysis, focusing on factors like network development and DeFi growth, provides a longer-term perspective.

- Potential price targets: Based on technical analysis, Ethereum could reach [insert price] in the short term, and [insert price] in the long term. (Note: These are speculative projections and should not be taken as financial advice.)

- Factors driving price up: Continued network upgrades, DeFi growth, and increased institutional adoption are bullish factors.

- Factors driving price down: Negative regulatory developments, macroeconomic headwinds, and general market corrections could exert downward pressure.

- Long-term outlook: The long-term outlook for Ethereum remains positive, driven by its strong technological foundation and the growing adoption of blockchain technology.

Conclusion: Summarizing Ethereum Price Analysis and Call to Action

This Ethereum price analysis reveals a cryptocurrency demonstrating resilience and substantial potential for growth. While market volatility remains a factor, Ethereum's ongoing development, thriving DeFi ecosystem, and increasing institutional adoption indicate a promising future. It's crucial to continuously monitor market conditions, network upgrades, and regulatory developments for a complete understanding.

Stay informed on the latest Ethereum price analysis and developments to make sound investment choices. Continue to monitor our updates for insightful analysis of this dynamic market. Ethereum's innovative technology and strong community support position it well for continued growth in the evolving landscape of blockchain technology.

Featured Posts

-

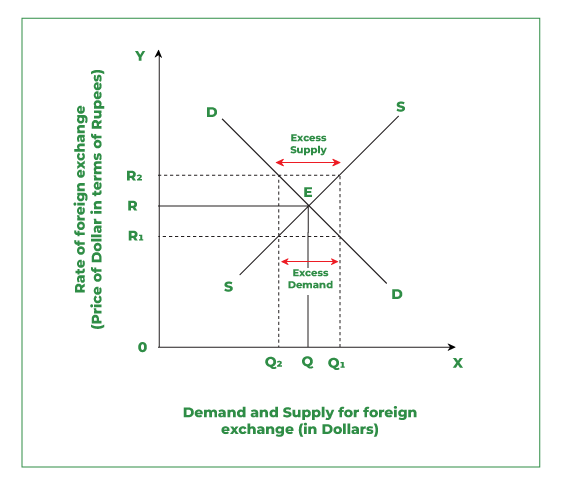

Hkd Usd Exchange Rate Intervention Triggers Record Interest Rate Drop

May 08, 2025

Hkd Usd Exchange Rate Intervention Triggers Record Interest Rate Drop

May 08, 2025 -

The Most Intense War Film Ever Made Find Out On Amazon Prime

May 08, 2025

The Most Intense War Film Ever Made Find Out On Amazon Prime

May 08, 2025 -

Princess Leias Return 3 Hints She Ll Appear In The New Star Wars Show

May 08, 2025

Princess Leias Return 3 Hints She Ll Appear In The New Star Wars Show

May 08, 2025 -

Smokey Robinson Accused Of Sexual Assault Four Former Employees Come Forward

May 08, 2025

Smokey Robinson Accused Of Sexual Assault Four Former Employees Come Forward

May 08, 2025 -

Is This Ethereum Buy Signal The Start Of A Rebound

May 08, 2025

Is This Ethereum Buy Signal The Start Of A Rebound

May 08, 2025