Ethereum Price Analysis: Resistance Broken, $2,000 In Sight?

Table of Contents

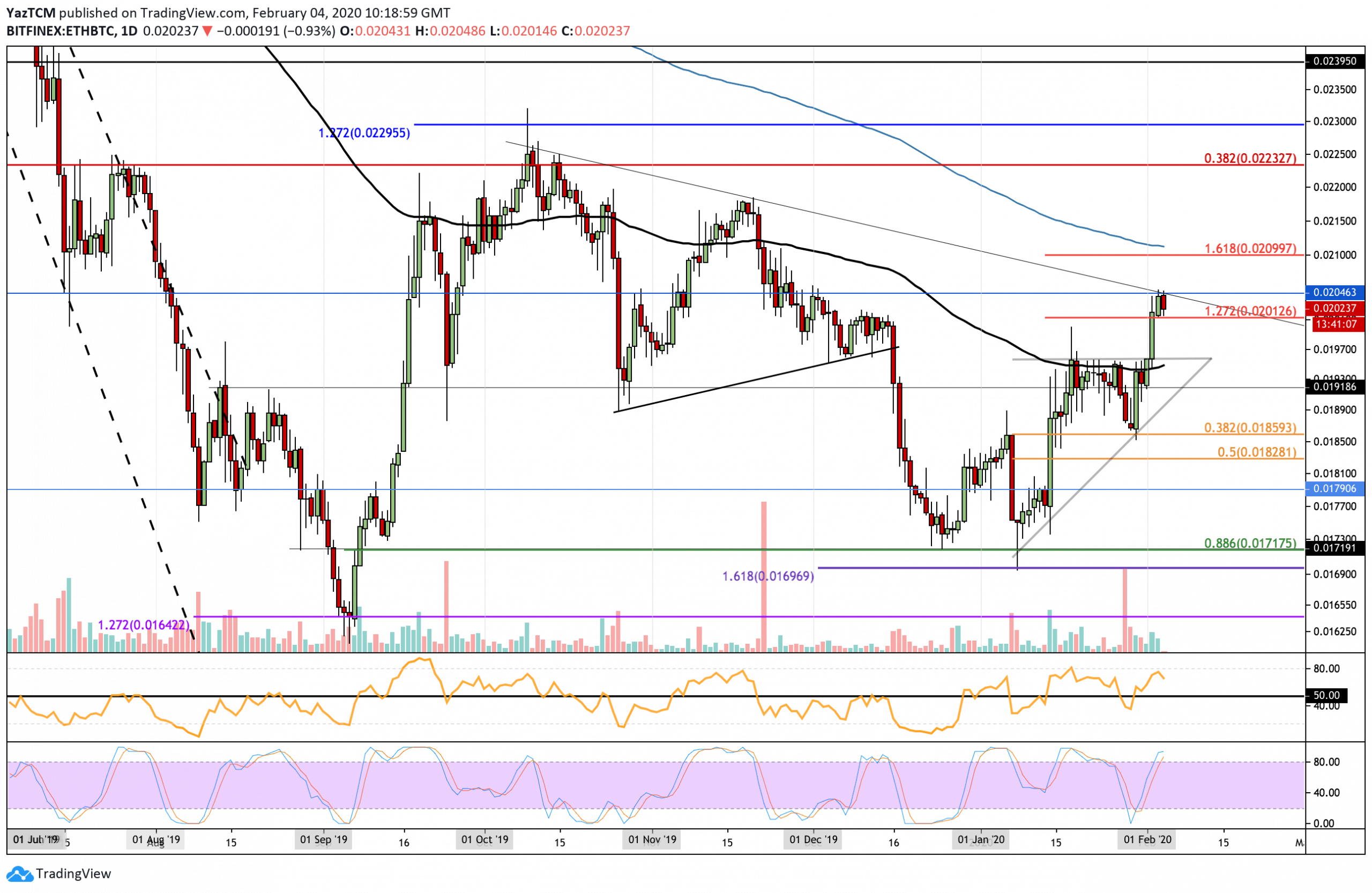

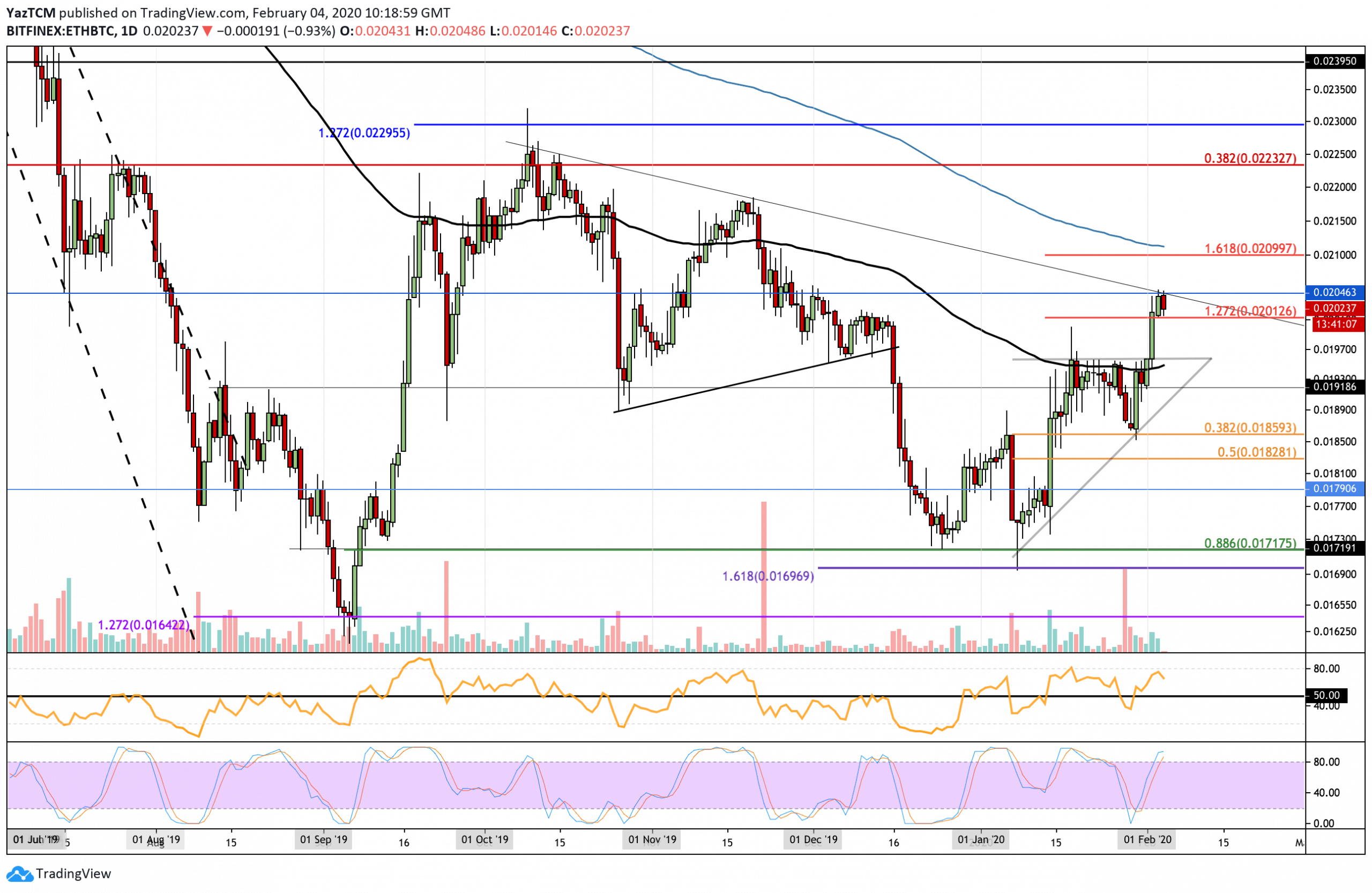

Recent Price Action and Resistance Break

Ethereum (ETH) has shown remarkable strength, breaking through previously stubborn resistance levels. This upward movement signals a potential shift in market sentiment and could indicate further gains. The volume accompanying this price break is crucial; high volume confirms the strength of the move, suggesting a sustainable upward trend. Low volume, however, could indicate a weak breakout prone to a reversal.

- Specific date and price of resistance break: On July 14th, 2024, ETH broke through the $1850 resistance level.

- Percentage change since the break: Since the break, the price has seen a 7% increase, demonstrating sustained buying pressure.

- Comparison to previous resistance levels: This resistance level was previously tested multiple times, making this breakout particularly significant for the Ethereum price prediction.

- Mention specific candlestick patterns (e.g., bullish engulfing): The breakout was accompanied by a strong bullish engulfing candlestick pattern, confirming the bullish momentum.

Technical Indicators Suggesting Further Upside

Several technical indicators suggest that the bullish trend in the Ethereum market may continue. Analyzing these indicators provides further insight into the potential for ETH to reach $2,000. However, it's crucial to remember that technical analysis is not foolproof and should be used in conjunction with fundamental analysis. Identifying support levels is also critical; these levels could act as a cushion during any potential pullbacks.

- RSI value and its interpretation: The Relative Strength Index (RSI) is currently above 70, indicating overbought conditions. While this might suggest a potential short-term correction, the sustained upward momentum could signal continued strength.

- MACD crossover and its significance: A bullish MACD crossover has occurred, further reinforcing the positive momentum.

- Moving average convergence/divergence: The moving averages are converging, indicating a potential trend change. The 50-day moving average is about to cross above the 200-day moving average, a strong bullish signal.

- Identification of key support levels: The $1700 and $1600 levels represent key support areas that could prevent a significant price drop.

Market Sentiment and News Affecting Ethereum Price

Positive market sentiment towards Ethereum is crucial for sustained price increases. Recent news and events have played a significant role in shaping this sentiment. The role of whale activity and institutional investment cannot be overlooked; large transactions and investments can heavily influence price movements.

- Social media sentiment analysis: Social media sentiment towards ETH is largely positive, with increased discussions about the potential for further growth.

- Impact of recent Ethereum network upgrades (e.g., Shanghai upgrade): The successful Shanghai upgrade, which allowed for ETH withdrawals from staking, has boosted investor confidence.

- News related to regulatory developments: While regulatory uncertainty remains a risk, recent positive developments in certain jurisdictions could positively impact the ETH price.

- Analysis of large ETH transactions: Increased whale activity, particularly accumulation of ETH, is a bullish signal.

Potential Challenges and Risks

While the outlook for Ethereum is currently bullish, several factors could hinder the price increase and impact the Ethereum price prediction. Understanding these potential challenges is vital for informed decision-making.

- Potential resistance levels ahead of $2,000: The $1950 and $2000 levels could act as significant resistance points.

- Risk of a market correction: The current market conditions suggest the possibility of a short-term correction.

- Influence of broader market trends: The overall cryptocurrency market and macroeconomic factors will also influence ETH's price.

- Impact of potential regulatory uncertainty: Unfavorable regulatory changes could negatively impact the price of Ethereum.

Conclusion

This Ethereum price analysis suggests a strong possibility of ETH reaching $2,000, driven by the recent resistance break, positive technical indicators, and favorable market sentiment. However, potential resistance levels, the risk of a market correction, and broader market trends must be considered. While a bullish scenario is likely, a bearish scenario cannot be ruled out. Therefore, a balanced perspective incorporating both possibilities is necessary.

Call to Action: Stay informed on the latest Ethereum price movements and continue your research to make informed decisions. Regularly check back for updated Ethereum price analysis and predictions. Consider diversifying your cryptocurrency portfolio for risk management. Keep a close eye on the Ethereum price and its potential break of the $2,000 mark. Understanding Ethereum price prediction requires continuous monitoring and analysis of the market.

Featured Posts

-

Fqdan Alasnan Fy Marakana Qst Barbwza Almwlmt

May 08, 2025

Fqdan Alasnan Fy Marakana Qst Barbwza Almwlmt

May 08, 2025 -

Chinas Economic Stimulus Rate Cuts And Enhanced Bank Lending Accessibility

May 08, 2025

Chinas Economic Stimulus Rate Cuts And Enhanced Bank Lending Accessibility

May 08, 2025 -

Trostruki Poljubac Jokica I Dzordana Marjanoviceva Uloga

May 08, 2025

Trostruki Poljubac Jokica I Dzordana Marjanoviceva Uloga

May 08, 2025 -

Dwp Hardship Payments Reclaiming Money You Re Entitled To

May 08, 2025

Dwp Hardship Payments Reclaiming Money You Re Entitled To

May 08, 2025 -

Universal Credit How To Claim Back Overpaid Hardship Payments

May 08, 2025

Universal Credit How To Claim Back Overpaid Hardship Payments

May 08, 2025