Ethereum Price Strength: Bulls In Control, Upside Potential High

Table of Contents

Technical Analysis: Signs of a Bullish Trend

Technical analysis offers compelling evidence supporting the current bullish sentiment surrounding Ethereum. Several key indicators and chart patterns point towards sustained upward momentum and significant price appreciation.

Breaking Resistance Levels

Recent price breakthroughs have confirmed the growing strength of the Ethereum market. The breaking of key resistance levels indicates a shift in market dynamics and a potential for continued upward movement.

- $1800 Resistance: The recent break above the $1800 resistance level, coupled with increased trading volume, strongly suggests a bullish momentum. This breakout signifies a significant shift in market sentiment, with buyers overcoming previous selling pressure.

- $2000 Resistance (Potential): Many analysts are watching the $2000 level as the next key resistance. A successful breach of this level would further solidify the bullish trend and potentially open the door for even higher price targets.

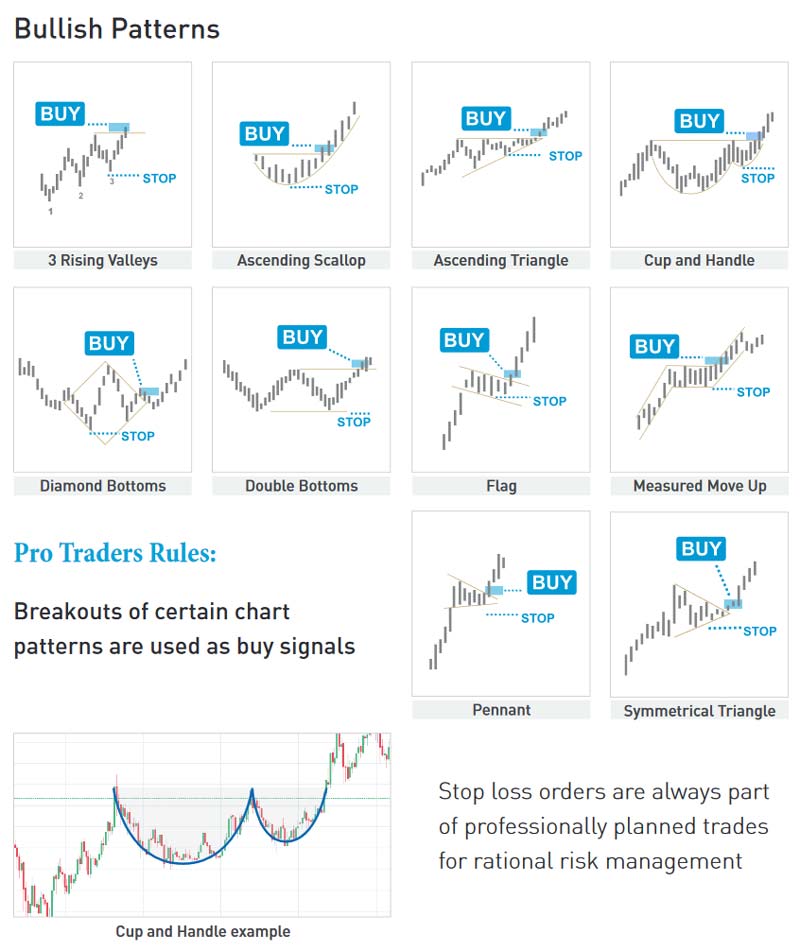

- Chart Patterns: The emergence of bullish pennant patterns on various timeframes indicates a likely continuation of the uptrend after a brief period of consolidation.

Positive Indicators

Key technical indicators reinforce the bullish trend, suggesting further price increases are likely.

- Relative Strength Index (RSI): The RSI moving above 70 indicates overbought conditions, often suggesting a potential short-term pullback. However, within the context of the broader uptrend, this remains a positive sign of strong momentum.

- Moving Average Convergence Divergence (MACD): A clear bullish crossover of the MACD lines further reinforces the strength of the uptrend. This indicates that buying pressure is exceeding selling pressure.

- Moving Averages (50-day and 200-day): The 50-day moving average crossing above the 200-day moving average (a "golden cross") is a classic bullish signal, indicating a potential long-term uptrend.

Chart Patterns: Bullish Flags and Potential Target Prices

Several bullish chart patterns are emerging, providing further clues about potential price movements.

- Bullish Flags: The formation of bullish flag patterns suggests a continuation of the uptrend after a brief period of consolidation. These patterns indicate a pause in the upward momentum before another leg higher.

- Target Prices: Based on the measured move of the flag pattern, a potential target price of $2500-$3000 is plausible in the near term. However, it is important to remember that this is just a projection and the actual price may vary.

Fundamental Factors Fueling Ethereum's Growth

Beyond technical indicators, several fundamental factors contribute to Ethereum's price strength and its potential for long-term growth.

Ethereum 2.0 and Staking

The ongoing transition to Ethereum 2.0 is a significant catalyst for Ethereum's price appreciation.

- Increased Security: The shift to a proof-of-stake (PoS) consensus mechanism significantly enhances network security and reduces energy consumption.

- Scalability Improvements (Sharding): Sharding will dramatically improve Ethereum's scalability, enabling faster and cheaper transactions.

- Deflationary Nature of ETH Staking: Staking ETH to validate transactions reduces the circulating supply, creating a deflationary pressure on the price.

Growing DeFi Ecosystem

Ethereum's thriving decentralized finance (DeFi) ecosystem is a major driver of ETH demand.

- Total Value Locked (TVL): The continuously increasing TVL in DeFi protocols highlights the growing adoption and utility of Ethereum.

- Decentralized Applications (dApps): The ever-expanding number of dApps built on Ethereum further solidifies its position as a leading blockchain platform. This fuels demand for ETH as transaction fees are paid in ETH.

NFT Market and Metaverse

The popularity of Non-Fungible Tokens (NFTs) and the burgeoning metaverse are significantly contributing to Ethereum's price strength.

- High Transaction Fees: The high gas fees associated with NFT trading and metaverse activities directly translate into increased demand for ETH.

- Network Effects: As more users participate in these activities, the value of the Ethereum network as a whole increases, driving up the price of ETH.

Potential Risks and Challenges

While the outlook for Ethereum is generally bullish, it is important to acknowledge potential risks and challenges.

Regulatory Uncertainty

Regulatory uncertainty remains a significant risk factor affecting the entire cryptocurrency market, including Ethereum.

- Government Regulations: Changes in government regulations could impact market sentiment and the price of Ethereum.

- Compliance Costs: Compliance with evolving regulations could increase the cost of operating on the Ethereum network.

Market Volatility

The cryptocurrency market is inherently volatile, and price corrections are a normal part of the market cycle.

- Market Corrections: Significant price corrections are possible, and investors should always practice risk management.

- Risk Management: Diversification and appropriate risk management strategies are essential for navigating market volatility.

Competition from Other Blockchains

Ethereum faces competition from other blockchain platforms vying for market share.

- Layer-1 Competitors: Several competing layer-1 blockchains are seeking to challenge Ethereum's dominance.

- Ethereum's Advantages: Despite the competition, Ethereum's established network effects, large developer community, and first-mover advantage remain significant strengths.

Conclusion

The current indicators suggest a strong bullish trend for Ethereum, fueled by both technical analysis and fundamental factors. While risks remain, the ongoing development of Ethereum 2.0, the thriving DeFi ecosystem, and the expanding NFT market all point towards significant upside potential for ETH. Understanding the factors driving Ethereum price strength is crucial for navigating the market effectively. Stay informed and monitor the market closely to capitalize on future opportunities within the exciting world of Ethereum. Keep an eye on future developments impacting Ethereum price strength and its related metrics for optimal investment strategies.

Featured Posts

-

Ethereums Resilient Price Signs Of An Upcoming Bull Run

May 08, 2025

Ethereums Resilient Price Signs Of An Upcoming Bull Run

May 08, 2025 -

Cryptocurrency And The Trade War A Potential Winner

May 08, 2025

Cryptocurrency And The Trade War A Potential Winner

May 08, 2025 -

Could A 10x Bitcoin Multiplier Reshape Wall Street Chart Analysis

May 08, 2025

Could A 10x Bitcoin Multiplier Reshape Wall Street Chart Analysis

May 08, 2025 -

Thunders Game 1 Triumph Alex Carusos Historic Playoff Debut

May 08, 2025

Thunders Game 1 Triumph Alex Carusos Historic Playoff Debut

May 08, 2025 -

Ikea And Sonos Part Ways The Future Of Their Smart Speaker Line

May 08, 2025

Ikea And Sonos Part Ways The Future Of Their Smart Speaker Line

May 08, 2025