Ethereum's Bullish Trend: Massive ETH Accumulation And Price Forecast Analysis

Table of Contents

Evidence of Massive ETH Accumulation

The bullish sentiment surrounding Ethereum isn't merely speculation; it's backed by substantial evidence of ETH accumulation across various sectors.

Whale and Institutional Activity

Large investors, commonly known as whales, and institutional funds are playing a crucial role in driving ETH accumulation. Their significant buying activity suggests strong confidence in Ethereum's long-term prospects.

- Recent large ETH transactions: Several on-chain analytics platforms have reported unusually large ETH transactions in recent months, exceeding hundreds of thousands, even millions, of ETH in a single transfer. These large purchases point to significant investment from whales and institutional investors.

- On-chain analysis ETH: Platforms like Glassnode and Santiment provide detailed on-chain data showing a consistent upward trend in ETH accumulation by large addresses. These platforms track metrics like the number of ETH held by top addresses and the distribution of ETH across different wallet sizes.

- Institutional ETH investment: Reports indicate increased investment in ETH by prominent institutional investors, including Grayscale Investments and several large hedge funds. These institutions conduct rigorous due diligence before making investments, lending credence to the bullish outlook. Their participation signals a shift towards mainstream acceptance of Ethereum as a valuable asset. This institutional adoption is a significant factor in driving up demand and price.

Declining Exchange Reserves

Another compelling indicator of a bullish trend is the steady decline in ETH reserves held on centralized exchanges. This signifies that investors are moving their ETH off exchanges, suggesting a long-term holding strategy rather than short-term trading.

- ETH exchange reserves: Charts tracking ETH reserves on major exchanges like Coinbase, Binance, and Kraken clearly show a consistent downward trend over the past several months. This outflow of ETH from exchanges indicates a reduction in the available supply for trading, potentially leading to upward price pressure.

- Crypto exchange outflow: The consistent outflow from exchanges suggests a strong belief in Ethereum's future growth, as investors are less inclined to sell and more inclined to HODL (hold on for dear life). This accumulation behavior is a classic bullish signal.

- Ethereum supply: The decreasing exchange reserves contribute to a tightening of the overall ETH supply, which can influence price appreciation through basic supply and demand dynamics.

Increased Network Activity and DeFi Growth

The burgeoning DeFi ecosystem and the increasing activity on the Ethereum network further bolster the bullish narrative. Higher network usage translates to higher demand for ETH, driving up its value.

- Ethereum DeFi: The Total Value Locked (TVL) in Ethereum-based DeFi protocols continues to grow, indicating strong investor confidence and increased usage of decentralized applications.

- Ethereum network activity: Transaction volume and gas fees on the Ethereum network have shown periods of significant increases, reflecting heightened demand for network usage. This increased usage directly correlates with a rise in ETH demand.

- Gas fees: Although volatile, consistently higher-than-average gas fees indicate robust network activity and demand for Ethereum's services. This is a positive signal for the long-term value of ETH.

- Total Value Locked (TVL): A higher TVL reflects the increased capital invested in DeFi protocols built on the Ethereum blockchain. This influx of capital contributes directly to the demand for ETH.

Factors Fueling Ethereum's Bullish Trend

Beyond accumulation, several other factors are contributing to the bullish momentum surrounding Ethereum.

Ethereum 2.0 and Upgrades

The ongoing development and implementation of Ethereum 2.0 are significant catalysts for the bullish trend. Upgrades like sharding are poised to enhance Ethereum's scalability and efficiency dramatically.

- Ethereum 2.0: The transition to Ethereum 2.0 is a multi-stage process. Each upgrade delivers improvements to scalability, transaction speed, and security, addressing limitations that previously hampered the network.

- Sharding: Sharding, a key component of Ethereum 2.0, will significantly improve transaction throughput, reducing congestion and lowering gas fees. This will make Ethereum more attractive to developers and users alike.

- Ethereum upgrades: The ongoing development and successful implementation of these upgrades demonstrate the commitment of the Ethereum community to continuously improve the platform. This ongoing innovation reinforces the long-term prospects of Ethereum.

- Scalability: Improved scalability is a major benefit of Ethereum 2.0. As the network becomes more scalable, it can handle a significantly larger volume of transactions, supporting its growth as a leading blockchain platform.

Growing Institutional Adoption

The increasing acceptance of Ethereum by institutional investors signals a growing level of confidence in its potential. This institutional interest is a crucial driver of the bullish trend.

- Institutional Ethereum adoption: Major institutional players are increasingly allocating a portion of their portfolios to ETH, driven by its established market position and future potential.

- Grayscale ETH Trust: The Grayscale Ethereum Trust provides a regulated avenue for institutional investors to gain exposure to Ethereum, further fueling institutional adoption.

- Ethereum ETF: The potential approval of an Ethereum ETF could significantly increase institutional investment, leading to a substantial price surge.

NFT Market and Metaverse Growth

The explosive growth of the NFT market and the burgeoning metaverse are both intrinsically linked to Ethereum, further boosting demand for ETH.

- Ethereum NFTs: A significant portion of the NFT market operates on the Ethereum blockchain, making ETH essential for creating, buying, and selling NFTs.

- NFT marketplace: The popularity of NFT marketplaces like OpenSea directly contributes to the demand for ETH, as most transactions on these platforms require ETH.

- Metaverse: Many metaverse platforms are built on the Ethereum blockchain, creating an ongoing demand for ETH for in-world transactions and interactions.

- Ethereum blockchain: The Ethereum blockchain's established infrastructure and security make it a preferred platform for many NFT and metaverse projects.

Ethereum Price Forecast Analysis

Predicting cryptocurrency prices is inherently challenging, subject to market volatility and unforeseen events. However, based on the evidence presented above – the massive ETH accumulation, the positive developments around Ethereum 2.0, the growing institutional interest, and the burgeoning NFT and metaverse markets – a cautiously optimistic outlook is warranted. While specific numerical predictions are speculative, we can expect continued upward pressure on ETH price in the long term, provided the positive trends continue. This forecast relies heavily on the continued successful development and adoption of Ethereum 2.0 and the sustained growth of the DeFi and NFT ecosystems. Any major setbacks in these areas could impact the price negatively.

Conclusion

The evidence overwhelmingly suggests a strong bullish trend for Ethereum. Massive ETH accumulation by whales and institutions, declining exchange reserves, increased network activity, and the positive impact of Ethereum 2.0 upgrades all point towards a positive outlook. The burgeoning NFT market and the growth of the metaverse further solidify Ethereum's position as a leading blockchain platform. While precise price predictions are impossible, the confluence of these factors suggests a positive long-term outlook for ETH. Invest wisely in Ethereum's bullish trend by conducting your own thorough research and understanding the inherent risks involved in cryptocurrency investments. Learn more about Ethereum's price forecast and potential, and stay updated on Ethereum's bullish market movement. Remember to diversify your portfolio and only invest what you can afford to lose.

Featured Posts

-

Kyle Kuzma Weighs In On Jayson Tatums Trending Instagram Post

May 08, 2025

Kyle Kuzma Weighs In On Jayson Tatums Trending Instagram Post

May 08, 2025 -

Rogues Team Affiliation A Marvel Fans Dilemma

May 08, 2025

Rogues Team Affiliation A Marvel Fans Dilemma

May 08, 2025 -

Rogue One Star Shares Honest Feelings About Beloved Character

May 08, 2025

Rogue One Star Shares Honest Feelings About Beloved Character

May 08, 2025 -

Xrp Ripple Investment Assessing The Risks And Rewards For The Future

May 08, 2025

Xrp Ripple Investment Assessing The Risks And Rewards For The Future

May 08, 2025 -

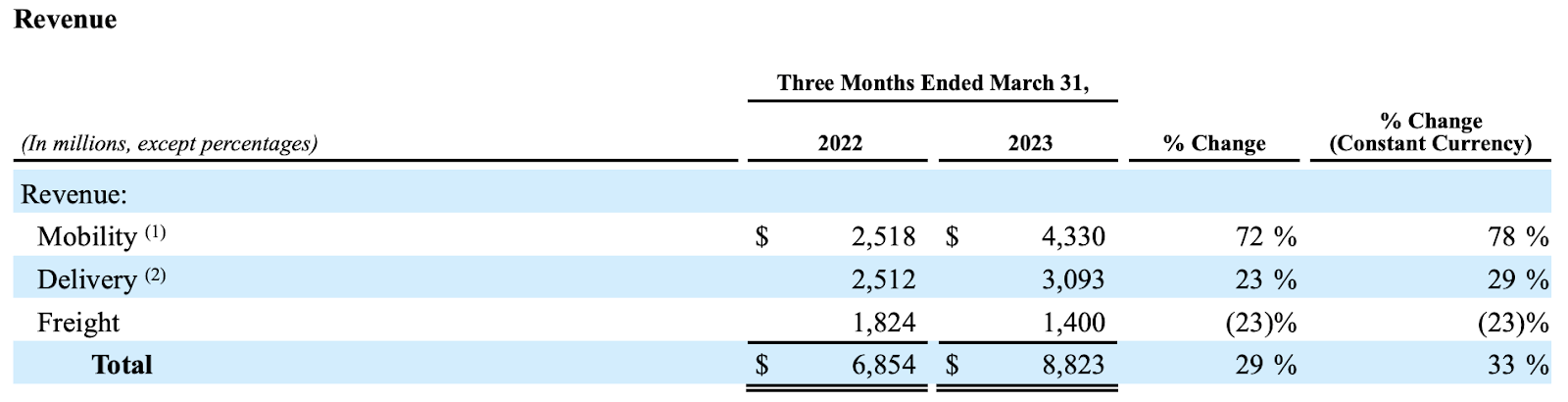

Uber Stock Performance And The Promise Of Autonomous Vehicles

May 08, 2025

Uber Stock Performance And The Promise Of Autonomous Vehicles

May 08, 2025