Evaluating Palantir Stock Before Its May 5th Earnings Report

Table of Contents

Recent Performance and Financial Trends

Analyzing Palantir's recent performance is crucial for predicting future stock movement and informing your Palantir investment strategy. We need to look at both the top and bottom lines.

Revenue Growth and Profitability

Palantir's revenue growth and profitability are key indicators of its financial health. Examining recent quarterly and annual reports reveals crucial trends. Let's look at some key metrics:

- Revenue Growth Rates: Analyze the percentage increase in revenue year-over-year and quarter-over-quarter. A consistent upward trend signals strong growth potential for PLTR stock.

- Profitability Margins: Scrutinize gross, operating, and net profit margins to understand Palantir's efficiency in converting revenue into profit. Improvements in these margins suggest stronger financial management.

- Key Performance Indicators (KPIs): Look beyond basic financial statements. Pay close attention to KPIs like customer acquisition cost, customer churn rate, and average revenue per user (ARPU) to get a clearer picture of the business's operational efficiency.

- Revenue Stream Diversification: Assess the balance between government and commercial contracts. A healthy mix reduces reliance on any single revenue source and mitigates risk for Palantir investment.

Cash Flow and Debt Levels

A company's cash flow and debt levels are critical for evaluating its financial stability and future growth potential. Analyzing Palantir's financial statements reveals:

- Operating Cash Flow: Strong operating cash flow indicates Palantir's ability to generate cash from its core business operations, a vital factor for long-term sustainability.

- Investing Cash Flow: Examine capital expenditures and acquisitions to understand Palantir's investment strategy and its potential impact on future profitability.

- Financing Cash Flow: Analyze debt levels, equity financing, and other financing activities to assess the company's financial leverage and its ability to manage debt effectively.

- Debt-to-Equity Ratio: This key metric reveals Palantir's financial risk. A lower ratio indicates lower financial risk, making PLTR stock potentially less volatile.

Future Growth Prospects and Market Opportunities

Evaluating Palantir's future growth hinges on its ability to secure new contracts and expand into new markets. The company operates in two key sectors:

Government Contracts and Expansion

Government contracts form a significant portion of Palantir's revenue. Future growth depends on:

- New Contract Wins: Monitor announcements of new government contracts, both domestically and internationally. Larger contracts can significantly boost Palantir's revenue and stock price.

- Expansion into New Government Sectors: Assess Palantir's ability to penetrate new government sectors, such as healthcare, law enforcement, or intelligence agencies, further diversifying its revenue streams.

- International Expansion: Growth in international government contracts reduces reliance on the US market, mitigating geopolitical risks associated with Palantir investment.

Commercial Market Penetration

Palantir's expansion into the commercial market is crucial for long-term growth. Key factors include:

- Traction in Key Sectors: Analyze progress in sectors like finance, healthcare, and energy. Successful commercial partnerships can demonstrate Palantir's ability to offer solutions beyond the government sector.

- Market Share Growth: Track Palantir's market share gain against competitors in its chosen commercial markets.

- Customer Acquisition and Retention: Effective customer acquisition and retention strategies are essential for sustainable growth in the competitive commercial sector.

Risk Assessment and Potential Challenges

Despite its growth potential, Palantir faces several risks that investors in PLTR stock should consider:

Competition and Market Saturation

Palantir operates in a competitive landscape. Understanding the competitive landscape is crucial:

- Key Competitors: Identify major competitors and analyze their strengths and weaknesses. This helps assess Palantir's competitive advantages.

- Market Saturation: Assess the potential for market saturation in Palantir's target markets, which could limit future growth.

- Competitive Differentiation: Examine Palantir's unique selling propositions and its ability to maintain a competitive edge.

Geopolitical Risks and Regulatory Uncertainty

Geopolitical events and regulatory changes can significantly impact Palantir's operations:

- International Relations: Geopolitical instability can affect contract negotiations and operations in certain regions.

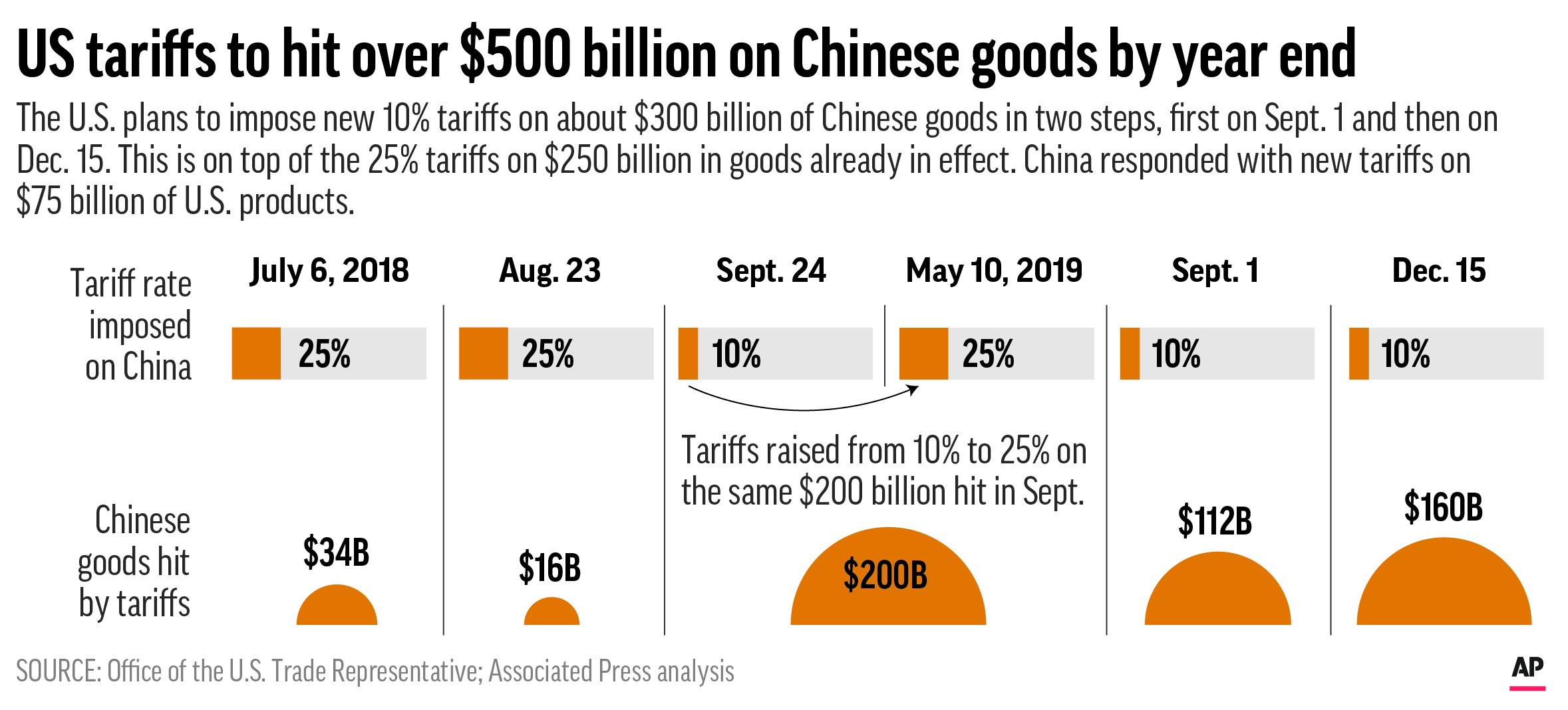

- Trade Wars and Sanctions: International trade conflicts and sanctions can disrupt Palantir's supply chains and access to international markets.

- Data Privacy Regulations: Changes in data privacy regulations can impact Palantir's operations and require significant adaptation.

Valuation and Investment Considerations

Before investing in Palantir stock, a thorough valuation analysis is essential:

Price-to-Earnings Ratio (P/E) and Other Key Metrics

Several key metrics provide insights into Palantir's valuation:

- Price-to-Earnings Ratio (P/E): Compare Palantir's P/E ratio to industry peers and historical trends to assess whether it's overvalued or undervalued.

- Price-to-Sales Ratio (P/S): This metric provides another valuation perspective, especially useful for companies with inconsistent profitability.

- Other Key Metrics: Consider other relevant metrics like PEG ratio and revenue growth to get a holistic view of Palantir’s valuation.

Analyst Ratings and Future Forecasts

Analyst opinions can offer valuable insights, but remember that these are opinions, not guarantees:

- Consensus Estimates: Review the consensus earnings estimates from leading financial analysts to get a sense of market expectations for Palantir's future performance.

- Range of Forecasts: Consider the range of analyst forecasts, recognizing the inherent uncertainty in predicting future performance.

- Analyst Sentiment: Note any significant changes in analyst sentiment, as this can indicate shifts in market perception of Palantir's prospects.

Conclusion

This analysis of Palantir stock before its May 5th earnings report highlights key factors influencing its valuation. We've examined recent performance, future growth prospects, and potential risks to provide a comprehensive overview. Understanding these aspects is crucial for making informed investment decisions. Remember that Palantir's performance is closely tied to the success of its government and commercial contracts, and market conditions can significantly influence its stock price.

Call to Action: Before making any investment decisions regarding Palantir stock, carefully review the provided analysis and conduct your own thorough due diligence. Continue to monitor Palantir's performance and market trends to stay updated on the evolving situation surrounding Palantir earnings and PLTR stock. Remember that this information is for educational purposes only and not financial advice. Thoroughly evaluate Palantir stock and its potential before making any investment choices.

Featured Posts

-

Elon Musk Remains Worlds Richest Despite 100 Billion Net Worth Decline Hurun Global Rich List 2025

May 10, 2025

Elon Musk Remains Worlds Richest Despite 100 Billion Net Worth Decline Hurun Global Rich List 2025

May 10, 2025 -

The Bubble Blasters And Other Chinese Goods Trade Chaos And Its Impact

May 10, 2025

The Bubble Blasters And Other Chinese Goods Trade Chaos And Its Impact

May 10, 2025 -

Ukraina 9 Maya Priezd Soyuznikov I Ego Znachenie

May 10, 2025

Ukraina 9 Maya Priezd Soyuznikov I Ego Znachenie

May 10, 2025 -

Live Stock Market Data Sensex And Nifty Significant Gains

May 10, 2025

Live Stock Market Data Sensex And Nifty Significant Gains

May 10, 2025 -

Elon Musks Billions Increase Tesla Rally Fuels Wealth Growth Post Dogecoin

May 10, 2025

Elon Musks Billions Increase Tesla Rally Fuels Wealth Growth Post Dogecoin

May 10, 2025