Extreme Price Hike: Broadcom's VMware Deal Costs AT&T 1,050% More

Table of Contents

The Broadcom-VMware Deal: A Deeper Dive

Broadcom's acquisition of VMware, finalized in late 2022, was a monumental deal in the tech industry. The $61 billion acquisition united a leading semiconductor company with a virtualization giant, raising significant concerns among industry watchers. VMware's role in providing virtualization and cloud computing solutions is crucial for many large organizations, enabling them to manage and optimize their IT infrastructure. For AT&T, VMware's technology is integral to its network operations, making it heavily reliant on the platform.

Key aspects of the Broadcom-VMware deal include:

- Acquisition Price: $61 billion

- Date of Completion: Late 2022

- Market Reaction: Mixed reactions, with some expressing concerns about potential monopolistic practices and increased pricing.

- Broadcom's Stated Goals: Broadcom cited synergies and expansion into new markets as key drivers of the acquisition. The company aims to leverage VMware's technology to enhance its existing product portfolio and expand its customer base.

AT&T's VMware Dependence and the Price Shock

AT&T's infrastructure heavily relies on VMware's virtualization technology for its network management and operations. This reliance left them exceptionally vulnerable when Broadcom acquired VMware. The subsequent price hike reflects the post-acquisition vulnerability. Reports indicate a shocking 1050% increase in AT&T's licensing costs, representing a massive blow to their operational budget.

This extreme price hike presents AT&T with significant challenges:

- Increased Operational Costs: A substantial increase in operational expenditures directly impacts profitability.

- Budgetary Constraints: The unexpected cost increase necessitates drastic budget reallocations and potentially impacts other projects.

- Potential Impact on Service Offerings: To offset the increased cost, AT&T may need to adjust its service offerings or pricing strategies.

- Need for Cost-Optimization Strategies: AT&T will be forced to implement aggressive cost-cutting measures across various departments.

Analyzing the Factors Contributing to the Extreme Price Hike

The 1050% price increase is unprecedented and requires careful analysis. Several factors may have contributed to this extreme price hike:

- Market Consolidation: The acquisition reduced competition, giving Broadcom significant market power.

- Lack of Viable Alternatives: The absence of strong competitors in the virtualization market limited AT&T's negotiating power.

- Changes in Licensing Agreements: Broadcom may have revised licensing agreements post-acquisition, leading to higher prices for existing customers like AT&T.

- Broadcom's Pricing Strategy: Broadcom's pricing strategy post-acquisition could be aimed at maximizing profits given their now-dominant market position. This could involve leveraging their newly acquired market dominance to extract higher prices from existing customers.

Implications and Future Outlook for AT&T and Other Businesses

The AT&T case serves as a cautionary tale for other companies reliant on VMware technology and highlights the risks associated with industry consolidation. This extreme price hike has broader implications for the telecommunications industry and other sectors reliant on similar technologies. Businesses need to implement strategies to mitigate such risks, including:

- Diversification of Vendors: Reducing reliance on single vendors minimizes vulnerability to sudden price increases.

- Negotiation Strength: Companies need to actively negotiate licensing agreements to ensure favorable terms.

- Long-Term Contracts: Securing long-term contracts with fixed pricing can protect against sudden price hikes.

Potential future scenarios include:

- Increased Scrutiny of Mergers and Acquisitions: Regulatory bodies may increase their scrutiny of mergers and acquisitions to prevent monopolistic practices.

- Development of Alternative Technologies: The pressure from extreme price hikes could accelerate the development and adoption of alternative virtualization technologies.

- Pressure on Regulators to Address Monopolistic Practices: The situation may lead to increased pressure on regulators to intervene in cases of anti-competitive behavior.

- Shifting Vendor Relationships: Companies may actively seek out new vendors or explore open-source alternatives to lessen dependence on dominant players.

Conclusion: Extreme Price Hike – Lessons Learned and Future Considerations

The extreme price hike experienced by AT&T due to Broadcom's acquisition of VMware underscores the significant risks associated with mergers and acquisitions in the tech industry. The 1050% increase highlights the potential for unexpected cost surges and the importance of proactive risk management. Factors contributing to this dramatic increase include market consolidation, lack of viable alternatives, and potentially aggressive pricing strategies. This case study serves as a vital lesson for businesses to diversify their vendor relationships, strengthen their negotiating power, and carefully analyze the potential implications of major industry mergers and acquisitions. Learn more about avoiding extreme price hikes caused by corporate mergers and acquisitions. Stay informed and protect your business.

Featured Posts

-

10 Fastest Stock Ferraris Official Track Data Analysis

May 24, 2025

10 Fastest Stock Ferraris Official Track Data Analysis

May 24, 2025 -

Amundi Msci World Catholic Principles Ucits Etf Acc Daily Nav And Its Implications

May 24, 2025

Amundi Msci World Catholic Principles Ucits Etf Acc Daily Nav And Its Implications

May 24, 2025 -

Heineken Exceeds Revenue Expectations Maintains Outlook Despite Tariffs

May 24, 2025

Heineken Exceeds Revenue Expectations Maintains Outlook Despite Tariffs

May 24, 2025 -

Live Stock Market Updates Bond Sell Off Dow Futures Bitcoin Rally

May 24, 2025

Live Stock Market Updates Bond Sell Off Dow Futures Bitcoin Rally

May 24, 2025 -

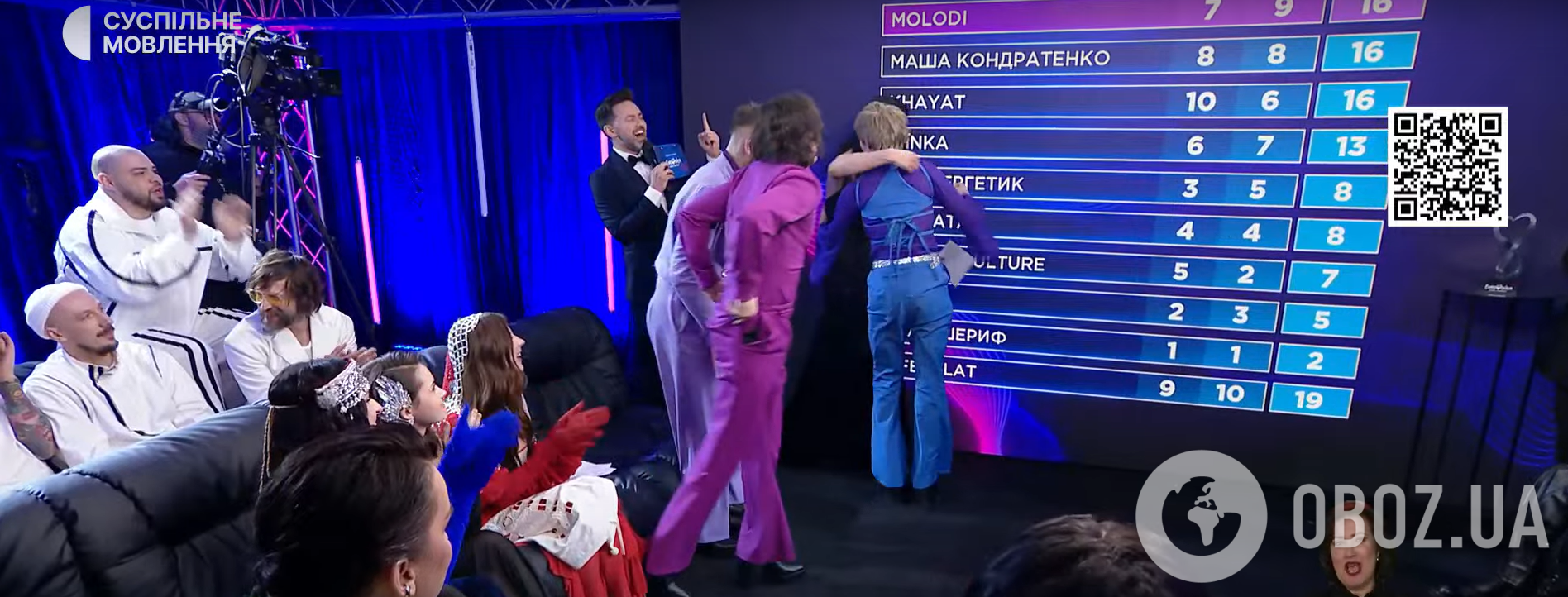

Konchita Vurst Predskazala Pobediteley Evrovideniya 2025 Podrobnosti Ot Unian

May 24, 2025

Konchita Vurst Predskazala Pobediteley Evrovideniya 2025 Podrobnosti Ot Unian

May 24, 2025

Latest Posts

-

Jonathan Groff On Asexuality Instinct Magazine Interview

May 24, 2025

Jonathan Groff On Asexuality Instinct Magazine Interview

May 24, 2025 -

Jonathan Groffs Past An Open Discussion Of Asexuality

May 24, 2025

Jonathan Groffs Past An Open Discussion Of Asexuality

May 24, 2025 -

Broadway Buzz Jonathan Groffs Performance In Just In Time And His Connection To Bobby Darin

May 24, 2025

Broadway Buzz Jonathan Groffs Performance In Just In Time And His Connection To Bobby Darin

May 24, 2025 -

Jonathan Groff Channels Bobby Darin A Deep Dive Into Just In Time

May 24, 2025

Jonathan Groff Channels Bobby Darin A Deep Dive Into Just In Time

May 24, 2025 -

Etoile A Spring Awakening Reunion Brings Laughter With Gideon Glick And Jonathan Groff

May 24, 2025

Etoile A Spring Awakening Reunion Brings Laughter With Gideon Glick And Jonathan Groff

May 24, 2025