Fed Holds Interest Rates Steady: Inflation And Job Market Risks Remain

Table of Contents

Inflation Remains a Persistent Concern

Inflation continues to be a major headache for the Federal Reserve. While recent figures might show a slight easing, the persistent upward pressure on prices remains a significant concern. Several factors contribute to this stubborn inflation. Supply chain disruptions, although easing, still impact the availability and cost of goods. Soaring energy prices, fueled by geopolitical instability and increased demand, add further inflationary pressure. Finally, robust consumer demand, while a sign of economic strength, contributes to upward pressure on prices.

The Fed's target inflation rate is typically around 2%. Currently, the inflation rate (measured by the Consumer Price Index or CPI) is still significantly above this target, indicating that the battle against inflation is far from won.

- Current CPI and PPI figures: While recent data shows a slowing of inflation, it remains above the Fed's target. The Producer Price Index (PPI), which measures inflation at the wholesale level, also needs closer monitoring.

- Analysis of core inflation vs. headline inflation: Core inflation, which excludes volatile food and energy prices, provides a clearer picture of underlying inflationary pressures. Monitoring the gap between headline and core inflation is crucial for the Fed's decision-making.

- Discussion of potential inflationary pressures in the future: Factors like wage growth and future energy price fluctuations will continue to impact inflation in the coming months.

The Job Market: A Mixed Bag

The job market presents a complex picture, adding another layer of complexity to the Fed's decision. While unemployment remains relatively low, signaling a strong economy, there are underlying tensions. Wage growth, while positive for workers, fuels concerns about a potential wage-price spiral, where rising wages lead to higher prices, perpetuating the inflationary cycle.

Furthermore, the labor market isn't uniform across all sectors. Some industries face significant labor shortages, while others experience higher unemployment. This uneven distribution complicates the Fed's assessment of the overall economic health.

- Current unemployment rate: The current unemployment rate, although low historically, doesn't tell the whole story.

- Job creation numbers for recent months: Analyzing job creation figures across various sectors helps provide a more granular understanding of labor market dynamics.

- Analysis of wage growth across different sectors: Wage growth varies significantly between sectors, highlighting areas of potential inflationary pressure.

- Discussion of potential labor market imbalances: Addressing the imbalances within the labor market is crucial for achieving sustainable economic growth and stable prices.

The Fed's Reasoning Behind the Decision to Hold Rates

The Fed's decision to hold interest rates steady reflects a cautious approach. Their statement emphasized the need to carefully assess the impact of previous rate hikes and the evolving economic data. Raising rates further could trigger a sharper economic slowdown or even a recession, jeopardizing the job market gains. Conversely, lowering rates too soon could reignite inflationary pressures.

The Fed's forward guidance hints at a data-dependent approach, suggesting that future decisions will hinge on incoming economic indicators. Geopolitical factors and global economic uncertainty further complicate the decision-making process.

- Key excerpts from the Fed's statement: Close examination of the Fed's official statement reveals their rationale and expectations.

- Analysis of the Fed's assessment of economic risks: The Fed carefully weighs the risks of inflation against the risks of a recession.

- Discussion of the potential impact of geopolitical factors: Global events can significantly influence economic conditions and the Fed's policy decisions.

Economic Outlook and Potential Future Scenarios

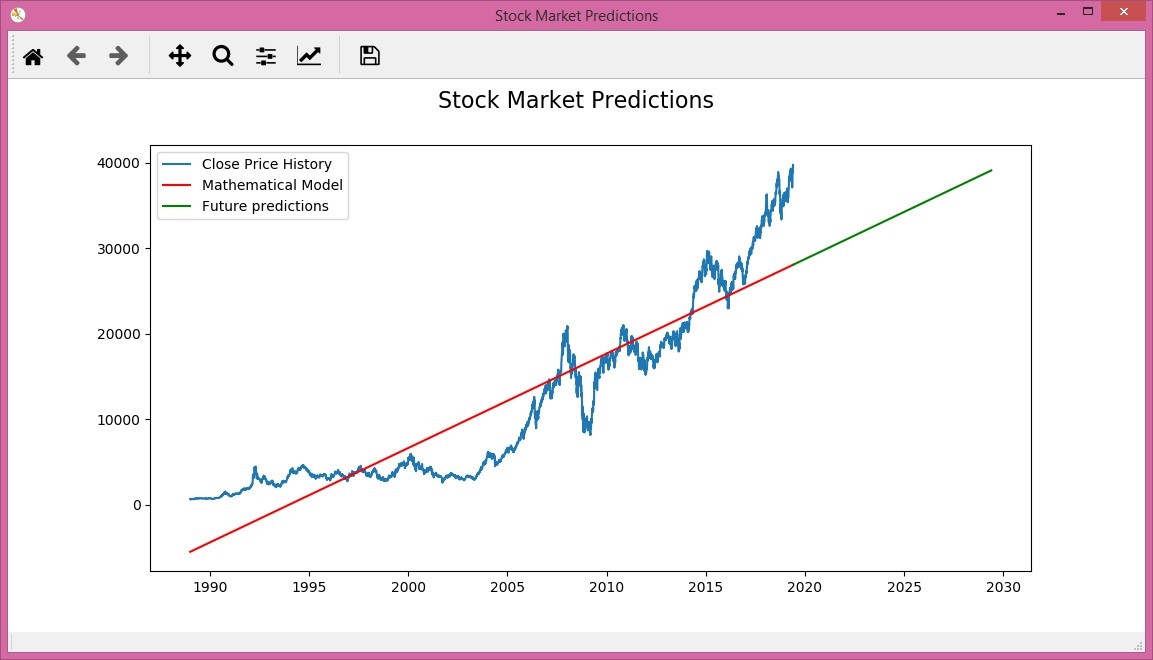

Economic forecasts vary, with some predicting a "soft landing" – a slowdown in economic growth without a recession – while others foresee a recession. The path forward depends on several factors, including consumer spending, business investment, and government policies. Global economic conditions also play a significant role.

- Forecasts from leading economists and financial institutions: Analyzing diverse perspectives helps understand the range of potential outcomes.

- Potential scenarios for economic growth in the coming year: Considering different scenarios – from robust growth to recession – is crucial for planning.

- Discussion of the potential impact of global economic events: Global factors can significantly influence the US economy and the Fed's actions.

Conclusion: The Fed's Steady Hand and the Road Ahead for Interest Rates

The Fed's decision to hold interest rates steady reflects a delicate balancing act between controlling inflation and preserving economic growth. The persistent inflationary pressures and the complexities of the job market present significant challenges. The Fed's future actions will be data-driven, carefully considering the evolving economic landscape. This decision has significant implications for consumers and businesses, impacting borrowing costs, investment decisions, and overall economic activity.

To stay informed about the evolving situation and the impact of Fed interest rates on your financial well-being, subscribe to our newsletter for regular updates on economic news and analysis. Understanding the dynamics of inflation and the job market is vital for navigating the current economic climate. Further reading on monetary policy and economic forecasting can enhance your understanding of these complex issues. Stay informed, stay ahead.

Featured Posts

-

Analyzing Palantirs Q1 2024 Earnings Government Contracts And Commercial Growth

May 09, 2025

Analyzing Palantirs Q1 2024 Earnings Government Contracts And Commercial Growth

May 09, 2025 -

Potential Hertl Absence Looms Large For Golden Knights

May 09, 2025

Potential Hertl Absence Looms Large For Golden Knights

May 09, 2025 -

Should You Heed Jeanine Pirros Stock Market Prediction

May 09, 2025

Should You Heed Jeanine Pirros Stock Market Prediction

May 09, 2025 -

Elon Musks Fortune Soars Billions Added As Tesla Stock Jumps After Dogecoin Departure

May 09, 2025

Elon Musks Fortune Soars Billions Added As Tesla Stock Jumps After Dogecoin Departure

May 09, 2025 -

Post Roe America How Otc Birth Control Impacts Access

May 09, 2025

Post Roe America How Otc Birth Control Impacts Access

May 09, 2025