Federal Election And The Canadian Dollar: A Potential Decline?

Table of Contents

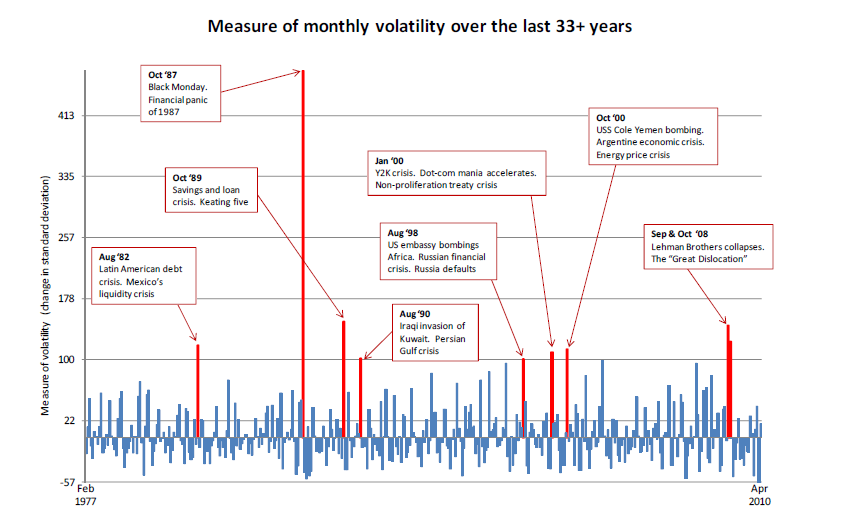

Political Uncertainty and Market Volatility

Uncertainty surrounding election outcomes significantly impacts investor confidence. The very act of an election introduces a period of unknown economic policies and potential shifts in government priorities. This uncertainty often translates into market volatility, affecting the Canadian dollar exchange rate.

- Increased volatility in the stock market: Investors become hesitant, leading to increased trading activity and price fluctuations as they react to evolving poll numbers and election-related news. This affects the Canadian dollar as it's intrinsically linked to the overall performance of the Canadian economy.

- Potential flight to safety: When uncertainty rises, investors often move their money to safer havens, such as the US dollar or other stable currencies. This capital outflow weakens the demand for the Canadian dollar, causing its value to decline.

- Uncertainty regarding future economic policies: Different political parties have varying economic platforms. The lack of clarity about which party will form the government and what policies they will implement creates uncertainty for businesses and investors, impacting investment decisions and consequently, the Canadian dollar exchange rate. This uncertainty affects long-term planning and investment strategies, further pressuring the loonie.

Impact of Different Party Platforms on the CAD

Major political parties in Canada typically have distinct economic platforms that could impact the CAD differently. Analyzing these platforms offers insight into potential future economic scenarios and their effect on the Canadian dollar. While specific party platforms vary over time, a general analysis can be made.

- Conservative party: A focus on fiscal conservatism might lead to policies aimed at controlling government spending and reducing the national debt. This could potentially strengthen the CAD in the long term by improving investor confidence in Canada's fiscal stability. However, depending on the implementation, it might also lead to slower economic growth in the short term.

- Liberal party: Policies prioritizing social programs may involve increased government spending. While this can boost short-term economic activity, it could also lead to higher inflation and potentially weaken the CAD if investors perceive increased fiscal risk.

- NDP party: Similar to the Liberal party, an NDP government might prioritize social programs leading to potential pressures on inflation and the Canadian dollar depending on how these programs are funded and implemented. These are complex relationships, and the specific impact would depend significantly on the details of the proposed policies and their actual implementation.

Global Economic Factors and their Interaction with the Election

The Canadian dollar's value is not solely determined by domestic political events. Global economic factors play a significant role, often irrespective of election outcomes.

- Impact of US dollar strength on CAD: The US dollar is a major global currency, and its strength or weakness directly affects the CAD. A strong US dollar typically puts downward pressure on the CAD.

- Effect of global commodity prices (oil, etc.) on CAD: Canada is a major commodity exporter, with oil being a significant component. Fluctuations in global commodity prices, particularly oil prices, directly impact the Canadian economy and the CAD. Higher commodity prices generally strengthen the Canadian dollar.

- Influence of international trade agreements: Canada's participation in international trade agreements influences its economic performance and the value of its currency. Changes in global trade relations or renegotiation of existing agreements can create uncertainty and affect the CAD's value.

Specific Policy Proposals and their Potential Effects

Specific policy proposals within party platforms can have significant effects on the Canadian dollar. For example:

- Tax policy: Changes to corporate or personal income tax rates can impact investment flows and consumer spending, affecting the CAD. Tax cuts might stimulate economic growth, potentially strengthening the CAD, while tax increases could have the opposite effect.

- Environmental policy: Significant investments in green initiatives or stricter environmental regulations could affect various industries, potentially impacting economic growth and the CAD.

- Regulatory changes: Changes in regulations affecting specific sectors (e.g., financial services, energy) could create uncertainty and impact investor confidence, leading to fluctuations in the CAD.

Conclusion

The impact of the federal election on the Canadian dollar is complex. While political uncertainty can cause market volatility and influence investor confidence, leading to potential fluctuations in the CAD exchange rate, the ultimate effect is intertwined with the specific policies implemented by the winning party. Furthermore, global economic conditions, including US dollar strength, commodity prices, and international trade dynamics, significantly affect the loonie irrespective of election outcomes. The CAD's future isn't solely dependent on the election but a complex interplay of variables.

Call to Action: Stay informed about the upcoming federal election and its potential ramifications for the Canadian dollar. Monitor the Canadian dollar exchange rate closely and consult with financial professionals for personalized investment advice regarding the impact of the Canadian dollar. Understanding the potential connections between the election and your investments is crucial for making informed financial decisions.

Featured Posts

-

Nevsehir De Meydana Gelen Yueksekten Duesme Kazasi Detaylar Ortaya Cikti

Apr 30, 2025

Nevsehir De Meydana Gelen Yueksekten Duesme Kazasi Detaylar Ortaya Cikti

Apr 30, 2025 -

S And P 500 Volatility Strategies For Managing Downside Risk

Apr 30, 2025

S And P 500 Volatility Strategies For Managing Downside Risk

Apr 30, 2025 -

Could Ryan Coogler Reboot The X Files With Gillian Anderson

Apr 30, 2025

Could Ryan Coogler Reboot The X Files With Gillian Anderson

Apr 30, 2025 -

Free Speech Under Scrutiny Black And Asian Police Leader Investigated

Apr 30, 2025

Free Speech Under Scrutiny Black And Asian Police Leader Investigated

Apr 30, 2025 -

Our Yorkshire Farm Reuben Owen On The Shows Difficulties

Apr 30, 2025

Our Yorkshire Farm Reuben Owen On The Shows Difficulties

Apr 30, 2025