S&P 500 Volatility: Strategies For Managing Downside Risk

Table of Contents

Understanding S&P 500 Volatility

Defining Volatility

Volatility, in the context of the S&P 500, refers to the degree of price fluctuation over a given period. High volatility translates to larger price swings, both upward and downward. This variability significantly impacts investment returns. Standard deviation is a common statistical measure quantifying this volatility; a higher standard deviation indicates greater price fluctuation. Beta, another key metric, measures the volatility of an individual stock or portfolio relative to the overall market (represented by the S&P 500).

- High volatility translates to higher potential losses. During periods of heightened S&P 500 volatility, sharp declines can quickly erode portfolio value.

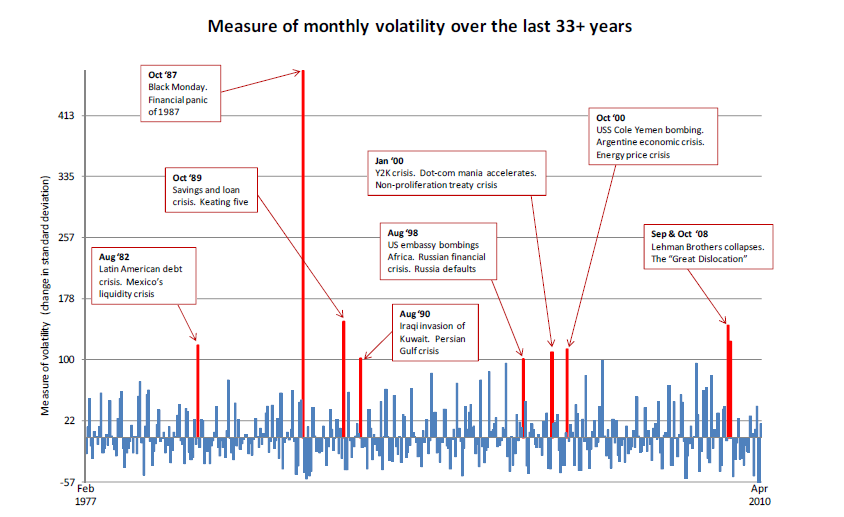

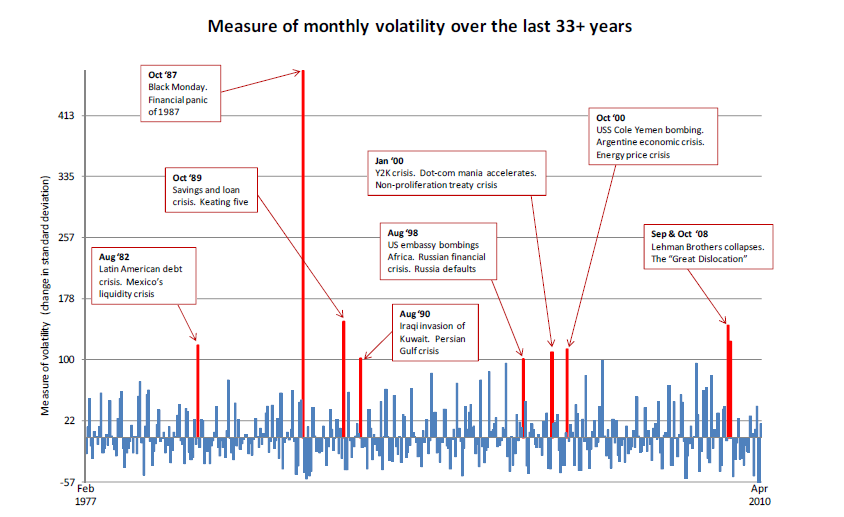

- Historical S&P 500 volatility data reveals several periods of significant upheaval, including the 2008 financial crisis, the COVID-19 pandemic market crash, and various geopolitical events. Analyzing these periods offers valuable insights into market behavior during times of stress.

- The VIX index (often called the "fear index") is a widely used measure of market implied volatility, providing a forward-looking perspective on expected S&P 500 volatility. Monitoring the VIX can help gauge investor sentiment and potential market turbulence.

Identifying Volatility Drivers

Several factors contribute to S&P 500 volatility:

- Economic Indicators: Unexpected shifts in key economic indicators like inflation, interest rates, and GDP growth significantly impact market sentiment and trigger volatility. Inflationary pressures, for instance, often lead to increased uncertainty and market corrections.

- Geopolitical Events: Global political instability, international conflicts, and unexpected policy changes can introduce significant uncertainty, causing increased S&P 500 volatility.

- Market Sentiment: Investor psychology and herd behavior play a substantial role. Fear and panic selling during market downturns can amplify volatility, while periods of excessive optimism can lead to unsustainable price increases and subsequent corrections. Understanding market sentiment is crucial for managing S&P 500 volatility.

- Sector-Specific Factors: Specific sectors or even individual large-cap stocks within the S&P 500 can experience periods of heightened volatility, impacting the overall index performance.

Strategies for Managing S&P 500 Downside Risk

Diversification

Diversification is a cornerstone of risk management. By spreading investments across different asset classes—such as stocks, bonds, real estate, and commodities—investors can reduce the overall volatility of their portfolios.

- A well-diversified portfolio might include a mix of US and international equities, fixed-income securities, and alternative investments.

- International diversification helps mitigate risk associated with US-specific economic or political events.

- Exchange-traded funds (ETFs) and mutual funds offer convenient and cost-effective ways to achieve broad diversification across numerous stocks and asset classes.

Hedging Strategies

Hedging involves using financial instruments to protect against potential losses. Several strategies can be employed to mitigate S&P 500 downside risk:

- Put Options: Purchasing put options on S&P 500 index funds or ETFs acts as insurance against portfolio declines. Put options give the holder the right, but not the obligation, to sell the underlying asset at a predetermined price (the strike price) before a specific date.

- Short Selling and Inverse ETFs: Short selling involves borrowing and selling an asset, hoping to buy it back later at a lower price. Inverse ETFs aim to profit from market declines. However, both strategies carry significant risk and should be used cautiously. Understanding the mechanics of short selling and inverse ETFs is crucial before implementing these strategies to manage S&P 500 volatility.

- Combining hedging strategies with other risk management techniques, such as diversification and rebalancing, can offer a more comprehensive approach to mitigating risk.

Rebalancing Your Portfolio

Regularly rebalancing your portfolio involves adjusting your asset allocation to maintain your target percentages for different asset classes. This strategy helps manage risk and capitalize on market opportunities.

- During periods of high S&P 500 volatility, rebalancing can involve selling some assets that have appreciated and buying assets that have declined, bringing the portfolio back to its target allocation.

- Rebalancing helps lock in profits from winning investments while simultaneously reducing exposure to assets that have underperformed.

- The frequency of rebalancing depends on individual investment goals and risk tolerance. A common approach is to rebalance annually or semi-annually.

Dollar-Cost Averaging (DCA)

Dollar-cost averaging involves investing a fixed amount of money at regular intervals, regardless of market fluctuations. This approach mitigates the risk of investing a lump sum during periods of high S&P 500 volatility.

- DCA reduces the impact of market timing. Instead of trying to time the market, investors consistently invest, averaging their purchase price over time.

- The psychological benefits of DCA are significant, as it reduces the emotional impact of market fluctuations.

- While DCA is a useful strategy, it doesn't eliminate the risk of market downturns.

Conclusion

Successfully managing S&P 500 volatility requires a multi-faceted approach. By understanding the factors driving volatility, diversifying your portfolio, employing appropriate hedging techniques where suitable, regularly rebalancing, and considering dollar-cost averaging, you can significantly reduce your exposure to downside risk. Remember to consult with a qualified financial advisor to develop a personalized strategy aligned with your risk tolerance and financial objectives. Start mitigating your S&P 500 volatility risk today!

Featured Posts

-

Former Ftc Commissioners Seek To Regain Positions

Apr 30, 2025

Former Ftc Commissioners Seek To Regain Positions

Apr 30, 2025 -

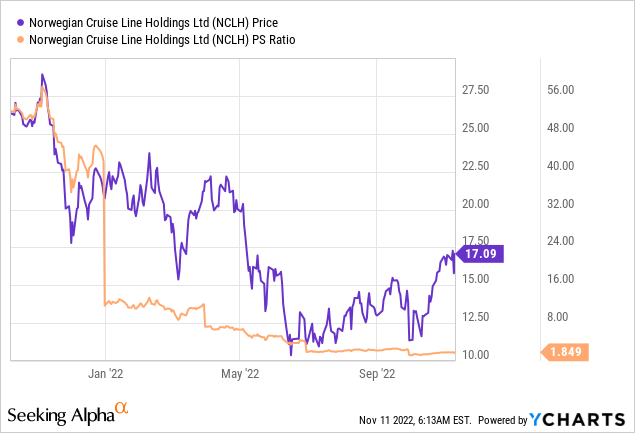

Is Norwegian Cruise Line Nclh Stock A Smart Hedge Fund Investment

Apr 30, 2025

Is Norwegian Cruise Line Nclh Stock A Smart Hedge Fund Investment

Apr 30, 2025 -

Analyzing Trumps 51st State Jabs At Canada Is It A Joke

Apr 30, 2025

Analyzing Trumps 51st State Jabs At Canada Is It A Joke

Apr 30, 2025 -

Bonus Deildin Dagskra Yfir Meistaradeildina Og Nba Leiki

Apr 30, 2025

Bonus Deildin Dagskra Yfir Meistaradeildina Og Nba Leiki

Apr 30, 2025 -

Tathyr Arqam Jwanka Ela Adae Nady Alnsr

Apr 30, 2025

Tathyr Arqam Jwanka Ela Adae Nady Alnsr

Apr 30, 2025