Federal Reserve's Powell Undercuts Bond Traders' Rate Cut Bets

Table of Contents

Powell's Hawkish Stance on Inflation

Powell's recent statements emphasize the Federal Reserve's unwavering commitment to fighting persistent inflation, even if it means slower economic growth. He highlighted the stickiness of core inflation, suggesting that further rate hikes may be necessary to achieve the Fed's 2% inflation target. This "hawkish" stance represents a significant shift from previous, more dovish pronouncements. The persistent nature of inflation, driven by factors like strong consumer demand and supply chain issues, necessitates a more aggressive monetary tightening approach.

- Powell reiterated the Fed's 2% inflation target, emphasizing its importance for long-term economic stability.

- He expressed deep concern about the resilience of inflation despite recent interest rate increases, indicating that the current level of monetary tightening might not be sufficient.

- He indicated a willingness to maintain a restrictive monetary policy for an extended period, signaling that interest rates are likely to remain elevated for longer than previously anticipated by the markets. This signals a continued commitment to curbing inflationary pressures.

Market Reaction and Bond Yields

Powell's remarks have led to a significant upward revision of expectations regarding future interest rates. This is clearly reflected in a sharp rise in Treasury yields, a key indicator of market sentiment regarding interest rates. The bond market, initially anticipating rate cuts, is now pricing in a lower probability of such reductions and potentially even further interest rate hikes. This shift has resulted in increased volatility within the bond market as traders frantically adjust their positions to reflect the altered outlook.

- Bond yields, particularly those on longer-term Treasury bonds, have risen sharply following Powell's comments, indicating a flight to safety and higher expectations for future interest rates.

- The market is now pricing in a higher probability of interest rates remaining elevated for a considerable period, significantly impacting long-term investment strategies.

- Increased volatility in the bond market is observed as traders scramble to adjust their portfolios in response to the changed expectations regarding monetary policy and future interest rate movements.

Implications for Economic Growth

The Federal Reserve's continued focus on inflation control carries the inherent risk of slowing economic growth and potentially triggering a recession. The delicate balance between fighting inflation and maintaining economic stability remains a significant challenge for policymakers. Higher interest rates, while effective in curbing inflation, can also dampen economic activity by increasing borrowing costs for businesses and consumers, potentially leading to reduced investment and spending.

- Higher interest rates can dampen economic activity and investment, slowing GDP growth and potentially impacting job creation.

- The potential for a recession is being discussed more frequently by economists, highlighting the risks associated with aggressive monetary tightening.

- The Fed is aiming for a "soft landing," a scenario where inflation is brought under control without causing a significant economic downturn, but the path to achieving this remains uncertain and fraught with challenges.

Analyzing the Disparity Between Fed's Stance and Market Sentiment

The divergence between the Federal Reserve's hawkish stance and earlier market expectations of rate cuts highlights a potential mispricing of risks in the bond market. This underscores the crucial importance of closely monitoring the Fed's communication and economic data to accurately gauge the true outlook for monetary policy. Market participants may have underestimated the Fed's resolve in its fight against inflation, leading to a misalignment between market sentiment and the actual policy direction.

- Market participants may have underestimated the Fed's commitment to controlling inflation, leading to overly optimistic predictions regarding future interest rates.

- Economic forecasts may need significant revision in light of Powell's recent statements, reflecting a more challenging outlook for economic growth.

- A reassessment of risk is critically necessary for investors navigating the current economic climate, particularly in the bond market, where mispricing of future interest rates can lead to significant losses.

Conclusion

Federal Reserve Chairman Jerome Powell's recent pronouncements have effectively undercut bond traders' bets on imminent rate cuts. His emphasis on persistent inflation and the commitment to a potentially prolonged period of tighter monetary policy have sent ripples through the financial markets, leading to increased bond yields and a reassessment of economic forecasts. Understanding the Federal Reserve's evolving stance on interest rates is crucial for investors and economic policymakers alike. Stay informed about the latest developments regarding Federal Reserve interest rate decisions and their impact on your investment strategies. Continue monitoring news and analysis related to the Federal Reserve's actions and their effect on the bond market and broader economy to effectively manage risk during this period of uncertainty. Understanding the Federal Reserve’s approach to interest rate policy is key to navigating the current economic landscape.

Featured Posts

-

Shevchenko Weili A Post Ufc 315 Superfight Possibility

May 12, 2025

Shevchenko Weili A Post Ufc 315 Superfight Possibility

May 12, 2025 -

Watch Sylvester Stallones Armor A Free Action Thriller This Month

May 12, 2025

Watch Sylvester Stallones Armor A Free Action Thriller This Month

May 12, 2025 -

Baroan E V Ludogorets Kakvo Ochakvame Ot Noviya Igrach

May 12, 2025

Baroan E V Ludogorets Kakvo Ochakvame Ot Noviya Igrach

May 12, 2025 -

The Evolving Landscape Of The Chinese Auto Market Lessons From Bmw And Porsche

May 12, 2025

The Evolving Landscape Of The Chinese Auto Market Lessons From Bmw And Porsche

May 12, 2025 -

Bilateral Anophthalmia A Comprehensive Guide For Parents And Caregivers

May 12, 2025

Bilateral Anophthalmia A Comprehensive Guide For Parents And Caregivers

May 12, 2025

Latest Posts

-

Kelly Graves Lands Australian Star A Major Recruiting Coup

May 13, 2025

Kelly Graves Lands Australian Star A Major Recruiting Coup

May 13, 2025 -

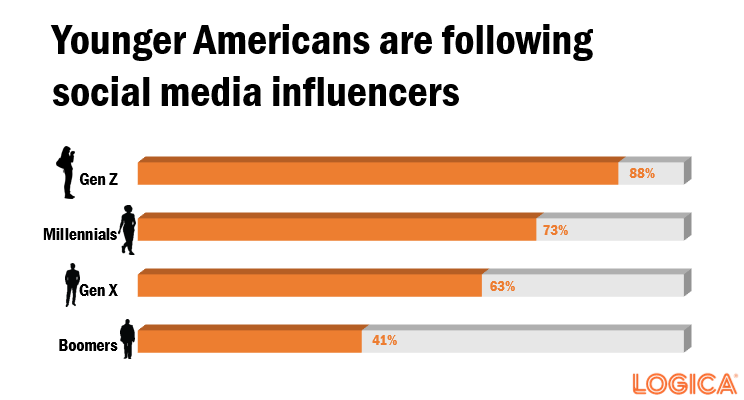

A Gen Z Influencers Journey From Kamala Harriss Team To Congressional Run

May 13, 2025

A Gen Z Influencers Journey From Kamala Harriss Team To Congressional Run

May 13, 2025 -

Kamala Harriss Former Influencer Seeks Congressional Seat

May 13, 2025

Kamala Harriss Former Influencer Seeks Congressional Seat

May 13, 2025 -

From Social Media To The Ballot Box A Gen Z Influencer Runs For Congress

May 13, 2025

From Social Media To The Ballot Box A Gen Z Influencer Runs For Congress

May 13, 2025 -

Gen Z Influencers Path To Congress She Worked For Kamala Harris

May 13, 2025

Gen Z Influencers Path To Congress She Worked For Kamala Harris

May 13, 2025