First Time Since 2020: Hong Kong Defends US Dollar Peg

Table of Contents

The Mechanics of Hong Kong's Linked Exchange Rate System (LERS)

Hong Kong's currency stability relies on the Linked Exchange Rate System (LERS), a complex mechanism designed to maintain a tight peg between the HKD and the USD. The HKMA, Hong Kong's central bank, plays a pivotal role in managing this system. Its primary function is to ensure the HKD remains within a narrow band against the USD, typically trading between 7.75 and 7.85 HKD per USD. The HKMA achieves this through a combination of interest rate adjustments and interventions in the foreign exchange market.

- Definition of the LERS and its band: The LERS is a managed float system, where the HKMA actively intervenes to keep the HKD within the predetermined band against the USD.

- Explanation of the HKMA's intervention mechanisms: The HKMA buys or sells US dollars in the foreign exchange market to influence the HKD exchange rate. If the HKD weakens towards the upper band, the HKMA buys HKD and sells USD, increasing demand for the HKD and pushing its value back up. Conversely, if the HKD strengthens towards the lower band, it sells HKD and buys USD.

- How the system differs from a completely fixed exchange rate: Unlike a completely fixed exchange rate, the LERS allows for minor fluctuations within the designated band. This flexibility provides a degree of shock absorption, but the HKMA's commitment to the peg remains paramount.

The Pressure on the Hong Kong Dollar and the Recent Defense

Recent market pressures, stemming from a confluence of factors, necessitated the HKMA's intervention to defend the HKD peg against the USD. These pressures included widening interest rate differentials between the US and Hong Kong, significant capital flows, and persistent global economic uncertainty. The resulting weakening of the HKD prompted the HKMA to take decisive action.

- Specific economic events leading to pressure on the HKD: The recent rise in US interest rates created a pull effect on capital away from Hong Kong, weakening the HKD. Increased global uncertainty also contributed to capital outflows.

- Amount of intervention by the HKMA: While the precise figures of the HKMA's intervention are often not immediately disclosed, market observers noted substantial activity in the foreign exchange market to support the HKD.

- Impact of the intervention on interest rates and exchange rates: The HKMA's actions successfully stabilized the HKD within its trading band and prevented significant depreciation. The intervention also affected interest rates, likely impacting borrowing costs.

Implications for Hong Kong's Economy and Financial Stability

The HKMA's defense of the peg has short-term and long-term implications for Hong Kong's economy and financial stability. While maintaining the peg offers several benefits, it also entails significant trade-offs.

- Potential benefits of maintaining the peg: A stable HKD fosters price stability, facilitates international trade, and attracts foreign investment, which are vital for Hong Kong’s economic health.

- Potential drawbacks of maintaining the peg: Maintaining the peg limits the HKMA’s ability to use monetary policy independently to address domestic economic concerns.

- Economic outlook for Hong Kong considering the recent events: The successful defense strengthens confidence in Hong Kong's financial system. However, the underlying economic challenges, such as interest rate differentials and global uncertainty, remain.

Comparison to Previous Defenses of the Hong Kong Dollar Peg

Comparing the recent defense of the HKD peg to previous instances reveals both similarities and differences. While the HKMA has intervened numerous times in the past, the scale and context of each intervention differ. Past instances often involved less dramatic interventions, demonstrating the HKMA's capacity to manage fluctuations and maintain the peg over time.

- Key differences between the current situation and past interventions: This intervention was notable due to its scale and the specific global economic environment. Past interventions often responded to more localized pressures.

- Long-term effectiveness of the LERS: Despite challenges, the LERS has proven remarkably effective in maintaining HKD stability over several decades.

- Lessons learned from past interventions: Past interventions provided the HKMA with valuable experience in managing the LERS and responding to diverse challenges.

Conclusion: The Future of Hong Kong's US Dollar Peg

Hong Kong's recent defense of its US dollar peg highlights the enduring importance of this system for the territory's economic stability. The HKMA's successful intervention reinforces the strength and effectiveness of the LERS, but challenges remain. Maintaining the peg in the face of global economic uncertainty and fluctuating interest rates will require ongoing vigilance and strategic adjustments. To stay informed about the ongoing impact of "Hong Kong defends US dollar peg" and its future implications, continue monitoring the HKMA's announcements and conduct further research on the evolving economic landscape in Hong Kong and globally. Understanding the nuances of this situation is crucial for investors, businesses, and anyone with a stake in Hong Kong's economic future.

Featured Posts

-

The Potent Powder Understanding Cocaines Global Surge

May 05, 2025

The Potent Powder Understanding Cocaines Global Surge

May 05, 2025 -

Norways Nicolai Tangen Navigating Trumps Tariffs

May 05, 2025

Norways Nicolai Tangen Navigating Trumps Tariffs

May 05, 2025 -

Blue Origin Rocket Launch Cancelled Subsystem Malfunction

May 05, 2025

Blue Origin Rocket Launch Cancelled Subsystem Malfunction

May 05, 2025 -

Oscars 2024 Lizzos New Look After Weight Loss

May 05, 2025

Oscars 2024 Lizzos New Look After Weight Loss

May 05, 2025 -

Lizzo Opens Up About Her Weight Loss A Look At Her Lifestyle Changes

May 05, 2025

Lizzo Opens Up About Her Weight Loss A Look At Her Lifestyle Changes

May 05, 2025

Latest Posts

-

Cops Cage Depraved Child Sex Offender Following Extensive Investigation

May 05, 2025

Cops Cage Depraved Child Sex Offender Following Extensive Investigation

May 05, 2025 -

Woman Dead In Raiwaqa House Fire

May 05, 2025

Woman Dead In Raiwaqa House Fire

May 05, 2025 -

Chicago Med Brian Tees Return In Season 10 Episode 14

May 05, 2025

Chicago Med Brian Tees Return In Season 10 Episode 14

May 05, 2025 -

Dr Choi Returns In Chicago Med Season 10 Episode 14

May 05, 2025

Dr Choi Returns In Chicago Med Season 10 Episode 14

May 05, 2025 -

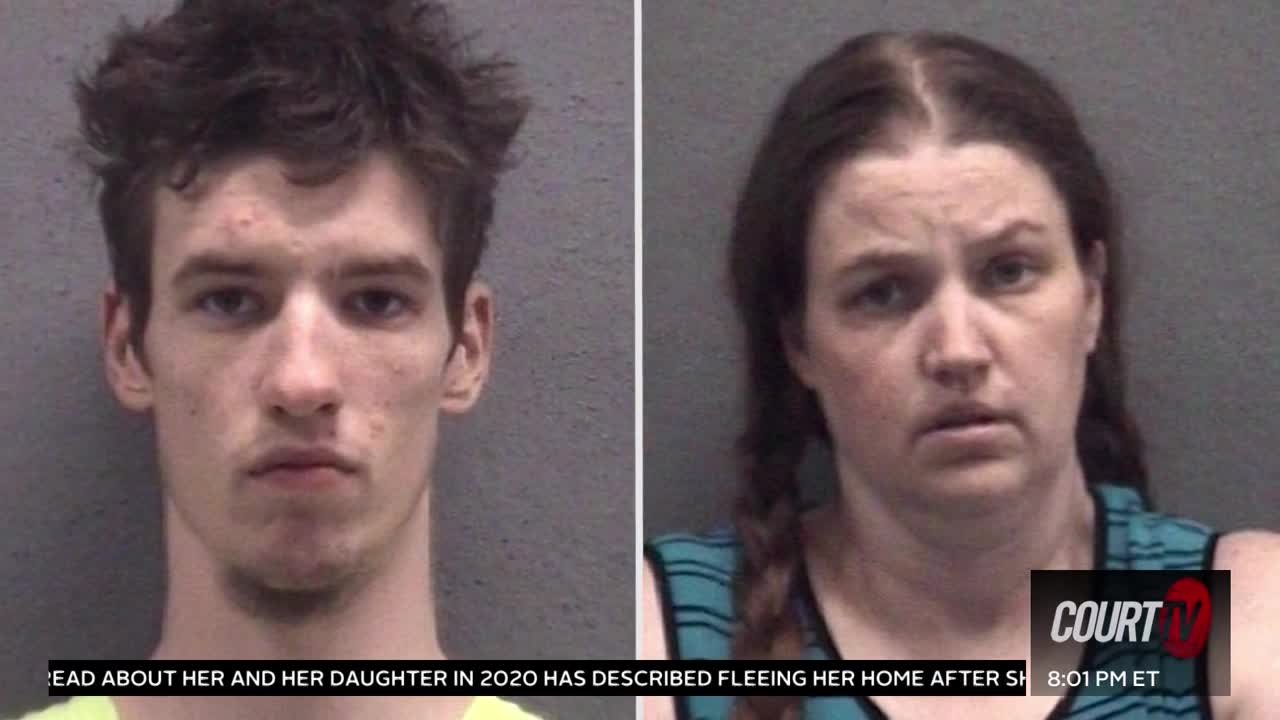

Mothers Role Questioned In 16 Year Olds Torture Murder Case

May 05, 2025

Mothers Role Questioned In 16 Year Olds Torture Murder Case

May 05, 2025