Norway's Nicolai Tangen: Navigating Trump's Tariffs

Table of Contents

This article examines how Nicolai Tangen, the CEO of Norges Bank Investment Management (NBIM), the manager of Norway's massive sovereign wealth fund, successfully steered the fund through the tumultuous period of Donald Trump's trade tariffs. We'll delve into the strategic decisions Tangen made, the challenges faced, and the lessons learned in navigating this complex geopolitical landscape. The impact of these tariffs on global markets, and how a leader like Tangen responded, provides valuable insights into effective risk management and investment strategies in an increasingly uncertain world.

The Impact of Trump's Tariffs on Global Markets

Understanding the Scope of the Tariffs

Donald Trump's administration implemented a series of tariffs, primarily targeting steel and aluminum imports from various countries, including key trading partners. These actions significantly impacted global trade and investment, triggering retaliatory measures and creating uncertainty in international markets. The unpredictable nature of these tariffs made effective risk management a critical priority for global investors.

- Specific examples of tariffs imposed: 25% tariffs on steel imports, 10% tariffs on aluminum imports, and targeted tariffs on specific goods from China.

- Affected industries: Steel, aluminum, manufacturing, agriculture, and technology sectors experienced significant disruptions due to increased import costs and decreased competitiveness.

- Initial market reactions: Stock markets experienced volatility, investor confidence declined, and supply chains faced disruptions.

NBIM's Exposure to Affected Sectors

Norges Bank Investment Management (NBIM), managing the Government Pension Fund Global (often referred to as Norway's oil fund), holds a globally diversified portfolio. However, this diversification didn't eliminate exposure to sectors affected by Trump's tariffs. The fund's significant investments in equities and fixed income meant some exposure to companies reliant on global trade.

- Examples of companies or sectors within NBIM's portfolio susceptible to tariff-related risks: Companies in the automotive, manufacturing, and technology sectors, which rely on global supply chains, faced potential risks. The impact varied based on the company's specific supply chain and geographic footprint.

Initial Response and Risk Assessment

NBIM's initial reaction to the escalating trade war was a thorough risk assessment of its portfolio. This involved analyzing the potential impact of tariffs on its holdings, identifying vulnerabilities, and developing mitigation strategies. Transparency and proactive communication were key.

- Steps taken:

- Comprehensive analysis of the fund's exposure to tariff-affected sectors.

- Development of various scenarios to assess potential impacts.

- Adjustment of the portfolio to reduce vulnerability where possible.

- Strengthening of communication channels with investee companies to understand their resilience plans.

Tangen's Strategic Decisions and Adaptability

Diversification and Portfolio Adjustments

Nicolai Tangen's leadership focused on strategic portfolio adjustments to mitigate the impact of the tariffs. This involved refining the fund's diversification strategy, focusing on geographical spread and sector weighting. The focus remained on long-term value creation, not short-term market fluctuations.

- Examples of strategic shifts: A potential increase in investments in less tariff-sensitive sectors, geographic diversification to regions less impacted by trade tensions, and a focus on companies demonstrating resilience to global economic shocks.

Engagement and Corporate Governance

NBIM actively engaged with companies affected by the tariffs, employing shareholder activism and promoting sustainable business practices. This approach aimed to support long-term value creation even amidst short-term uncertainties. This strategy highlights the proactive nature of NBIM's response.

- Examples of engagement strategies: Direct communication with company management to understand their strategies for navigating the trade war, engaging in proxy voting to support sustainable corporate governance, and encouraging companies to foster strong relationships with their supply chains.

Long-Term Vision and Sustainability

Tangen's emphasis on long-term investment strategies and the integration of sustainability principles proved crucial in navigating the volatility. A long-term perspective helped mitigate the impact of short-term market fluctuations stemming from the trade war.

- Examples of how long-term perspective mitigated short-term market fluctuations: Maintaining a long-term outlook, reducing reliance on short-term market timing, and focusing on fundamental analysis of companies' long-term prospects. Sustainability investments were also less susceptible to short-term shocks.

Lessons Learned and Future Implications

Importance of Robust Risk Management

The Trump tariff episode underscored the critical role of robust risk management frameworks. Proactive scenario planning, stress testing, and regular portfolio reviews are essential tools for navigating geopolitical uncertainty and global trade wars. NBIM's experience serves as a case study in proactive risk management.

- Key aspects of effective risk management:

- Diversification across asset classes, geographies, and sectors.

- Regular monitoring of geopolitical risks and their potential impact.

- Stress testing of portfolios under various adverse scenarios.

- Development of contingency plans to mitigate potential losses.

Adaptability and Strategic Flexibility

The ability to adapt and respond quickly to changing circumstances is crucial in unpredictable economic environments. NBIM demonstrated this flexibility and agility throughout the period of the Trump tariffs. This adaptive approach underscores the importance of responsiveness.

- Examples of how agility and responsiveness helped NBIM manage the impact of tariffs effectively: The ability to quickly analyze market trends, adjust the portfolio accordingly, and engage with investee companies to address the potential challenges of the tariffs.

The Role of International Cooperation

The Trump tariffs highlighted the importance of international cooperation and multilateral agreements in mitigating the negative consequences of trade disputes. The need for global collaboration in fostering free and fair trade is undeniable.

- Importance of global collaboration: Multilateral trade agreements can reduce trade barriers, promote stability, and minimize the risk of disruptive trade wars.

Conclusion

Nicolai Tangen's leadership at NBIM during the Trump tariff period demonstrates the importance of proactive risk management, diversification, and a long-term investment strategy. The successful navigation of this turbulent period underscores the need for adaptability and a commitment to sustainability, which played a critical role in mitigating the negative impacts of the trade war. His approach serves as a valuable lesson for investors worldwide.

Call to Action: Learn from Nicolai Tangen's successful navigation of Trump's tariffs and discover how to apply these strategies to your own investment approach. Explore resources on global macroeconomics and risk management to better understand and navigate future economic uncertainties. Understand how to effectively manage risk in a world of unpredictable trade policies – learn more about navigating global trade complexities today!

Featured Posts

-

Hate Crime Attack Man Receives 53 Year Prison Sentence

May 05, 2025

Hate Crime Attack Man Receives 53 Year Prison Sentence

May 05, 2025 -

Marvels Quality Control Addressing Criticisms Of Recent Films And Series

May 05, 2025

Marvels Quality Control Addressing Criticisms Of Recent Films And Series

May 05, 2025 -

Are Bmw And Porsche Losing Ground In China A Deep Dive Into Market Dynamics

May 05, 2025

Are Bmw And Porsche Losing Ground In China A Deep Dive Into Market Dynamics

May 05, 2025 -

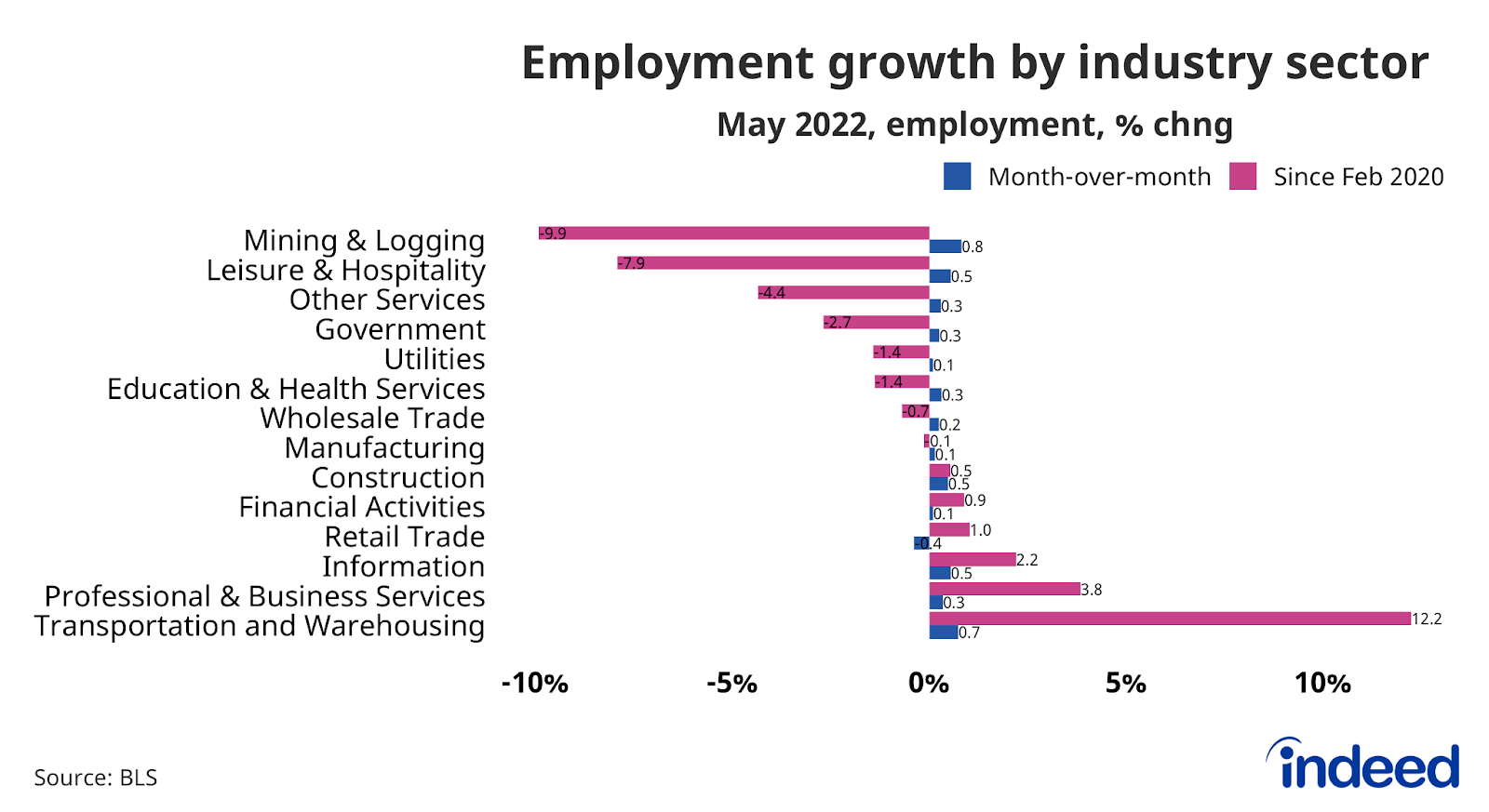

U S Labor Market Report 177 000 Jobs Added Unemployment Rate At 4 2

May 05, 2025

U S Labor Market Report 177 000 Jobs Added Unemployment Rate At 4 2

May 05, 2025 -

Lizzo Returns With A Fiery New Track A Powerful New Sound

May 05, 2025

Lizzo Returns With A Fiery New Track A Powerful New Sound

May 05, 2025

Latest Posts

-

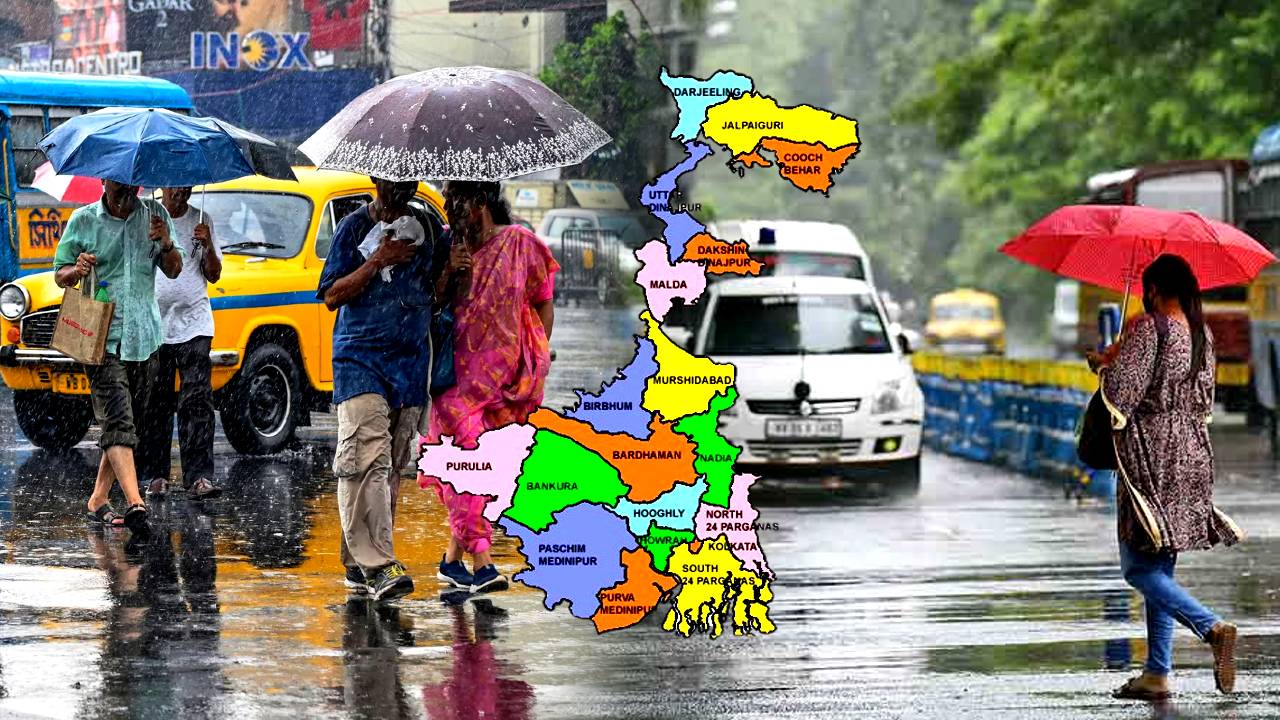

North Bengal Weather Forecast Rain Expected Met Department Says

May 05, 2025

North Bengal Weather Forecast Rain Expected Met Department Says

May 05, 2025 -

Kolkata Weather Update March Temperatures To Exceed 30 Degrees

May 05, 2025

Kolkata Weather Update March Temperatures To Exceed 30 Degrees

May 05, 2025 -

Urgent Weather Update Heatwave Sweeps Across Four West Bengal Districts

May 05, 2025

Urgent Weather Update Heatwave Sweeps Across Four West Bengal Districts

May 05, 2025 -

West Bengal A Deep Dive Into The Recent Temperature Drop

May 05, 2025

West Bengal A Deep Dive Into The Recent Temperature Drop

May 05, 2025 -

Urgent Heatwave Warning Issued For Five South Bengal Districts

May 05, 2025

Urgent Heatwave Warning Issued For Five South Bengal Districts

May 05, 2025