Fiscal Responsibility: A Necessary Element Of Canada's Vision

Table of Contents

The Importance of Balanced Budgets and Debt Reduction in Canada

A cornerstone of fiscal responsibility is achieving balanced budgets and reducing Canada's national debt. High levels of debt burden future generations with increased interest payments, diverting resources from essential public services like healthcare and education. This debt accumulation hampers economic growth by crowding out private investment and increasing the vulnerability of the Canadian economy to external shocks.

Successfully managing public finances requires a commitment to:

- Reduced reliance on borrowing: Minimizing deficit spending through careful expenditure planning and revenue generation.

- Lower interest payments: A lower national debt translates directly into lower interest payments, freeing up funds for crucial public investments.

- Increased investment in infrastructure and social programs: Fiscal prudence allows for strategic investments in infrastructure, education, and healthcare – vital for long-term economic growth and improved quality of life.

- Improved credit rating: A responsible fiscal approach enhances Canada's creditworthiness, enabling access to cheaper borrowing costs in the future.

Countries like Sweden, known for their strong fiscal management, offer valuable lessons. Their commitment to long-term fiscal planning, coupled with structural reforms, demonstrates how sustained fiscal responsibility contributes to economic stability and prosperity.

Strategic Investment and Prioritization of Government Spending in Canada

Effective fiscal management necessitates strategic investment and prioritization of government spending. This means allocating resources efficiently to programs and initiatives that deliver the highest social and economic returns. Prioritizing investments in education, infrastructure, and healthcare yields significant long-term benefits, boosting productivity, improving public health, and enhancing overall quality of life.

Successful strategic investment requires:

- Cost-benefit analysis of government programs: Rigorous evaluation of program effectiveness and return on investment.

- Transparent budgeting processes: Open and accessible budgetary information enabling public scrutiny and accountability.

- Regular audits and performance reviews: Independent assessments to ensure program effectiveness and identify areas for improvement.

- Accountability and transparency in government spending: Clear and concise reporting on how public funds are utilized, fostering public trust and confidence.

Public-private partnerships can play a role, but careful consideration of potential risks and benefits is crucial to ensure value for money and avoid compromising public interests.

The Role of Tax Policy in Fostering Fiscal Responsibility in Canada

A fair and efficient tax system is essential for fiscal responsibility. Tax policy plays a crucial role in generating sufficient government revenue to fund public services while minimizing its impact on economic activity. The design of the tax system needs to balance the needs for revenue generation with the promotion of economic growth and social equity. Progressive taxation, where higher earners pay a larger percentage of their income in taxes, can contribute to a fairer distribution of wealth and resources.

Key aspects of a responsible tax policy include:

- Tax simplification and efficiency: Streamlining tax processes to reduce compliance costs for businesses and individuals.

- Closing tax loopholes: Eliminating opportunities for tax avoidance and evasion, ensuring fairness and equity in the tax system.

- Fair taxation across income brackets: Implementing a tax system that balances the needs of revenue generation with principles of social equity.

- Strengthening tax collection mechanisms: Improving the efficiency and effectiveness of tax collection to minimize revenue loss.

Understanding the interplay between different tax policies and their impact on economic growth and fiscal sustainability is critical for effective policymaking.

Transparency and Accountability in Canadian Fiscal Management

Openness and accountability are vital for maintaining public trust in government financial management. Accessible government financial information empowers citizens to hold their elected officials accountable and participate in informed discussions about fiscal policy. Independent oversight bodies play a crucial role in ensuring that financial practices adhere to the highest standards of transparency and integrity.

Strengthening transparency and accountability requires:

- Open data initiatives: Making government financial data readily accessible to the public.

- Independent audits of government accounts: Regular reviews by independent auditors to ensure accuracy and compliance.

- Public consultations on budget proposals: Engaging the public in discussions about budgetary priorities and spending decisions.

- Stronger parliamentary oversight of government finances: Enhancing the role of Parliament in scrutinizing government financial practices.

Active public participation in budgetary processes fosters greater trust and ensures that fiscal decisions reflect the needs and priorities of Canadian citizens.

Securing Canada's Future Through Fiscal Responsibility

Fiscal responsibility is not just a political goal; it's a necessity for Canada's long-term economic and social well-being. Achieving balanced budgets, making strategic investments, implementing an effective tax policy, and fostering transparency and accountability are all interconnected elements of sound financial management. These measures are vital for securing Canada's future prosperity and ensuring a strong, equitable society for generations to come. Demand fiscal responsibility. Support policies promoting fiscal responsibility. Learn more about fiscal responsibility in Canada today and become an active participant in shaping a fiscally responsible future for our nation.

Featured Posts

-

Canadian Dollars Unexpected Dip Strong Against Usd Weak Against Others

Apr 24, 2025

Canadian Dollars Unexpected Dip Strong Against Usd Weak Against Others

Apr 24, 2025 -

Review Lg C3 77 Inch Oled Tv Performance And Features

Apr 24, 2025

Review Lg C3 77 Inch Oled Tv Performance And Features

Apr 24, 2025 -

The China Factor Why Luxury Carmakers Face Headwinds

Apr 24, 2025

The China Factor Why Luxury Carmakers Face Headwinds

Apr 24, 2025 -

Auto Dealers Intensify Fight Against Ev Sales Requirements

Apr 24, 2025

Auto Dealers Intensify Fight Against Ev Sales Requirements

Apr 24, 2025 -

Nbas Ja Morant Investigation A Deeper Look At The Allegations

Apr 24, 2025

Nbas Ja Morant Investigation A Deeper Look At The Allegations

Apr 24, 2025

Latest Posts

-

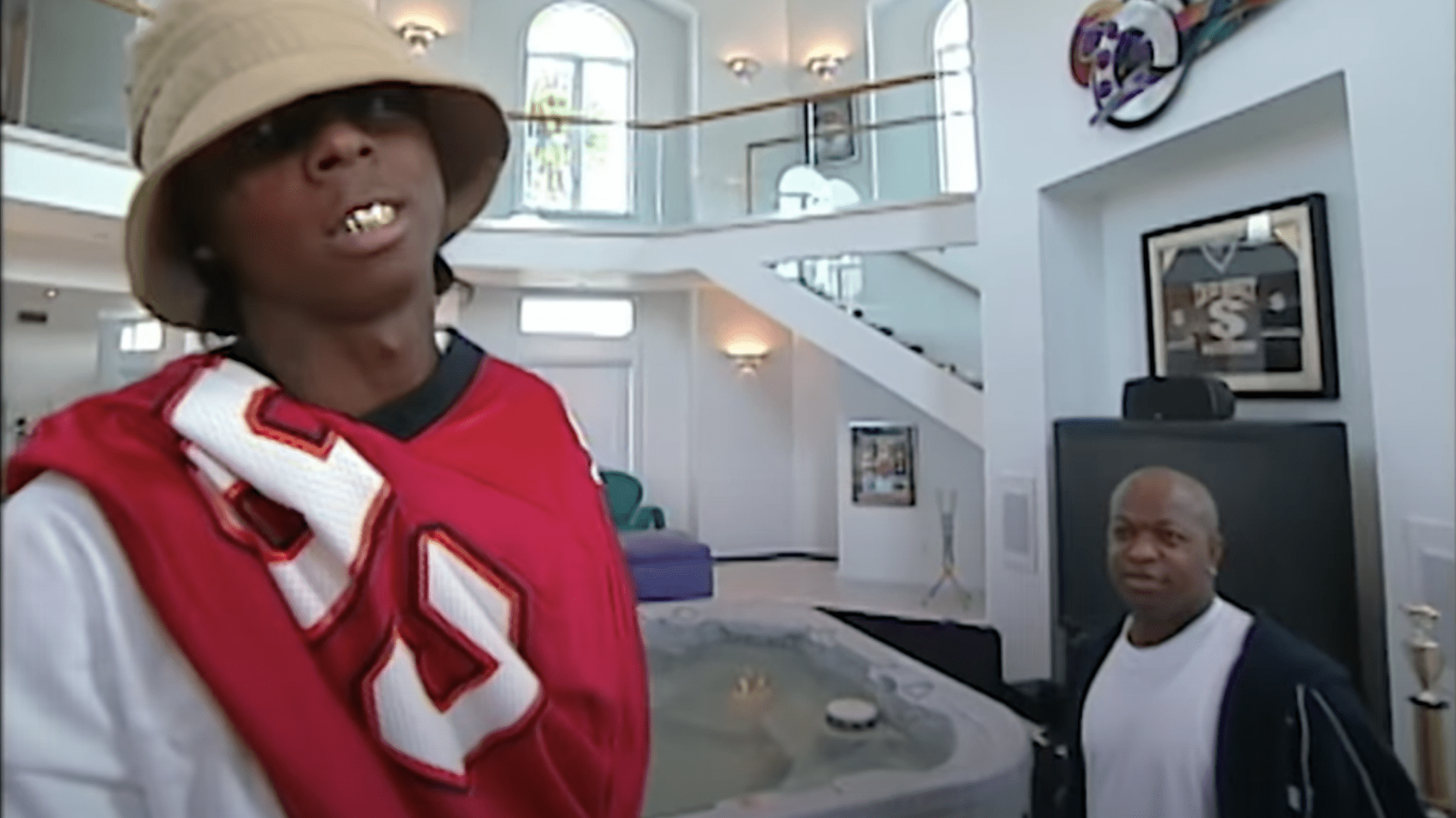

Inside The Beach Homes Of Mtv Cribs Architecture And Design

May 12, 2025

Inside The Beach Homes Of Mtv Cribs Architecture And Design

May 12, 2025 -

The Most Impressive Mansions Featured On Mtv Cribs

May 12, 2025

The Most Impressive Mansions Featured On Mtv Cribs

May 12, 2025 -

Luxury Coastal Living A Look At Mtv Cribs Beach Properties

May 12, 2025

Luxury Coastal Living A Look At Mtv Cribs Beach Properties

May 12, 2025 -

Mtv Cribs Unveiling The Architecture And Design Of Celebrity Homes

May 12, 2025

Mtv Cribs Unveiling The Architecture And Design Of Celebrity Homes

May 12, 2025 -

Inside The Mansions Of Mtv Cribs A Look At Luxurious Living

May 12, 2025

Inside The Mansions Of Mtv Cribs A Look At Luxurious Living

May 12, 2025