Frankfurt Stock Exchange: DAX Remains Stable Following Record Performance

Table of Contents

DAX Performance and Stability

The DAX, Germany's leading stock market index, achieved an all-time high of 16,290 on June 1, 2023. While experiencing some minor fluctuations since then, it has shown remarkable resilience, maintaining a relatively stable position. This stability, however, needs careful analysis. While the DAX hasn’t plummeted, it hasn't consistently risen either, suggesting a period of consolidation rather than continued explosive growth. Let’s examine the contributing factors:

-

Key factors contributing to recent DAX stability: Strong corporate earnings from major German companies, positive economic indicators within the Eurozone (despite global uncertainties), and relatively stable global market trends have all played a crucial role in maintaining the DAX's position. The resilience of the German economy, particularly in manufacturing and exports, has been a significant buffer.

-

Analysis of volatility: Compared to the volatility witnessed during the initial stages of the COVID-19 pandemic, current DAX volatility is significantly lower. However, comparing it to pre-pandemic levels reveals a slightly higher degree of fluctuation, indicating some underlying uncertainty in the market.

-

Significant events impacting the DAX: Geopolitical tensions, particularly the ongoing war in Ukraine and its impact on energy prices, have created market uncertainty. However, the German government’s proactive measures to mitigate the energy crisis have helped stabilize the situation, preventing a more significant negative impact on the DAX. Regulatory changes within the EU also play a role, subtly influencing investor behavior and market trends.

Key Sectors Driving DAX Stability

Several key sectors have been instrumental in driving the DAX's resilience. The automotive industry, despite facing challenges related to the global chip shortage and the transition to electric vehicles, has shown remarkable strength. The technology sector, though experiencing a global correction, remains a significant contributor. The financial sector, benefiting from rising interest rates in some areas, has also demonstrated stability.

-

Performance analysis of individual companies: Companies like Volkswagen, Siemens, and Allianz have demonstrated strong performance, contributing significantly to the DAX's overall stability. Their robust financial results and strategic adaptations have bolstered investor confidence.

-

Impact of global economic events: Global economic slowdowns and inflation concerns have impacted these sectors differently. While the automotive sector faced supply chain disruptions, the financial sector benefited from higher interest rates. The technology sector's performance was more sensitive to global macroeconomic shifts.

-

Future outlook for key sectors: The future outlook for these sectors is mixed. Continued growth is expected in the renewable energy sector within the automotive industry, while the technology sector may face further corrections before a renewed period of expansion. The financial sector's performance will likely be tied to overall interest rate movements.

Frankfurt Stock Exchange: Investor Sentiment and Outlook

Investor sentiment towards the Frankfurt Stock Exchange and the DAX remains cautiously optimistic. While record highs have fueled positive sentiment, the recent minor fluctuations reflect a degree of uncertainty. Many investors are taking a wait-and-see approach, monitoring global economic indicators and geopolitical developments before making significant investment decisions.

-

Analysis of trading volume and investor activity: Trading volume on the Frankfurt Stock Exchange indicates moderate investor activity. This suggests that while investors remain engaged, there is no overwhelming rush to either buy or sell, reflecting the overall cautious sentiment.

-

Potential geopolitical risks: Geopolitical risks, including the war in Ukraine and rising global tensions, remain significant concerns. These risks could easily trigger market volatility, impacting the DAX's performance.

-

Predictions for the future performance of the DAX: Predicting the future performance of the DAX is challenging. However, continued strong corporate earnings, coupled with a stable Eurozone economy and careful management of geopolitical risks, suggest the DAX should maintain a relatively stable trajectory, though substantial growth might be slower than in previous periods.

Conclusion

The DAX has demonstrated remarkable stability following its record performance, thanks to strong corporate earnings, positive economic indicators, and the resilience of key sectors like automotive, technology, and finance. However, investor sentiment remains cautiously optimistic, reflecting the underlying uncertainties in the global economic landscape. While the Frankfurt Stock Exchange and the DAX show signs of robustness, continuous monitoring of key indicators and market trends remains crucial.

Call to Action: Stay informed about the dynamic landscape of the Frankfurt Stock Exchange and the DAX. Continue monitoring key indicators and market trends for informed investment decisions. Learn more about investing in the DAX and the Frankfurt Stock Exchange by [link to relevant resource, e.g., a financial news website]. Understanding the Frankfurt Stock Exchange and the DAX is crucial for successful investing.

Featured Posts

-

M62 Resurfacing Westbound Closure Between Manchester And Warrington

May 24, 2025

M62 Resurfacing Westbound Closure Between Manchester And Warrington

May 24, 2025 -

Massimo Vian Leaves Gucci Impact On The Luxury Brands Industrial Operations

May 24, 2025

Massimo Vian Leaves Gucci Impact On The Luxury Brands Industrial Operations

May 24, 2025 -

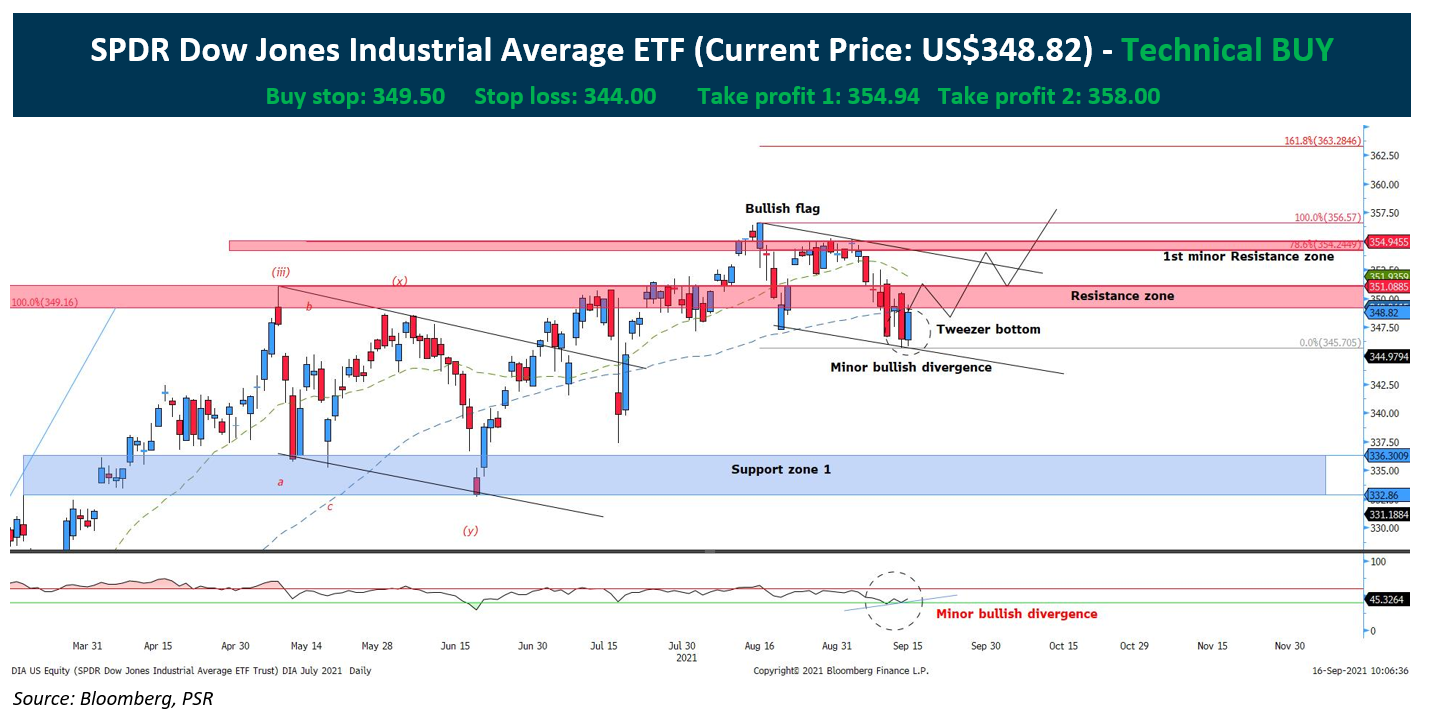

Amundi Dow Jones Industrial Average Ucits Etf Nav Analysis And Implications

May 24, 2025

Amundi Dow Jones Industrial Average Ucits Etf Nav Analysis And Implications

May 24, 2025 -

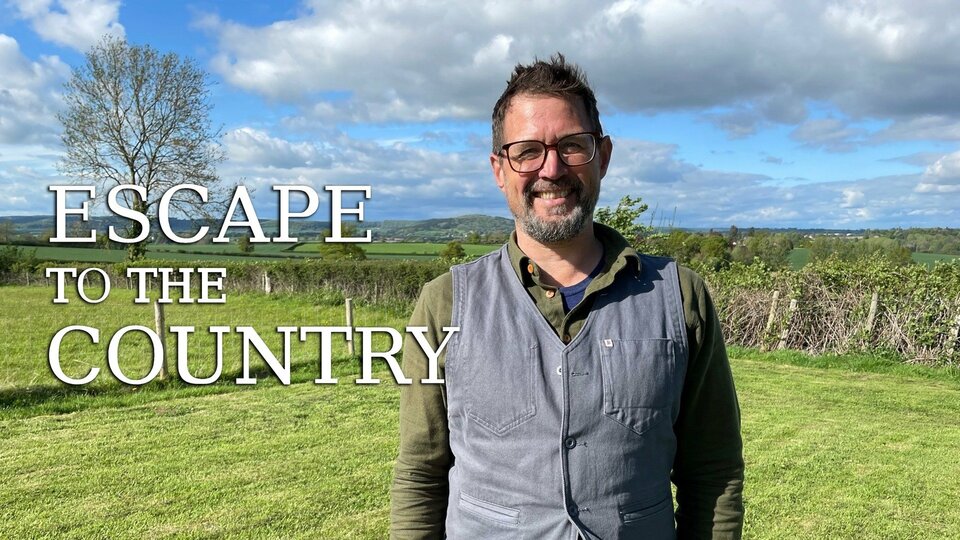

Escape To The Country Choosing The Right Location For You

May 24, 2025

Escape To The Country Choosing The Right Location For You

May 24, 2025 -

Escape To The Country Your Guide To A Peaceful Retreat

May 24, 2025

Escape To The Country Your Guide To A Peaceful Retreat

May 24, 2025

Latest Posts

-

French Cac 40 Index Friday Losses Offset By Weekly Stability March 7 2025

May 24, 2025

French Cac 40 Index Friday Losses Offset By Weekly Stability March 7 2025

May 24, 2025 -

Paris Facing Economic Headwinds The Impact Of The Luxury Goods Market Slowdown March 7 2025

May 24, 2025

Paris Facing Economic Headwinds The Impact Of The Luxury Goods Market Slowdown March 7 2025

May 24, 2025 -

Gucci Industrial Chief Massimo Vians Exit Analysis And Future Outlook

May 24, 2025

Gucci Industrial Chief Massimo Vians Exit Analysis And Future Outlook

May 24, 2025 -

Cac 40 Index Week Ends Lower But Remains Steady Overall March 7 2025

May 24, 2025

Cac 40 Index Week Ends Lower But Remains Steady Overall March 7 2025

May 24, 2025 -

Luxury Goods Slump Hits Paris Economic Impact Of Market Downturn March 7 2025

May 24, 2025

Luxury Goods Slump Hits Paris Economic Impact Of Market Downturn March 7 2025

May 24, 2025