Frankfurt Stock Market Update: DAX At 24,000 And Below

Table of Contents

DAX Performance Analysis: Recent Trends and Factors

Analyzing the DAX's Fall Below 24,000:

The DAX's fall below 24,000 represents a significant downturn for the German Stock Market. This decline, while not unprecedented, is noteworthy given its speed and the confluence of factors contributing to it.

- Percentage Drop: The DAX experienced a [Insert Percentage]% drop from its recent high [Insert Date and Value] to its low of [Insert Date and Value] below 24,000. This represents a substantial correction within a relatively short timeframe.

- Key Dates: Significant dips occurred on [Insert Dates], often coinciding with key announcements and events impacting investor confidence.

- Contributing Factors: Several intertwined factors contributed to this decline. These include:

- The ongoing war in Ukraine and its impact on global energy prices and supply chains.

- Persistent inflationary pressures and the resulting interest rate hikes by the European Central Bank (ECB), impacting borrowing costs for businesses.

- The ongoing energy crisis in Europe, significantly affecting energy-intensive German industries.

- Concerns about a potential global economic slowdown, impacting consumer spending and corporate earnings.

[Insert relevant chart/graph illustrating the DAX's performance over the specified period].

Technical Analysis of the DAX: Support and Resistance Levels

Technical analysis suggests several key support and resistance levels around the 24,000 mark for the DAX. The 24,000 level itself acted as a significant psychological barrier and support level in the past. A break below this level may trigger further selling pressure, while a rebound above it could indicate renewed buying interest.

- Support Levels: Potential support levels lie around [Insert Values], based on previous price action and technical indicators.

- Resistance Levels: Resistance is likely to be encountered at [Insert Values], representing potential hurdles for the DAX's recovery.

- Technical Indicators: Moving averages (e.g., 50-day, 200-day) and the Relative Strength Index (RSI) are showing [Insert Analysis based on current indicator values - e.g., oversold conditions suggesting potential rebound or overbought conditions suggesting further decline]. These indicators can provide insights into the short-term and medium-term momentum.

Impact on German Economy and Key Sectors

Effect on Major German Companies:

The DAX's decline reflects the performance of its constituent companies, many of which are leading German businesses. The impact varies across sectors.

- Volkswagen: [Discuss the impact on VW's stock price and its contribution to the overall DAX decline].

- Siemens: [Discuss the impact on Siemens' stock price and its contribution to the overall DAX decline].

- BASF: [Discuss the impact on BASF's stock price and its contribution to the overall DAX decline].

- Sector-Specific Impacts: The automotive sector, heavily reliant on global supply chains and energy prices, has been particularly impacted. The technology and chemical sectors are also feeling the effects of the economic slowdown and rising inflation.

Broader Economic Implications:

A weakening DAX has significant implications for the German economy.

- Consumer Confidence: Declining stock prices can negatively impact consumer confidence, leading to reduced spending.

- Investment: Uncertainty in the market may lead to decreased investment by both businesses and individuals.

- Job Market: A prolonged economic slowdown could translate into job losses and increased unemployment.

- European Context: The DAX's performance is intrinsically linked to broader European economic trends. A weakening DAX often reflects broader concerns about the European Union's economic outlook.

Investor Sentiment and Future Outlook

Analyst Predictions and Market Forecasts:

Analyst opinions regarding the DAX's future direction are varied.

- Bullish Forecasts: Some analysts remain optimistic, citing potential for a rebound based on [reasons].

- Bearish Forecasts: Others remain cautious, citing concerns about [reasons].

- Neutral Forecasts: Many adopt a neutral stance, suggesting a period of consolidation before a clearer trend emerges.

Investment Strategies for Navigating Market Volatility:

Navigating the current market volatility requires a well-defined investment strategy.

- Risk Management: Implementing appropriate risk management techniques, including diversification and stop-loss orders, is crucial.

- Diversification: Diversifying investments across different asset classes can help mitigate risk.

- Investment Opportunities: While the DAX's current position presents challenges, it also creates potential investment opportunities for long-term investors who can identify undervalued stocks or sectors.

Conclusion: Frankfurt Stock Market Update: Navigating the DAX Below 24,000

This Frankfurt Stock Market update highlights the significant decline of the DAX below 24,000, influenced by geopolitical events, inflation, rising interest rates, and economic slowdown concerns. The impact extends to major German companies and the broader German economy. Analyst opinions on the future are divided, emphasizing the need for cautious yet strategic investment approaches. Understanding the factors influencing the DAX is crucial for navigating this volatile market.

Key Takeaways:

- The DAX's fall below 24,000 is a significant event with far-reaching consequences.

- Several intertwined factors contribute to the current market situation.

- Investors need to adapt their strategies to navigate the current volatility.

- Staying informed is crucial for making informed investment decisions.

Call to Action: Stay informed about the evolving situation in the Frankfurt Stock Market and the DAX's trajectory by regularly checking back for future updates on our website and following us on social media for the latest Frankfurt Stock Market news and insights into DAX performance.

Featured Posts

-

The Crucial Role Of Middle Managers Bridging The Gap In Modern Businesses

May 25, 2025

The Crucial Role Of Middle Managers Bridging The Gap In Modern Businesses

May 25, 2025 -

Ai Powered Podcast Creation Analyzing And Transforming Scatological Data

May 25, 2025

Ai Powered Podcast Creation Analyzing And Transforming Scatological Data

May 25, 2025 -

Joy Crookes Unveils Haunting New Song I Know You D Kill Details Inside

May 25, 2025

Joy Crookes Unveils Haunting New Song I Know You D Kill Details Inside

May 25, 2025 -

Escape To The Country Balancing Rural Life And Modern Needs

May 25, 2025

Escape To The Country Balancing Rural Life And Modern Needs

May 25, 2025 -

Under 1m Country Properties A Buyers Guide To Location And Value

May 25, 2025

Under 1m Country Properties A Buyers Guide To Location And Value

May 25, 2025

Latest Posts

-

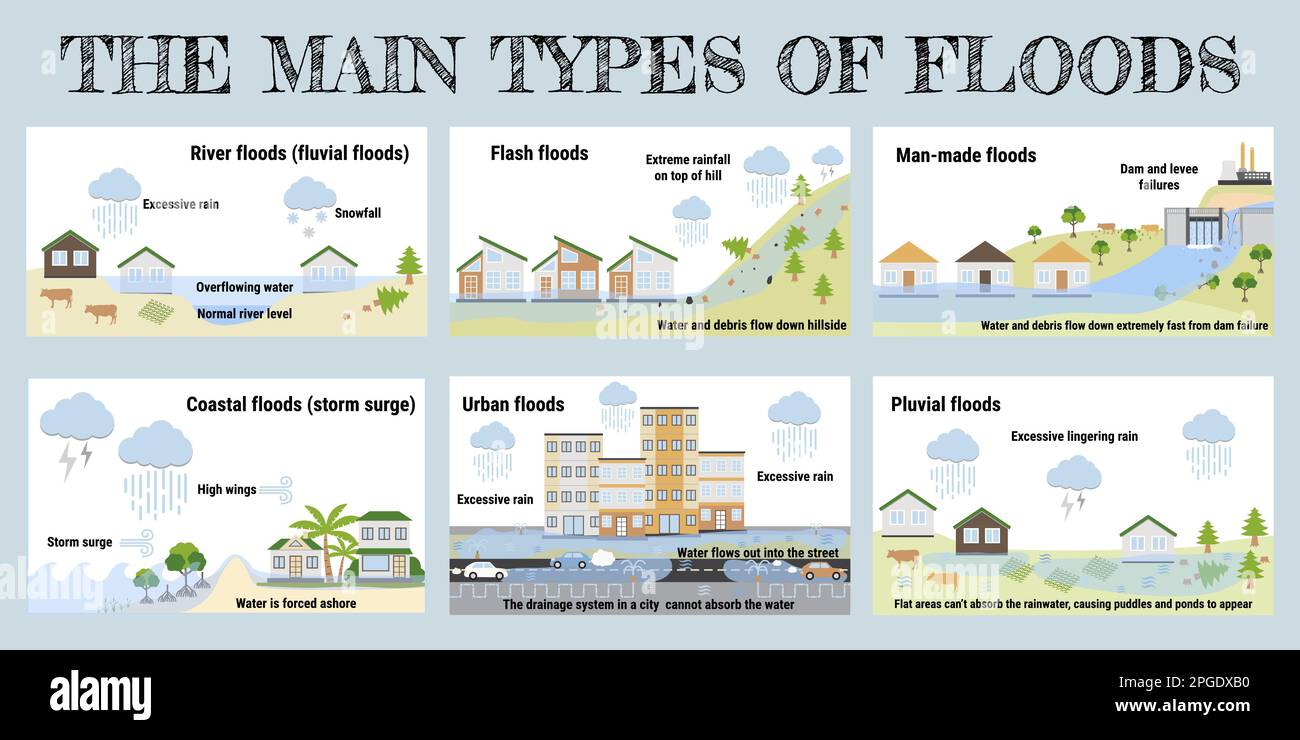

Understanding Flash Floods How To Prepare For And Respond To Flood Warnings

May 25, 2025

Understanding Flash Floods How To Prepare For And Respond To Flood Warnings

May 25, 2025 -

Exploring New Avenues For Canada Mexico Trade Amidst Us Tariff Disputes

May 25, 2025

Exploring New Avenues For Canada Mexico Trade Amidst Us Tariff Disputes

May 25, 2025 -

Tariffs Largely Ignored At G7 Finance Ministers Meeting

May 25, 2025

Tariffs Largely Ignored At G7 Finance Ministers Meeting

May 25, 2025 -

What Is A Flash Flood Understanding Flood Warnings And Alerts

May 25, 2025

What Is A Flash Flood Understanding Flood Warnings And Alerts

May 25, 2025 -

Gold Market Volatility Analyzing The Impact Of Trumps Trade War Rhetoric

May 25, 2025

Gold Market Volatility Analyzing The Impact Of Trumps Trade War Rhetoric

May 25, 2025