Gold Market Volatility: Analyzing The Impact Of Trump's Trade War Rhetoric

Table of Contents

Trump's Trade War Rhetoric and its Impact on Global Uncertainty

Trump's trade war policies, characterized by increased tariffs and threats of further trade restrictions, dramatically altered global economic sentiment. This created a climate of profound uncertainty, impacting investor confidence and market stability.

- Increased tariffs and trade disputes: The imposition of tariffs on goods from various countries, notably China, led to retaliatory measures, escalating trade tensions and disrupting global supply chains.

- Uncertainty regarding global trade agreements: The unpredictable nature of Trump's trade policy undermined confidence in existing and future trade agreements, creating uncertainty for businesses and investors.

- Negative impact on global economic growth forecasts: The trade war significantly dampened global economic growth forecasts, raising concerns about a potential recession and increasing risk aversion among investors.

- Rise in market uncertainty and risk aversion: The overall effect was a substantial increase in market uncertainty and a surge in risk aversion, pushing investors towards safer assets like gold.

This heightened uncertainty directly influenced investor behavior. As risk aversion increased, investors sought refuge in safe-haven assets, leading to a surge in demand for gold. The relationship between risk aversion and gold prices is well-established; when uncertainty rises, gold prices typically increase as investors flock to its perceived safety.

Safe Haven Demand and Gold Price Fluctuations

Gold has long been considered a safe-haven asset, offering a hedge against economic and political instability. During periods of uncertainty, investors often increase their gold holdings as a way to protect their portfolios from potential losses.

- Increased demand for gold as a hedge against economic risk: The trade war rhetoric significantly fueled this demand, as investors sought to protect their investments against the economic fallout of escalating trade tensions.

- Correlation between gold prices and the VIX (volatility index): The VIX, a measure of market volatility, often shows a strong positive correlation with gold prices. During periods of heightened trade war rhetoric, both the VIX and gold prices typically rose.

- Analysis of gold price movements during specific periods of heightened trade war rhetoric: Examining specific periods of heightened trade rhetoric, such as the announcement of new tariffs or the breakdown of trade negotiations, reveals a clear upward trend in gold prices.

- The influence of investor sentiment on gold price volatility: Negative news and increasing uncertainty regarding trade relations directly influenced investor sentiment, leading to increased gold purchases and price volatility.

For example, the announcement of a new round of tariffs against China often triggered immediate spikes in gold prices, reflecting the market's reaction to the increased uncertainty and risk. Chart analysis from this period would visually demonstrate this correlation.

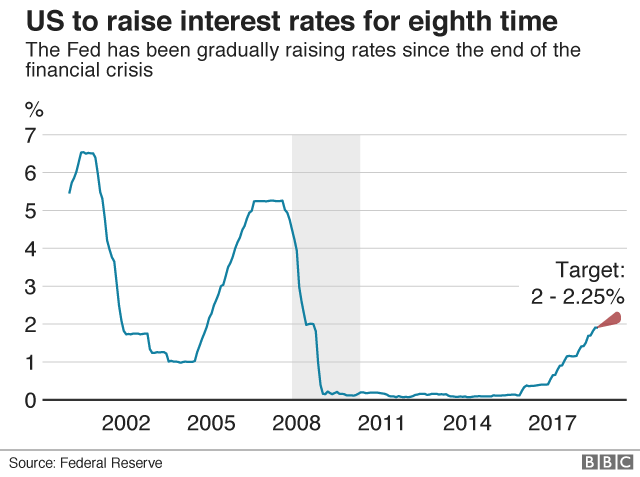

The Dollar's Role in Gold Price Volatility

Gold is typically priced in US dollars. There is an inverse relationship between the US dollar and gold prices: a weaker dollar generally leads to higher gold prices, and vice versa.

- The impact of trade war uncertainty on the US dollar: The uncertainty generated by the trade war negatively impacted the US dollar. Investors often move away from the dollar during periods of uncertainty and geopolitical risk.

- How a weaker dollar can drive up gold prices: As the dollar weakens, the price of gold, denominated in dollars, rises, making it more affordable for buyers holding other currencies.

- The interplay between trade tensions and currency fluctuations: Trade tensions contribute significantly to currency fluctuations, further influencing the price of gold through the dollar's movements.

- Data illustrating the correlation between the dollar and gold prices during this period: Analyzing the dollar index (DXY) against gold prices during the Trump administration's trade war demonstrates a clear negative correlation.

The uncertainty surrounding the trade wars weakened the dollar, thereby contributing to the rise in gold prices. This interplay between trade tensions, currency movements, and gold prices highlights the complex dynamics at play.

Analyzing Specific Policy Announcements and Their Market Reactions

Specific policy announcements directly impacted gold prices. For example:

- Examples of specific tariffs and their effect on gold prices: The imposition of tariffs on steel and aluminum, followed by retaliatory tariffs from other countries, often led to immediate spikes in gold prices.

- Market reactions to specific trade deal negotiations: Periods of optimism regarding trade negotiations saw gold prices fall slightly as uncertainty decreased; however, setbacks often resulted in a renewed surge.

- Analysis of news sentiment and its impact on gold prices: News articles and analysts' comments regarding the trade war heavily influenced investor sentiment, and hence, the volatility in gold prices.

A detailed analysis of these specific instances reinforces the direct correlation between trade policy announcements and resulting gold market volatility. Charting these events against gold price movements would provide compelling visual evidence.

Conclusion

Trump's trade war rhetoric had a significant impact on gold market volatility. The created uncertainty fueled increased demand for gold as a safe-haven asset, while simultaneously influencing the US dollar and thereby impacting the gold price. Understanding the interplay of these factors – uncertainty, safe-haven demand, and the US dollar – is crucial for interpreting gold price movements.

Understanding gold market volatility, particularly in response to geopolitical events such as trade wars, is crucial for investors. Continue learning about the factors influencing gold price movements and refine your investment strategies accordingly. Stay informed about global economic events and their impact on the gold market to effectively manage your gold investments. Remember to diversify your portfolio to mitigate risk in the volatile gold market. By monitoring global events and understanding the dynamics of gold market volatility, you can make more informed decisions regarding your gold investments.

Featured Posts

-

Zheng Eliminated By Gauff In Italian Open Semifinal

May 25, 2025

Zheng Eliminated By Gauff In Italian Open Semifinal

May 25, 2025 -

Frankfurt Stock Exchange Dax Ends Trading Day Below 24 000

May 25, 2025

Frankfurt Stock Exchange Dax Ends Trading Day Below 24 000

May 25, 2025 -

Herstel Op Beurzen Aex Fondsen Stijgen Na Uitstel Trump

May 25, 2025

Herstel Op Beurzen Aex Fondsen Stijgen Na Uitstel Trump

May 25, 2025 -

Flash Flood Warning Pennsylvania Under Heavy Rain Until Thursday

May 25, 2025

Flash Flood Warning Pennsylvania Under Heavy Rain Until Thursday

May 25, 2025 -

Actors Join Writers Strike Full Hollywood Production Shutdown

May 25, 2025

Actors Join Writers Strike Full Hollywood Production Shutdown

May 25, 2025

Latest Posts

-

Hells Angels New Business Model Revealed Through Mandarin Killings

May 25, 2025

Hells Angels New Business Model Revealed Through Mandarin Killings

May 25, 2025 -

Mandarin Killing Highlights Hells Angels New Business Model

May 25, 2025

Mandarin Killing Highlights Hells Angels New Business Model

May 25, 2025 -

Jerome Powell Trade Tariffs And The Challenges Facing Monetary Policy

May 25, 2025

Jerome Powell Trade Tariffs And The Challenges Facing Monetary Policy

May 25, 2025 -

Federal Reserve Goals At Risk Amidst Rising Tariffs Powells Assessment

May 25, 2025

Federal Reserve Goals At Risk Amidst Rising Tariffs Powells Assessment

May 25, 2025 -

Madrid Open Swiateks Dramatic Win Sets Up Gauff Semifinal

May 25, 2025

Madrid Open Swiateks Dramatic Win Sets Up Gauff Semifinal

May 25, 2025