French Consumer Spending: April's Figures Fall Short Of Predictions

Table of Contents

Key Figures and Shortfalls

April's retail sales figures paint a concerning picture for the French economy. Compared to March, consumer spending saw a decrease of 1.2%, a steeper drop than the predicted 0.5% decline. The year-on-year comparison reveals an even more worrying trend, with a 2.8% decrease in spending compared to April 2022. This represents a substantial fall in overall consumer activity and signifies a potential economic slowdown in France.

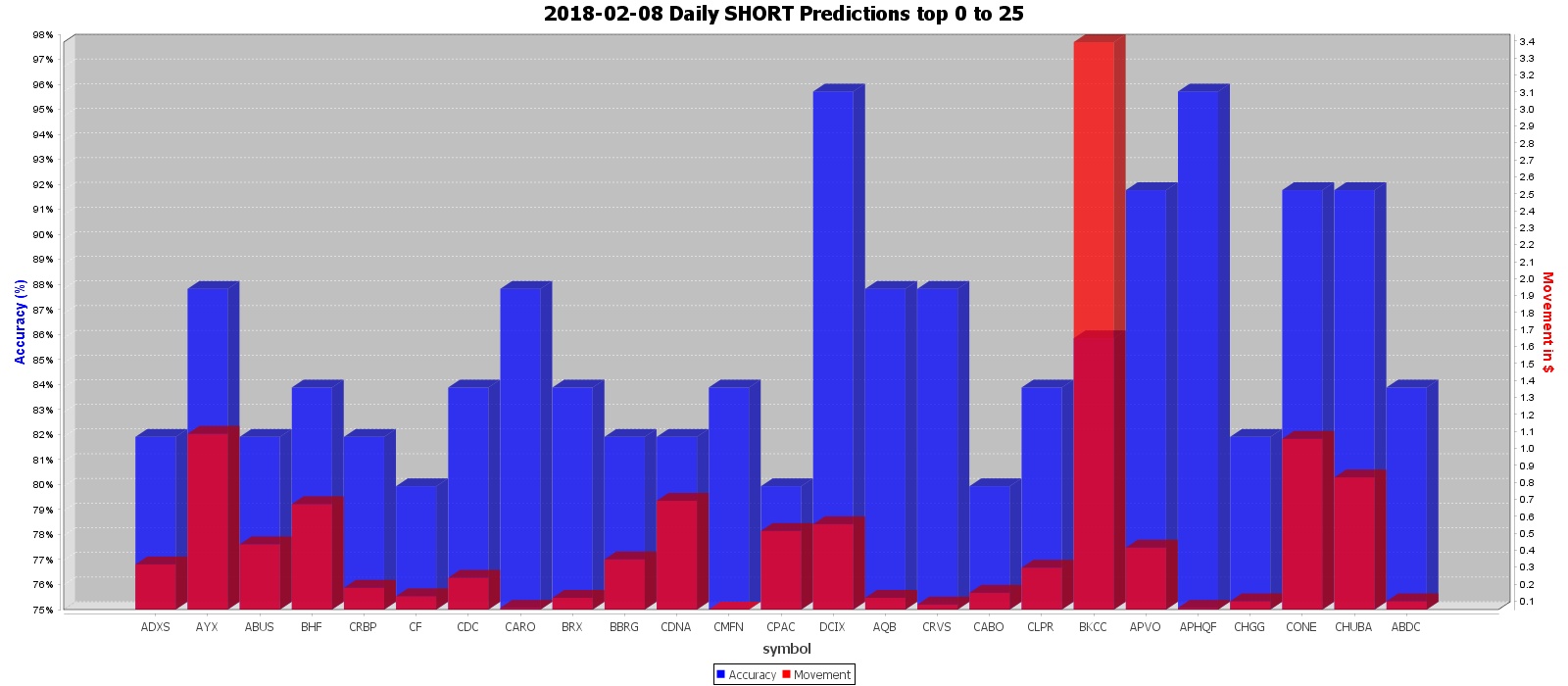

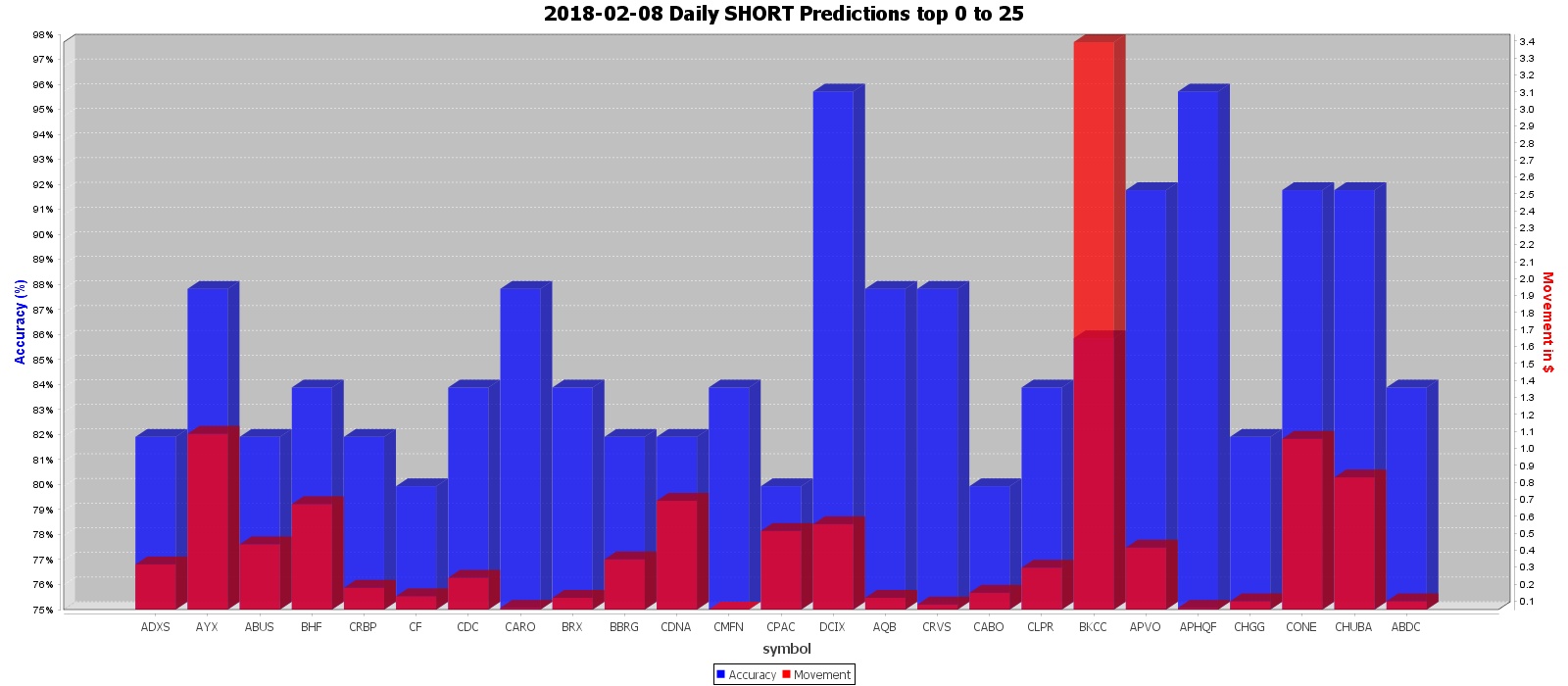

The following chart visually represents the monthly change in French consumer spending:

[Insert Chart/Graph Here showing monthly spending data for the past year, highlighting April's dip]

- Specific percentage change in consumer spending: A 1.2% decrease compared to March and a 2.8% decrease compared to April 2022.

- Breakdown of spending across different sectors: Preliminary data suggests a particularly sharp decline in spending on durable goods (-4.1%), indicating consumers are delaying larger purchases. Spending on food and essential items remained relatively stable, although a slight decrease was observed (-0.8%). Clothing and footwear also experienced a notable drop (-3.5%).

- Significant discrepancies between predicted and actual figures: The actual decrease of 1.2% in monthly spending was significantly larger than the predicted 0.5%, highlighting a more severe economic situation than initially anticipated.

Underlying Factors Contributing to the Decline

Several interconnected factors contributed to the disappointing April figures for French consumer spending. The ongoing cost of living crisis is a major driver, fueled by persistent inflation and rising interest rates.

- Impact of persistent inflation on purchasing power: Inflation in France remains stubbornly high, eroding consumer purchasing power and forcing households to cut back on non-essential spending. The rising prices of energy, food, and other essential goods are leaving less disposable income for discretionary purchases.

- The effect of rising interest rates on borrowing and consumer sentiment: The European Central Bank's efforts to combat inflation through interest rate hikes are impacting consumer borrowing and confidence. Higher borrowing costs make it more expensive to finance large purchases like homes and cars, dampening consumer demand.

- The influence of increased energy prices and the cost of living crisis: The sustained high energy prices, exacerbated by the ongoing geopolitical situation, are significantly impacting household budgets. This leads to reduced spending on other goods and services as consumers prioritize essential expenses.

- Geopolitical factors and supply chain issues: While less direct, lingering effects from global supply chain disruptions and the ongoing war in Ukraine continue to contribute to inflationary pressures and uncertainty in the market.

Impact on Different Demographic Groups

The decline in French consumer spending disproportionately impacts vulnerable populations. Low-income households are particularly affected, as they have less financial cushion to absorb the impact of rising prices.

- Data illustrating the impact on low-income households: Studies suggest that low-income households are reducing spending on necessities, leading to potential food insecurity and decreased access to essential services.

- Discussion on differing spending patterns among age groups: Older generations, often living on fixed incomes, are likely to be hit hardest by inflation, while younger generations face challenges entering the housing market and securing stable employment.

- Potential for increased inequality as a result: The current economic climate risks exacerbating existing inequalities, potentially widening the gap between high and low-income households in France.

Government Response and Future Outlook

The French government has implemented several measures to mitigate the impact of the cost of living crisis, including targeted financial aid for vulnerable households and tax cuts. However, the effectiveness of these measures remains to be seen. Economic forecasts for the coming months remain cautious, with predictions varying on the rate of recovery. The ongoing situation demands close monitoring of consumer sentiment and spending habits.

Conclusion

April’s French consumer spending fell significantly short of expectations, primarily due to persistent inflation, rising interest rates, and the ongoing cost of living crisis. The impact is disproportionately felt by low-income households and vulnerable populations, potentially increasing societal inequality. Understanding these trends in French consumer spending is vital for policymakers and businesses alike.

Stay informed about future developments in French consumer spending by regularly checking our website for updates and analysis. We’ll continue to provide in-depth coverage of French consumer spending trends and their implications for the French economy. Understanding French consumer spending is crucial for navigating the current economic landscape.

Featured Posts

-

The Importance Of Character Name In Hbos Harry Potter Remake Beyond Snape And Dumbledore

May 29, 2025

The Importance Of Character Name In Hbos Harry Potter Remake Beyond Snape And Dumbledore

May 29, 2025 -

Ipa I Apoxorisi Toy Elon Mask Kai Oi Epiptoseis Tis

May 29, 2025

Ipa I Apoxorisi Toy Elon Mask Kai Oi Epiptoseis Tis

May 29, 2025 -

Entertainment Stock Dip Analyst Buy Recommendation

May 29, 2025

Entertainment Stock Dip Analyst Buy Recommendation

May 29, 2025 -

Joshlin Sale Smiths Denial And Accusations Against Lombaard And Letoni

May 29, 2025

Joshlin Sale Smiths Denial And Accusations Against Lombaard And Letoni

May 29, 2025 -

A Technological Assessment Of The Nintendo Switch

May 29, 2025

A Technological Assessment Of The Nintendo Switch

May 29, 2025

Latest Posts

-

Ticketmaster Proceso De Reembolso Por La Cancelacion Del Axe Ceremonia 2025

May 30, 2025

Ticketmaster Proceso De Reembolso Por La Cancelacion Del Axe Ceremonia 2025

May 30, 2025 -

Cancelacion Axe Ceremonia 2025 Solicita Tu Reembolso En Ticketmaster

May 30, 2025

Cancelacion Axe Ceremonia 2025 Solicita Tu Reembolso En Ticketmaster

May 30, 2025 -

Bala Summer Concert Series Kees Victoria Day Weekend Launch

May 30, 2025

Bala Summer Concert Series Kees Victoria Day Weekend Launch

May 30, 2025 -

Preventa Entradas Bad Bunny Madrid Y Barcelona Ticketmaster Y Live Nation

May 30, 2025

Preventa Entradas Bad Bunny Madrid Y Barcelona Ticketmaster Y Live Nation

May 30, 2025 -

Bad Bunny Preventa De Entradas Conciertos En Madrid Y Barcelona Ticketmaster Live Nation

May 30, 2025

Bad Bunny Preventa De Entradas Conciertos En Madrid Y Barcelona Ticketmaster Live Nation

May 30, 2025