German Market's Rise: The Impact Of Wall Street's Performance

Table of Contents

The Correlation Between Wall Street and the German Market

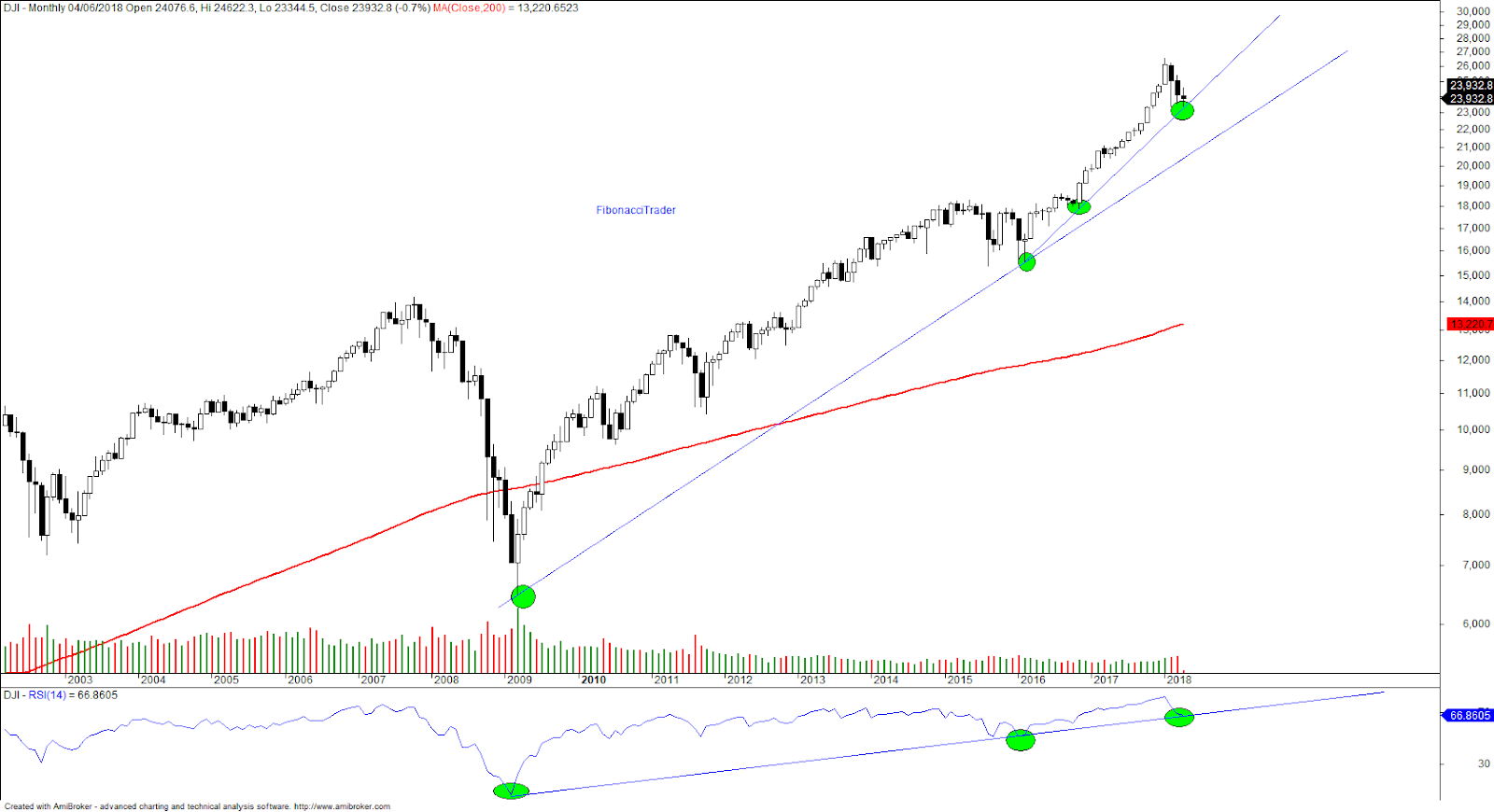

Analyzing the correlation between Wall Street and the German market reveals a significant interdependence in global market trends. A correlation analysis reveals a strong historical link between the DAX and the Dow Jones, suggesting that movements in one market often foreshadow similar movements in the other.

-

Historical Correlation: Over the long term, a clear positive correlation exists between the DAX and the Dow Jones. This signifies that when the Dow Jones experiences growth, the DAX tends to follow suit, and vice-versa. However, the strength of this correlation can fluctuate depending on various economic and geopolitical factors.

-

Impact of Global Events: Global events, such as interest rate hikes by the US Federal Reserve, geopolitical instability (e.g., the war in Ukraine), or significant shifts in global commodity prices, often impact both markets simultaneously. These shared sensitivities highlight the interconnected nature of global finance.

-

Leading Economic Indicators: Leading economic indicators, such as manufacturing PMI (Purchasing Managers' Index) for both the US and Germany, often show similar trends, providing early warning signs of potential market movements in both regions. Analyzing these indicators can help predict future market behavior.

-

Illustrative Events: The 2008 financial crisis and the COVID-19 pandemic offer stark examples of the interconnectedness. Both events triggered sharp declines in both the Dow Jones and the DAX, demonstrating their shared vulnerability to systemic global shocks.

Impact of US Monetary Policy on the German Economy

The US Federal Reserve's monetary policy plays a significant role in shaping the German economy. Changes in US interest rates, driven by the Fed's efforts to manage inflation, directly influence capital flows and exchange rates, impacting German economic performance.

-

Capital Flows: Higher US interest rates often attract capital away from Germany, weakening the Euro and potentially slowing German economic growth. Conversely, lower US interest rates can stimulate capital inflows into Germany, bolstering the Euro and fostering economic expansion.

-

Inflationary Pressures: US inflation directly influences inflation in Germany, as imported goods from the US become more expensive. This necessitates careful monitoring of US inflation data by the European Central Bank (ECB).

-

Euro-Dollar Exchange Rate: Fluctuations in the Euro-Dollar exchange rate significantly impact German exports and imports. A stronger dollar makes German exports more expensive globally, potentially hindering export-led growth.

-

ECB Response: The ECB must carefully consider US monetary policy actions when formulating its own policies. It often needs to adjust its interest rates and quantitative easing programs to mitigate the impact of US monetary decisions on the Eurozone economy, including Germany.

Investment Strategies Considering the Wall Street-German Market Link

Understanding the Wall Street-German market link is critical for developing effective investment strategies. Investors can leverage this relationship for potential gains but must also carefully manage associated risks.

-

Hedging Strategies: Investors can use hedging instruments to mitigate potential losses arising from negative correlations between the two markets. This could involve using derivatives or investing in assets that exhibit an inverse relationship to the Dow Jones.

-

Risk Management: Relying solely on the correlation between the two markets for investment decisions is risky. Diversification across different asset classes and geographic regions is essential for robust risk management.

-

Portfolio Diversification: A diversified portfolio that includes assets from various sectors and geographies can reduce overall portfolio volatility and exposure to the risks associated with any single market, including the US and German markets.

-

Successful Strategies: Historically, strategies combining exposure to both US and German equities, but with careful hedging against adverse movements, have proven successful for some investors. However, past performance is not indicative of future results.

The Role of German Exports in the Equation

Germany's export-oriented economy is heavily influenced by US consumer demand and global supply chain dynamics.

-

US Consumer Demand: Strong US consumer demand often translates into increased demand for German exports, boosting German economic growth. Conversely, weak US consumer spending can negatively impact German exports.

-

Global Supply Chain Disruptions: Global supply chain disruptions, such as those experienced during the COVID-19 pandemic, can impact both the US and German economies, disrupting production and affecting trade flows.

-

US Dollar Strength: A strong US dollar can make German exports less competitive in global markets, reducing export revenues and potentially impacting economic growth.

Conclusion

The German market’s rise is undeniably influenced by the performance of Wall Street. Understanding the correlation between the DAX and the Dow Jones, along with the impact of US monetary policy, global trade, and German exports, is crucial for informed investment decisions and effective economic policymaking. The intricate interplay within global finance necessitates a comprehensive understanding of this relationship.

Call to Action: Stay informed about the dynamic relationship between the German market and Wall Street's performance to make well-informed decisions regarding your investments in the German economy and global markets. Learn more about navigating the complexities of global market trends and maximizing your investment opportunities in the German market and beyond.

Featured Posts

-

Amsterdam Stock Index Plunges Over 4 Hitting One Year Low

May 25, 2025

Amsterdam Stock Index Plunges Over 4 Hitting One Year Low

May 25, 2025 -

2 Drop In Lvmh Shares After Disappointing Q1 Sales Figures

May 25, 2025

2 Drop In Lvmh Shares After Disappointing Q1 Sales Figures

May 25, 2025 -

Dow Jones Cautious Uptrend Continues Analysis Of Recent Pmi Data

May 25, 2025

Dow Jones Cautious Uptrend Continues Analysis Of Recent Pmi Data

May 25, 2025 -

Understanding And Interpreting The Nav Of The Amundi Dow Jones Industrial Average Ucits Etf

May 25, 2025

Understanding And Interpreting The Nav Of The Amundi Dow Jones Industrial Average Ucits Etf

May 25, 2025 -

The Price Of Progress Exploring The Penalties For Seeking Change

May 25, 2025

The Price Of Progress Exploring The Penalties For Seeking Change

May 25, 2025

Latest Posts

-

Farrows Plea Hold Trump Accountable For Venezuelan Gang Member Deportations

May 25, 2025

Farrows Plea Hold Trump Accountable For Venezuelan Gang Member Deportations

May 25, 2025 -

Actress Mia Farrow Demands Trumps Arrest For Venezuelan Deportation Policy

May 25, 2025

Actress Mia Farrow Demands Trumps Arrest For Venezuelan Deportation Policy

May 25, 2025 -

Actress Mia Farrow Seeks Trumps Imprisonment Regarding Venezuelan Deportations

May 25, 2025

Actress Mia Farrow Seeks Trumps Imprisonment Regarding Venezuelan Deportations

May 25, 2025 -

From Fame To Shame 17 Celebrities Who Lost It All

May 25, 2025

From Fame To Shame 17 Celebrities Who Lost It All

May 25, 2025 -

The Downfall 17 Celebrities Whose Careers Imploded

May 25, 2025

The Downfall 17 Celebrities Whose Careers Imploded

May 25, 2025