Gold Market Update: Back-to-Back Weekly Declines For 2025

Table of Contents

Analysis of the Recent Gold Price Drop

The recent dip in gold prices is a complex issue stemming from a confluence of factors. Let's delve into the key macroeconomic and geopolitical influences.

Macroeconomic Factors

Rising interest rates are a significant factor impacting gold prices. Higher interest rates make holding non-interest-bearing assets like gold less attractive compared to interest-bearing investments. This negative correlation between interest rate hikes and gold prices is well-established.

- Rising Interest Rates: The Federal Reserve's recent interest rate announcements have significantly impacted gold price correlation, leading to decreased demand.

- Strengthening US Dollar: A stronger US dollar also contributes to the gold price decline. Gold is priced in US dollars, so when the dollar strengthens, gold becomes more expensive for holders of other currencies, reducing demand.

- Shifting Inflation Expectations: While inflation remains a concern, expectations for its future trajectory are influencing investor sentiment. If inflation is perceived to be under control, the safe-haven appeal of gold diminishes.

Here's a summary of relevant economic data:

- CPI (Consumer Price Index): The latest CPI figures show a slight decrease in the inflation rate, reducing the pressure to hold gold as an inflation hedge.

- Interest Rate Announcements: The Federal Reserve's recent announcements indicate a potential pause or slowdown in future interest rate increases.

Geopolitical Influences

Geopolitical uncertainty is often a driver of gold demand, as investors seek a safe haven asset during times of instability. However, periods of relative geopolitical stability can lead to decreased demand for gold.

- Geopolitical Risk: While specific events can vary, ongoing geopolitical tensions can increase demand for gold. However, in periods of reduced conflict, gold may not be seen as a primary safe-haven asset.

- Gold as a Safe Haven: The perception of gold as a safe haven fluctuates based on the global climate. In times of peace and economic stability, investors might shift their focus away from gold toward riskier, higher-return assets.

Technical Analysis of Gold Charts

Technical analysis provides another perspective on the recent gold price movements.

Chart Patterns and Indicators

Analyzing gold charts using technical indicators offers valuable insights into potential future price movements.

- Support and Resistance Levels: Recent price action has tested key support levels, indicating potential buying opportunities for some traders. However, failure to break through resistance levels signals a potential continuation of the downward trend.

- Technical Indicators: Indicators like RSI (Relative Strength Index) and MACD (Moving Average Convergence Divergence) show signs of bearish sentiment, suggesting the potential for further declines in the short term.

- Chart Patterns: Head and shoulders patterns, often indicative of trend reversals, have not yet been confirmed on the gold charts.

(Insert relevant gold chart here)

Trading Volume and Sentiment

Observing trading volume provides clues about investor sentiment.

- Decreased Trading Volume: Low trading volume often indicates a lack of strong conviction either way, suggesting indecision in the market.

- Bearish Sentiment: The recent gold price declines alongside reduced trading volume signal a prevailing bearish sentiment among investors.

Future Outlook for Gold in 2025

Predicting future gold prices is challenging; however, by examining various factors, we can create potential scenarios.

Predictions and Forecasts

Expert opinions on the 2025 gold forecast vary widely. Some analysts predict a price rebound based on ongoing geopolitical uncertainty and persistent inflationary pressures, while others anticipate further declines based on rising interest rates.

- Potential for Rebound: A sudden surge in geopolitical risk or a resurgence of unexpected inflation could push gold prices higher.

- Potential for Further Declines: If interest rates remain high and geopolitical stability prevails, gold prices might continue their downward trajectory.

Investment Strategies

The current market conditions require careful consideration of gold investment strategies.

- Risk Management: Implementing risk management techniques, such as diversification, is crucial to mitigate potential losses.

- Portfolio Diversification: Diversifying your portfolio with other asset classes can help reduce overall risk and protect against significant losses in the gold market.

- Dollar-Cost Averaging: This strategy involves investing a fixed amount of money at regular intervals, regardless of price fluctuations, reducing the impact of market volatility.

Conclusion: Navigating the Gold Market's Back-to-Back Declines in 2025

The recent back-to-back weekly declines in gold prices are a result of interacting macroeconomic and geopolitical factors, coupled with bearish technical indicators. Understanding these influences is paramount for developing a sound gold investment strategy. Investors need to carefully monitor gold price trends, consider the interplay of interest rates, the US dollar's strength, and geopolitical stability, and incorporate robust risk management techniques into their portfolios. Stay informed about gold market updates and adapt your strategy accordingly to successfully navigate this fluctuating market. Develop a comprehensive gold investment strategy that aligns with your risk tolerance and long-term financial goals.

Featured Posts

-

Staffing Shortages And Their Impact 7 Days Of Disruption At Newark Airport

May 06, 2025

Staffing Shortages And Their Impact 7 Days Of Disruption At Newark Airport

May 06, 2025 -

Romania Election 2024 Far Right And Centrist Vie For Presidency

May 06, 2025

Romania Election 2024 Far Right And Centrist Vie For Presidency

May 06, 2025 -

The Halle Bailey Diss Track Ddg Releases Dont Take My Son

May 06, 2025

The Halle Bailey Diss Track Ddg Releases Dont Take My Son

May 06, 2025 -

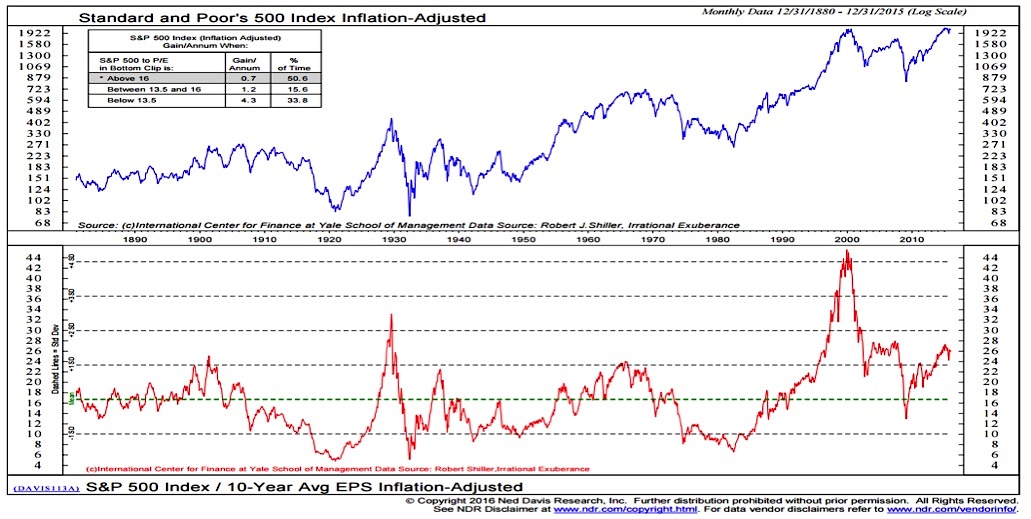

Stock Market Valuations Bof As Reassurance For Investors

May 06, 2025

Stock Market Valuations Bof As Reassurance For Investors

May 06, 2025 -

Trumps Response On Upholding The Constitution I Dont Know

May 06, 2025

Trumps Response On Upholding The Constitution I Dont Know

May 06, 2025

Latest Posts

-

The Dont Take My Son Diss Track Ddg Fires Back At Halle Bailey

May 06, 2025

The Dont Take My Son Diss Track Ddg Fires Back At Halle Bailey

May 06, 2025 -

Celebrating Independence Day A Guide To Patriotic Festivities

May 06, 2025

Celebrating Independence Day A Guide To Patriotic Festivities

May 06, 2025 -

Who Is Jeff Goldblums Wife Emilie Livingston Her Age And Children

May 06, 2025

Who Is Jeff Goldblums Wife Emilie Livingston Her Age And Children

May 06, 2025 -

New Ddg Diss Track Dont Take My Son Aimed At Halle Bailey

May 06, 2025

New Ddg Diss Track Dont Take My Son Aimed At Halle Bailey

May 06, 2025 -

Emilie Livingston Age Family Life And Marriage To Jeff Goldblum

May 06, 2025

Emilie Livingston Age Family Life And Marriage To Jeff Goldblum

May 06, 2025