Goldman Sachs CEO Pay Row: Banker Vs. Private Markets Executive

Table of Contents

The Traditional Banking Model and Compensation

Traditional banking compensation models have long been a subject of debate. Understanding these models is crucial to grasping the nuances of the Goldman Sachs CEO pay row.

Performance Metrics and Bonuses

Traditional banking performance is typically measured by metrics like investment banking fees, trading revenue, and overall profitability. These metrics directly influence CEO and executive compensation through bonus structures.

- Profitability: Higher profits generally translate to larger bonuses, rewarding risk-taking and successful deal-making.

- Risk-Taking: The inherent risk in traditional banking activities (e.g., lending, trading) is often rewarded, potentially creating incentives for excessive risk-taking.

- Regulatory Changes: Post-2008 financial crisis regulations have significantly impacted bonus structures, aiming to reduce excessive risk-taking and align incentives with long-term stability. These changes have, however, also influenced the overall compensation debate.

- Criticisms: Critics argue that this bonus-driven model can incentivize short-term gains over long-term sustainable growth, potentially neglecting risk management and client interests.

Long-Term Incentives and Stock Options

To align executive interests with shareholder value, traditional banking often utilizes long-term incentives such as stock options and restricted stock units (RSUs).

- Vesting Periods: These incentives typically have vesting periods, requiring executives to remain with the firm for a specified time before they can exercise their options or receive the RSUs.

- Performance Hurdles: Some stock-based compensation packages include performance hurdles, linking payouts to the achievement of specific financial goals.

- Downsides: Market volatility significantly impacts the value of stock options, potentially reducing their effectiveness as incentives. Furthermore, stock-based compensation can sometimes decouple executive pay from short-term performance, leading to further criticism.

The Rise of Private Markets and its Impact on Compensation

Goldman Sachs's increasing focus on private markets, including private equity and alternative investments, has dramatically altered the compensation landscape. This shift forms a significant part of the Goldman Sachs CEO pay row.

Different Performance Metrics

Private markets employ different performance metrics compared to traditional banking. Fund performance, measured by returns on invested capital, and carried interest are key drivers of compensation.

- Long-Term Nature: Private market investments have a longer-term horizon than many traditional banking activities, impacting the timing and structure of compensation.

- Carried Interest: This is a significant component of private market compensation, representing a share of the profits generated by successful investments. It's often a much larger percentage than bonuses in traditional banking.

Higher Potential Returns and Compensation

The potential for significantly higher returns in private markets justifies, in the eyes of some, higher compensation for executives in this sector.

- Higher Fees: Private equity and other alternative investment strategies command significantly higher fees than many traditional banking services.

- Talent Competition: Attracting and retaining top talent in the competitive private markets requires offering lucrative compensation packages, contributing to the disparity seen in the Goldman Sachs CEO pay row.

The Goldman Sachs CEO Pay Row: A Deeper Dive

Let's now examine the specifics contributing to the ongoing Goldman Sachs CEO pay row.

Analyzing the Specific Compensation Packages

Analyzing the detailed compensation packages of Goldman Sachs's CEO and other key executives reveals significant discrepancies between those in traditional banking and private markets. While precise figures are often confidential, publicly available information, combined with reporting from financial media, highlights the substantial differences in base salaries, bonuses, stock options, and other forms of compensation.

- Compensation Breakdown: A thorough analysis needs to distinguish the different components of executive pay, including base salary, performance-based bonuses, long-term incentives (stock options, RSUs), and other benefits.

- Controversies: Public scrutiny often focuses on the size and structure of these packages, particularly concerning the proportion attributed to performance-based incentives versus fixed compensation.

Shareholder Activism and Public Scrutiny

The Goldman Sachs CEO pay row has attracted significant shareholder activism and public scrutiny. This reaction is largely due to the perceived disparity in compensation between those leading the traditional banking arms and private markets divisions.

- Shareholder Proposals: Shareholders may submit proposals at annual meetings to review and potentially modify executive compensation structures.

- Lawsuits: In some cases, lawsuits may be filed by shareholders challenging the fairness and appropriateness of executive pay.

- Media Coverage: Negative media coverage can significantly influence public perception and intensify pressure on the firm to address concerns about executive compensation.

Conclusion

The Goldman Sachs CEO pay row highlights the complex interplay between executive compensation, performance metrics, and the evolving business model of financial institutions. The stark differences in compensation structures between traditional banking and private markets within Goldman Sachs reflect the different risk profiles, return potentials, and long-term investment horizons of each segment. This debate underscores the need for more transparency and perhaps a reevaluation of compensation structures to ensure alignment with shareholder interests and long-term firm success. Further research and analysis are needed to ensure fair and equitable compensation structures. Understanding the nuances of the Goldman Sachs CEO pay row is crucial for anyone interested in financial markets and corporate governance. Continued monitoring of this situation and similar cases within the financial industry is vital.

Featured Posts

-

Hollywood Shut Down Writers And Actors Strike Impacts Film And Tv

Apr 23, 2025

Hollywood Shut Down Writers And Actors Strike Impacts Film And Tv

Apr 23, 2025 -

Alerte Trader Maitriser Les Seuils Techniques Pour Le Trading

Apr 23, 2025

Alerte Trader Maitriser Les Seuils Techniques Pour Le Trading

Apr 23, 2025 -

Nationals Jorge Lopez Suspended Three Games For Intentional Throw At Andrew Mc Cutchen

Apr 23, 2025

Nationals Jorge Lopez Suspended Three Games For Intentional Throw At Andrew Mc Cutchen

Apr 23, 2025 -

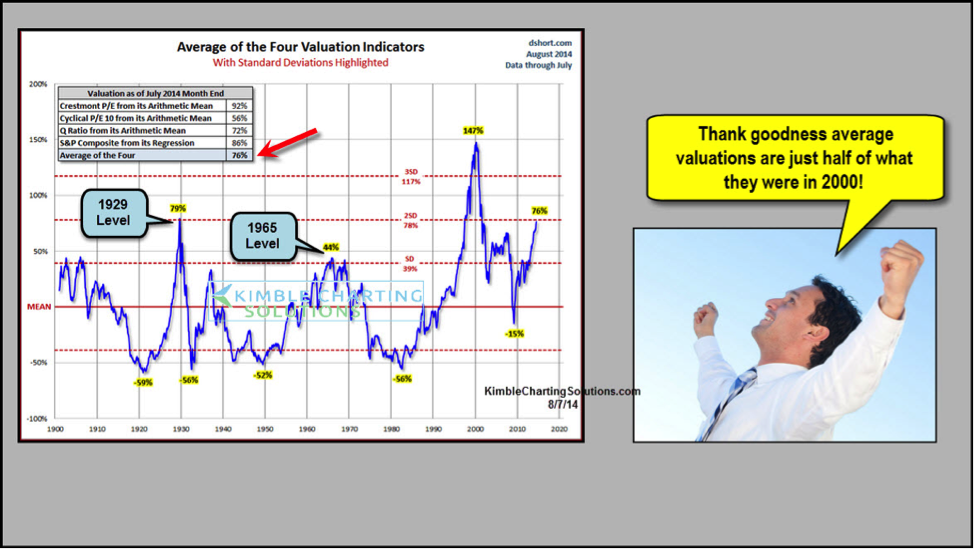

High Stock Market Valuations Understanding Bof As Optimistic Outlook

Apr 23, 2025

High Stock Market Valuations Understanding Bof As Optimistic Outlook

Apr 23, 2025 -

Pavel Pivovarov I Aleksandr Ovechkin Novaya Kollektsiya Mercha

Apr 23, 2025

Pavel Pivovarov I Aleksandr Ovechkin Novaya Kollektsiya Mercha

Apr 23, 2025