Gold's Decline: Back-to-Back Weekly Losses Mark 2025 Trend

Table of Contents

Rising Interest Rates and Their Impact on Gold Prices

Gold's price often moves inversely to interest rates. This means that as interest rates rise, gold prices tend to fall, and vice versa. This inverse relationship stems from the opportunity cost of holding non-yielding assets like gold.

- Higher interest rates increase the opportunity cost of holding non-yielding assets like gold. When interest rates are high, investors can earn a higher return on their investments in interest-bearing assets such as bonds and Treasury bills. This makes gold, which doesn't pay interest, less attractive.

- Investors shift towards higher-yielding investments like bonds. The allure of higher returns in the bond market diverts capital away from gold, reducing demand and putting downward pressure on its price.

- The Federal Reserve's monetary policy and its influence on global interest rates. The Federal Reserve's decisions regarding interest rate hikes significantly impact global interest rates, influencing the overall investment landscape and affecting gold's appeal. In 2025, several aggressive rate hikes were implemented, directly correlating with gold's decline. Data shows a clear negative correlation; for example, the 0.75% increase in June saw a concurrent 2.5% drop in gold prices.

- Impact of rising interest rates on gold investment strategies. Investors holding gold as part of a diversified portfolio may need to re-evaluate their strategies in response to rising interest rates. Some may choose to reduce their gold holdings to invest in higher-yielding options.

Strengthening US Dollar and its Effect on Gold Prices

The US dollar's strength is another significant factor contributing to gold's decline. Gold is priced in US dollars, creating a direct relationship between the two.

- Gold is priced in US dollars; a stronger dollar makes gold more expensive for holders of other currencies. When the dollar strengthens against other currencies, it becomes more expensive for international investors to buy gold, reducing global demand.

- Increased demand for the US dollar reduces demand for gold as a safe haven asset. A strong dollar often reflects a robust US economy, diminishing the need for investors to seek refuge in gold during times of economic uncertainty.

- Factors contributing to the strengthening US dollar in 2025 (e.g., economic performance, geopolitical events). Several factors contributed to the dollar's strength in 2025, including robust economic growth, geopolitical stability in certain regions, and the Federal Reserve's monetary policies. These elements collectively reduced the perceived need for gold as a safe-haven asset.

- Analysis of the correlation between USD strength and gold price fluctuations in 2025. A clear correlation existed between the USD's appreciation and gold's price drop throughout 2025. As the dollar strengthened, investor confidence in other assets increased, leading to less demand for gold.

Shifting Investor Sentiment and Reduced Safe-Haven Demand for Gold

The perception of gold as a safe haven has diminished, contributing to the recent decline.

- Increased risk appetite among investors leading to a move towards riskier assets. With economic conditions seemingly improving, investors have shown a growing willingness to take on more risk, opting for assets with potentially higher returns than gold.

- Geopolitical stability (or perceived stability) reducing demand for gold as a hedge against uncertainty. Periods of relative geopolitical calm tend to reduce the demand for gold as a hedge against global uncertainty. Investors are less inclined to seek refuge in gold when geopolitical risks seem less imminent.

- Emerging market trends and their influence on global gold demand. Changes in the economic outlook of major emerging markets influence global gold demand. Positive growth in these markets can shift investment away from gold toward higher-growth opportunities.

- Analysis of investor sentiment data and gold market flows. Data from investor surveys and market flow analysis corroborate a shift in investor sentiment. A decrease in investment flows into gold ETFs further supports this observation.

Technical Analysis and Chart Patterns Suggesting Continued Decline

Technical analysis suggests a continuation of the downward trend in gold prices.

- Identification of key support and resistance levels. Technical analysts identify key price levels that may indicate potential turning points in the gold price. Recent price action suggests a breakdown below crucial support levels.

- Analysis of moving averages and other technical indicators. Indicators like moving averages and relative strength index (RSI) signal bearish momentum, suggesting a continuation of the downward trend.

- Discussion of chart patterns suggesting a continuation of the downward trend. Chart patterns such as head and shoulders and descending triangles reinforce the bearish outlook.

- Inclusion of relevant charts and graphs to illustrate the technical analysis. (Charts and graphs would be inserted here to visually support the technical analysis).

Conclusion

Gold's decline in 2025 is a result of multiple interacting factors: rising interest rates increasing the opportunity cost of holding gold, a strengthening US dollar reducing demand, shifting investor sentiment leading to reduced safe-haven demand, and technical analysis pointing towards a continuation of the downward trend. The back-to-back weekly losses are a significant signal of this shift. The near-future outlook for gold prices remains cautious, though opportunities may arise for astute investors who understand these dynamics. Stay informed about the evolving dynamics of the gold market and understand the factors driving gold's decline. Monitor market trends closely to make informed investment decisions concerning gold and other precious metals. Continue to research the latest updates on gold price movements to adjust your investment strategy accordingly.

Featured Posts

-

Cut The Cord And Watch Fox Best Alternatives To Cable

May 05, 2025

Cut The Cord And Watch Fox Best Alternatives To Cable

May 05, 2025 -

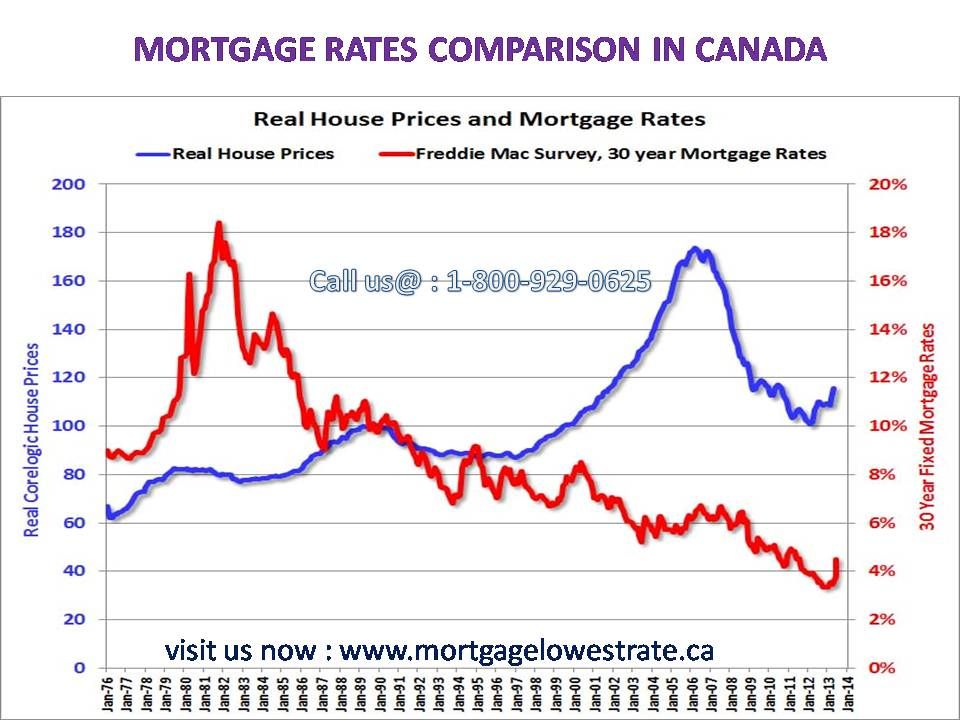

Understanding The Unpopularity Of 10 Year Mortgage Terms In Canada

May 05, 2025

Understanding The Unpopularity Of 10 Year Mortgage Terms In Canada

May 05, 2025 -

Shopifys New Lifetime Program Impact On Developer Revenue

May 05, 2025

Shopifys New Lifetime Program Impact On Developer Revenue

May 05, 2025 -

Oscars 2024 Lizzos New Look After Weight Loss

May 05, 2025

Oscars 2024 Lizzos New Look After Weight Loss

May 05, 2025 -

Murder And Torture Charges Filed Against Stepfather Of 16 Year Old Victim

May 05, 2025

Murder And Torture Charges Filed Against Stepfather Of 16 Year Old Victim

May 05, 2025

Latest Posts

-

A Look At Fleetwood Macs Best Selling Albums And Their Lasting Impact

May 05, 2025

A Look At Fleetwood Macs Best Selling Albums And Their Lasting Impact

May 05, 2025 -

Analyzing The Continued Success Of Fleetwood Macs Extensive Discography

May 05, 2025

Analyzing The Continued Success Of Fleetwood Macs Extensive Discography

May 05, 2025 -

Fleetwood Macs Hit Albums A Deep Dive Into Their Continued Popularity

May 05, 2025

Fleetwood Macs Hit Albums A Deep Dive Into Their Continued Popularity

May 05, 2025 -

The Enduring Success Of Fleetwood Macs Multi Platinum Albums

May 05, 2025

The Enduring Success Of Fleetwood Macs Multi Platinum Albums

May 05, 2025 -

Buckingham And Fleetwoods Reunion Future Of Fleetwood Mac Uncertain

May 05, 2025

Buckingham And Fleetwoods Reunion Future Of Fleetwood Mac Uncertain

May 05, 2025