Understanding The Unpopularity Of 10-Year Mortgage Terms In Canada

Table of Contents

Higher Interest Rate Risk with 10-Year Mortgages in Canada

One of the primary reasons for the unpopularity of 10-year mortgages in Canada is the significant interest rate risk involved. The Canadian mortgage landscape is dynamic, with interest rates fluctuating based on various economic factors.

Interest Rate Volatility

Canadian interest rates are notoriously volatile, influenced by the Bank of Canada's monetary policy decisions and global economic trends. A 10-year mortgage locks you into a specific interest rate for a decade. If interest rates drop significantly during that period, you'll be paying a higher rate than you might otherwise have secured with a shorter-term mortgage.

- Illustrative Example: Let's say you secure a 10-year mortgage at 5%. If rates drop to 3% after five years, you'll continue paying the higher rate for the remaining five years. A 5-year term would allow you to refinance at the lower rate.

- Unpredictable Bank of Canada Actions: The Bank of Canada's interest rate adjustments are notoriously difficult to predict. This uncertainty makes a long-term commitment riskier.

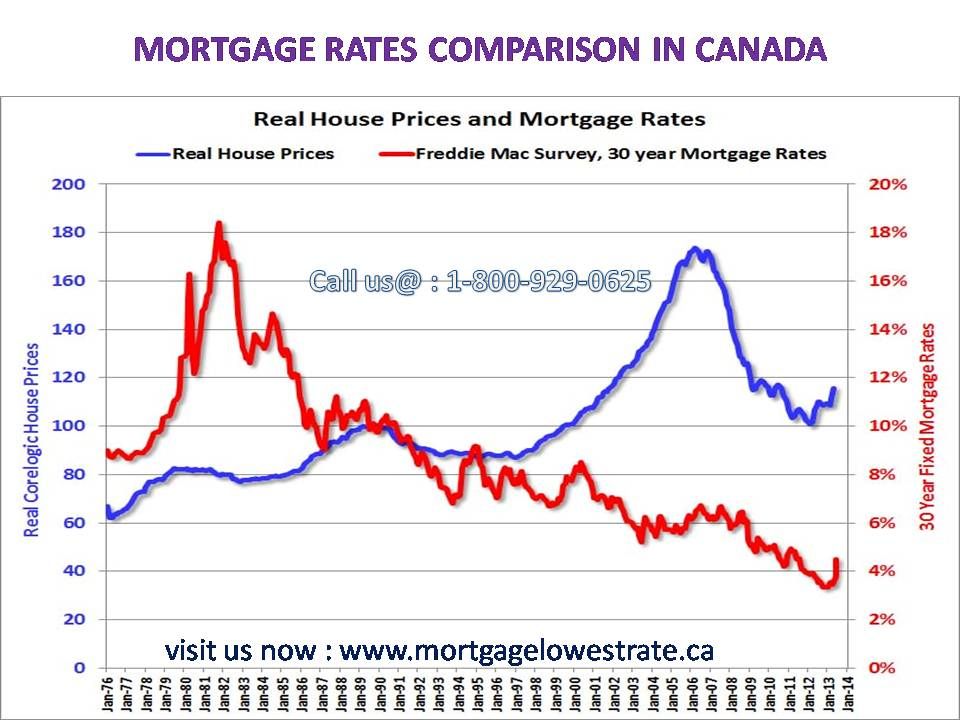

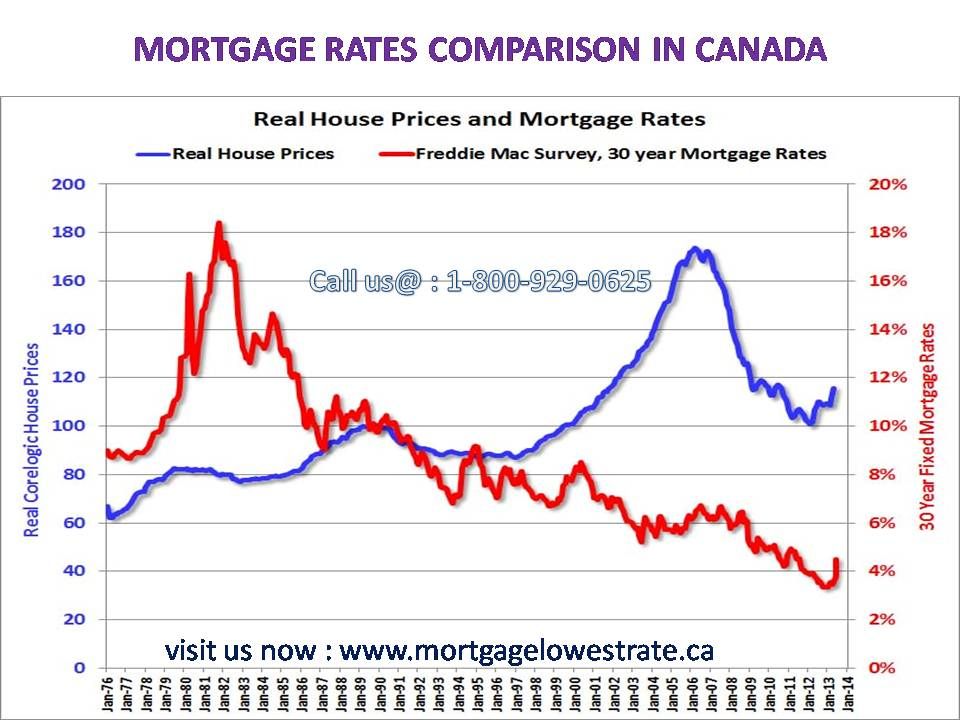

- Historical Fluctuations: [Link to a reliable source illustrating historical interest rate fluctuations in Canada]. Reviewing historical data can help illustrate the potential for significant shifts in interest rates over a 10-year period.

Prepayment Penalties

Breaking a 10-year mortgage early in Canada can be costly. Prepayment penalties can significantly impact your finances, especially if you refinance due to lower interest rates.

- Penalty Calculation: Prepayment penalties in Canada are usually calculated based on the difference between your current mortgage rate and the prevailing rate, multiplied by the remaining principal balance.

- Penalty Comparison: Prepayment penalties for a 10-year mortgage are considerably higher than those for shorter-term mortgages (e.g., 5-year terms).

- Understanding Clauses: Carefully review the prepayment clauses in your mortgage agreement before signing to understand the potential financial implications of breaking the contract early.

Financial Flexibility and 10-Year Mortgage Terms

Another crucial factor influencing the choice of mortgage term length is financial flexibility. A 10-year mortgage significantly reduces your financial adaptability.

Reduced Flexibility

Committing to a 10-year mortgage limits your ability to respond to unforeseen circumstances. Job loss, unexpected medical expenses, or other life changes can significantly impact your capacity to manage monthly payments.

- Unforeseen Circumstances: A long-term commitment can create significant stress if unexpected financial burdens arise.

- Refinancing Options: Shorter-term mortgages provide the opportunity to refinance at better rates or adjust your payments according to your financial situation. This flexibility is largely absent with a 10-year mortgage.

- Financial Stress: The long-term commitment of a 10-year mortgage can be a source of significant financial stress for many homeowners.

Alternatives to 10-Year Mortgages in the Canadian Market

Fortunately, several alternatives to 10-year mortgages exist within the Canadian market, offering a better balance between stability and flexibility.

Shorter-Term Mortgages

Five-year terms are the most popular choice in Canada, offering a good compromise.

- Renegotiation Opportunities: Shorter terms allow you to renegotiate your interest rate every five years, taking advantage of potential market improvements.

- Easy Refinancing: Refinancing a 5-year mortgage is relatively straightforward compared to a 10-year term.

Variable Rate Mortgages

Variable rate mortgages offer lower initial interest rates, but expose you to the risks of fluctuating rates.

- Advantages & Risks: Variable rates can be beneficial if rates remain low or decrease. However, they are risky if rates increase significantly.

- Financial Planning: Thorough financial planning and a robust emergency fund are crucial if considering a variable rate mortgage.

Hybrid Mortgage Options

Some lenders offer hybrid mortgage products combining fixed and variable rate features.

- Product Examples: Research different hybrid options available from Canadian lenders to find a suitable balance.

- Benefits & Drawbacks: Hybrid mortgages can help mitigate some of the risks associated with purely fixed or variable rate mortgages but require careful consideration.

Conclusion

The limited popularity of 10-year mortgage terms in Canada is primarily due to the substantial interest rate risk and the significant reduction in financial flexibility. While the perceived stability of a long-term fixed rate might seem attractive, the potential for high prepayment penalties and the lack of adaptability make shorter-term mortgages or variable rate options a more attractive choice for many Canadian homeowners. Before committing to a 10-year mortgage, thoroughly evaluate your financial situation, consider the risks and rewards, and explore alternative options. Seeking professional financial advice is highly recommended to make an informed decision about your Canadian mortgage needs, ensuring you select the right mortgage term length for your circumstances – be it a 5-year term or another option best suited to your long-term financial goals.

Featured Posts

-

Blue Origin Scraps Rocket Launch Due To Technical Issue

May 05, 2025

Blue Origin Scraps Rocket Launch Due To Technical Issue

May 05, 2025 -

Public Reaction To Lizzos Comparison Of Britney Spears And Janet Jackson

May 05, 2025

Public Reaction To Lizzos Comparison Of Britney Spears And Janet Jackson

May 05, 2025 -

How Norways Top Investor Nicolai Tangen Responded To Trumps Tariffs

May 05, 2025

How Norways Top Investor Nicolai Tangen Responded To Trumps Tariffs

May 05, 2025 -

Rimeik Body Heat T Ha Protagonistisei I Emma Stooyn

May 05, 2025

Rimeik Body Heat T Ha Protagonistisei I Emma Stooyn

May 05, 2025 -

Analyzing The Key Issues In Singapores Upcoming General Election

May 05, 2025

Analyzing The Key Issues In Singapores Upcoming General Election

May 05, 2025

Latest Posts

-

A 390 000 Win For Nelson Dong In Apo Main Event

May 05, 2025

A 390 000 Win For Nelson Dong In Apo Main Event

May 05, 2025 -

Apo Main Event Nelson Dong Secures A 390 000 Top Prize

May 05, 2025

Apo Main Event Nelson Dong Secures A 390 000 Top Prize

May 05, 2025 -

Murder Charge Filed Against Stepfather Accused Of Torturing Starving And Beating 16 Year Old Stepson

May 05, 2025

Murder Charge Filed Against Stepfather Accused Of Torturing Starving And Beating 16 Year Old Stepson

May 05, 2025 -

Tortured Teens Death Mother Accused Of Criminal Neglect

May 05, 2025

Tortured Teens Death Mother Accused Of Criminal Neglect

May 05, 2025 -

Nelson Dongs A 390 000 Apo Main Event Victory

May 05, 2025

Nelson Dongs A 390 000 Apo Main Event Victory

May 05, 2025