Grants And Financing For Eco-Friendly SMEs: A Comprehensive Guide

Table of Contents

Government Grants and Subsidies for Green Initiatives

Securing government funding is a significant opportunity for eco-friendly SMEs. Numerous national, regional, and local government initiatives support sustainable businesses across various sectors. Successfully navigating this landscape requires understanding where to look and how to apply effectively.

Identifying Relevant Programs

Finding the right grant requires diligent research. Begin by exploring these resources:

-

Websites to check for grant listings:

- Your national government's environmental agency website (e.g., the EPA in the US, DEFRA in the UK).

- Regional and local government websites focusing on economic development and sustainability.

- EU funding portals (if applicable) such as the European Commission's Funding & Tenders portal.

- Specialized databases focusing on green business grants.

-

Specific keywords to use in grant searches: Use precise keywords to refine your search, such as:

- "renewable energy grants"

- "sustainable agriculture funding"

- "circular economy subsidies"

- "green technology grants for SMEs"

- "eco-friendly business loans"

The application process typically involves detailed eligibility criteria, specific documentation (financial statements, business plans, environmental impact assessments), and often tight deadlines. Thoroughly review the requirements before starting your application.

Navigating the Application Process

A strong application is crucial. Focus on these key elements:

- A compelling business plan: Clearly outline your business model, target market, and financial projections.

- Measurable environmental impact: Quantify the positive environmental effects of your business (e.g., reduced carbon emissions, waste reduction, water conservation).

- A strong narrative: Connect your business’s environmental impact to the grant’s objectives. Show why your project deserves funding.

Tips for a winning grant proposal:

- Develop a concise and persuasive executive summary.

- Clearly define your environmental impact targets and how you will measure success.

- Provide a detailed and realistic budget outlining how the grant funds will be used.

Successful grant applications often highlight strong partnerships, innovative solutions, and a clear path to sustainability. Conversely, common reasons for rejection include weak business plans, unrealistic budgets, and a lack of clear environmental impact.

Green Loans and Financing Options

Beyond grants, green loans offer another powerful avenue for funding eco-friendly SMEs. These loans often come with attractive terms, encouraging sustainable business practices.

Understanding Green Loan Products

Green loans differ from traditional loans by focusing on environmentally friendly projects. They frequently offer:

- Lower interest rates: Incentives encouraging sustainable investments.

- Favorable repayment terms: Flexible repayment schedules to ease the financial burden.

Different types of green loans include:

- Energy efficiency loans (for upgrading equipment or buildings).

- Sustainable agriculture loans (for implementing eco-friendly farming practices).

- Green bonds (financing projects with positive environmental impact).

Securing Funding from Green Banks and Financial Institutions

Several institutions specialize in green financing:

- Green banks: Public or quasi-public entities dedicated to financing environmental projects.

- Commercial banks: Many now offer specific green loan products as part of their broader sustainability initiatives.

- Impact investors: These investors prioritize both financial returns and positive social/environmental impact.

Examples of Green Banks and Financial Institutions (will vary by region – replace with relevant examples): (Insert relevant examples here)

Building strong relationships with lenders is vital. Prepare comprehensive financial statements showcasing your business's viability and the potential for a strong return on investment.

Impact Investing and Venture Capital for Sustainable Businesses

Impact investing and venture capital offer alternative funding sources for eco-friendly SMEs focused on significant social and environmental impact.

Attracting Impact Investors

Impact investors prioritize both financial returns and positive social/environmental impact. To attract them, you need:

- A strong ESG (Environmental, Social, and Governance) profile: Demonstrate your commitment to sustainability and ethical business practices.

- Measurable environmental and social benefits: Clearly quantify the positive impact of your business.

Key aspects of a compelling investment proposal:

- A clear articulation of your business model and its environmental and social impact.

- A strong management team with experience in the relevant sector.

- A well-defined financial model, including projections of revenue, expenses, and profitability.

Exploring Crowdfunding Platforms for Green Initiatives

Crowdfunding provides a way to raise capital while building brand awareness. Platforms like Kickstarter and Indiegogo are suitable for eco-friendly SMEs.

Tips for a successful crowdfunding campaign:

- Set realistic fundraising goals.

- Create a compelling campaign video and story.

- Offer attractive rewards to potential backers.

- Engage actively with your backers throughout the campaign.

Conclusion

Securing grants and financing is vital for eco-friendly SMEs. By exploring government grants, green loans, impact investing, and crowdfunding, you can access the capital necessary for growth and success. Remember to thoroughly research available Grants and Financing for Eco-Friendly SMEs and tailor your application strategy to each opportunity. Start exploring these options today and take the first step towards securing the funding your eco-friendly SME needs to thrive.

Featured Posts

-

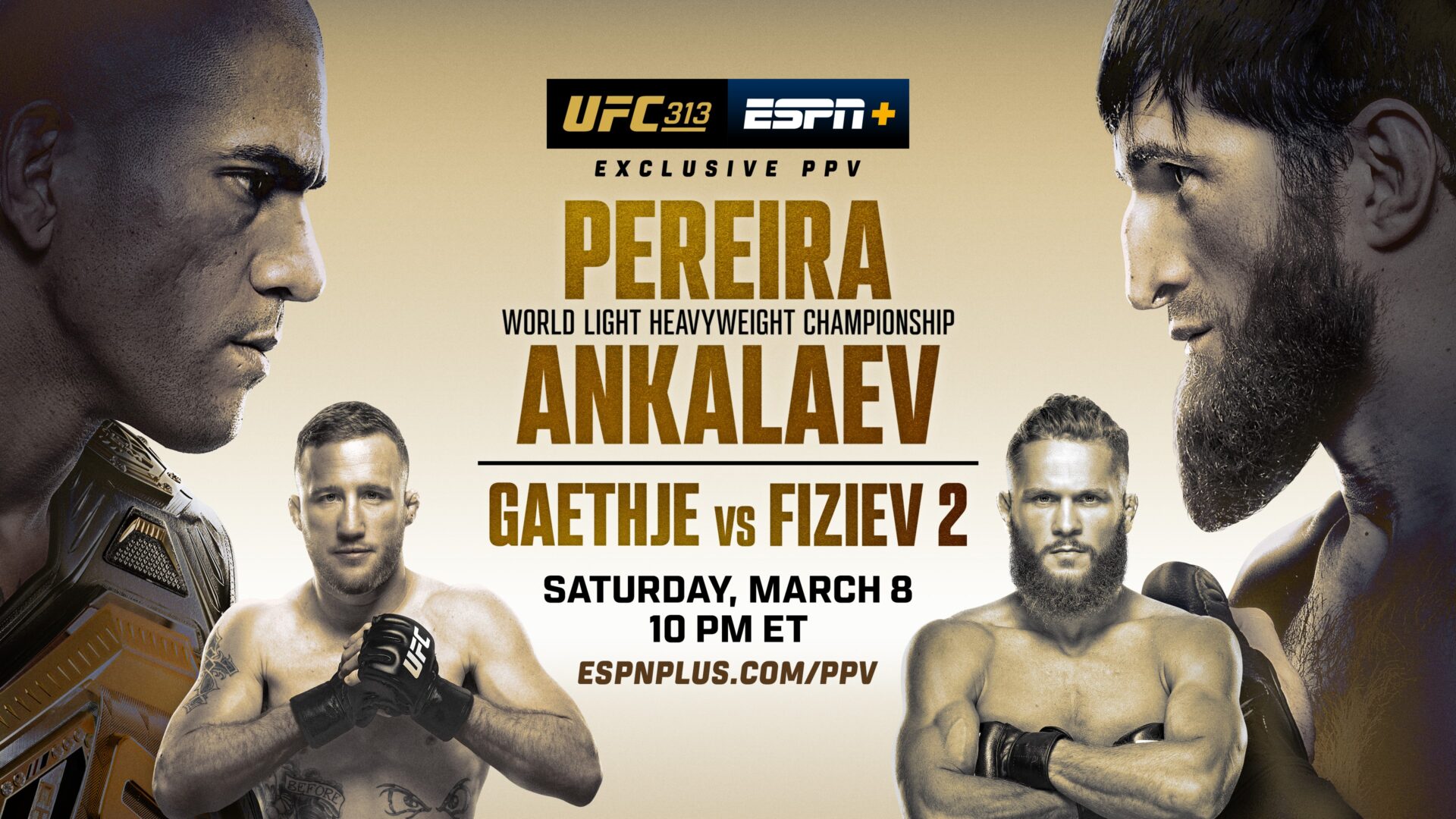

Ufc 313 Live Results Fight Card Recap And Analysis Pereira Vs Ankalaev

May 19, 2025

Ufc 313 Live Results Fight Card Recap And Analysis Pereira Vs Ankalaev

May 19, 2025 -

Announcing Vermonts 2025 Presidential Scholars Celebrating Academic Excellence

May 19, 2025

Announcing Vermonts 2025 Presidential Scholars Celebrating Academic Excellence

May 19, 2025 -

The Low Key Path To Wealth How The Stealthy Wealthy Achieve Financial Success

May 19, 2025

The Low Key Path To Wealth How The Stealthy Wealthy Achieve Financial Success

May 19, 2025 -

Tampoy Epomeno Epeisodio I Epithesi Me Maxairi Sti Marilena

May 19, 2025

Tampoy Epomeno Epeisodio I Epithesi Me Maxairi Sti Marilena

May 19, 2025 -

Orlando 2025 Tourism Event Photo Highlights From The Orlando Sentinel

May 19, 2025

Orlando 2025 Tourism Event Photo Highlights From The Orlando Sentinel

May 19, 2025