The Low-Key Path To Wealth: How The Stealthy Wealthy Achieve Financial Success

Table of Contents

Mindset: The Foundation of Stealth Wealth

The journey to building stealth wealth begins with the right mindset. It's not about impressing others; it's about building a secure financial future based on your own terms.

Avoiding the "Keeping Up with the Joneses" Trap

The pressure to keep up with societal expectations can derail even the most well-intentioned financial plans. The Stealthy Wealthy understand that true wealth isn't defined by material possessions but by financial freedom and security.

- Avoid Status Symbols: Instead of buying luxury items to impress others, focus on acquiring assets that appreciate in value, like real estate or appreciating investments.

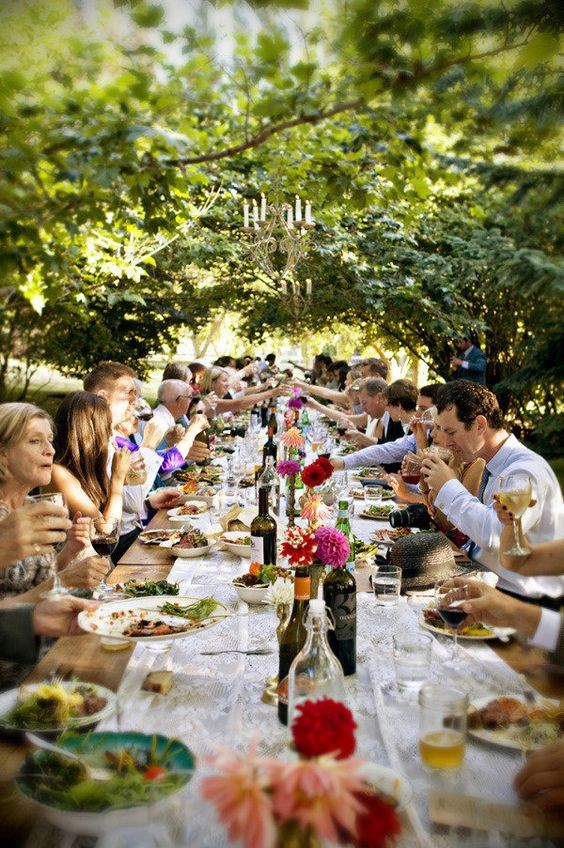

- Focus on Intrinsic Value: Prioritize experiences over material possessions. Investing in education, travel, or personal growth often yields greater long-term satisfaction than fleeting material pleasures.

- Define Your Own Success: Your financial goals should be aligned with your personal values and aspirations, not dictated by societal pressures. This is a core tenet of quiet wealth strategies.

Long-Term Vision over Short-Term Gratification

The Stealthy Wealthy understand the power of delayed gratification. They prioritize long-term wealth building over instant gratification.

- Long-Term Investment Strategies: Index funds, real estate investment trusts (REITs), and dividend-paying stocks are examples of investments that offer potential for long-term growth.

- The Power of Compounding Interest: The magic of compounding interest allows your investments to grow exponentially over time. This is a cornerstone of sustainable wealth.

- Patient Investing: Avoid impulsive decisions driven by market fluctuations. Focus on your long-term financial plan and stick to it.

Strategic Financial Habits of the Stealthy Wealthy

The Stealthy Wealthy aren't just lucky; they possess disciplined financial habits that contribute significantly to their success.

Living Below Your Means

This is arguably the most crucial habit of the Stealthy Wealthy. It involves carefully budgeting, saving diligently, and making mindful spending choices.

- Create a Realistic Budget: Track your income and expenses to identify areas where you can cut back.

- Build an Emergency Fund: Having 3-6 months' worth of living expenses in a readily accessible account provides a financial safety net.

- Mindful Spending: Differentiate between needs and wants before making purchases. This is key to frugal living and achieving financial independence.

Strategic Investing and Diversification

Diversification is crucial to mitigating risk. Don't put all your eggs in one basket.

- Diverse Investment Portfolio: Consider a mix of stocks, bonds, real estate, and potentially alternative investments like private equity or commodities.

- Professional Financial Advice: Seeking guidance from a qualified financial advisor can help you create a personalized investment strategy tailored to your risk tolerance and financial goals.

- Intelligent Investing: Thorough research and understanding of your investments is paramount. Avoid get-rich-quick schemes.

Continuous Learning and Financial Literacy

The Stealthy Wealthy are committed to lifelong learning. They continually expand their financial knowledge and skills.

- Financial Education Resources: Explore books, online courses, and workshops to enhance your understanding of personal finance.

- Stay Informed: Keep abreast of current events and market trends to make informed investment decisions.

- Seek Expert Advice: Don't hesitate to consult with financial professionals when needed.

Protecting and Growing Your Stealth Wealth

Once you've accumulated wealth, it's essential to protect and grow it wisely.

Tax Optimization and Estate Planning

Minimizing your tax liability and planning for the future is critical for long-term wealth preservation.

- Tax-Advantaged Accounts: Utilize retirement accounts like 401(k)s and IRAs to reduce your tax burden.

- Estate Planning: Create a comprehensive estate plan to ensure your assets are distributed according to your wishes.

- Professional Tax Advice: Consult with a tax advisor to optimize your tax strategy.

Debt Management and Avoidance

High-interest debt can severely hinder your wealth-building efforts.

- Pay Down Debt Strategically: Prioritize paying off high-interest debt first.

- Avoid Credit Card Debt: Use credit cards responsibly and pay off your balance in full each month.

- Negotiate Favorable Loan Terms: Shop around for the best interest rates and loan terms before taking on debt.

Conclusion

Building stealth wealth is a journey that requires patience, discipline, and a long-term perspective. By embracing the strategies outlined above—a focused mindset, disciplined financial habits, strategic investing, and proactive protection—you can begin your path to achieving financial freedom. Emulate the stealthy wealthy by focusing on sustainable growth, avoiding unnecessary debt, and continually expanding your financial literacy. Download our free budgeting template today and start building your stealth wealth!

Featured Posts

-

Wnba White Guilt Parade A Critical Analysis

May 19, 2025

Wnba White Guilt Parade A Critical Analysis

May 19, 2025 -

Plirofories Gia Tin Kyriaki Toy Antipasxa Sta Ierosolyma Programmatismos Kai Organosi

May 19, 2025

Plirofories Gia Tin Kyriaki Toy Antipasxa Sta Ierosolyma Programmatismos Kai Organosi

May 19, 2025 -

Swissquote Bank Sovereign Bond Market Analysis And Outlook

May 19, 2025

Swissquote Bank Sovereign Bond Market Analysis And Outlook

May 19, 2025 -

Super Eagles Players Future Uncertain As Gent Contract Talks Begin

May 19, 2025

Super Eagles Players Future Uncertain As Gent Contract Talks Begin

May 19, 2025 -

Music Festivals Mark Rylances Criticism Of Their Impact On London Parks

May 19, 2025

Music Festivals Mark Rylances Criticism Of Their Impact On London Parks

May 19, 2025