Grayscale's XRP ETF Application: Impact On XRP Price And Future Predictions

Table of Contents

The Potential Impact of an Approved XRP ETF on XRP Price

An approved XRP ETF would have profound consequences for XRP's price and market dynamics.

Increased Liquidity and Trading Volume

- Enhanced Accessibility: An approved ETF would dramatically increase XRP's liquidity, making it easier for institutional and retail investors to trade. This increased accessibility is a key factor driving potential price increases. Currently, accessing XRP often involves navigating cryptocurrency exchanges, a process less familiar and potentially more complex for traditional investors.

- Trading Volume Surge: Increased trading volume is almost guaranteed. The influx of institutional money, coupled with easier access for retail investors, will lead to a substantial surge in trading volume. This could lead to greater price volatility in the short term, but potentially greater price stability over the long term as the market matures.

- Boosted Demand: This increased accessibility will undoubtedly attract significant investment, boosting demand and driving up the XRP price. The ease of access through traditional brokerage accounts will likely attract a new wave of investors who may have previously been hesitant to invest directly in cryptocurrencies.

Enhanced Institutional Adoption

- Regulatory Comfort: ETFs provide a regulated and familiar investment vehicle for institutional investors, who are often hesitant to invest directly in cryptocurrencies due to regulatory uncertainties and security concerns. An XRP ETF would alleviate many of these concerns.

- Price Appreciation Catalyst: Approval could signal a wider acceptance of XRP among institutional investors, leading to substantial price appreciation. This level of institutional backing can significantly influence market sentiment and drive up the price.

- Mainstream Integration: This increased institutional adoption could accelerate XRP's integration into mainstream financial markets, making it a more widely accepted and utilized asset.

Price Volatility and Market Sentiment

- Pre-Decision Fluctuations: The uncertainty surrounding the SEC's decision will likely cause price fluctuations in the lead-up to a decision. Investors will react to news and rumors, creating periods of both upward and downward pressure on the XRP price.

- News-Driven Volatility: Positive news surrounding the application will likely result in price increases, while negative news will cause declines. Market sentiment is extremely sensitive to regulatory updates and legal developments.

- Anticipation Factor: Market sentiment plays a crucial role; widespread anticipation of approval could already be influencing XRP’s price. This speculative buying could lead to price increases even before a final decision is made.

Factors Influencing the SEC's Decision on the XRP ETF Application

The SEC's decision is a complex one, weighed down by numerous factors.

Regulatory Scrutiny and Legal Precedents

- Regulatory Status of XRP: The SEC's decision will heavily rely on its assessment of XRP's regulatory status and its classification as a security. This is directly tied to the ongoing Ripple vs. SEC lawsuit.

- Previous ETF Decisions: The SEC’s previous decisions on other crypto ETFs, particularly those involving Bitcoin and Ethereum, will provide valuable precedents. These past rulings will inform their approach to the XRP ETF application.

- Ripple Lawsuit Outcome: The ongoing Ripple vs. SEC lawsuit significantly impacts the outcome; a favorable ruling for Ripple could greatly improve the chances of approval. A positive outcome would remove a major hurdle for the SEC's consideration.

Market Maturity and Investor Protection

- Investor Protection: The SEC's primary concern is investor protection. A mature and transparent XRP market will improve the chances of approval. This includes clear regulations and mechanisms to protect investors from fraud and market manipulation.

- AML/KYC Compliance: The presence of robust anti-money laundering (AML) and know-your-customer (KYC) measures within the XRP ecosystem is crucial. Demonstrating a commitment to these measures is essential for gaining SEC approval.

- Network Security: The overall stability and security of the XRP network will be considered. A secure and reliable network will build confidence in the SEC and potential investors.

XRP Price Predictions and Future Outlook

Predicting the future of XRP's price is inherently speculative, but we can outline potential scenarios.

Bullish Scenarios (ETF Approval):

- Price Surge: Significant price increases, potentially exceeding previous all-time highs, are highly probable. The increased liquidity and institutional interest would fuel this growth.

- Increased Adoption: Increased adoption by institutional investors and a wider range of retail investors is almost certain. The ETF would make XRP significantly more accessible.

- Wider Integration: Integration into more financial applications and services would likely follow, solidifying XRP's position in the financial ecosystem.

Bearish Scenarios (ETF Rejection):

- Price Decline: A potential price decline due to disappointed investors and reduced market confidence is a likely consequence of rejection. The lack of SEC approval would be a major blow to XRP's credibility.

- Regulatory Uncertainty: Continued regulatory uncertainty and hesitancy from institutional investors would likely persist. This would hinder the growth and adoption of XRP.

- Slower Growth: Slower growth compared to alternative cryptocurrencies is likely, as the lack of ETF approval would stifle mainstream adoption.

Neutral Scenarios (Delayed Decision):

- Price Stagnation: Price stagnation or moderate fluctuations until a decision is reached is a likely outcome of a delayed decision. Uncertainty will keep investors on the sidelines.

- Continued Uncertainty: Continued uncertainty impacting investor sentiment and investment decisions would likely persist. This would create volatility and hesitation in the market.

- Consolidation Period: Opportunity for consolidation and preparation for either a positive or negative outcome. This period could allow the market to prepare for either a significant price increase or a period of decline.

Conclusion:

Grayscale's XRP ETF application presents a pivotal moment for XRP and the broader cryptocurrency market. The SEC's decision will undoubtedly have a significant impact on XRP's price and future trajectory. While predicting the future is inherently uncertain, understanding the factors influencing the decision and analyzing potential scenarios helps to navigate this exciting phase of the cryptocurrency landscape. Stay informed about the progress of Grayscale's XRP ETF application and the Ripple vs. SEC lawsuit to make informed investment decisions regarding XRP and other cryptocurrencies. Keep researching the Grayscale XRP ETF for a comprehensive understanding of its potential impact.

Featured Posts

-

Revealed Superman Sneak Peek Shows Kryptos Brutal Attack

May 08, 2025

Revealed Superman Sneak Peek Shows Kryptos Brutal Attack

May 08, 2025 -

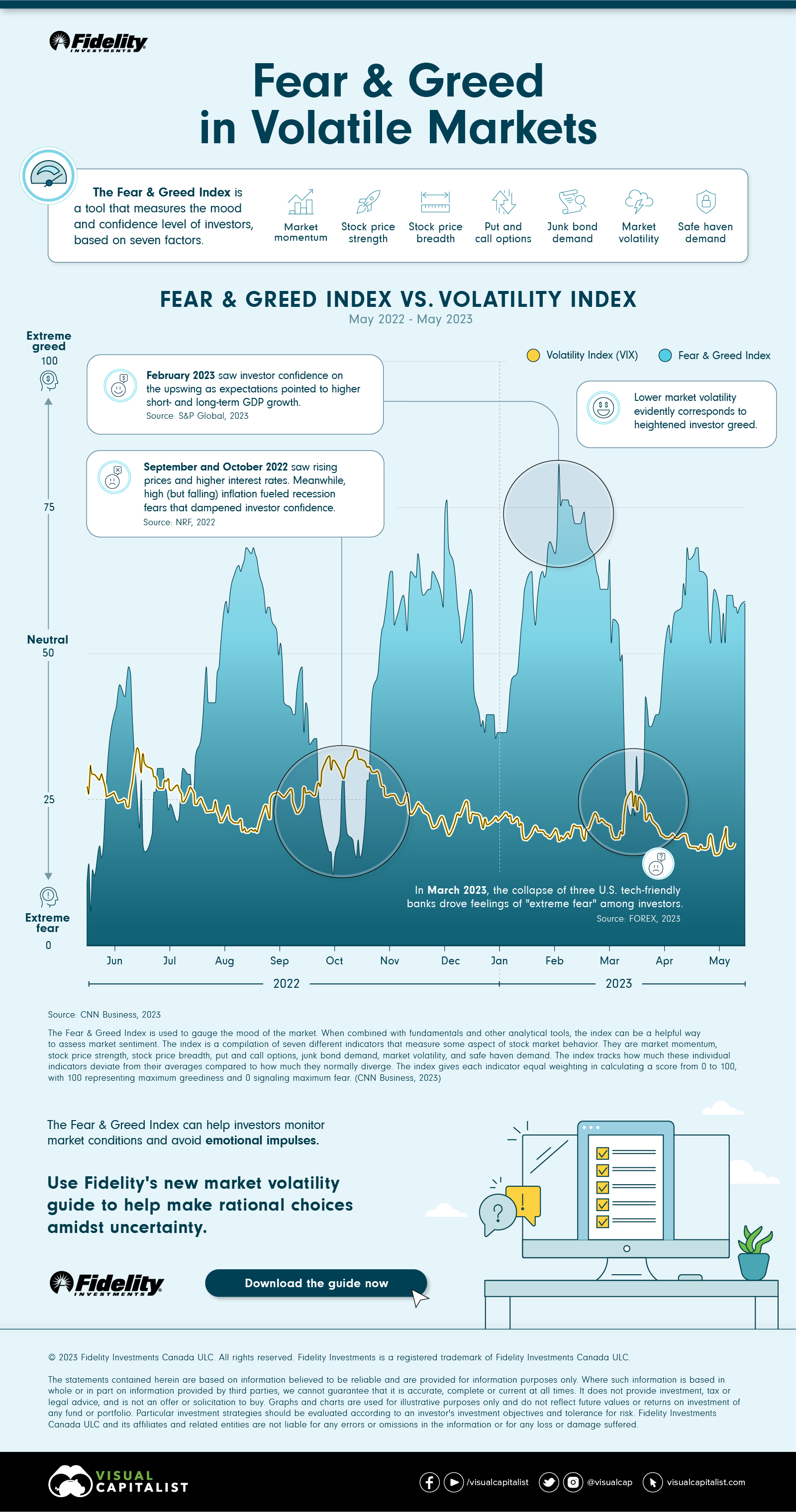

The Liberation Day Tariffs Stock Market Volatility And Investor Behavior

May 08, 2025

The Liberation Day Tariffs Stock Market Volatility And Investor Behavior

May 08, 2025 -

The Strategic Importance Of Middle Management In Modern Organizations

May 08, 2025

The Strategic Importance Of Middle Management In Modern Organizations

May 08, 2025 -

Saving Private Ryan A Character Ranking Of The 10 Best

May 08, 2025

Saving Private Ryan A Character Ranking Of The 10 Best

May 08, 2025 -

Triunfo Para Filipe Luis Un Nuevo Titulo

May 08, 2025

Triunfo Para Filipe Luis Un Nuevo Titulo

May 08, 2025