The 'Liberation Day' Tariffs: Stock Market Volatility And Investor Behavior

Table of Contents

Immediate Market Reaction to the Liberation Day Tariffs

The immediate aftermath of the Liberation Day tariff announcement was characterized by significant market turmoil. Major stock indices experienced sharp declines, reflecting widespread investor concern.

- Percentage point changes: The Dow Jones Industrial Average plunged by X%, the S&P 500 dropped by Y%, and the NASDAQ Composite fell by Z% within the first hour of the announcement. These figures represent some of the most dramatic single-day percentage changes seen in recent years.

- Sector-specific reactions: The technology sector, heavily reliant on global supply chains, was particularly hard hit, experiencing a larger percentage decline than other sectors. Conversely, sectors less dependent on international trade, such as utilities, showed more resilience. Manufacturing and consumer goods sectors faced considerable uncertainty due to increased input costs.

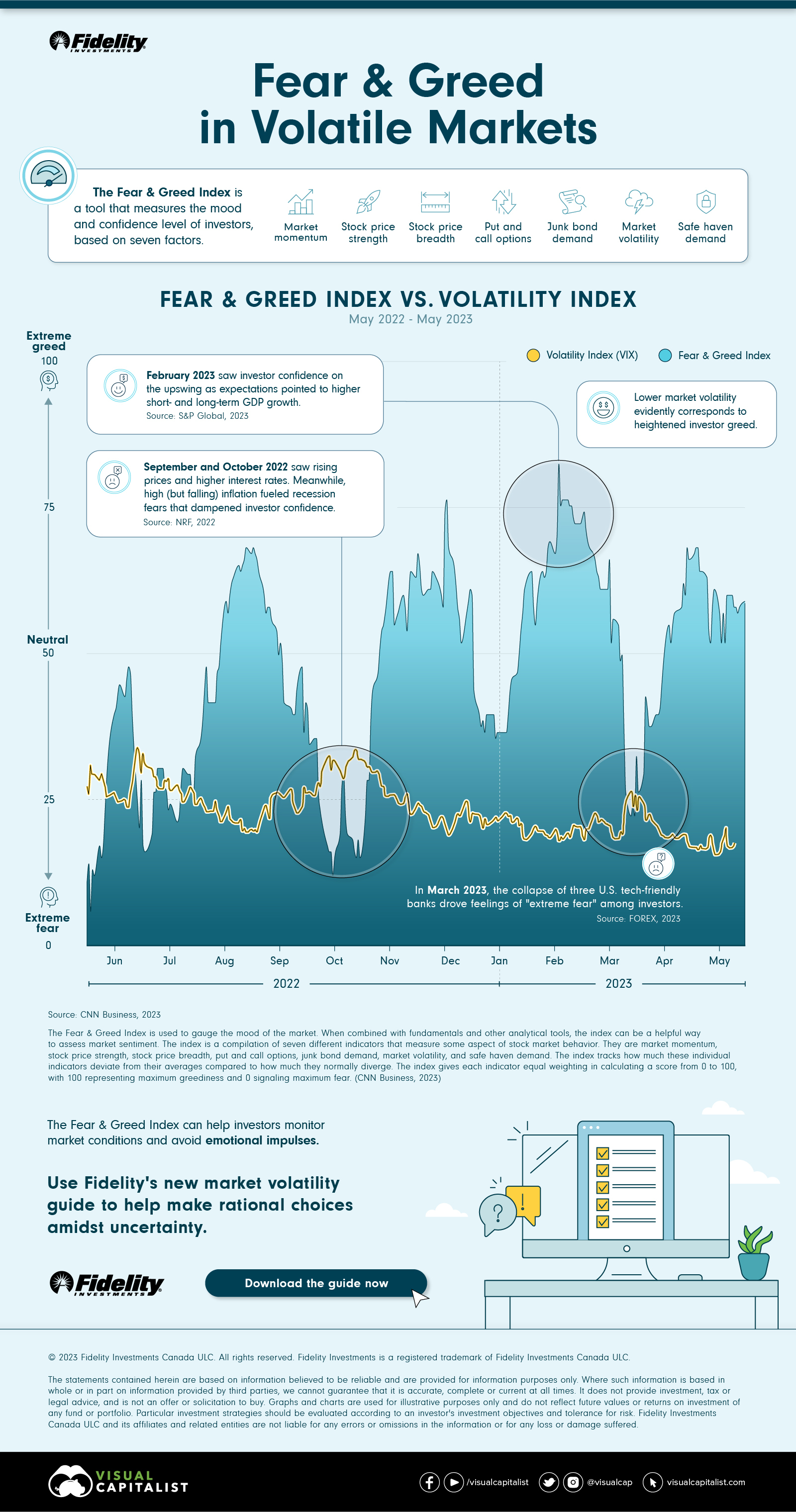

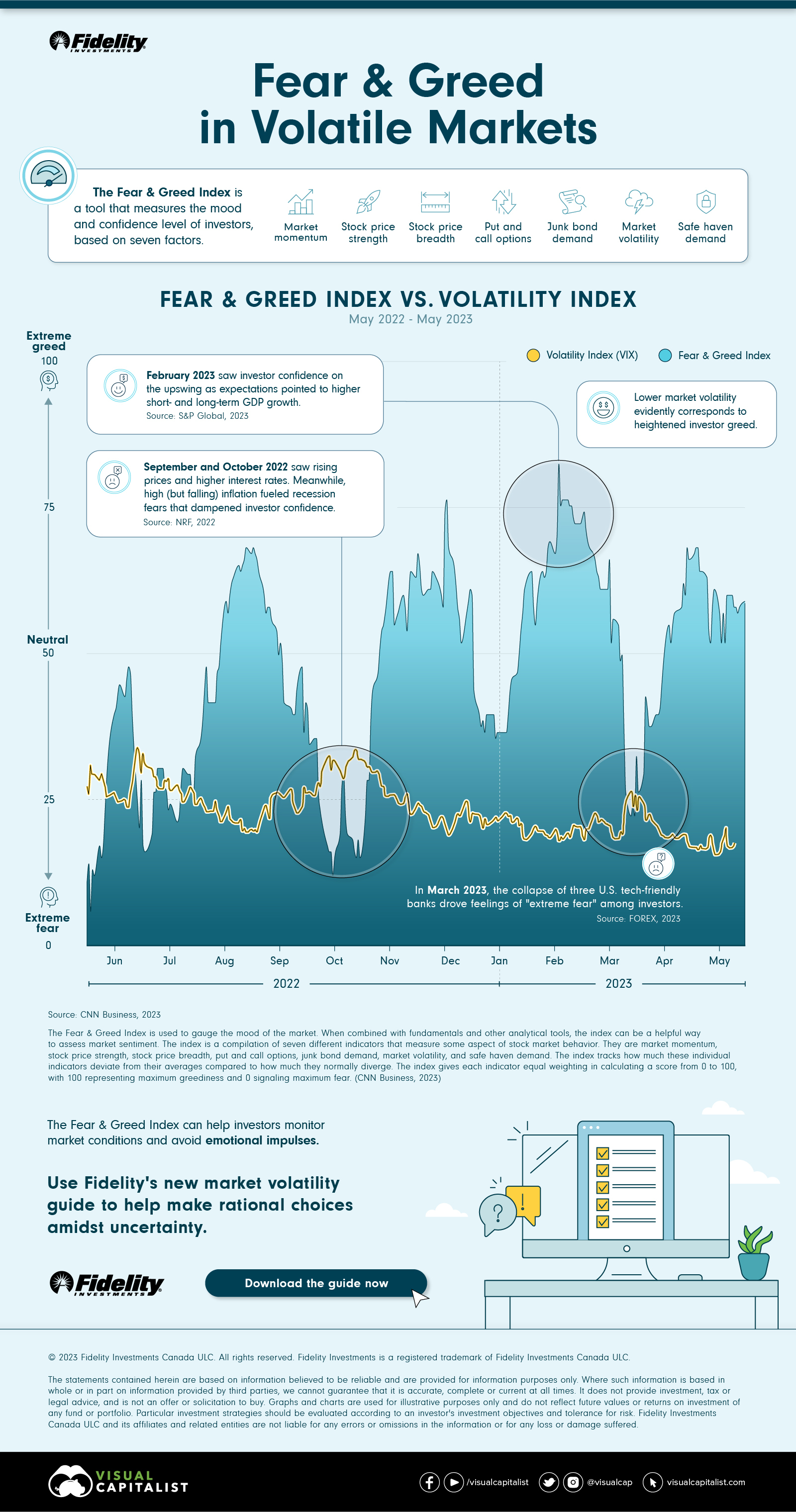

- Trading volume and volatility spikes: Trading volume surged dramatically, indicating heightened investor activity and panic selling. Volatility indices, such as the VIX (fear gauge), spiked significantly, reflecting the increased uncertainty and risk aversion in the market.

- Circuit breakers: While no major circuit breakers were triggered in this instance, the proximity to established thresholds highlighted the severity of the market reaction and the potential for further drastic measures.

Investor Behavior in the Face of Uncertainty

The Liberation Day tariffs triggered a classic flight-to-safety response among investors. Behavioral finance principles clearly illustrated themselves in the market's response.

- Increased risk aversion and flight to safety: Investors moved away from riskier assets like stocks and into safer havens such as government bonds and precious metals like gold. This shift reflected a widespread desire to minimize potential losses in the face of economic uncertainty.

- Changes in trading strategies: Many investors adopted short-selling strategies, betting on further declines in the market. Long-term investment strategies were frequently paused or reassessed, as investors prioritized preserving capital over long-term growth.

- Impact on investor confidence and sentiment: Investor confidence plummeted, as reflected in various sentiment indices. The VIX index, a measure of market volatility and investor fear, surged dramatically, indicating heightened anxiety and uncertainty within the market.

- Herd behavior: The market reaction showcased elements of herd behavior, with investors mimicking each other’s actions, exacerbating the sell-off and amplifying the volatility.

Long-Term Implications of the Liberation Day Tariffs

The long-term consequences of the Liberation Day tariffs remain to be fully seen, but several potential lasting effects are already apparent.

- Inflationary pressures: Increased tariffs can lead to higher prices for imported goods, contributing to inflationary pressures and squeezing consumer spending. This, in turn, could impact corporate profits and economic growth.

- Supply chain disruptions: Tariffs can disrupt global supply chains, making it more expensive and difficult for companies to source goods and materials. This can lead to production delays, shortages, and higher prices for consumers.

- Potential for retaliatory tariffs and trade wars: The Liberation Day tariffs could trigger retaliatory measures from other countries, leading to a broader trade war with negative consequences for global economic growth.

- Long-term impact on investor confidence: The uncertainty and volatility surrounding the Liberation Day tariffs could erode investor confidence, leading to decreased investment and slower economic growth in the long term.

Geopolitical Considerations and the Liberation Day Tariffs

The geopolitical context surrounding the Liberation Day tariff announcement played a significant role in shaping market reactions.

- International relations: Existing tensions in international relations likely amplified the negative impact of the tariff announcement, creating a climate of heightened uncertainty and risk aversion.

- Impact of news coverage and media narratives: Media coverage and public discourse surrounding the tariffs influenced investor perception and contributed to the market's volatility. Negative news narratives tended to exacerbate sell-offs.

- Government responses and policy interventions: Government responses to the tariff announcement, such as policy interventions or statements from central banks, influenced investor sentiment and market reactions.

Conclusion

The "Liberation Day" tariffs served as a stark reminder of the significant impact geopolitical events and trade policies can have on stock market volatility and investor behavior. Understanding investor reactions, both short-term and long-term, to events such as these is crucial for effective portfolio management. By analyzing the immediate market reaction, investor behavior, and long-term implications, investors can better prepare for and navigate future periods of uncertainty. Further research into the "Liberation Day" tariffs and similar economic events is encouraged to develop robust strategies for mitigating risk and capitalizing on market opportunities amidst future economic volatility surrounding tariff announcements. Staying informed about global trade developments and their potential impact on the market is key to effectively managing your investments in the face of future "Liberation Day" tariff-like events. Understanding the intricacies of the Liberation Day tariffs and their consequences is vital for navigating future market fluctuations.

Featured Posts

-

Pro Shares Xrp Etfs Details On The New Non Spot Offerings

May 08, 2025

Pro Shares Xrp Etfs Details On The New Non Spot Offerings

May 08, 2025 -

222 Milione Euro Agjenti Zbulon Te Fshehta Nga Transferimi I Neymar Te Psg

May 08, 2025

222 Milione Euro Agjenti Zbulon Te Fshehta Nga Transferimi I Neymar Te Psg

May 08, 2025 -

Behind The Scenes Of Andor Cast Insights Into The Rogue One Prequels Final Season

May 08, 2025

Behind The Scenes Of Andor Cast Insights Into The Rogue One Prequels Final Season

May 08, 2025 -

Angels Hitting Woes Continue 13 More Strikeouts In Twins Sweep

May 08, 2025

Angels Hitting Woes Continue 13 More Strikeouts In Twins Sweep

May 08, 2025 -

La Geometrie Des Corneilles Une Performance Cognitive Superieure A Celle Des Babouins

May 08, 2025

La Geometrie Des Corneilles Une Performance Cognitive Superieure A Celle Des Babouins

May 08, 2025