Greene Advocates For Reduced QE In Future Economic Crises

Table of Contents

Quantitative easing (QE) has become a mainstay of economic crisis management. However, Representative [Greene's Name] is advocating for a significant reduction in future reliance on QE during economic downturns. This article will examine Greene's concerns, proposed alternatives, and the potential consequences of this bold proposal on Reduced QE.

Understanding Greene's Concerns About Quantitative Easing (QE):

Quantitative easing, where central banks inject liquidity by purchasing assets, has been widely used to combat economic crises. While often credited with preventing deeper recessions, Greene argues that its long-term consequences outweigh short-term benefits.

- Increased Inflation: QE can fuel inflation by increasing the money supply without a corresponding rise in goods and services. This can erode purchasing power and destabilize the economy.

- Asset Bubbles: The influx of liquidity can inflate asset prices, creating unsustainable bubbles prone to bursting and causing significant economic damage. This risk is heightened with prolonged QE programs.

- Increased Inequality: QE disproportionately benefits asset owners, exacerbating income inequality and social unrest. The benefits do not always reach the lower and middle classes, widening the wealth gap.

Greene’s core criticism is that QE masks underlying structural problems instead of directly addressing them, leading to unsustainable economic growth patterns and future vulnerabilities.

Greene's Proposed Alternatives to Large-Scale QE:

Instead of relying on large-scale QE, Greene suggests a multi-pronged approach:

- Targeted Fiscal Stimulus: Strategic investment in infrastructure projects and social programs to directly boost demand and create jobs. This offers more direct economic impact compared to the indirect effects of QE.

- Regulatory Reforms: Strengthening financial regulations and oversight to prevent future crises and promote stability in the financial system. This addresses the root causes of instability instead of just treating the symptoms.

- Investment in Human Capital: Prioritizing education and job training programs to equip the workforce with the skills needed for a changing economy. This builds long-term resilience instead of short-term fixes.

These measures aim to address the root causes of economic instability without the potentially destabilizing side effects associated with widespread QE. They represent a shift from reactive to proactive economic management.

Analyzing the Potential Impact of Reduced QE on Future Economic Recessions:

Reduced QE reliance could offer several advantages:

- Increased Market Efficiency: Less government intervention might lead to a more efficient allocation of capital and resources, fostering innovation and growth.

- Reduced Inflation Risks: A more controlled monetary policy lowers the risk of sustained high inflation, protecting consumers' purchasing power.

However, it also presents potential drawbacks:

- Less Effective Crisis Response: The absence of QE as a readily available tool could hinder the ability to respond effectively to severe economic downturns. This is a major concern for policymakers.

- Slower Economic Recovery: A transition away from QE might result in a slower recovery period compared to past interventions, increasing the length and severity of recessions.

The optimal approach likely involves a nuanced balance, tailoring strategies to the specific circumstances of each economic crisis. A flexible approach may be more effective than a rigid adherence to either QE or alternative policies.

Counterarguments and Rebuttals to Greene's Position:

Opponents argue that QE is crucial for preventing catastrophic economic collapses and that alternatives lack its immediate impact. They highlight instances where QE seemingly averted deeper crises. However, Greene's supporters contend that QE's long-term costs eventually surpass short-term benefits, leading to unsustainable economic models. The debate hinges on the relative weighting of short-term crisis mitigation versus long-term economic health.

The Future of Economic Crisis Management: Rethinking QE

Representative Greene's proposal to reduce QE in future economic crises necessitates a crucial discussion about the long-term effects of current economic intervention strategies. While QE has played a significant role in mitigating recessions, its potential negative consequences cannot be ignored. A comprehensive evaluation of alternative strategies and a thorough understanding of their impact are crucial for developing more robust and sustainable economic crisis management. Further discussion and analysis of the implications of Reduced QE are needed to inform future economic policy decisions. The future of economic stability may depend on it.

Featured Posts

-

Tarik Skubals Dominant Performance 7 Shutout Innings Against Brewers

Apr 23, 2025

Tarik Skubals Dominant Performance 7 Shutout Innings Against Brewers

Apr 23, 2025 -

Brewers Fall To Sf Giants Flores And Lee Shine

Apr 23, 2025

Brewers Fall To Sf Giants Flores And Lee Shine

Apr 23, 2025 -

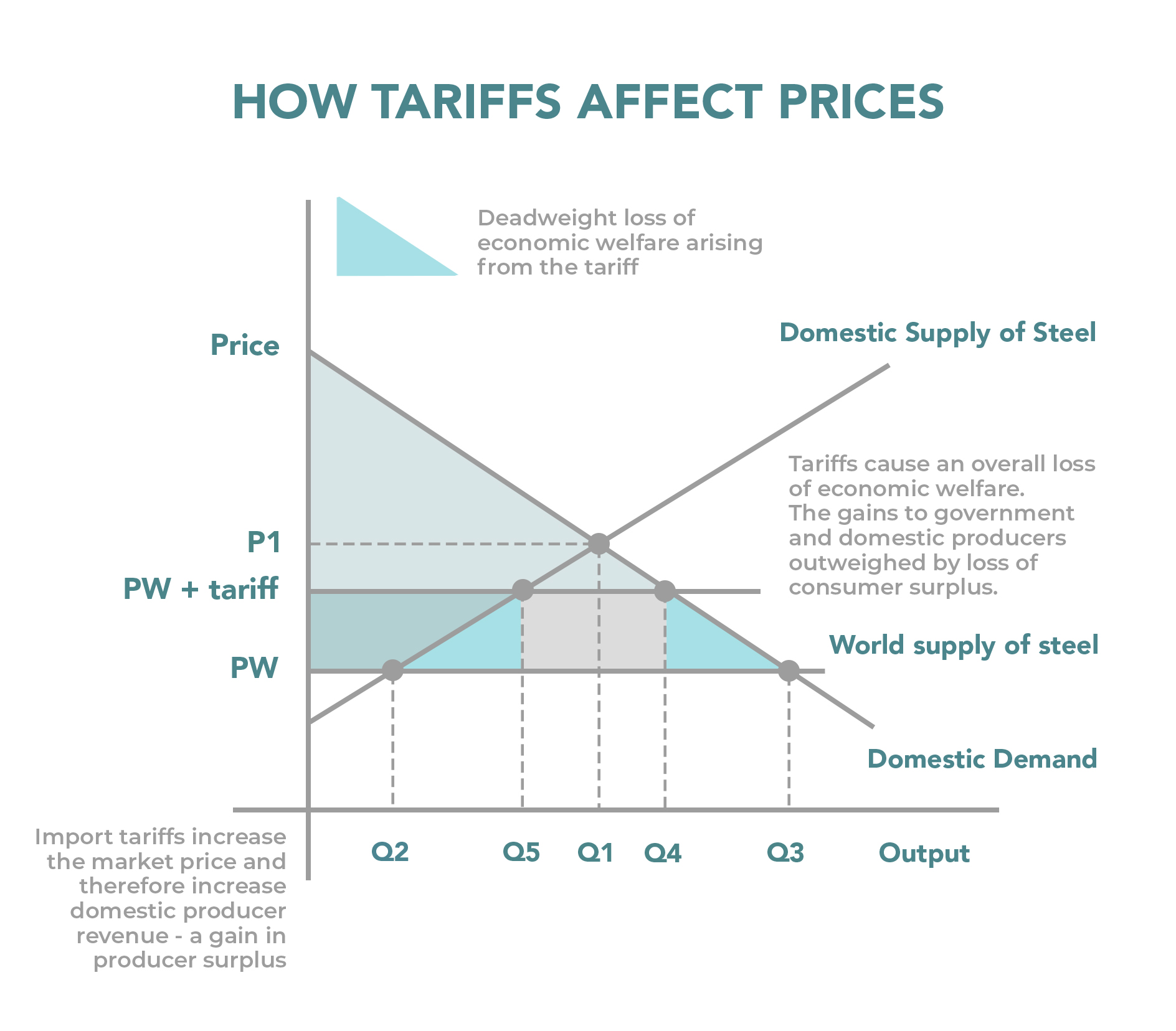

Tongling Metals Us Tariffs Cloud Short Term Copper Outlook

Apr 23, 2025

Tongling Metals Us Tariffs Cloud Short Term Copper Outlook

Apr 23, 2025 -

Trumps Trade Wars How Canadian Families Are Feeling The Pinch

Apr 23, 2025

Trumps Trade Wars How Canadian Families Are Feeling The Pinch

Apr 23, 2025 -

Yankees Set New Homerun Record Judges 3 Lead 9 Homer Explosion

Apr 23, 2025

Yankees Set New Homerun Record Judges 3 Lead 9 Homer Explosion

Apr 23, 2025