Tongling Metals: US Tariffs Cloud Short-Term Copper Outlook

Table of Contents

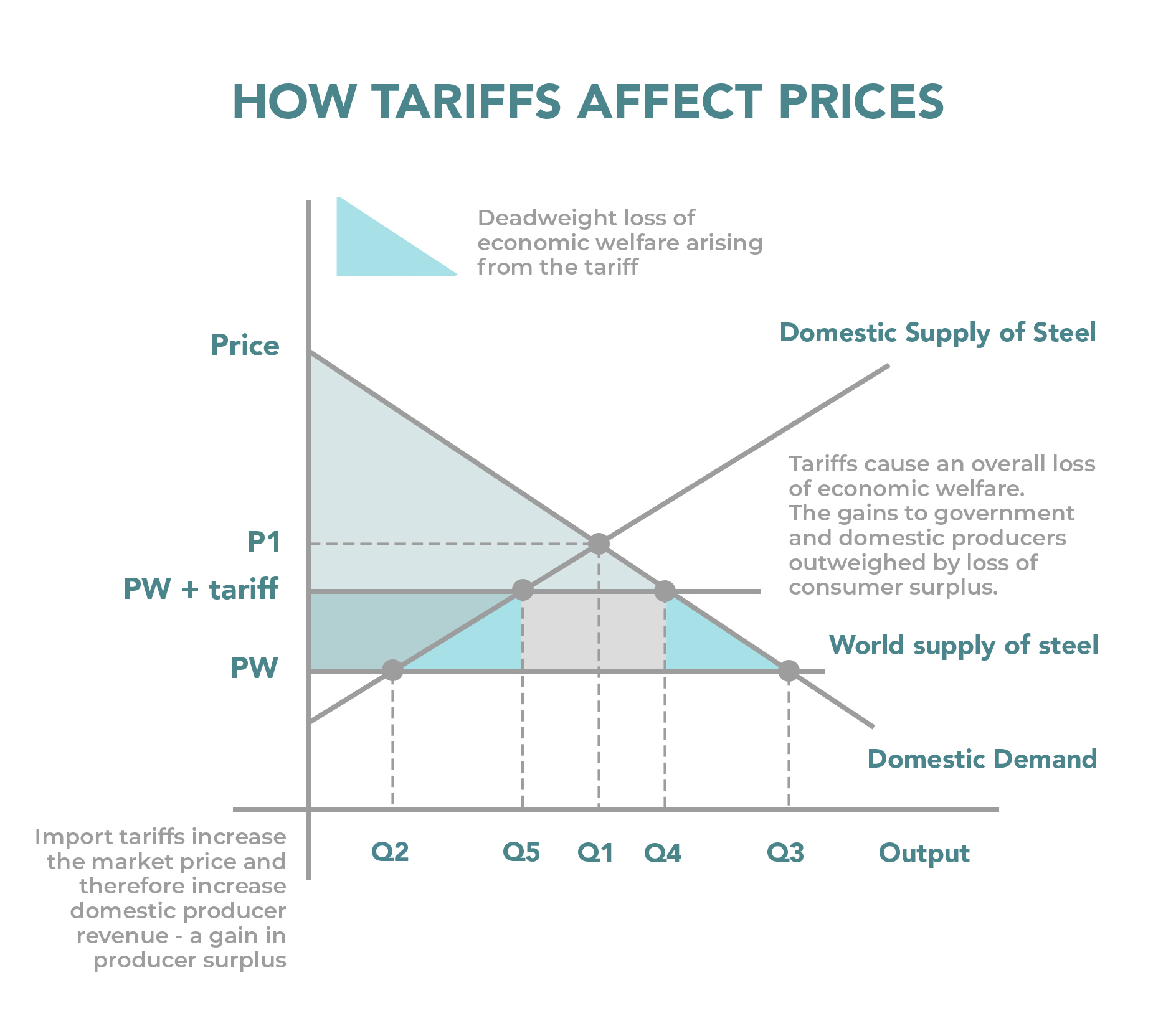

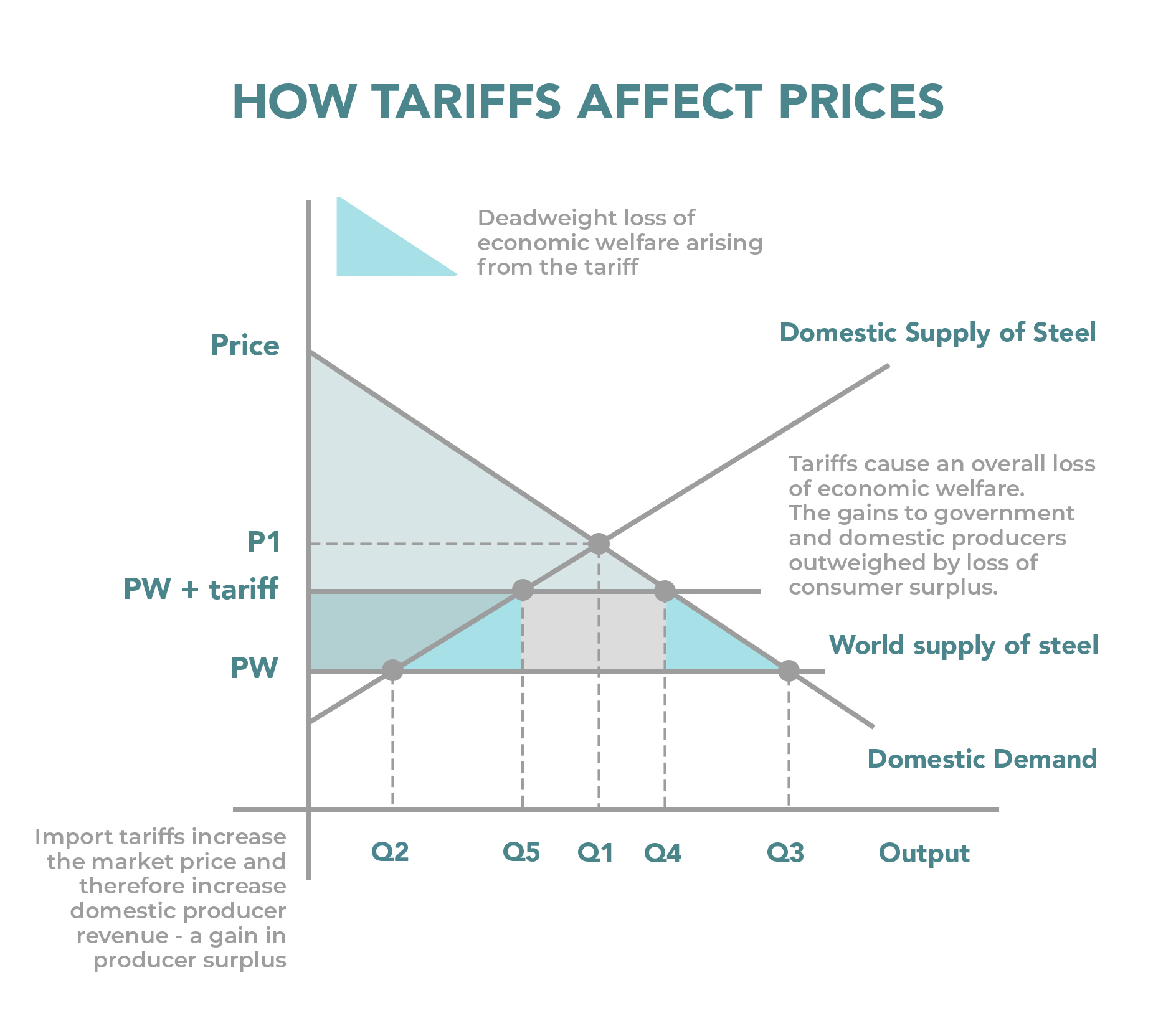

Impact of US Tariffs on Copper Prices

US tariffs on imported copper directly influence global copper prices. These tariffs act as a barrier to trade, increasing the cost of copper entering the US market. This increased cost is not isolated; it ripples through the global market, impacting prices even for copper not directly subject to the tariffs. The resulting price increases create significant challenges for companies like Tongling Metals.

- Increased cost of raw materials: Higher copper prices directly translate to increased input costs for Tongling Metals, squeezing profit margins.

- Reduced competitiveness in international markets: With higher production costs, Tongling Metals faces reduced competitiveness against producers in regions with lower tariff burdens.

- Potential for decreased profit margins: The pressure of higher raw material costs, combined with potential price reductions to maintain market share, can lead to significantly decreased profit margins.

- Historical data analysis: Examining historical instances of tariff imposition on various commodities reveals a consistent pattern of price increases in the short term, though the magnitude varies based on market dynamics and the specific tariff structure.

Tongling Metals' Production and Supply Chain Disruptions

US tariffs can severely disrupt Tongling Metals' intricate supply chain. The imposition of tariffs might lead to delays in importing raw materials essential for copper production or in exporting finished products to the US market. This disruption can cause significant operational challenges.

- Increased transportation costs: Navigating trade barriers often involves increased shipping costs and logistical complexities, further adding to the overall production expenses.

- Potential for production slowdowns or shutdowns: If access to key raw materials is severely hampered, Tongling Metals might be forced to slow down or even temporarily halt production.

- Risk of supply chain bottlenecks: The uncertainty created by tariffs can lead to supply chain bottlenecks, affecting the timely delivery of materials and finished products.

- Alternative sourcing strategies: Tongling Metals might explore alternative sourcing strategies to mitigate supply chain disruptions, but this requires significant investment and time.

Strategic Responses by Tongling Metals

To navigate the challenges posed by US tariffs, Tongling Metals will likely employ several strategic responses. These are not mutually exclusive and could be implemented concurrently.

- Investment in domestic sourcing of raw materials: Reducing reliance on imported materials by investing in domestic sourcing can lessen vulnerability to external trade policies.

- Exploration of new export markets outside the US: Diversifying export markets reduces dependence on the US market and provides resilience against trade barriers.

- Potential for price adjustments and cost-cutting measures: Adjusting product pricing and implementing cost-cutting measures might be necessary to maintain profitability.

- Lobbying efforts to influence trade policy: Engaging in lobbying efforts to influence trade policies and advocate for reduced tariff burdens can be a crucial long-term strategy.

Long-Term Outlook for Tongling Metals and the Copper Market

While the short-term outlook for Tongling Metals is clouded by uncertainty due to US tariffs on copper, the long-term prospects remain positive. The inherent demand for copper, driven by global infrastructure development and technological advancements, remains strong.

- Growth potential in emerging markets: Rapid economic growth in developing nations creates significant demand for copper, offering opportunities for expansion.

- Continued demand driven by infrastructure development: Ongoing global infrastructure projects, such as renewable energy initiatives and electric vehicle production, sustain substantial copper demand.

- Technological advancements in copper production: Innovations in copper extraction and processing techniques can enhance efficiency and lower production costs.

- Potential for government support and policy changes: Government policies aimed at supporting domestic industries or promoting free trade could significantly impact the market.

Navigating the Uncertainties Around Tongling Metals and Copper Tariffs

The impact of US tariffs on copper presents significant short-term challenges for Tongling Metals, impacting production, pricing, and overall market outlook. However, the company's strategic responses and the underlying robust demand for copper suggest a positive long-term outlook. To stay updated on Tongling Metals, monitor copper market trends closely, and understand the impact of US tariffs on Tongling Metals and the broader copper market, follow reputable news sources covering US trade policy and the global metals industry. Staying informed is crucial for navigating this dynamic market landscape.

Featured Posts

-

Cy Young Winner Remains Fiercely Competitive Despite 9 Run Lead In April Game

Apr 23, 2025

Cy Young Winner Remains Fiercely Competitive Despite 9 Run Lead In April Game

Apr 23, 2025 -

Scrutin Allemand Guide Complet Pour Les Elections Legislatives J 6

Apr 23, 2025

Scrutin Allemand Guide Complet Pour Les Elections Legislatives J 6

Apr 23, 2025 -

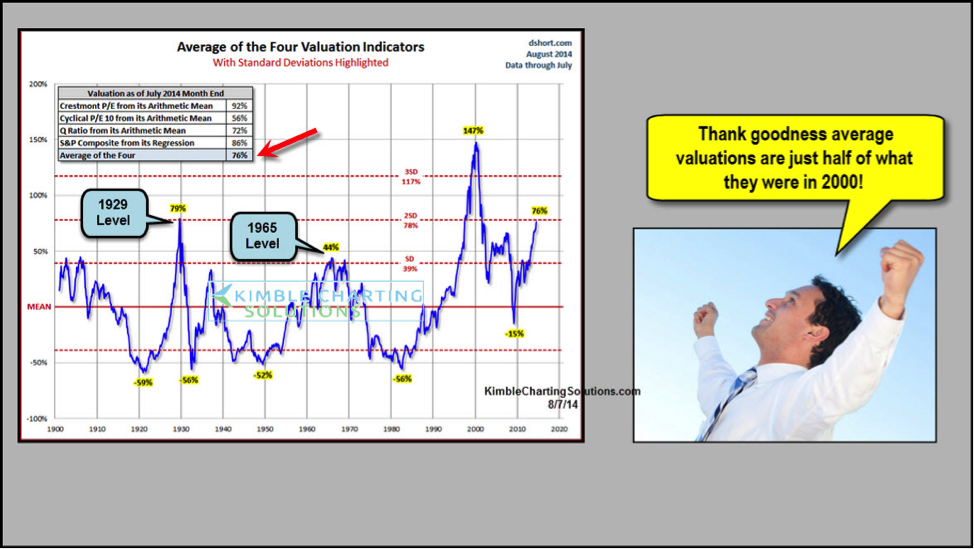

Bof A On Stock Market Valuations Why Investors Shouldnt Panic

Apr 23, 2025

Bof A On Stock Market Valuations Why Investors Shouldnt Panic

Apr 23, 2025 -

Boes Smaller Qe Response To Future Economic Shocks Greenes Proposal

Apr 23, 2025

Boes Smaller Qe Response To Future Economic Shocks Greenes Proposal

Apr 23, 2025 -

Walmart And Target Executives To Meet Trump Amidst Tariff Concerns

Apr 23, 2025

Walmart And Target Executives To Meet Trump Amidst Tariff Concerns

Apr 23, 2025