Greg Abel: A Deep Dive Into Berkshire Hathaway's Future CEO

Table of Contents

Greg Abel's Career Trajectory at Berkshire Hathaway

Greg Abel's journey within Berkshire Hathaway is a testament to dedication and strategic acumen. His long tenure provides a deep understanding of the company's culture, investment philosophy, and diverse subsidiaries. His rise through the ranks is a story of consistent achievement and demonstrable leadership.

- Start date at Berkshire Hathaway: While the exact start date might require further research, his decades-long career at Berkshire Hathaway demonstrates sustained commitment and involvement.

- Key roles held: Abel's progression illustrates a clear path to the top. He served in various roles, including manager, executive, and ultimately Vice Chairman, showcasing increasing responsibility and impact.

- Significant projects overseen: Abel's involvement in key projects within Berkshire Hathaway's diverse portfolio, such as overseeing significant energy and utility operations, showcases his operational expertise and strategic thinking. These projects likely involved substantial investments and complex negotiations, demonstrating his capabilities.

- Notable achievements and awards: While specific awards may need further research, his elevation to CEO speaks volumes about his achievements and contributions to Berkshire Hathaway's overall success. His contributions are deeply embedded in the company's growth and stability.

Abel's Leadership Style and Management Philosophy

Understanding Greg Abel's leadership style is crucial to predicting his impact on Berkshire Hathaway. While direct comparisons to Warren Buffett are inevitable, Abel's approach seems to blend decisive action with a collaborative spirit. His management style emphasizes a more data-driven and analytical approach than Buffett's intuitively driven style.

- Decision-making process: Reports suggest a more analytical and data-driven approach compared to Buffett's often intuitive decision-making. This suggests a more structured and potentially less risk-tolerant approach.

- Communication style: While specifics remain elusive, his career progression indicates effective communication skills, crucial for managing Berkshire Hathaway's diverse portfolio of companies.

- Team management approach: Abel's success within the organization points to a collaborative team management approach, fostering growth and efficiency within complex operations.

- Emphasis on employee development: While the extent of this emphasis needs further research, a modern leadership perspective often incorporates employee development, a key factor in long-term success.

Abel's Impact on Berkshire Hathaway's Future

The transition to Greg Abel as CEO presents both continuity and the potential for significant change within Berkshire Hathaway. His leadership will undoubtedly shape the company's investment strategy, its relationship with subsidiaries, and its overall direction.

- Changes in investment focus: While maintaining Buffett's core principles of value investing, Abel may introduce a greater focus on technology, renewable energy, or other sectors showing strong long-term potential.

- Impact on existing subsidiaries: Abel's experience overseeing various Berkshire Hathaway subsidiaries positions him to improve operational efficiency and strategic alignment across the conglomerate's diverse holdings.

- Strategic acquisitions or divestitures: Under Abel’s leadership, we can anticipate a more data-driven and potentially more active approach to acquisitions and divestitures, aligning the portfolio with long-term growth objectives.

- Succession planning within the leadership team: Abel will need to develop a strong leadership team and implement a clear succession plan, ensuring the long-term stability and success of Berkshire Hathaway.

Comparing Greg Abel to Warren Buffett

Comparing Greg Abel to Warren Buffett highlights both similarities and crucial differences. While both share a commitment to value investing and long-term growth, their styles differ considerably.

| Feature | Warren Buffett | Greg Abel |

|---|---|---|

| Investment Style | Intuitive, value-oriented, long-term focus | Data-driven, value-oriented, potentially more active |

| Leadership Style | Charismatic, decisive, hands-on | Collaborative, analytical, strategic |

| Risk Tolerance | Relatively high, with a focus on long-term gains | Potentially more risk-averse, data-informed |

Conclusion: The Future of Berkshire Hathaway Under Greg Abel's Leadership

Greg Abel's appointment as CEO of Berkshire Hathaway marks a significant moment. His decades-long tenure, coupled with his demonstrated leadership skills and experience across diverse sectors, suggests a future of both continuity and evolution. While maintaining the core principles of value investing, Abel’s analytical approach and data-driven decision-making could lead to a more active and potentially diversified investment strategy. The challenge will be to balance innovation with the preservation of Berkshire Hathaway’s legacy. What are your predictions for Berkshire Hathaway under Greg Abel's leadership? Share your thoughts in the comments below! Let's discuss Greg Abel's leadership and the future of Berkshire Hathaway's CEO.

Featured Posts

-

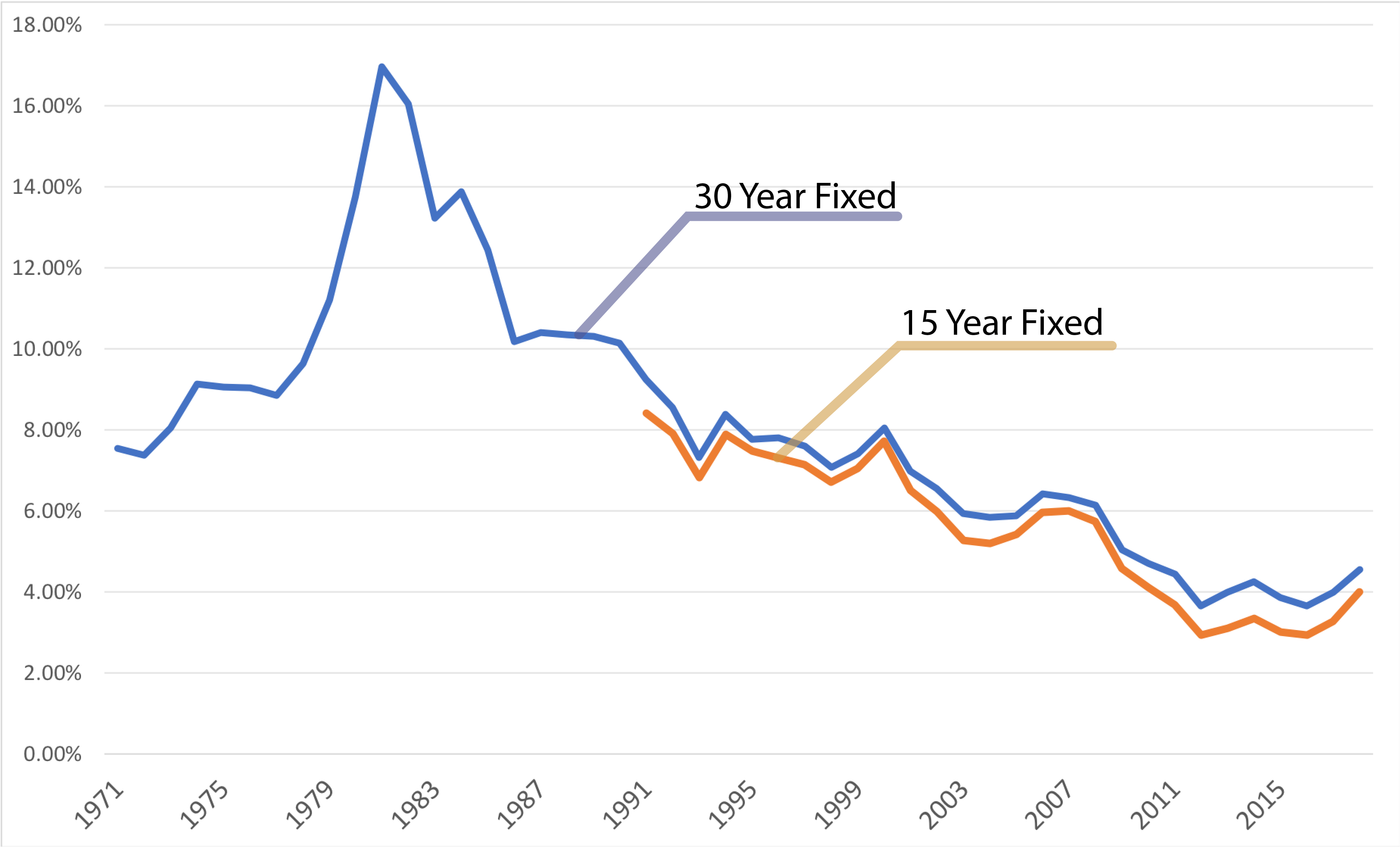

10 Year Mortgages In Canada Exploring The Reasons For Low Adoption

May 06, 2025

10 Year Mortgages In Canada Exploring The Reasons For Low Adoption

May 06, 2025 -

Arnold Schwarzenegger On Patrick Schwarzeneggers Nude Photography

May 06, 2025

Arnold Schwarzenegger On Patrick Schwarzeneggers Nude Photography

May 06, 2025 -

House Democrats Public Battle The Issue Of Senior Leadership

May 06, 2025

House Democrats Public Battle The Issue Of Senior Leadership

May 06, 2025 -

Nike X Hyperice Unveiling Their New Collaboration

May 06, 2025

Nike X Hyperice Unveiling Their New Collaboration

May 06, 2025 -

Romanias Election Key Runoff Battle Between Far Right And Centrist

May 06, 2025

Romanias Election Key Runoff Battle Between Far Right And Centrist

May 06, 2025

Latest Posts

-

Dylan Beard Balancing Walmart Deli And Elite Track

May 06, 2025

Dylan Beard Balancing Walmart Deli And Elite Track

May 06, 2025 -

Met Gala 2024 Rachel Zegler Lizzo Doechii And More

May 06, 2025

Met Gala 2024 Rachel Zegler Lizzo Doechii And More

May 06, 2025 -

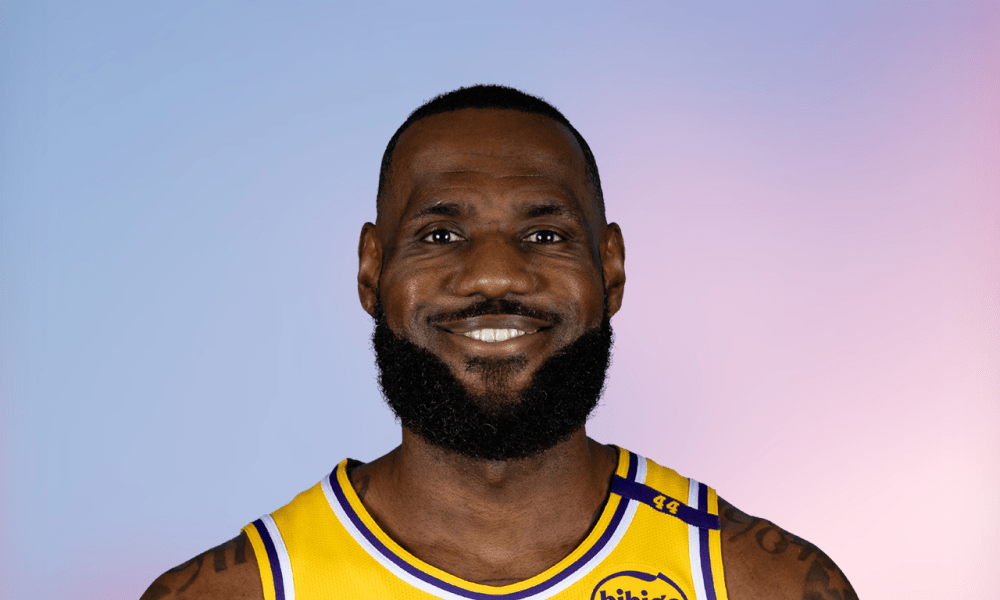

Knee Injury Prevents Le Bron James From Chairing 2025 Met Gala

May 06, 2025

Knee Injury Prevents Le Bron James From Chairing 2025 Met Gala

May 06, 2025 -

Le Bron James Absence At 2025 Met Gala Confirmed Knee Injury

May 06, 2025

Le Bron James Absence At 2025 Met Gala Confirmed Knee Injury

May 06, 2025 -

Rachel Zegler At The Met Gala Snow White Controversy And Star Studded Guest List

May 06, 2025

Rachel Zegler At The Met Gala Snow White Controversy And Star Studded Guest List

May 06, 2025