Harvard President Denounces Attempts To Revoke University's Tax-Exempt Status

Table of Contents

President's Strong Condemnation of the Efforts to Revoke Tax-Exemption

In a strongly worded press release issued on [Date of Release], Harvard's President [President's Name] vehemently condemned the attempts to revoke the university's tax-exempt status. The statement characterized these efforts as a misrepresentation of Harvard's mission and a threat to the institution's ability to serve the public good. The President's tone was resolute, emphasizing Harvard's unwavering commitment to its educational and research goals. Key phrases from the statement included: "[Insert direct quote emphasizing commitment to public benefit]", and "[Insert direct quote refuting claims against Harvard]". Keywords: Harvard President, condemnation, statement, public declaration, response.

Arguments Used to Defend Harvard's Tax-Exempt Status

Harvard's defense of its tax-exempt status rests on several pillars, all integral to its standing as a 501(c)(3) non-profit organization.

Public Benefit and Charitable Contributions

Harvard's contribution to society extends far beyond its hallowed halls. The university's significant charitable contributions include:

- Research Funding: Millions are invested annually in groundbreaking research across diverse fields, from medicine and engineering to the humanities and social sciences. For example, [cite specific example and funding amount for a notable research project].

- Scholarship Programs: Generous financial aid programs ensure accessibility for students from all socioeconomic backgrounds. [Cite statistics on the number of students receiving financial aid].

- Community Engagement: Harvard actively engages with the surrounding community through various initiatives, including [cite specific examples of community outreach programs].

These contributions demonstrably fulfill the criteria for a public benefit organization, justifying its tax-exempt status under IRS regulations. Keywords: charitable contributions, research funding, public benefit, community engagement, scholarship programs.

Educational Mission and Public Service

Harvard's enduring legacy is inextricably linked to its educational mission and its contribution to public service. The university consistently cultivates future leaders across various sectors, driving innovation and societal progress. Notable alumni contributions to society range from [cite specific examples of notable alumni and their achievements]. This commitment to leadership development and public service forms the bedrock of its claim to tax exemption. Keywords: educational mission, societal impact, leadership development, alumni contributions, public service.

Legal Basis for Tax-Exemption

Harvard’s tax-exempt status is firmly grounded in its legal compliance with IRS regulations under section 501(c)(3) of the Internal Revenue Code. This framework necessitates a demonstrable commitment to charitable purposes and the absence of private inurement. Harvard maintains meticulous records and undergoes regular audits to ensure complete adherence to these non-profit law requirements. Keywords: IRS regulations, 501(c)(3), non-profit law, legal compliance.

Motivations Behind the Attempts to Revoke Tax-Exempt Status

The motivations behind the attempts to revoke Harvard's tax-exempt status are complex and multifaceted. Some analysts point to political motivations, with critics targeting the university’s perceived influence and wealth. Concerns about wealth inequality within higher education also fuel the debate, with some arguing that Harvard's endowment size undermines its non-profit status. Furthermore, disagreements over specific university policies, such as [mention specific policies], may contribute to the ongoing pressure. Various advocacy groups, including [mention specific groups if applicable], are actively involved in this campaign. Keywords: political motivations, wealth inequality, policy disagreements, advocacy groups.

Potential Consequences of Revoking Harvard's Tax-Exempt Status

Revoking Harvard's tax-exempt status would have profound consequences. The university would face significant financial challenges, impacting its ability to fund research, provide financial aid, and maintain its operational capacity. This would not only severely limit Harvard’s ability to fulfill its mission but could also set a dangerous precedent for other non-profit institutions and the higher education sector as a whole. The ripple effect on funding for research, scholarships, and community programs could be devastating. Keywords: financial impact, operational challenges, funding implications, higher education, non-profit sector.

Conclusion: The Future of Harvard's Tax-Exempt Status and the Broader Implications

President [President's Name]'s resolute defense of Harvard’s tax-exempt status highlights the critical importance of this issue for the university and the broader non-profit sector. The arguments presented—centered around public benefit, educational mission, and legal compliance— underscore the crucial role Harvard plays in society. The potential consequences of revoking its tax exemption are far-reaching and should prompt careful consideration. Stay informed about further developments regarding Harvard's tax-exempt status and similar debates involving non-profit institutions. Understanding the intricacies of non-profit law and the impact of tax policies on higher education is crucial for shaping the future of these vital organizations. Further research into IRS regulations and 501(c)(3) organizations will provide a more comprehensive understanding of the issues at stake. Keywords: Harvard University, tax exemption, non-profit organization, future implications.

Featured Posts

-

Cassidy Hutchinsons Memoir Key Jan 6 Witness To Share Her Story

May 05, 2025

Cassidy Hutchinsons Memoir Key Jan 6 Witness To Share Her Story

May 05, 2025 -

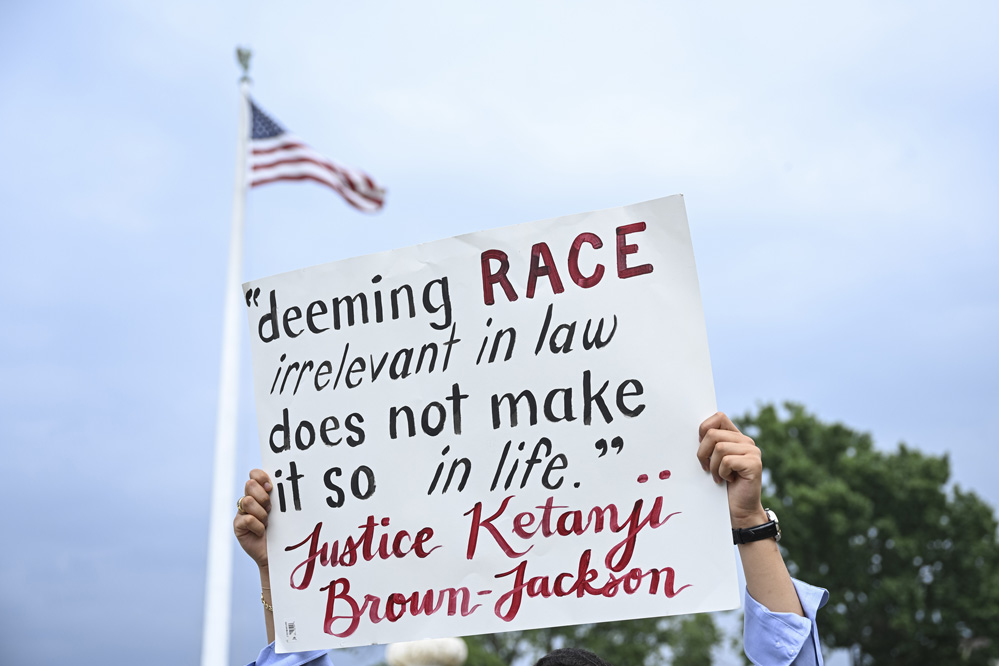

Germanys Eurovision 2025 Hopeful The Search Begins After Eurovision 2024

May 05, 2025

Germanys Eurovision 2025 Hopeful The Search Begins After Eurovision 2024

May 05, 2025 -

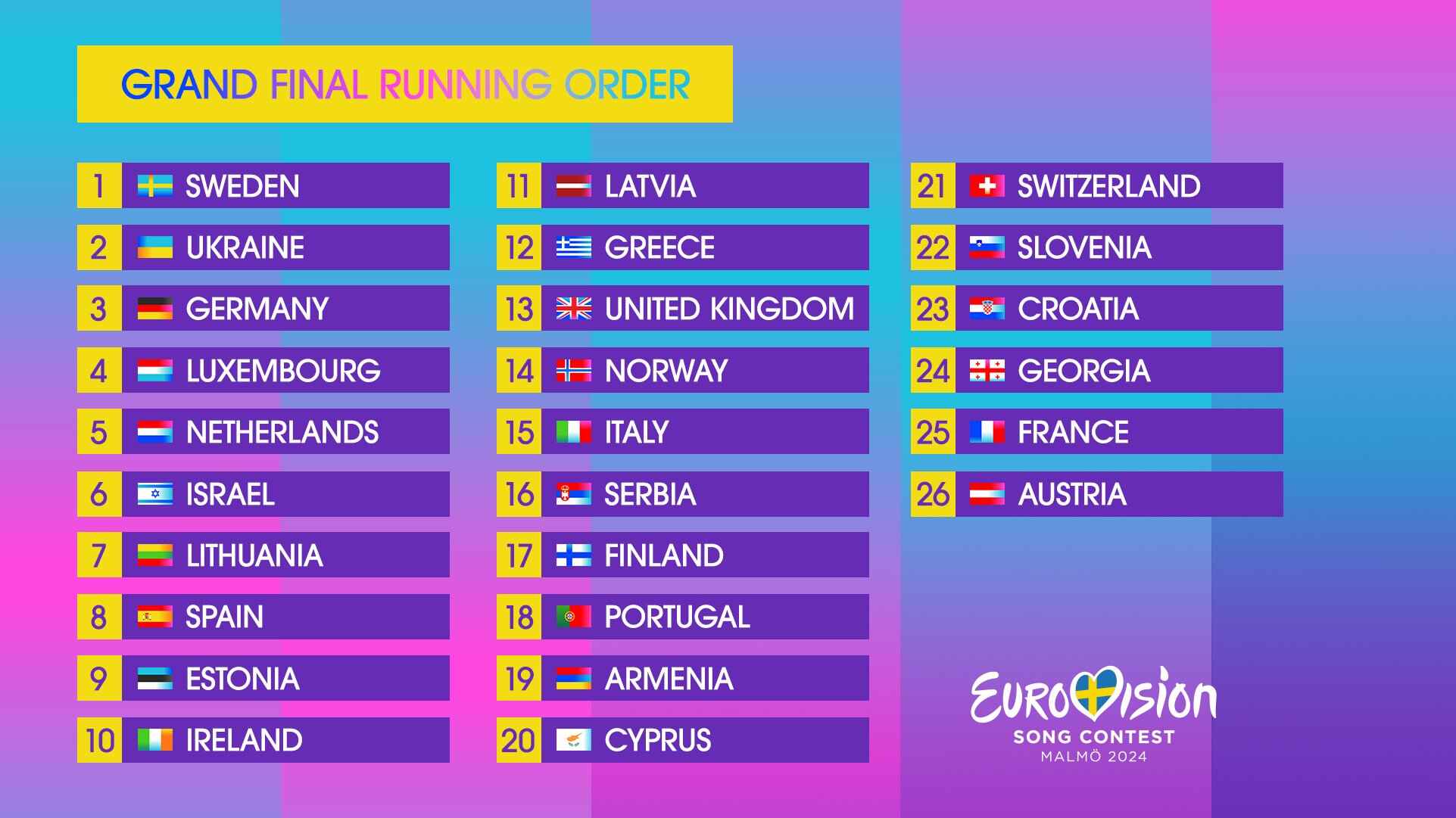

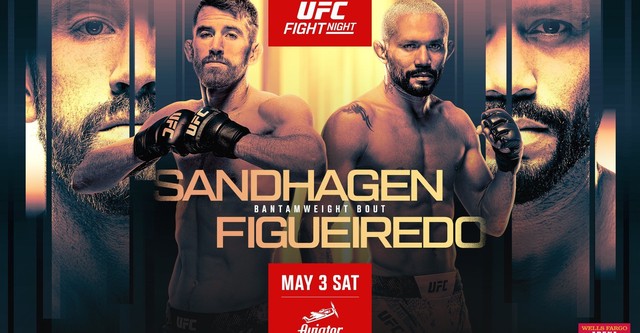

Ufc Fight Night Predictions Cory Sandhagen Vs Deiveson Figueiredo

May 05, 2025

Ufc Fight Night Predictions Cory Sandhagen Vs Deiveson Figueiredo

May 05, 2025 -

Understanding The Alleged Blake Lively And Anna Kendrick Conflict

May 05, 2025

Understanding The Alleged Blake Lively And Anna Kendrick Conflict

May 05, 2025 -

2025 Gold Market Analysis Of Recent Price Drops

May 05, 2025

2025 Gold Market Analysis Of Recent Price Drops

May 05, 2025

Latest Posts

-

Ufc Des Moines Predictions And Fight Breakdown

May 05, 2025

Ufc Des Moines Predictions And Fight Breakdown

May 05, 2025 -

Ufc On Espn 67 A Complete Guide To The Sandhagen Vs Figueiredo Results

May 05, 2025

Ufc On Espn 67 A Complete Guide To The Sandhagen Vs Figueiredo Results

May 05, 2025 -

Best Mma Bets Today Ufc Des Moines Fight Night Predictions And Odds

May 05, 2025

Best Mma Bets Today Ufc Des Moines Fight Night Predictions And Odds

May 05, 2025 -

Des Moines Ufc Predictions Analyzing The Upcoming Fights

May 05, 2025

Des Moines Ufc Predictions Analyzing The Upcoming Fights

May 05, 2025 -

Ufc Espn 67 Sandhagen Vs Figueiredo Fight Night Results Breakdown

May 05, 2025

Ufc Espn 67 Sandhagen Vs Figueiredo Fight Night Results Breakdown

May 05, 2025