Hedge Fund Manager's US Ban: Accusations Of Lying To Immigration Officials

Table of Contents

The Accusations Against the Hedge Fund Manager

The hedge fund manager, [Name of Hedge Fund Manager, if publicly known, otherwise use "the individual"], is accused of making materially false statements on their immigration application. While specific details may remain under wraps due to ongoing legal proceedings, initial reports suggest the accusations revolve around misrepresentations concerning [Specify area of misrepresentation, e.g., income levels, asset ownership, or intent to reside permanently in the US].

- Alleged False Statements: Reports indicate the individual may have understated their income on form [Specify Form, e.g., I-140, Immigrant Petition for Alien Worker] and overstated their ties to their home country on form [Specify Form, e.g., DS-160, Nonimmigrant Visa Application].

- Supporting Evidence: While the specifics of the evidence are not publicly available, it's speculated that [mention potential evidence if known, e.g., bank statements, tax returns, travel records] are central to the immigration authorities' case. The gravity of the situation hinges on the perceived intent to deceive.

The US Immigration Process and Potential Penalties

The US immigration system places a paramount emphasis on truthfulness and accuracy. Applicants must provide complete and truthful information on all forms and during interviews. Falsifying information, even seemingly minor details, can have severe repercussions. The penalties for providing false information on immigration applications are substantial and can include:

- Ban from the US: A US entry ban can range from a few years to a lifetime, effectively barring the individual from entering the country. This is a particularly damaging consequence for those involved in global finance, where international travel is essential.

- Criminal Charges: Perjury and immigration fraud are serious federal crimes carrying significant prison sentences and hefty fines. A criminal conviction can have devastating long-term impacts.

- Deportation: If the individual is already residing in the US, they face the risk of deportation, resulting in the loss of their current status and potential assets.

- Civil Penalties and Fines: Even without criminal charges, significant civil penalties and fines can be levied, adding further financial strain to the situation.

Relevant US immigration laws and regulations include [cite specific statutes and regulations, e.g., 8 U.S. Code § 1101, INA Section 212(a)(6)(C)(i)]. These statutes explicitly prohibit misrepresentations and outline the potential consequences.

Impact on the Hedge Fund and Financial Markets

The implications of a Hedge Fund Manager US Ban extend far beyond the individual. The hedge fund they manage could face significant disruptions:

- Potential Loss of Clients or Investors: The scandal could damage investor confidence, leading to withdrawals and a loss of crucial capital.

- Difficulty in International Business Dealings: A US ban severely limits the manager's ability to engage in transactions and meetings involving US-based clients or assets.

- Reputational Damage to the Hedge Fund: The association with legal controversies can significantly harm the hedge fund's reputation, affecting its ability to attract future investments.

Legal Representation and Future Outcomes

The hedge fund manager is likely represented by a high-profile legal team, possibly employing strategies such as [mention potential legal strategies, e.g., challenging the evidence, arguing for a lesser penalty, or seeking a settlement].

- Legal Precedents: Past cases involving similar accusations of fraud in immigration applications will serve as important precedents.

- Potential Timeline for Resolution: The process could take months or even years, depending on the complexity of the case and potential appeals.

- Ramifications: The outcome of the case will have a profound impact on the hedge fund manager's career, their financial standing, and the future of their firm. A successful appeal could mitigate some penalties, while a conviction could result in severe consequences, including a lengthy US entry ban.

Conclusion

The accusations against this hedge fund manager underscore the severe penalties for dishonesty in US immigration applications. A Hedge Fund Manager US Ban carries substantial professional and personal repercussions, highlighting the critical need for absolute transparency and accuracy in all immigration paperwork. The potential penalties – including bans, criminal charges, and financial ruin – are far-reaching and devastating. For high-net-worth individuals and those seeking US entry, meticulous preparation and professional legal counsel are paramount. Don't risk a Hedge Fund Manager US Ban scenario; ensure absolute accuracy in your applications and seek expert legal advice to navigate the complexities of US immigration law.

Featured Posts

-

Matheus Cunha To Man United Journalist Shares Concerning Transfer News

May 20, 2025

Matheus Cunha To Man United Journalist Shares Concerning Transfer News

May 20, 2025 -

L Affaire Melvyn Jaminet Kylian Jaminet S Exprime Sur Le Transfert Controverse

May 20, 2025

L Affaire Melvyn Jaminet Kylian Jaminet S Exprime Sur Le Transfert Controverse

May 20, 2025 -

Suki Waterhouses Fresh Spring Baby Doll Makeup Look

May 20, 2025

Suki Waterhouses Fresh Spring Baby Doll Makeup Look

May 20, 2025 -

Dusan Tadic Fenerbahce Ye Tarihi Bir Imza

May 20, 2025

Dusan Tadic Fenerbahce Ye Tarihi Bir Imza

May 20, 2025 -

Understanding Wayne Gretzky Fast Facts For Fans

May 20, 2025

Understanding Wayne Gretzky Fast Facts For Fans

May 20, 2025

Latest Posts

-

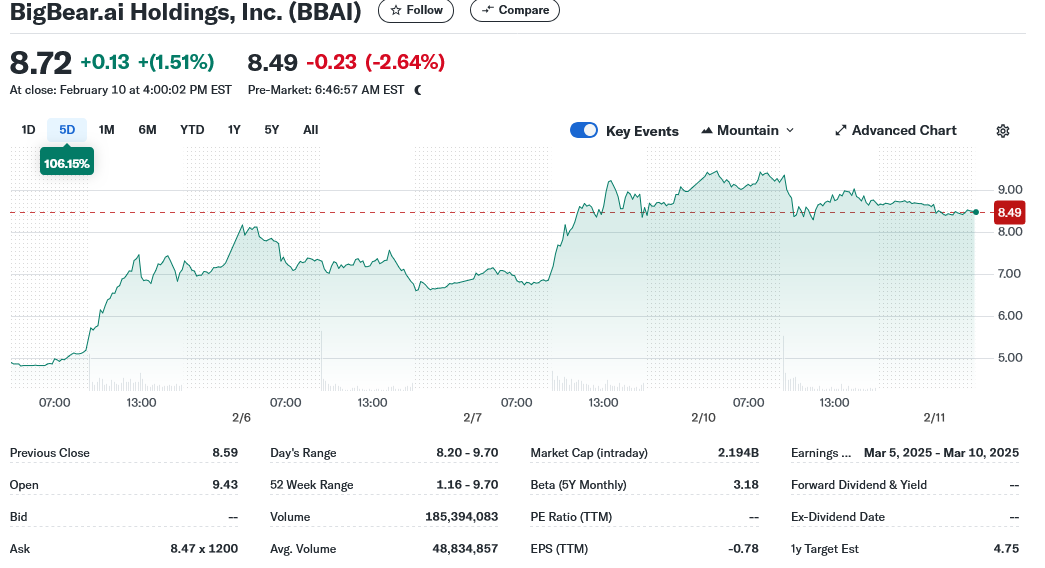

Big Bear Ai Bbai Stock Analyst Downgrade Fuels Growth Uncertainty

May 20, 2025

Big Bear Ai Bbai Stock Analyst Downgrade Fuels Growth Uncertainty

May 20, 2025 -

D Wave Quantum Qbts Explaining The Stock Price Rise On Monday

May 20, 2025

D Wave Quantum Qbts Explaining The Stock Price Rise On Monday

May 20, 2025 -

Market Analysis Deciphering The D Wave Quantum Qbts Stock Fall On Thursday

May 20, 2025

Market Analysis Deciphering The D Wave Quantum Qbts Stock Fall On Thursday

May 20, 2025 -

D Wave Quantum Qbts Stock Explaining The Thursday Price Drop

May 20, 2025

D Wave Quantum Qbts Stock Explaining The Thursday Price Drop

May 20, 2025 -

Understanding The Market Reaction D Wave Quantum Qbts Stock On Thursday

May 20, 2025

Understanding The Market Reaction D Wave Quantum Qbts Stock On Thursday

May 20, 2025