High Stock Market Valuations: A BofA Analysis And Investor Guidance

Table of Contents

BofA's Assessment of Current Market Valuations

BofA employs a rigorous methodology to assess market valuations, utilizing a combination of traditional and advanced techniques. This includes analyzing key metrics such as Price-to-Earnings (P/E) ratios, Price-to-Sales (P/S) ratios, and Discounted Cash Flow (DCF) models across various sectors. Their analysis considers historical data, current economic indicators, and future growth projections to arrive at a comprehensive valuation picture.

BofA's recent reports indicate that, while certain sectors show signs of fair valuation, many sectors, particularly Technology and Consumer Discretionary, exhibit elevated valuations relative to historical averages and intrinsic value estimates. This suggests a potential vulnerability in the market should economic conditions change.

- Specific valuation metrics used by BofA: P/E ratios, P/S ratios, PEG ratios, DCF models, and market capitalization-to-GDP ratio.

- Key sectors showing high valuations according to BofA: Technology, Consumer Discretionary, and certain segments within the healthcare industry.

- Comparison of current valuations to historical averages: Current valuations are significantly above the long-term average in many sectors, suggesting an elevated level of risk. Charts illustrating these comparisons would be included here.

Factors Contributing to High Stock Market Valuations

Several macroeconomic factors and market dynamics are contributing to the current environment of high stock market valuations.

-

Low interest rates and quantitative easing: Historically low interest rates have fueled borrowing and investment, pushing asset prices higher. Quantitative easing, a monetary policy tool used by central banks, has also increased liquidity in the market, further supporting asset prices.

-

Strong corporate earnings (in some sectors): While some sectors are experiencing robust earnings growth, the overall picture is less clear, and these earnings may not justify current valuations across the entire market.

-

Investor sentiment and market psychology: Optimism and FOMO (Fear Of Missing Out) can drive investors to bid up prices regardless of underlying fundamentals.

-

Technological advancements and disruptive innovations: The rapid pace of innovation in technology has fueled significant investment in growth stocks, potentially leading to inflated valuations in certain segments.

-

Impact of low interest rates on valuation multiples: Lower interest rates generally lead to higher valuation multiples as the discount rate used in DCF models decreases.

-

Role of investor speculation and FOMO: Speculative trading and herd behavior can artificially inflate asset prices, leading to unsustainable valuations.

-

Influence of technological innovation on growth projections: The promise of future growth from disruptive technologies can drive high valuations even if current profitability is limited.

Risk Assessment and Potential Downside

The elevated valuations present significant risks.

-

Market corrections: High valuations often precede market corrections or even crashes. A sudden shift in investor sentiment or an unexpected economic event could trigger a sharp decline in asset prices.

-

Interest rate hikes: If central banks raise interest rates to combat inflation, borrowing costs will increase, potentially dampening economic growth and reducing corporate profits, impacting valuations.

-

Economic slowdown or recession: A slowdown in economic activity could lead to lower corporate earnings, reducing the justification for current high valuations.

-

Market bubble: Some analysts believe the current market conditions resemble a bubble, characterized by unsustainable price increases driven by speculation rather than fundamentals.

-

Scenario analysis of different market outcomes: BofA likely models various scenarios, ranging from a mild correction to a more significant downturn, assessing the potential impact on different asset classes.

-

Potential impact on different investment strategies: Growth-oriented strategies would be particularly vulnerable during a market correction, while value investing strategies may fare better.

-

Historical precedents of market corrections following periods of high valuations: Reviewing past market cycles shows that periods of high valuations are often followed by corrections, offering valuable lessons for investors.

Investor Guidance and Strategies for High Valuation Environments

Navigating high stock market valuations requires a cautious and strategic approach.

-

Portfolio diversification: Diversifying across different asset classes (stocks, bonds, real estate, etc.) can help mitigate risk and reduce the impact of a market downturn in any single sector.

-

Risk management: Investors should carefully assess their risk tolerance and adjust their portfolios accordingly. This may involve reducing exposure to high-valuation sectors and increasing holdings in more defensive assets.

-

Value investing: Focusing on undervalued companies with strong fundamentals can be a prudent strategy in a high-valuation market.

-

Dividend investing: Investing in companies that pay consistent dividends can provide a steady income stream, regardless of market fluctuations.

-

Alternative investments: Exploring alternative investments, such as private equity or real estate, can offer diversification benefits and potentially higher returns, but with increased risk.

-

Specific portfolio adjustment recommendations: Reducing exposure to high-growth, high-valuation stocks and increasing allocation to value stocks or defensive sectors.

-

Strategies for mitigating risk in a high-valuation market: Employing stop-loss orders to limit potential losses and diversifying across geographies and asset classes.

-

Alternative investment options to consider: Real estate investment trusts (REITs), infrastructure investments, and private equity.

Conclusion: Making Informed Decisions in a High Stock Market Valuation Environment

BofA's analysis reveals that current high stock market valuations present both opportunities and risks. While some sectors may be fairly valued, many exhibit significant overvaluation, increasing the likelihood of a market correction. Investors should prioritize risk management, diversification, and a long-term perspective. A cautious approach, possibly emphasizing value investing and dividend strategies, is advisable. Consider diversifying into assets less correlated with the stock market to further reduce risk. Consult with a financial advisor to develop a personalized investment strategy tailored to your risk tolerance and financial goals in this climate of high stock market valuations. By understanding the nuances of this market environment, you can make informed decisions and navigate the complexities of high stock market valuations effectively.

Featured Posts

-

Nyt Spelling Bee Answers For February 10 2025 Complete Solution Guide

Apr 29, 2025

Nyt Spelling Bee Answers For February 10 2025 Complete Solution Guide

Apr 29, 2025 -

The Ramiro Helmeyer Story Loyalty And The Blaugrana

Apr 29, 2025

The Ramiro Helmeyer Story Loyalty And The Blaugrana

Apr 29, 2025 -

India Fund Manager Dsp Stock Market Concerns And Strategic Cash Increase

Apr 29, 2025

India Fund Manager Dsp Stock Market Concerns And Strategic Cash Increase

Apr 29, 2025 -

The Impact Of Snow Tornadoes And Flooding On Louisville In Early 2025

Apr 29, 2025

The Impact Of Snow Tornadoes And Flooding On Louisville In Early 2025

Apr 29, 2025 -

Choosing Between One Plus 13 R And Pixel 9a The Ultimate Guide

Apr 29, 2025

Choosing Between One Plus 13 R And Pixel 9a The Ultimate Guide

Apr 29, 2025

Latest Posts

-

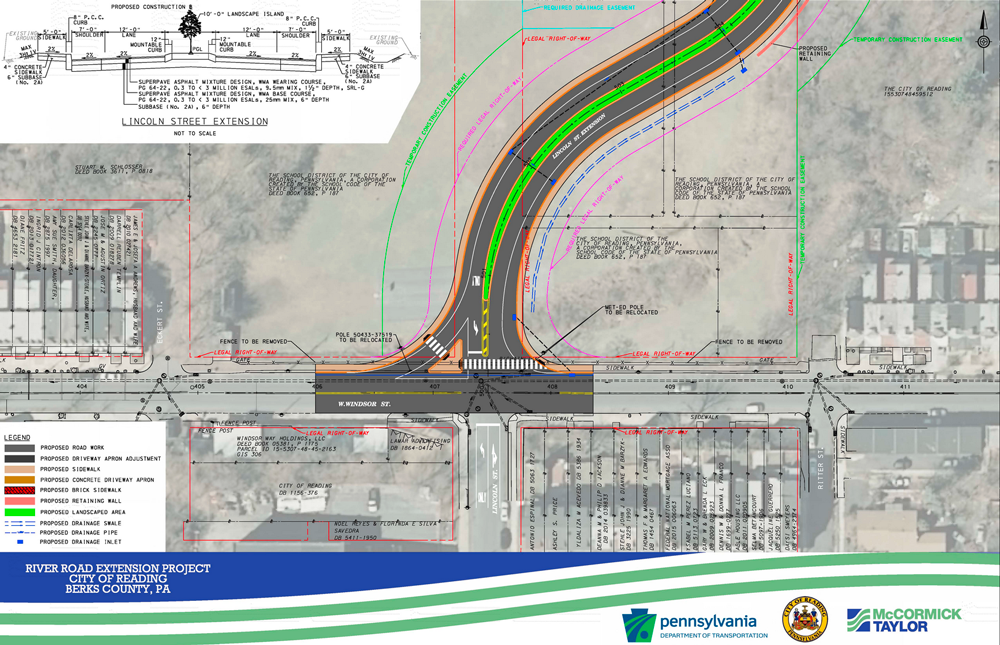

River Road Construction A Crisis For Louisvilles Restaurant Businesses

Apr 29, 2025

River Road Construction A Crisis For Louisvilles Restaurant Businesses

Apr 29, 2025 -

Tornado And Flooding Emergency Louisville Under State Of Emergency

Apr 29, 2025

Tornado And Flooding Emergency Louisville Under State Of Emergency

Apr 29, 2025 -

Louisville Restaurants Seek Relief From River Road Construction Delays

Apr 29, 2025

Louisville Restaurants Seek Relief From River Road Construction Delays

Apr 29, 2025 -

Louisville Tornado State Of Emergency Issued Severe Flooding Imminent

Apr 29, 2025

Louisville Tornado State Of Emergency Issued Severe Flooding Imminent

Apr 29, 2025 -

Help Louisville Restaurants Weather River Road Construction

Apr 29, 2025

Help Louisville Restaurants Weather River Road Construction

Apr 29, 2025