India Fund Manager DSP: Stock Market Concerns And Strategic Cash Increase

Table of Contents

Rising Concerns in the Indian Stock Market

The Indian stock market has experienced increased volatility recently, driven by a confluence of factors impacting investor sentiment and confidence. Several key concerns are contributing to this uncertainty:

- Rising Inflation: Persistent inflation is eroding consumer purchasing power, impacting corporate profitability and slowing down economic growth. This uncertainty makes investors cautious.

- Increasing Interest Rates: The Reserve Bank of India's (RBI) efforts to curb inflation through interest rate hikes have increased borrowing costs for businesses, potentially hindering investment and expansion plans. This directly affects corporate performance and stock valuations.

- Global Economic Uncertainty: Global economic headwinds, including potential recessions in major economies, create a ripple effect impacting the Indian economy and its stock market. This external uncertainty adds to the domestic pressures.

- Geopolitical Risks: Geopolitical tensions and uncertainties, both regionally and globally, inject further volatility into the market, impacting investor confidence and influencing investment decisions.

- Key Market Indicators: Several key market indicators, such as the volatility index (India VIX), show a significant increase in market uncertainty reflecting heightened risk aversion amongst investors.

DSP's Strategic Cash Increase: A Defensive Strategy

DSP's decision to significantly boost its cash reserves represents a proactive defensive investment strategy aimed at mitigating potential risks associated with the current market volatility.

- Defensive Investing: By increasing its cash holdings, DSP is adopting a more conservative approach, prioritizing capital preservation over aggressive growth in the short term.

- Market Downturn Buffer: The increased cash reserves serve as a crucial buffer against potential market downturns. This liquidity allows DSP to weather market storms and potentially capitalize on opportunities that may arise during periods of correction.

- Enhanced Liquidity: Higher liquidity provides DSP with greater flexibility to react swiftly to changing market conditions and seize attractive investment opportunities as they emerge. This agility is vital in a volatile market.

- Impact on Portfolio: The exact percentage increase in cash reserves hasn't been publicly specified by DSP, but market analysts estimate a substantial rise, significantly altering the asset allocation of their portfolio. This emphasizes their cautious approach.

Analyzing the Impact on Investors

DSP's strategic move has several implications for investors:

- Investor Sentiment: The increase in cash reserves may signal a cautious outlook among major fund managers, potentially impacting overall investor sentiment and confidence.

- Portfolio Diversification: This reinforces the importance of portfolio diversification for individual investors. A well-diversified portfolio can help mitigate the impact of market volatility on overall returns.

- Risk Tolerance: Investors with different risk tolerances will react differently. Risk-averse investors might view this as a prudent strategy, while aggressive investors might seek opportunities elsewhere.

- Long-Term Implications: For investors in DSP mutual funds, this suggests a shift towards a more conservative investment approach in the short term. The long-term implications depend on the fund's overall performance and market recovery.

- Investor Advice: Investors should carefully assess their own risk tolerance and adjust their portfolios accordingly. Consider consulting a financial advisor for personalized advice.

Future Outlook and Investment Strategies

Predicting the future of the Indian stock market with certainty is impossible, but analyzing DSP's actions provides insights:

- Market Predictions: The near-term outlook appears uncertain, with potential for further volatility. However, long-term growth prospects for the Indian economy remain strong.

- Investment Opportunities: While volatility presents risks, it also creates opportunities for discerning investors. A cautious approach, with a focus on value investing and long-term growth potential, might be beneficial.

- Long-Term Perspective: Maintaining a long-term investment perspective is crucial. Short-term market fluctuations should not overshadow the long-term growth potential of the Indian economy.

- Key Recommendations: Diversify your portfolio across asset classes, focus on fundamentally strong companies, and consider a disciplined investment approach to manage risk effectively.

Conclusion

DSP's significant increase in cash reserves reflects growing concerns about volatility in the Indian stock market. This strategic move, indicative of a defensive investment strategy, highlights the importance of risk mitigation in the current economic climate. Understanding the actions of key players like India Fund Manager DSP is crucial for navigating the complexities of the Indian stock market. Investors should carefully consider their risk tolerance, diversify their portfolios, and perhaps seek professional financial advice before making any significant investment decisions related to India Fund Manager DSP or similar entities. The current market conditions emphasize the need for a well-informed and adaptable investment strategy.

Featured Posts

-

Can Film Tax Credits Boost Minnesotas Tv And Film Industry

Apr 29, 2025

Can Film Tax Credits Boost Minnesotas Tv And Film Industry

Apr 29, 2025 -

Lower Migration To Germany After Covid 19 The Role Of Border Management

Apr 29, 2025

Lower Migration To Germany After Covid 19 The Role Of Border Management

Apr 29, 2025 -

Food Fuel And Water Scarcity In Gaza Calls To End Israeli Aid Ban Intensify

Apr 29, 2025

Food Fuel And Water Scarcity In Gaza Calls To End Israeli Aid Ban Intensify

Apr 29, 2025 -

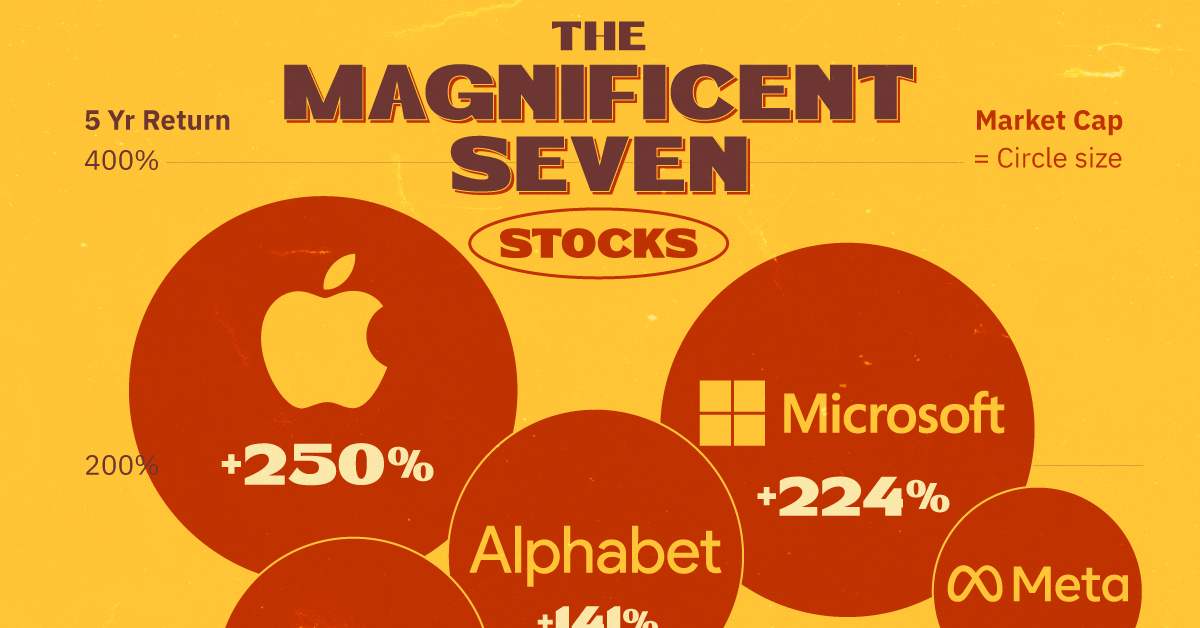

2 5 Trillion Evaporated The Market Value Decline Of The Magnificent Seven

Apr 29, 2025

2 5 Trillion Evaporated The Market Value Decline Of The Magnificent Seven

Apr 29, 2025 -

Minnesota Film Production The Impact Of Tax Credits

Apr 29, 2025

Minnesota Film Production The Impact Of Tax Credits

Apr 29, 2025

Latest Posts

-

Techs Top Seven Analyzing A 2 5 Trillion Market Value Loss

Apr 29, 2025

Techs Top Seven Analyzing A 2 5 Trillion Market Value Loss

Apr 29, 2025 -

The Magnificent Sevens 2024 Losses A 2 5 Trillion Market Cap Drop

Apr 29, 2025

The Magnificent Sevens 2024 Losses A 2 5 Trillion Market Cap Drop

Apr 29, 2025 -

2 5 Trillion Evaporated The Market Value Decline Of The Magnificent Seven

Apr 29, 2025

2 5 Trillion Evaporated The Market Value Decline Of The Magnificent Seven

Apr 29, 2025 -

Seven Tech Titans A 2 5 Trillion Market Value Plunge In 2024

Apr 29, 2025

Seven Tech Titans A 2 5 Trillion Market Value Plunge In 2024

Apr 29, 2025 -

Magnificent Seven Stocks 2 5 Trillion In Lost Market Value This Year

Apr 29, 2025

Magnificent Seven Stocks 2 5 Trillion In Lost Market Value This Year

Apr 29, 2025