HMRC Child Benefit Communication: Action Required

Table of Contents

Identifying Genuine HMRC Child Benefit Communications

It’s vital to distinguish between legitimate HMRC Child Benefit communications and fraudulent attempts to obtain your personal information. Phishing scams are unfortunately common, so being vigilant is key. Legitimate HMRC Child Benefit communications will always display specific features:

- Official letterhead: Look for the official HMRC branding and logo. A poorly designed or unprofessional-looking letter is a major red flag.

- Correct contact details: The communication should contain accurate HMRC contact details, including address and telephone numbers readily verifiable on the official HMRC website.

- Unique reference numbers: Genuine communications will include a unique reference number specific to your Child Benefit claim. This number allows HMRC to quickly identify your case.

- Consistent tone and language: HMRC uses clear, concise, and formal language in its communications. Beware of communications containing grammatical errors or overly informal or aggressive language.

Warning Signs of Fraudulent Communications:

- Suspicious email addresses or postal addresses: Check carefully for slight variations in the sender's email address or postal address. Fraudsters often use addresses that closely mimic the official ones.

- Urgent requests for personal information: HMRC will rarely ask for sensitive information via email or phone. If you're unsure, contact HMRC directly through official channels to verify.

- Unexpected links or attachments: Never click on links or open attachments in emails or messages unless you are absolutely certain they are from a legitimate source.

Understanding Different Types of HMRC Child Benefit Communications

HMRC may contact you for several reasons, including:

- Annual statements: These statements summarize your Child Benefit payments over the previous tax year. Review them carefully for accuracy and report any discrepancies immediately.

- Payment changes: You may receive a communication regarding changes to your Child Benefit payments. This could be due to changes in your income, the number of qualifying children, or changes in your circumstances. Understanding the reason for these changes is essential.

- Information requests: HMRC might request additional information to verify your eligibility for Child Benefit or to update your records. Responding promptly and accurately is vital.

Responding to HMRC Child Benefit Communications: A Step-by-Step Guide

Responding to HMRC Child Benefit communications promptly and accurately is crucial. Here's a step-by-step guide:

- Gather necessary documents: This might include payslips, P60s, or other relevant documentation supporting your claim.

- Access your online HMRC account: The online portal provides the most efficient way to manage your Child Benefit claim and respond to communications.

- Respond to letters/emails within deadlines: Adhere to any stated deadlines in the communication. Delays can lead to penalties.

- Keep records: Maintain a record of all communications and your responses, including dates, reference numbers, and actions taken.

Common Problems and Solutions Related to HMRC Child Benefit Communications

Addressing common issues proactively can save you time and potential complications.

- Missing payments: If you haven't received a Child Benefit payment, report it to HMRC immediately via their online portal or helpline.

- Incorrect personal information: Ensure your personal details (address, bank details, number of children) are up-to-date. You can update this information through your online account.

- Technical issues accessing the online account: If you experience difficulties logging in, refer to HMRC's online help section or contact their helpline for assistance.

Take Action on Your HMRC Child Benefit Communication Today!

Responding promptly and accurately to HMRC Child Benefit communications is vital to avoiding potential penalties and ensuring you receive the correct payments. Ignoring these communications can have serious consequences. Review any recent HMRC child benefit correspondence you have received and take necessary action immediately. Use the official HMRC online portal to manage your Child Benefit claim, or contact them directly via their helpline if you have any questions or require assistance. Don't delay; take action on your HMRC child benefit communication today!

Featured Posts

-

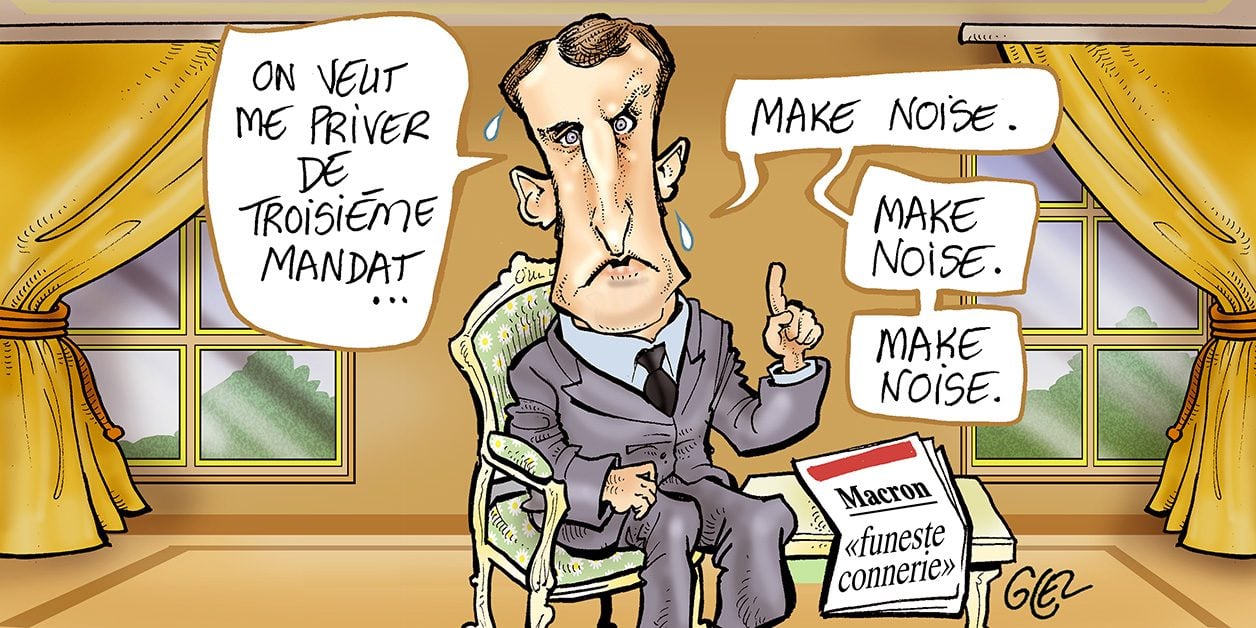

Presidentielle Cameroun 2032 La Position De Macron Face Au Referendum

May 20, 2025

Presidentielle Cameroun 2032 La Position De Macron Face Au Referendum

May 20, 2025 -

Plans D Urbanisme De Detail En Cote D Ivoire Bruno Kone Appelle A La Collaboration Des Maires

May 20, 2025

Plans D Urbanisme De Detail En Cote D Ivoire Bruno Kone Appelle A La Collaboration Des Maires

May 20, 2025 -

14 279 Voies Abidjan Avancement Du Projet D Adressage

May 20, 2025

14 279 Voies Abidjan Avancement Du Projet D Adressage

May 20, 2025 -

Politique Camerounaise Macron Troisieme Mandat Et Perspectives Pour 2032

May 20, 2025

Politique Camerounaise Macron Troisieme Mandat Et Perspectives Pour 2032

May 20, 2025 -

Us Credit Downgrade Impact On Dow Futures And The Dollar

May 20, 2025

Us Credit Downgrade Impact On Dow Futures And The Dollar

May 20, 2025

Latest Posts

-

Will Climate Risk Affect My Ability To Buy A Home

May 20, 2025

Will Climate Risk Affect My Ability To Buy A Home

May 20, 2025 -

50 Years Of Snl A Retrospective On The Season Finales Impact

May 20, 2025

50 Years Of Snl A Retrospective On The Season Finales Impact

May 20, 2025 -

Brutal Murders Of Colombian Model And Mexican Influencer Expose Global Femicide Crisis

May 20, 2025

Brutal Murders Of Colombian Model And Mexican Influencer Expose Global Femicide Crisis

May 20, 2025 -

Rising Sea Levels And Your Credit Score The Link To Homeownership

May 20, 2025

Rising Sea Levels And Your Credit Score The Link To Homeownership

May 20, 2025 -

Climate Change A Growing Factor In Home Loan Approvals

May 20, 2025

Climate Change A Growing Factor In Home Loan Approvals

May 20, 2025